“Bitcoin is the first software network with the ability to accumulate and store all monetaryenergy in the world without losing energy with the flowtime and with negligible transmission losses. If we assume that this invention becomes widespread, then it will become the most valuable invention of the modern era. Few understand this. ”[1] - Michael Saylor, CEO of MicroStrategy, October 16, 2020.

</p>Introduction

Somehow I came across several articles inwhich argued for a $1,000,000 Bitcoin (like this one)[3]. Therefore, I thought it worthwhile to look into the future and decided to write about this case of Bitcoin at $10,000,000, or, moreover, Bitcoin at $15,000,000, and also about the parity between dollar and satoshi (dollar-sat), that is, the price of Bitcoin at $100,000,000. We live in very unusual times, but the reason for such times should not be hidden behind a shroud of secrecy. Make no mistake, the current economic problems the world is experiencing are not caused by COVID-19 or any other Black Swan event. They are caused by an imbalance in the economic system, which is largely due to massive money printing by central banks and manipulation of the economy. As the Austrian economist Ludwig von Mises wrote in his book Human Action: A Treatise on Economic Theory:

“Ways to avoid a sudden collapse of the boom,caused by credit expansion does not exist. The alternative is limited by two options: the crisis will come either earlier, as a result of a voluntary refusal from further credit expansion, or later, as a final and general catastrophe of the monetary system ”[4].

Whatever Traditional Keynesian Believeseconomists and central bankers, in many ways it was their policies and ideas that pulled us into this mess we are in now. In my other articles, I have already looked at The Origin of Money [5] and The Origin of Wealth [6], as well as The Origin of Bitcoin [7]. So I would recommend that you refer to these articles if you want to get a better understanding of how money came to be, how it developed and what led to the state of affairs that we are in now. I also recommend that you carefully read Nick Szabo's excellent History of the Origin of Money [8], The Numerous Traditions of Private Money [9], and Money, Blockchains and Social Scalability [10].

Money must be created by free market mechanisms

However, it is necessary to briefly touch upona few points. First of all, money — it is, first and foremost, a tool created by the free market to store value and deliver it into the future. This value can then be exchanged for goods and services. This is a much more efficient system than barter, which has difficulty establishing a balance between the respective values of the goods being traded. Money serves as an intermediary, as well as a “transport mechanism for economic settlements” [12]. However, their mediating role is not at all accidental. Money cannot be created out of nothing and from scratch. They should arise naturally in a free market. In the past, the most sought-after goods, such as shells, beads, silver, gold, etc., were always used as money. To become sound money, its supply must be limited. The volume of supply itself does not matter — all that matters is that it be limited or fixed. This is to ensure that they are the embodiment of scarcity. Any amount of money can absorb all the value that exists in an economy. The specific volumes of supply do not matter, provided that they are limited. This is an important point because, as Mises tells us, “the purchasing power of money is determined by supply and demand, as in the case of the prices of all goods and services sold,” and “he who intends to buy or give money, of course, first of all they are interested in their future purchasing power and future price structure” [13]. Bitcoin represents the latest evolution of money. Its creator and numerous collaborators worked on its implementation, but in many ways it arose as a solution to a serious problem in the free market.

The essence of the problem — fiat currency and “easy money”.

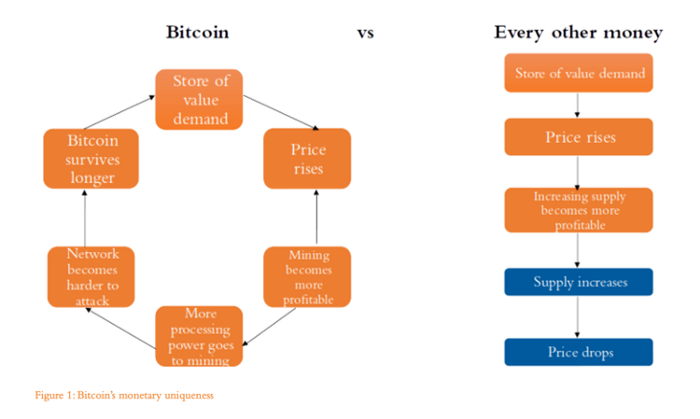

Since 1971 in the United States and othersparts of the world do not use the gold standard system. Instead, countries use fiat currencies, which are created by governments to act as money. At the same time, there is a constant inflation of the aggregate supply of such currencies — it is currently being carried out on a huge scale. The 2008 financial crisis, a result of too much easy money created by the Federal Reserve as well as other massive government policies, signaled the emergence of Bitcoin, and its subsequent price is a sign that the free market has fully accepted it as a store of value a value that satisfies many of the functions that gold and previous free market money performed before it. Bitcoin has absolute scarcity, with a total maximum supply of 21 million units, with each unit of Bitcoin consisting of 100,000,000 satoshis. Because Bitcoin is “intrinsically expensive” [14], in the words of Nick Szabo, it cannot be created in any quantity at will. Bitcoin's supply cannot be inflated, and due to its distributed and decentralized nature, its scarcity is immutable. Thus, it is superior to gold in terms of fixed supply, portability (being digital), security (being easily stored) and liquidity. Bitcoin is also easier to verify, less subject to confiscation, less censorship, and antifragile [15].

