I see quite regularly the following: "Keep an eye on Bitcoin, the dollar index is on the move!"The dollar is strengthening, so that means bitcoin should be weakening, right?It's not that simple...

I'm sure many of you already know that there is no reason why the strength of the US dollar (hereinafter referred to as the dollar), as measured by the dollar index (DXY), would have anything to do with the price of bitcoin.

Let's take a closer look at this. What is the dollar index anyway?

The dollar index measures the dollar against a weighted basket of currencies. It consists of:

- 57.6% of the euro against the dollar,

- 13.6% Japanese yen against the dollar,

- 11.9% of the GBP against the dollar,

- 9.1% Canadian dollar against the dollar,

- 4.2% of the Swedish krona against the dollar,

- 3.6% Swiss franc against the dollar.

Interestingly, some major trading partners are not represented in the index, such as Mexico and China.

As you can see, this index is just a mix of exchange rates between and a number of their trading partners.

So what the dollar's “strength” reflects is the balance between the macroeconomic components that govern these exchange rates:

- differences in monetary policy,

- relative deficit,

- trade balance,

- ...

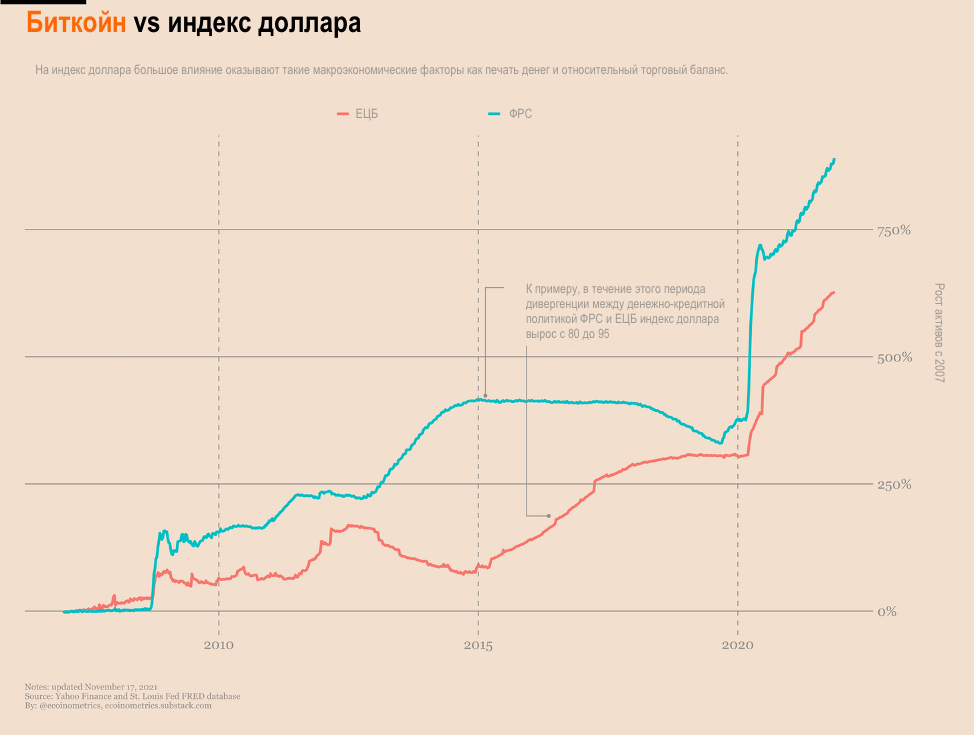

As an example, at the end of 2014 it became clear that the Federal Reserve and the European Central Bank wouldImplement various policies related to "money printing".

The Federal Reserve was going to keep its balance sheet unchanged for the foreseeable future, while the ECB, by contrast, ramped up its asset-buying program.

This meant that the euro should be devalued against the dollar. And what do we see now? The DXY jumped from 80 to 95. This seems logical considering that the euro weighs more than half of the basket.

