Predicting the purchasing power of bitcoin as it demonetizes other asset classes.

Humanity is naturally approachingglobal adoption of the bitcoin standard, as BTC has unrivaled monetary properties. In this research report, Blockware Intelligence predicts the future purchasing power of BTC as it becomes the dominant store of wealth by demonetizing other asset classes.

Key points

- The nominal value of assets is determined by theirutility plus the ratio of cash bonus and savings bonus. Fiat currencies are unable to store value over time, which encourages people to use non-monetary assets to preserve capital, with the result that these assets receive a certain percentage of their nominal value through a monetary premium. In a hyper-bitcoinized world, Bitcoin will absorb the cash premium of other asset classes.

- Useful value: the overall satisfaction or benefit derived from the consumption of a good or service.

- Cash premium: The portion of the face value of a good that results from its use as a store of value.

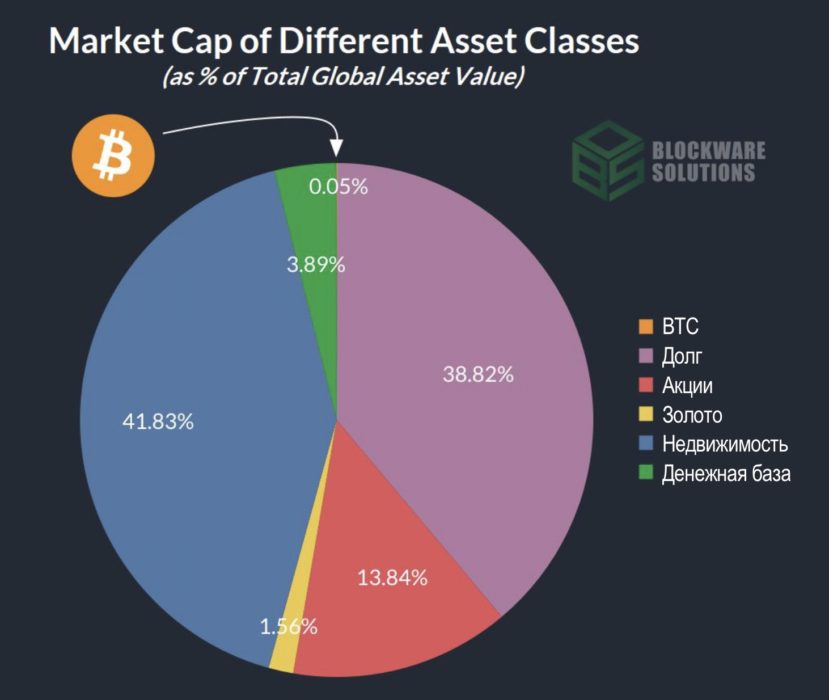

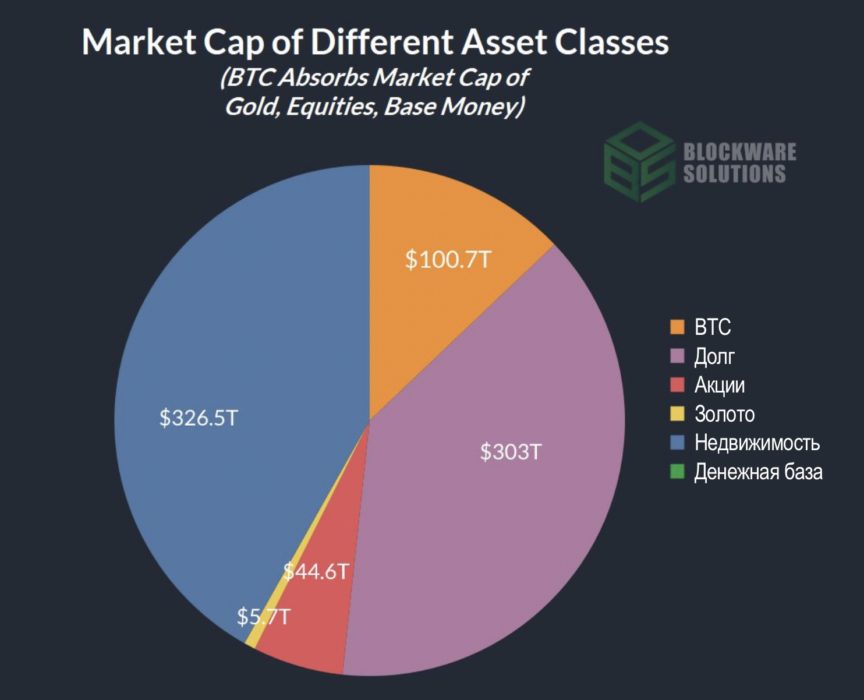

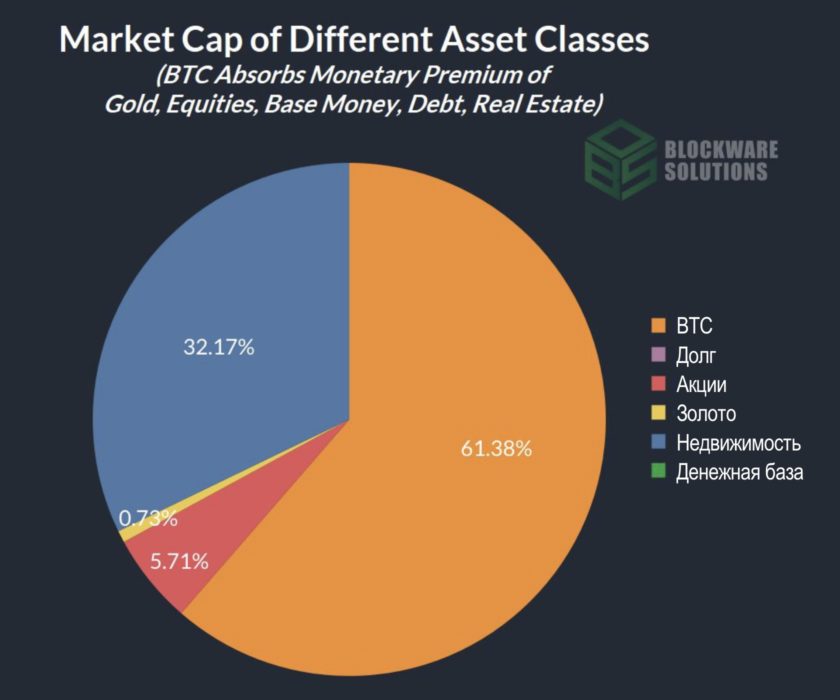

- Bitcoin market capitalization todayis ~0.05% of the total market capitalization of all financial assets. Gold, monetary base, stocks, debt and real estate make up the other 99.5%. If BTC absorbs the cash premium of these financial assets, then its share in the total market capitalization of financial assets will be ~61.38%.

