Article Reading Time:

1 min.

US Tax Service (IRS) applied to the courts for permission to obtain data on the transactions of clients of the cryptocurrency dealer SFOX and its partner M.Y. Safra Bank.

IRS intends to identify customerscryptocurrency platform SFOX and M.Y. Safra Bank to identify violations of tax laws. To that end, the IRS has asked federal judges in New York and Los Angeles to allow tax authorities to serve subpoenas on users.

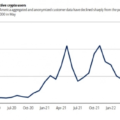

“Cryptocurrency transactions have grown significantlyin recent years. Therefore, the IRS is concerned that some taxpayers are not properly reporting these transactions on their tax returns. The IRS plans to inspect the accounts of SFOX and M.Y. users. Safra Bank with cryptocurrency transactions amounting to more than $20,000 for the period from 2016 to 2021,” the department reports.

Let us remind you that in 2019 the SFOX companyentered into a partnership agreement with M.Y. Bank. Safra, allowing its clients to gain access to FDIC-insured bank accounts.

Previously, the IRS asked for information about users of cryptocurrency exchanges Kraken, Poloniex and Coinbase, as well as the issuer of the stablecoin USDC Circle.