Now, by what mechanism will the DXY change affect the bitcoin price (in dollars)?

To be honest, I don't see any direct connection between DXY and BTC.

There might be something there. But only indirectly.

For the most part, the setting of new price levels that takes place on exchanges affectsstablecoins that are stable against the U.S. dollar.An indirect relationship that looks like this: local currency -> stablecoin -> Bitcoin.

So if DXY is stronger, it means that some currency in the basket is gettingless purchasing power from dollar-denominated stablecoins... and in the end, that should make Bitcoin cheaper.

This could have any effect for sure, but I doubt it will be anything serious.

Let's take a look at past data.

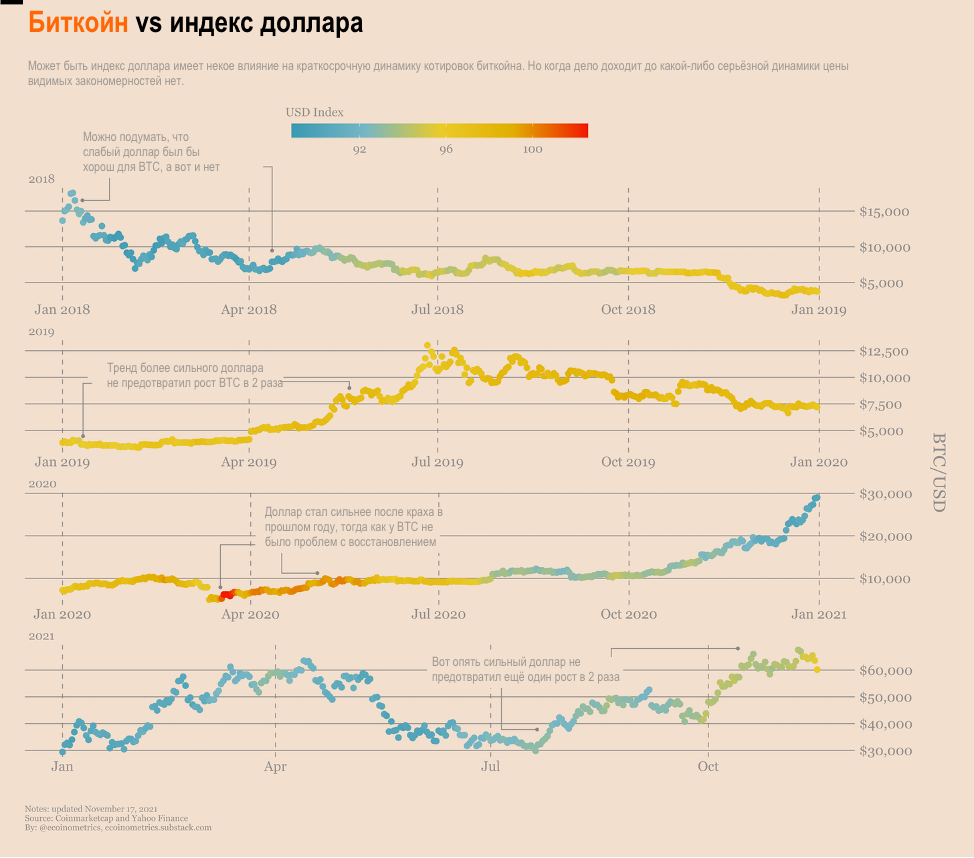

In the chart below, the price of bitcoin is broken down by year, where each day is colored according to the value of the dollar index. Blue means a low index value, red means a high one.

If any significant effect existed, we would expect:

- see bitcoin rise when the DXY index changes from blue to red;

- see bitcoin drop when the DXY index changes from red to blue.

Take a look at the graph.

If you look closely enough at the graph,different combinations can be seen. BTC rises when DXY rises. BTC falls when DXY rises. BTC rises when DXY falls. BTC falls when DXY falls.

So when it comes to long-term trends, don't worry too much about the DXY.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>