- Devaluation of fiat money as a result of monetaryexpansion leads to the fact that they poorly perform the function of a monetary unit of account, since with a conventional 1 dollar, over time, you can buy an ever smaller amount of real goods and services. Our forecasts are calculated using the US dollar as the unit of account as of 2021. However, if the hyperbitcoinization thesis works, then the expansion of the monetary base will be an important driving factor in this process. Thus, the nominal growth of BTC market capitalization, as well as the nominal demonetization of other asset classes, is likely to be much higher than the actual values projected here.

- Hyperbitcoinization: The adoption of Bitcoin as the world's reserve currency.

- Methodology used to determineThe cash premium for each class of demonetized assets varies. A detailed description of the methodology for each asset class is provided below in the relevant sections. The estimated share of cash premium in the value of each asset class, in order from smallest to largest target market:

- Gold: 53%

- Monetary base (all fiat currencies converted to USD): 100%

- Stocks: 58.7%

- Debt: 100%

- Property: 23.1%

- How global adoption of the Bitcoin standard will change traditional market dynamics:

- In the absence of monetary expansion, long-termchanges in share valuation will be primarily driven by changes in performance. In the fiat standard, any increase in the par value of shares, minus the increase in overall performance, can be attributed to the cash premium of the asset class.

- In the absence of monetary expansion, purchasing powerthe power of money generally increases at the same rate as productivity. Following BTC's absorption of the monetary premium of other financial assets, it is likely that BTC's purchasing power will continue to increase steadily in line with the natural productivity gains resulting from technological advancement. Deflationary prices driven by rising purchasing power of BTC will change the incentive structure to one that encourages savers and discourages debt growth.

BTC as a store of wealth

Due to the inability of fiat currencies to maintain theirvalue over time, people are forced to use non-monetary goods as savings instruments. The nominal market value of assets is the sum of their useful value, derived from the direct consumption of the good, plus a cash (savings) premium, the value attributed to the use of the good as a store of capital. Under the global Bitcoin standard, with BTC serving as a store of value, free from counterparty risk and depreciation through inflation, people will no longer have to use risky assets as a store of value; thus, their cash bonus will be significantly reduced. Asset prices will be determined by their utility and the function of supply and demand. In the process of moving towards the Bitcoin standard, BTC will absorb the monetary premium of other asset classes.

Despite its widespread popularity, BTC iseven at the very beginning of its development as a means of preserving capital. Compared to other assets, BTC's market capitalization is quite high - 14th among public companies and precious metals - but BTC is more than just a unique asset. BTC is uniqueasset class, and should be compared with the market capitalizations of otherasset classes.

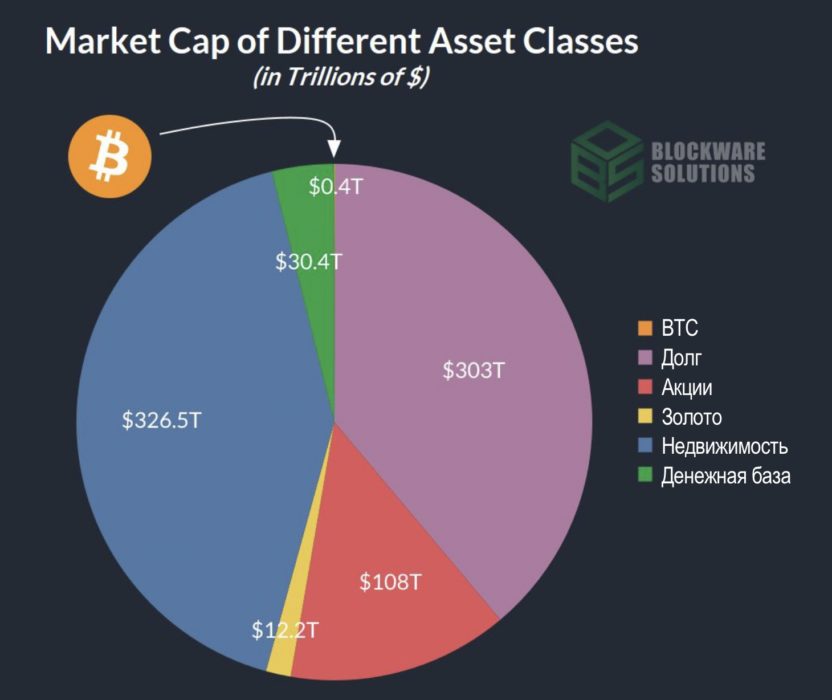

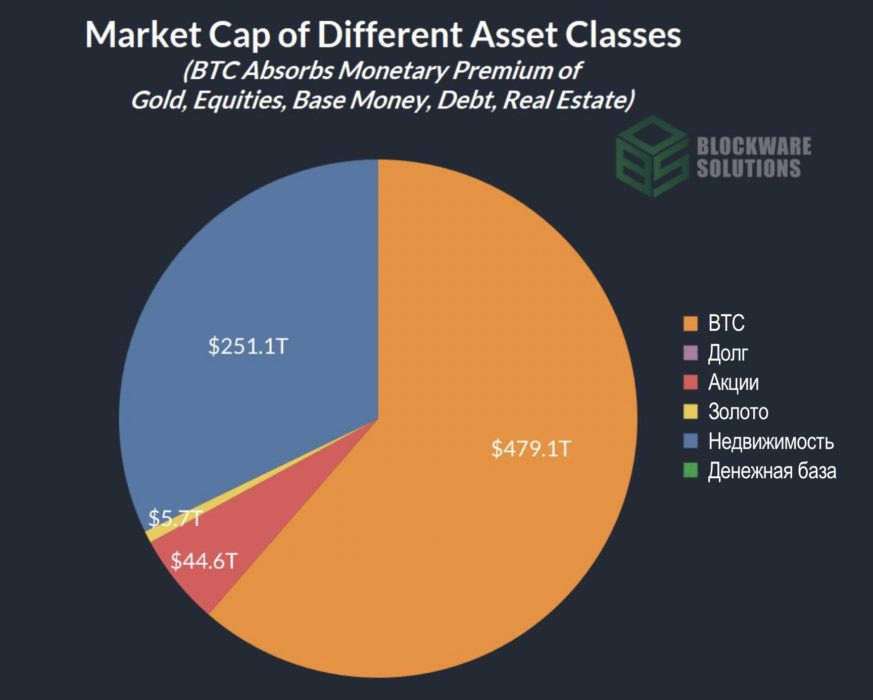

Market capitalization of various asset classes (in trillions of dollars)