The current crisis

The current COVID-19 pandemic 2019-2020led to widespread economic contraction by governments, destroying small businesses, jobs and undermining the economy. Whatever the relative dangers of the virus, it represents massive government intervention in the economy that can only have negative economic consequences. Central banks have responded by printing money even more intensively, which in turn has already led to massive inflation. The CPI (Consumer Price Index), which measures inflation, is based on an outdated basket of goods. This does not take into account factors such as real estate, asset inflation, education spending and, in principle, everything else that really matters. Real inflation is much higher than reported inflation. This is the inevitable result of a massive increase in the money supply, namely the fiat money supply. As Richard Cantillon (1755) wrote in his essay Essay on the Nature of Trade in General: “Everyone agrees that the abundance of money, or its increase in exchange, will increase the price of everything. The amount of money brought from America to Europe over the past two centuries confirms this truth in practice ”[17]. As a result, we see that the stock market continues to rise in value, despite the fact that there is no actual increase in the value of companies represented by shares. Those who are closest to the new money supply (for example, banks, financiers, and the largest corporations) benefit most. This phenomenon is known as the Cantillon effect (named after Richard Cantillon). People are fleeing from fiat currencies to stocks, real estate and other assets. Nowadays, both individuals and institutions are also investing in bitcoins en masse. At the moment, the price has jumped to a level close to $ 60,000 per BTC. This is a huge increase from the low in March 2019, when the price of bitcoin dropped to almost $ 4,000.

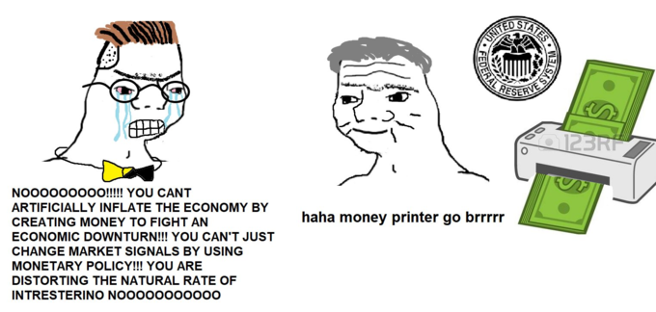

The money printer makes tyr-tyr-tyrrrrrr….

