Blockchain data provides valuable information about the Bitcoin network and BTC price action. Let's figure out whichThe indicators are useful for the investor in cryptocurrency assets.

The public nature of blockchains is continuousgenerates an endless stream of data as every single transaction and address leaves a clear trail. This information allows you to accurately analyze cryptocurrency network activity. Some industry indicators, such as the number of active addresses, hodl wave and hashrate, have become widely known in the industry, but the general public has really only scratched the surface.

Since the number of metrics available for the blockchain is overhas grown to an incredible number in recent years, and figuring out which ones are most useful for an investor has become a daunting task. A good place to start — the size of the average deposit on exchanges, sender addresses in the Bitcoin network and indicators of miner participation on exchanges.

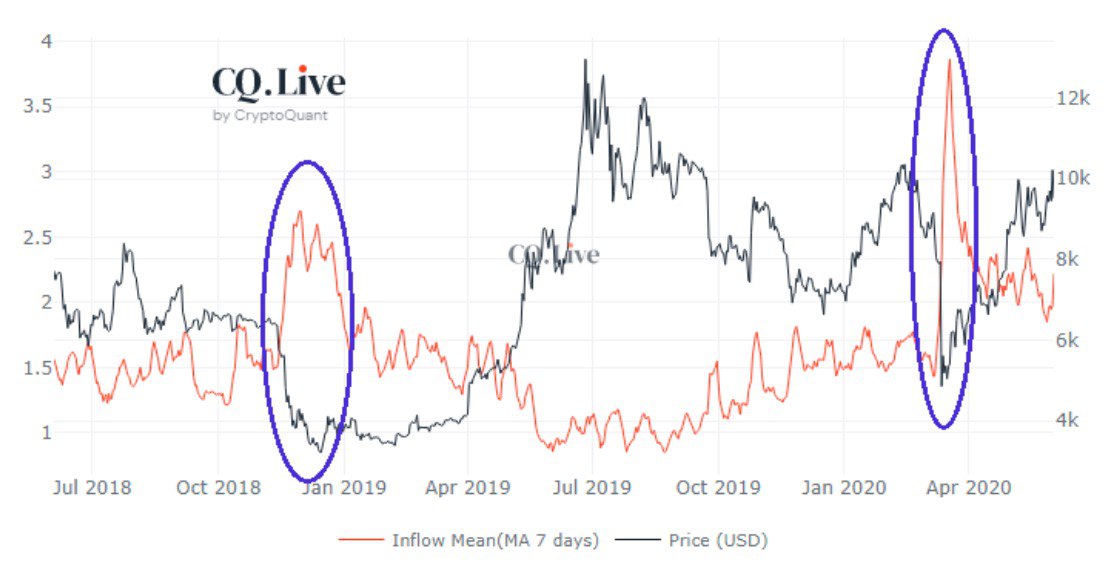

Average deposit size on the exchange

When analyzing the inflow and outflow of funds from exchanges, confusion usually occurs.

Buyers do not need to withdraw funds aftercryptocurrency purchases, and the same can be said about the inflow, since the funds can remain inactive for quite some time before any trade occurs.

The best way to quantify such flow— is to measure the average size of deposits. As shown in the chart above, each peak size in average deposits coincides with a local Bitcoin price bottom. This movement may be the consequence of a large capitulation and cutting of losses.

This indicator is especially relevant duringlong-term downtrend. As mentioned earlier, blockchain data should not be analyzed in isolation. Mass withdrawals, also known as “capitulations,” can only occur months after price fails to demonstrate strength.

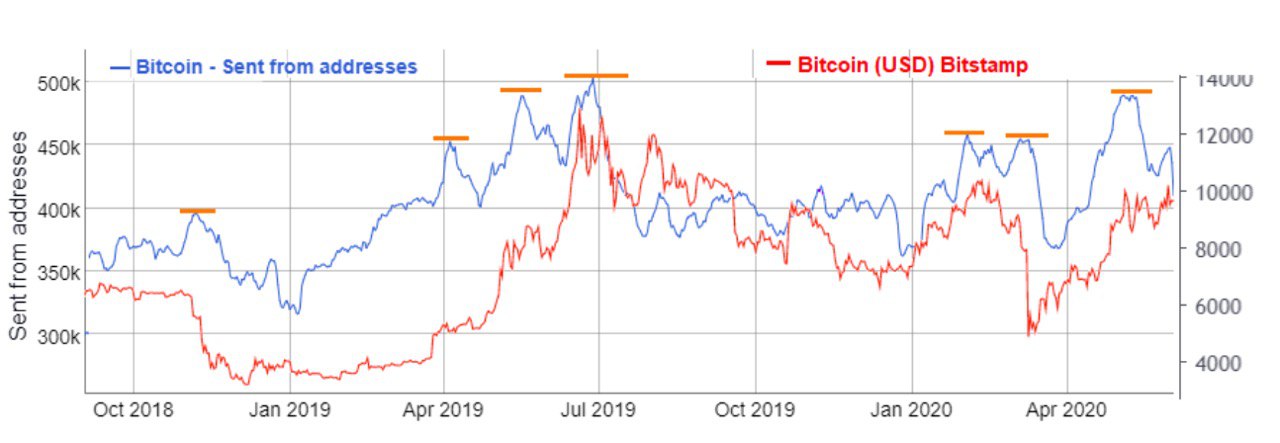

Sender Addresses

Instead of measuring the active quantityaddresses, a 7-day average of "Sent From" addresses provides a clearer picture of network activity. This significantly reduces the noise level of funds exchange and double counting in transaction mixing services.