We estimate that the total global costfinancial assets are about $780 trillion. The calculation takes into account the capitalization of BTC plus the market capitalizations of all global debt, equity, real estate and gold markets. Of the ~$780 trillion global financial asset capitalization, BTC currently accounts for ~0.05%.

To conceptualize the future purchasingability of BTC, you need to use fiat currency as the unit of account for this forecast. As the world moves from fiat to bitcoin, the former will continue to depreciate, and the values in our model may be very low in nominal terms. The values obtained in this model are presented in real terms using the 2021 dollar as the unit of account.

Market capitalization of various asset classes (in % of total global asset capitalization).

During the transition to the global bitcoin standardthe supply of dollars is likely to continue growing exponentially. Therefore, it is useful to consider the breakdown by asset class as a percentage rather than a nominal value.

BTC monetization by demonetizing other asset classes

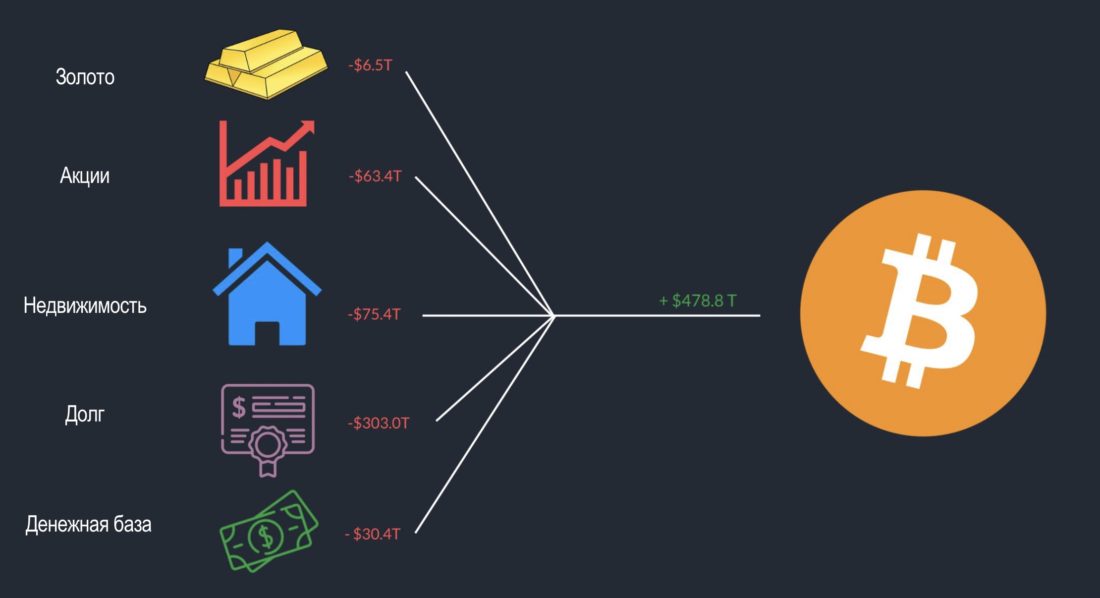

In order to determine the future value of BTC,we need to estimate the monetary premium of each asset class. Given our assumption that BTC will absorb the cash premiums of other assets, we can determine the future value of BTC in 2021 dollars by subtracting the cash premiums from the market capitalizations of the respective asset classes and adding them to the capitalization of BTC.

The share of the cash premium in the value of each of these asset classes is different. Other precious metals, like silver and copper, we have excluded from the calculation, since they have already been demonetized by gold.

The order in which we next presentdemonetization of assets is not a chronological forecast: asset classes are presented in order from the smallest target market capitalization to the largest. The process of their demonetization is likely to occur simultaneously and over a long period of time.

In the transition to the bitcoin standard, gold,real estate, stocks, debt securities and the monetary base will be demonetized. Since these asset classes will no longer be used as a store of value, their value will be determined solely by utility.

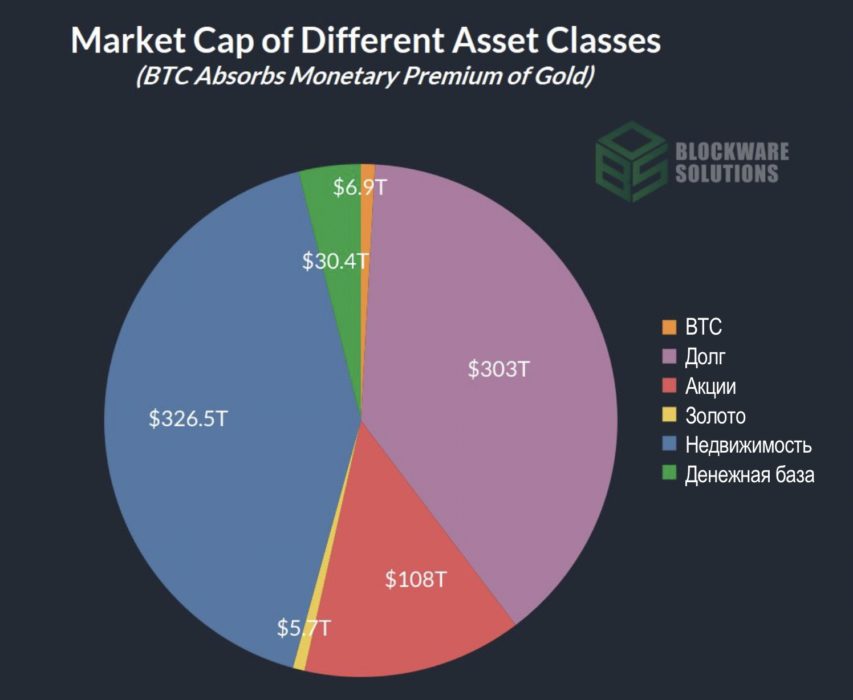

Demonetization of gold

Gold ended 2021 with an estimated market capitalization of ~$12 trillion.

