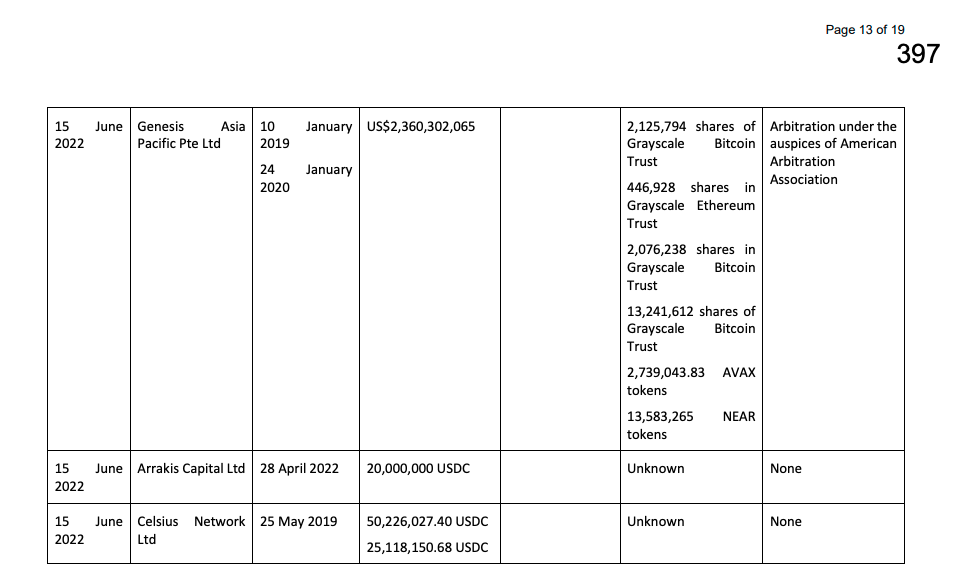

The hedge fund Three Arrows Capital (3AC) owes the cryptocurrency OTC platform Genesis $2.36 billion. This is stated in the documents,submitted by the consulting company Teneo.

They indicate that Genesis tried to return the partloan by launching arbitration proceedings against 3AC in June. Then representatives of the platform said that the hedge fund violated "two loan agreements signed in January 2019 and January 2020."

According to the documents, the loans were partially secured by the following assets:

Data: Documents hosted by Teneo.

According to The Block, Genesis suspended the AAA case after it became aware of Teneo's involvement in the hedge fund's insolvency case.

In a series of tweets on July 6, Genesis Trading CEO Michael Moreau acknowledged that the OTC platform liquidated Three Arrows Capital's positions in June.

Then he added that the parent companyDigital Currency Group (DCG) has made certain commitments to Genesis to ensure that the capital is available to “manage and scale” its business in the future.

One of the sources of the publication noted that because of this, it is DCG that bears the potential losses associated with 3AC's debt.

User DrSoldmanGachs, who previously identified himself as the creditor of the liquidated hedge fund, announced the total amount of outstanding obligations of Three Arrows Capital - $ 2.8 billion.

Among the creditors, he named one of the founders of 3AC, Su Zhu, DCG and others.

As a reminder, the liquidators of Three Arrows Capital are trying to investigate and save the Singapore assets of the cryptocurrency hedge fund, according to media reports.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.