Please note that each main peakin average daily addresses, “Sent From” coincides with the local short-term top of the Bitcoin price. These sudden peaks in holders moving coins indicate short-term discomfort, although it does not necessarily indicate a change in the market trend.

Once again, this indicator should notinterpreted outside of market trends. This happened during the rally from April to July 2019, when the metric doubled sharply, signaling a recession, although prices continued to rise several weeks later.

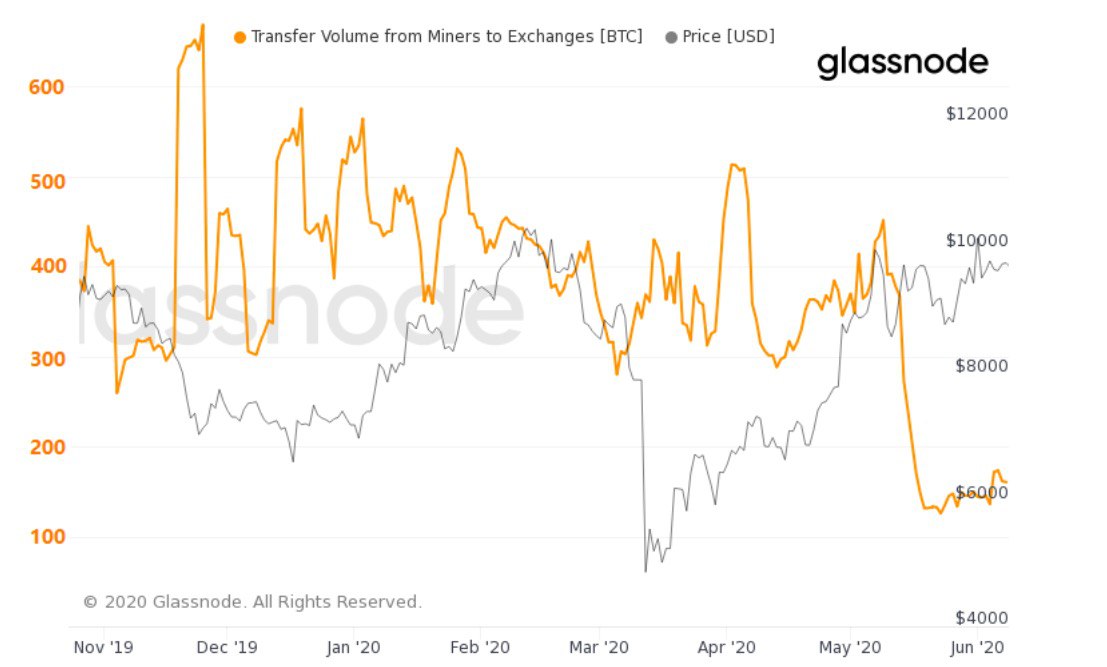

Miners on the exchange

Analytics company Glassnode providesanother way of looking at the market — behavior of Bitcoin miners on exchanges. On average, about 18% of coins mined daily (before halving 1’800 BTC, now 900 BTC) go to exchanges — This is the norm and is the starting point.

Although cryptocurrency exchanges are not necessarilythe only way for miners to sell their assets is the best indicator for assessing their short-term price expectations. In general, when the number of assets withdrawn by miners to exchanges is reduced — there is a growth expectation if the flow increases — falls.

In the 7-day chart above, the amountBCT coming from miners on the exchange shows that such flow was sharply reduced before the Bitcoin halving, and now the figure remains at its lowest level in 12 months.

This accumulated position of miners refusing to sell could be a potential catalyst for a more significant downturn in the event that the Bitcoin price is unable to maintain higher levels.

As mentioned earlier, the average deposit size perthe stock exchange may remain above the real assessment of the situation for some time. Unlike open interest rate futures contracts, where short positions are liquidated as the market rises, this effect will not occur as the amount of BTC held by miners will increase.

Excluding bias

Blockchain analysis is not an exact science, sohow trading is by nature a human activity, at least for now. When faced with conflicting signals, investors tend to rationalize them and eliminate those that do not fit their idea and desires.

As stated earlier, there is a lot of noise in the market, but analyzing blockchain data can help investors separate the true signal from all the distracting noise and eliminate the tunnel vision of their own.

</p> 5

/

5

(

1

voice

)