Sources estimate that 47% of gold's capitalization is made up of jewelry. The remaining 53% (~$6.4 trillion) is made up of bars, coins, ETFs and other financial assets.

Adding a 53% gold cash premium to BTC's market cap reduces gold's cap to ~$5.7 trillion, while BTC's cap rises to ~$6.9 trillion.

$6.868.650.000.000 / 21.000.000 = ~$327.078 per BTC

There is also a strong argument in favor of the fact thatThe jewelry sector in the gold market structure will also be demonetized. A significant and unknown percentage of the useful value of gold as jewelry appears to be due to the prestige factor: gold is commonly associated with wealth. However, gold as a symbol of wealth and power will be threatened if Bitcoin eats into its market capitalization. In turn, this should negatively affect the demand for gold jewelry and its prices. This is worth noting, however, in order to remain more conservative in our forecast, we will not consider this possibility here.

Market capitalization of various asset classes (BTC absorbs the cash premium of gold).

After absorbing gold's monetary premium, Bitcoin's market cap will be nearly $7 trillion and BTC's price will be ~$327 thousand.

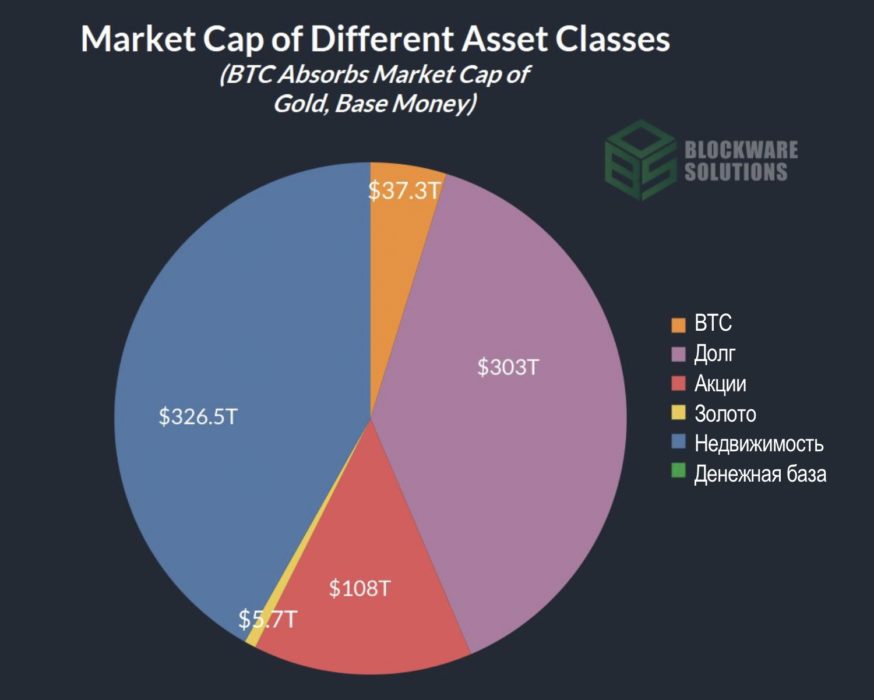

Demonetization of the monetary base

The thesis of this report is based on the fact thatIn the future, BTC will replace fiat currency as the global monetary standard. If so, then it would be correct to distribute the market capitalization of the fiat monetary base in favor of the capitalization of BTC. After all, the value of money is 100% monetary premium: it has no useful value because it cannot be consumed.

The monetary base of all fiat currencies has a totalmarket capitalization ~$30.4 trillion. If we spread this out in favor of BTC's market cap, also keeping in mind the gold premium added earlier, then Bitcoin's cap would be ~$37.3 trillion.

$37.268.650.000.000 / 21.000.000 = ~$1.774.697 per BTC.

Cash premium of other asset classes,significantly exceeding in absolute terms the monetary premium of the monetary base is a symptom that fiat money cannot be a reliable means of storing capital. If today's money were to perform well as a store of capital, then the entire monetary premium of other assets would be in the monetary base.

Market capitalization of various asset classes (BTC absorbs the monetary premium of gold and capitalization of the monetary base).

After absorbing gold's monetary premium and monetary base, Bitcoin's market cap will be nearly ~$37.3 trillion and BTC's price will be ~$1,774,697.

Demonetization of shares

Over time, through innovation andtechnological progress, the total productivity of mankind increases. In other words, the output of goods and services in the economy grows faster than the inputs of labor and capital. People are able to produce more value and improve the overall standard of living.

In a monetary system that does not suffer from endlessmonetary expansion, the main driving force behind the increase in the value of shares would be the increase in productivity. In the current fiat system, the dominant factor in increasing the nominal value of shares is the constant depreciation of fiat currencies. Any increase in the nominal value of shares that exceeds the increase in productivity can be attributed to a cash bonus:

% stock growth = % productivity growth + % cash bonus

We have stock price growth data andperformance. And all we have to do is apply the associative property, then divide by the total growth in the value of the stock, and we have a formula for determining the percentage of the value of the stock:

% cash bonus = (% stock growth — % productivity growth) / % stock growth

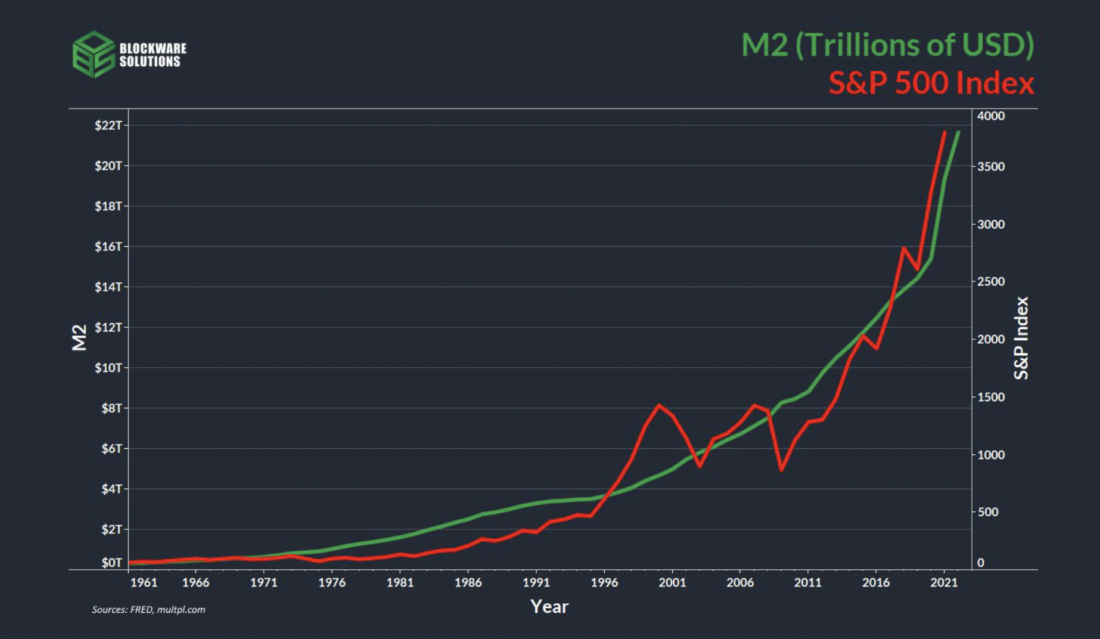

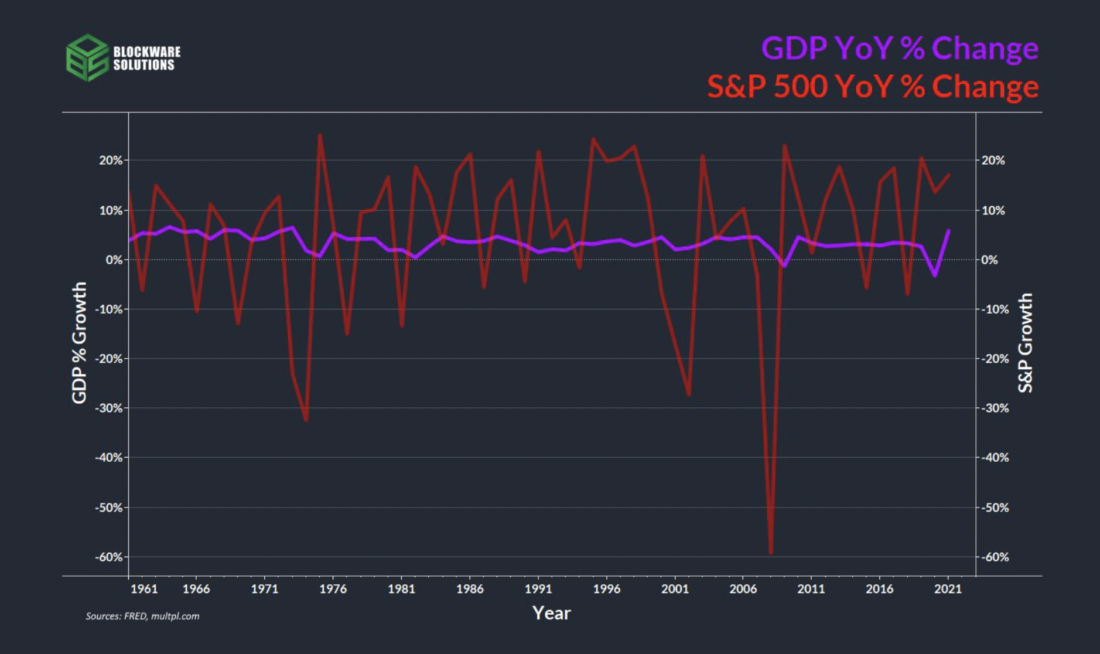

The expansion of the money supply is the driving forcegrowth in the value of shares. 2020 has given us a great example of how cash premiums are built into stock prices by the market. Despite negative GDP growth, stock prices rose sharply as central banks aggressively stimulated the market by expanding monetary base and credit.

From 1961 to 2021, the S&P's compound annual growth rate (CAGR) was 7.16%. The annual growth of US GDP over the same period was 2.96%.

Let's use our formula:

% cash bonus = (% stock growth — % productivity growth) / % stock growth

58.7% = (7.16% — 2.96%) / 7.16%

We can now subtract the 58.7% cash premium from the total market capitalization of all stocks and add it to Bitcoin's capitalization.

Change in GDP (%) in annual terms (purple); S&P500 price change (%) in annual terms (red).

In annual terms, the S&P500 index hastrend towards directional growth along with GDP growth, albeit in a more volatile manner. However, over the long term, the S&P500 has grown much more in percentage terms than productivity over the same time. This is due to the cash premium applied to the shares.

Redistribution of 58.7% cash premium of shares(~$63.4 trillion) in BTC, with the previously added cash premiums of gold and the monetary base, brings the market capitalization of Bitcoin to ~$100.7 trillion. At the same time, the market capitalization of shares decreases to ~$44.6 trillion.

$100.664.650.000.000 / 21.000.000 = ~$4.793.554 per BTC.

Market capitalization of various asset classes (BTC absorbs the monetary premium of gold, stocks and the monetary base).

After absorbing the cash premium of gold, equities, and monetary base, Bitcoin's market cap will be ~$100.7 trillion and BTC's price will be ~$4,793,554.

Demonetization of debt

Bonds, treasuries, fixed income, fiatcontracts, etc. This asset class has many names. We will here simply call it duty. The fiat money system is built on a shaky foundation that the promise of money (debt) is just as good as real money. The depreciation of fiat money creates an incentive structure where, in most cases, the most profitable financial move is to take on as much debt as possible.

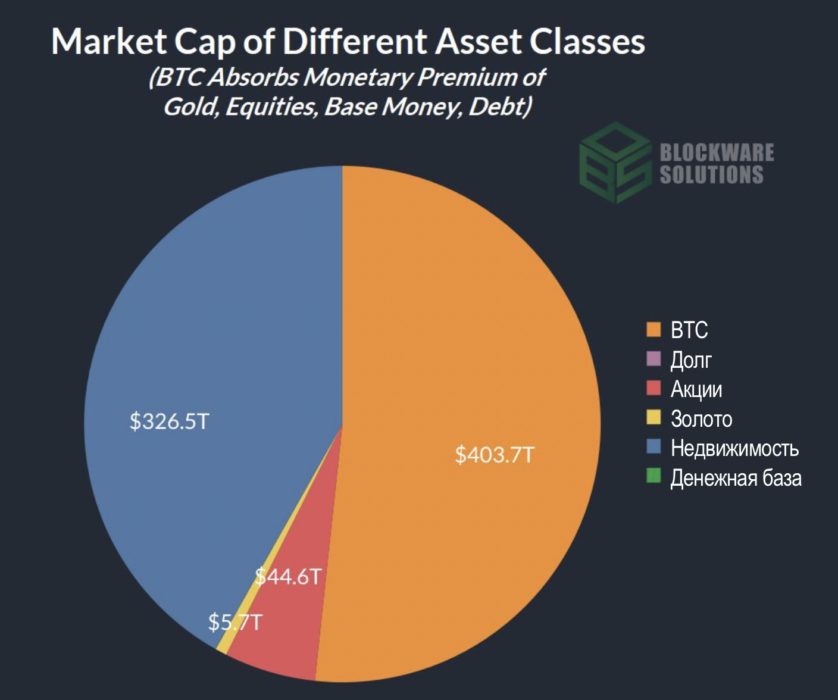

Debt, like the monetary base, has zero utility.price. Its value is 100% cash prize. Therefore, we will distribute all ~373 trillion of global debt market capitalization in favor of BTC market capitalization. As a result, the market capitalization of Bitcoin will reach ~$403.7 trillion.

$403.664.650.000.000 / 21.000.000 = $19.222.126 per BTC.

Under the Bitcoin standard, the debt will be very different, andits quantity relative to the monetary base will pale in comparison to the current monetary system. Once Bitcoin becomes a global reserve asset, BTC's purchasing power will increase along with global productivity (more on this below). Thus, the need for debt will be much less, since the real return on saving BTC will become the new «risk-free rate». Debt under the Bitcoin standard will most likely be in the form of short-term (less than 5 years) loans. The thirty-year mortgage is likely to disappear. However, speculation about the role of debt in a hyperbitcoinized economy is not part of our plans. We just want to express the idea that debt in its current fiat form will be absorbed by Bitcoin.

Market capitalization of various asset classes (BTC absorbs the monetary premium of gold, stocks, monetary base and debt).

After absorbing the monetary premium of gold, equities, monetary base, and debt, Bitcoin's market cap will be ~$403.7 trillion and BTC's price will be ~$19,222,126.

Demonetization of real estate

Michael Saylor describes rising prices with the expression«inflation is a vector». When the base currency depreciates, the prices of different goods and services rise at different rates. Products that are difficult to produce and in high demand tend to grow the most. This is why some goods respond more sensitively to monetary expansion than others. Pasta production is inexpensive and the demand for it is consistently moderate, so money supply inflation has minimal impact on its price. Real estate and houses are complex to produce, requiring a large number of different resources - lumber, steel, labor, time, etc. In addition, real estate is in constant demand due to its high useful value. For this reason, the real estate market tends to react strongly to the expansion of the money supply.

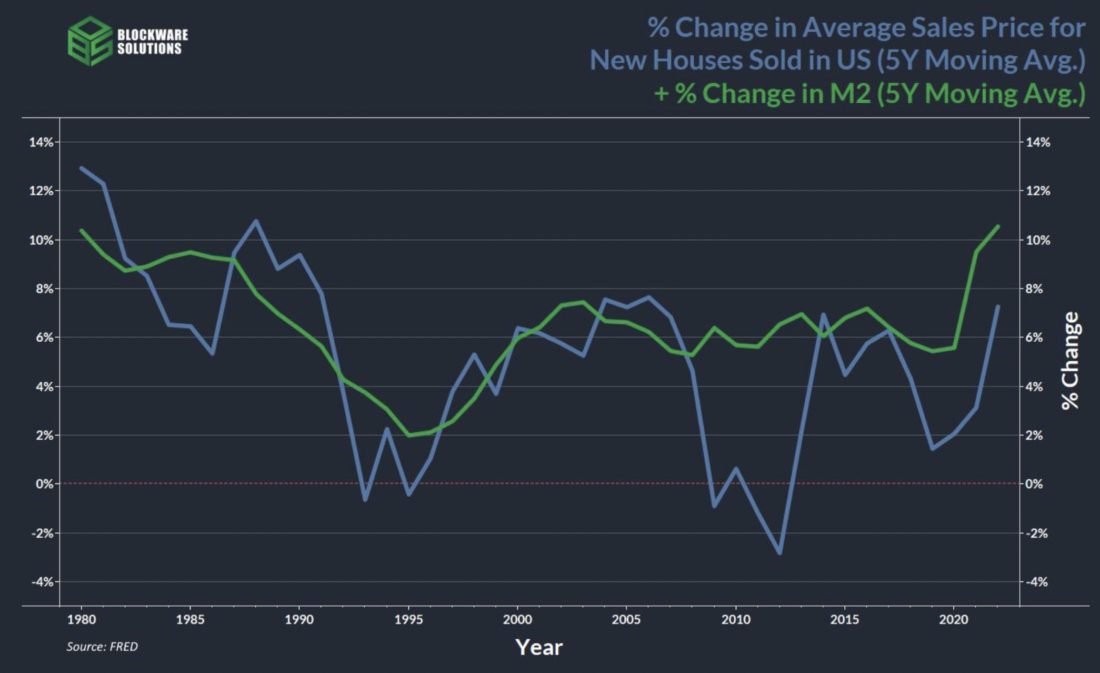

Although there has not yet been a year with negative M2 growth,It can be seen that during periods when M2 growth slowed down, the housing market responded with a slowdown or negative growth. Conversely, periods of high growth in M2 correspond to periods of high growth in property prices.

% change in the average sales price of US new homes (5-year moving average) (blue) + % change in the money supply M2 (5-year moving average) (green)

As with stocks, the main driver behind the rise in property prices over time has been the expansion of the money supply.

To determine the real estate monetary premium, we will compare the cost of construction with the selling price of new homes.

Reasons why these metrics provideThe best calculation of real estate cash premium are as follows. First, the depreciation of fiat currency increases the face value of the materials used to build houses. This means that not all of the increase in the sale price of new homes can be explained by an increase in the monetary premium: the main contribution is made by an increase in the nominal cost of construction. Secondly, considering prices for new houses, we exclude the factor of physical depreciation, which must be taken into account in the secondary market and which acts as a deflationary force on their real price. The only deflationary force affecting the selling price of new homes is productivity growth.

Monitoring changes in prices for unbuiltland can be an effective way to determine the monetary premium of real estate. However, this is less viable than our method because A) the data in this area is scarce and incomplete and B) the rate of change of the performance metric and the price metric must be compared to determine the monetary premium. If you look at the rate of change of one metric, it will not give any idea of the monetary premium.

The selling price of a home increases over timethe result of monetary expansion. But part of the overall increase in the selling price can be attributed to rising prices for materials and resources used in construction.

We can calculate real estate cash premiumsimilar to our cash premium calculation for stocks, where we compared stock price growth rates with productivity growth rates. Here we compare the rate of increase in the selling price of new homes with the rate of increase in construction costs. Under a fixed monetary standard, we would expect the price of new houses to change in line with changes in construction costs. But in the fiat standard, it works differently, and we can attribute the difference to the monetary premium included in the value of the property.

To determine the real estate monetary premium, we will use the following formula:

% cash bonus = (% increase in real estate prices — % increase in construction costs) / % increase in real estate prices

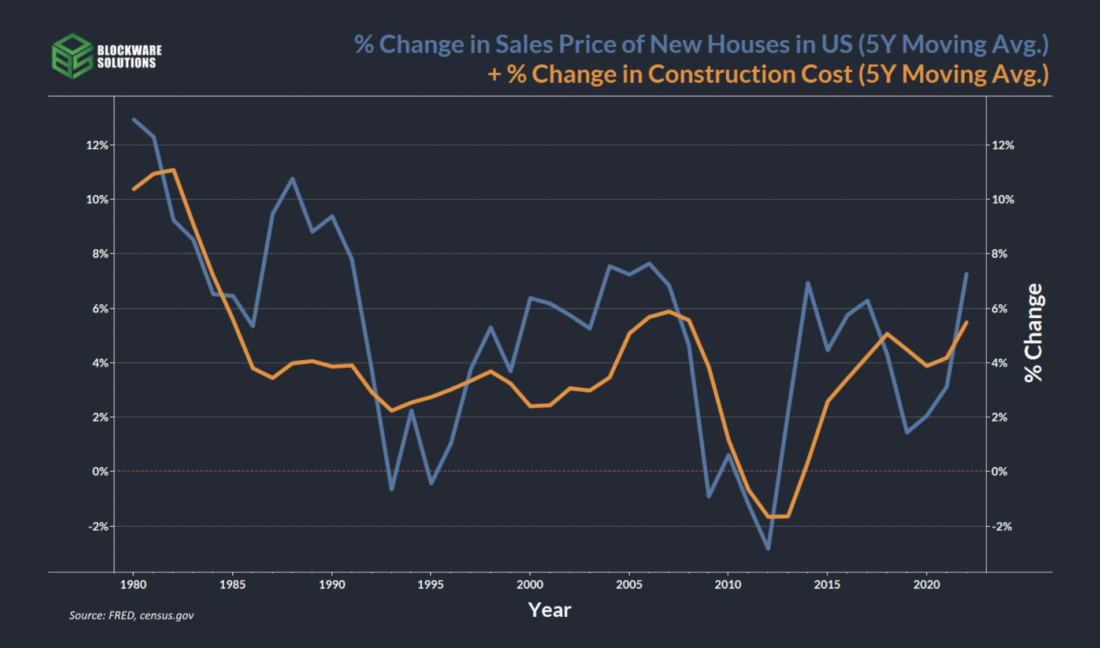

% change in US new home sales price (5-year moving average) (blue) + % change in construction cost (5-year moving average) (orange)

Looking at a graph of the rate of change (from 5 yearsmoving average for visual smoothing), we see that the selling price of new homes and construction costs are roughly correlated, with the selling price being the more volatile of the two.

Note:the available construction cost data is the annual rate of change (shown on the previous slide with a 5-year moving average); there is no reliable data on the cost of construction itself. To correlate changes in construction costs with sales prices, we created an index in which construction costs are initially set equal to the sales price of real estate in the base year 1975, and then rates of change from the construction data set are applied to the indicators.

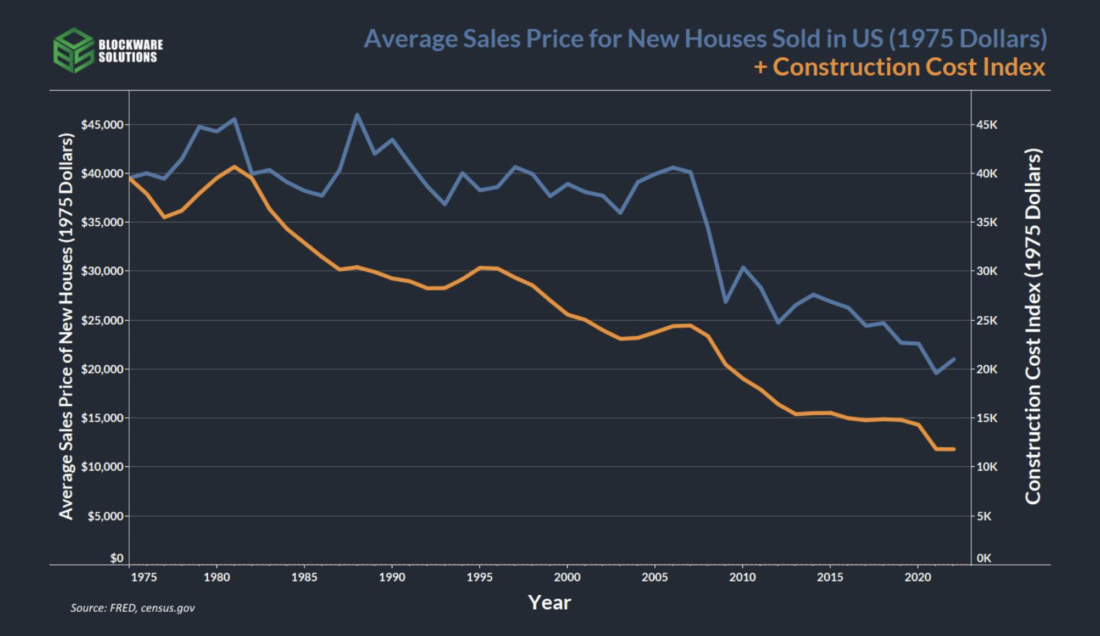

As mentioned earlier, in terms of«solid» monetary system, the cost of goods is deflationary due to rising productivity, and the cost of real estate is no exception. Adjusted for the M2 money supply, construction costs fell significantly over time, as did the final selling price.

Average selling price of new US homes (in 1975 dollars) (blue) + building cost index (orange)

When adjusting for inflation, it is important to doadjusted for money growth, not a CPI that tracks an arbitrary basket of goods. The real cost (adjusted for M2) of building a house, as well as the final sale price, has decreased significantly over time.

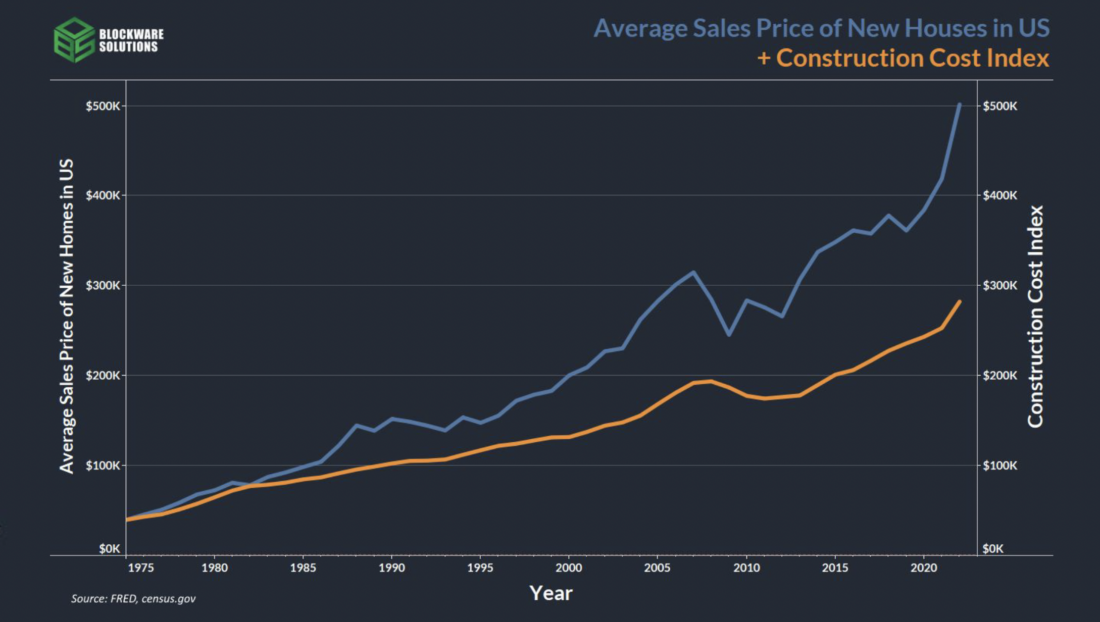

The following chart shows the nominalvalues of the average selling price of new homes and the construction cost index. To determine the real estate cash premium, we will calculate the compound annual growth rate (CAGR) for both measures. For the sale price of housing, the average annual growth rate was ~ 5.55%, and for the cost of construction - 4.27%.

This gives a cash premium for real estate of ~23.1%.

23.1% = (5.55% — 4.27%) / 5.55%

Average selling price of new US homes (blue) + building cost index (orange)

While construction costs are on the riseby an average of only 4.27% per year, the final selling price of new homes increases by an average of 5.55% per year. This ~23% difference in rate of change is the real estate cash premium.

23.1% = (5.55% — 4.27%) / 5.55%

With this 23.1% cash premium reallocated to Bitcoin, its market capitalization would rise to ~$479.1 trillion. At the same time, the capitalization of the real estate market is reduced to ~$251.1 trillion.

$479.095.945.000.000 / 21.000.000 = ~$22.814.092 per BTC

Market capitalization of various asset classes (BTC absorbs the monetary premium of gold, stocks, monetary base, debt and real estate).

After absorbing the monetary premium of gold, equities, monetary base, debt and real estate, the market capitalization of Bitcoin will be ~$479.1 trillion, and the price of BTC will be ~$22,814,092.

Conclusion

Upon completion of demonetization of other classesassets, the purchasing power of Bitcoin will be approximately 61.4% of the total global financial asset market. The purchasing power of 1 BTC would be equivalent to ~$22,814,092 (in 2021 dollars).

The last point we wanted to make isis that even after the demonetization of the listed asset classes, the purchasing power of BTC can grow indefinitely along with productivity growth. As discussed above, technological progress increases the productivity of an economy over time. Thus, the real cost of goods and services, measured in BTC under the Bitcoin standard, will decrease every year. BTC holders will accumulate purchasing power without having to invest in risky assets. This increase in purchasing power will represent a new «risk-free rate» — opportunity cost and target return for all investment instruments. While in the fiat standard the «risk-free rate» is the rate on government bonds (government debt).

And with an average annual global GDP growth of 2%, the purchasing power of BTC will double every 36 years.

This forecast does not contain a time frame,for it is impossible to predict exactly how long this transition may take, if it occurs at all. However, given BTC's superior monetary properties, its accelerating adoption rate, and persistently high inflation rates among all fiat currencies, it's reasonable to assume that a transition to a global bitcoin standard is becoming increasingly likely.

Market capitalization of various asset classes (BTC absorbs the monetary premium of gold, stocks, monetary base, debt and real estate).

Even after demonetization of other financialBitcoin assets will encourage hoarding and behavior based on low time preference tactics. And the increase in purchasing power from simply holding Bitcoin will become the new «risk-free bet» On the market.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>