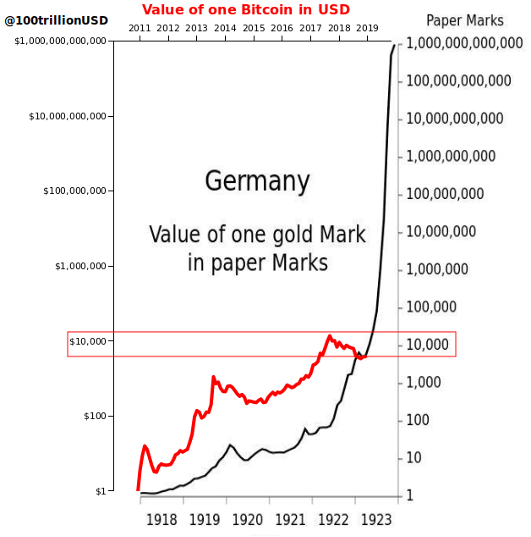

We are currently faced with a situationsimilar to previous financial and economic crises of the past. We are dangerously close to a Weimar-style hyperinflation scenario that could lead to the end of fiat currencies as we know them. However, we can find examples of currency depreciation going back thousands of years in history. As I already said in the article “The Origin of Money”: “After all, even the Athenians resorted to minting bronze coins during the war, issuing in 406 BC. symbolic bronze coins to offset the costs of the Peloponnesian War (431-404 BC) [19]. By the way, Athens lost that war, so the depreciation of the currency did not bring them any benefit. Devaluation was also carried out by Dionysius of Syracuse, who demanded that all coins be collected for recoinage, which resulted in the standard being halved while their face value was doubled and half of the coins being retained to pay off his outstanding debts, thus devaluing the currency by 50% [20]. Rome, the great empire of Europe, originally had a stable currency based on gold and silver" [21]. As for Athens, after they were defeated by the Spartan admiral Lysander in 405 BC, they were forced to demolish the long walls and fortifications of Piraeus, surrender all but twelve ships, and accept Spartan leadership in any expedition. which Sparta may ever undertake [22]. Thus, they lost both their empire and their supremacy in the region. The Peloponnesian War of our time — it's COVID-19. Instead of minting bronze coins, the US government, along with many other governments, is trying in vain to mitigate the effects of COVID-19 and the economic collapse by handing out stimulus checks, paying out Social Security benefits and making other massive financial spending. However, such spending not only does not solve the problem, but only aggravates the main problem — currency depreciation. It seems that we are now mired in an era of permanent stimulus and constant currency depreciation. The only logical continuation of this process is inflation. As President-elect Joe Biden recently announced, the $900 billion stimulus package — this is “at best just a down payment,” and the current total is $3.3 trillion — “this is just the beginning” [23]. It seems likely that individual payments of $900-$2,000 to Americans are a harbinger of the coming permanent UBI (universal basic income).

Destruction - painting by Thomas Cole (1833)

The value of absolute scarcity

Bitcoin is without a doubt the mostscarce asset on the planet. And what are the grounds for such a loud statement? The point is that the scarcity of bitcoin is immutable and provable. Consider a couple of reasons to support this fact. Take gold for example. Although the total amount of gold reserves can be estimated, it is impossible to verify whether the estimate is reliable or not. The stock of Picasso artwork, cited as being more scarce than the supply of Bitcoin, thanks to the flawed argument of Keynesian economist Francis Coppola, is also not 100% verifiable, not to mention that Picasso's paintings are neither liquid nor replaceable, and require exceptional security measures to protect them from theft or damage. Bitcoin, in contrast, is antifragile to use the expression of Nassim Nicholas Taleb [25]. This means that the Bitcoin network is reliable, indestructible and can survive all unforeseen circumstances without exception, even a nuclear war or economic collapse. Plus, it's “genuinely expensive,” as Nick Szabo put it. This means that it cannot be easily created, counterfeited or copied.

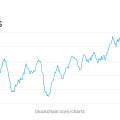

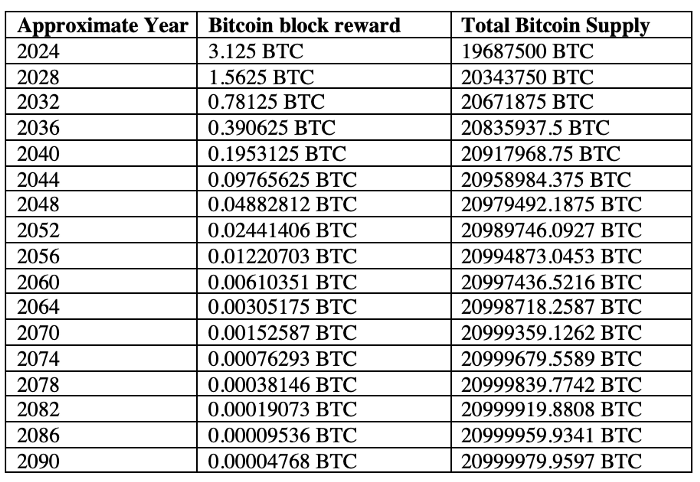

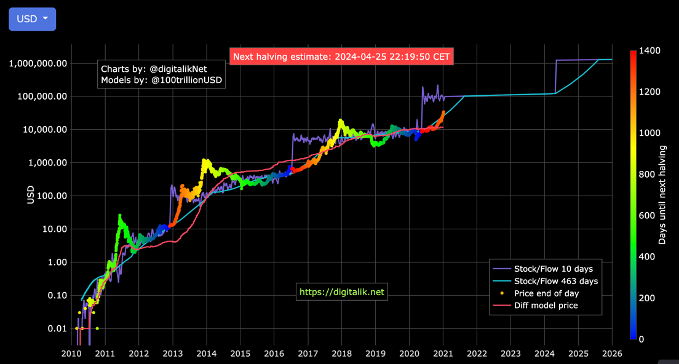

One of Satoshi's greatest creations wasinvention of a schedule for cutting a sentence in half or halving. Providing assurances that new supply of bitcoins will halve roughly every four years, or every 210,000 blocks, means that bitcoin's inflation rate decreases significantly over time. Thus, if in the early years inflation was high, now it is incredibly low and will soon be much lower than that of gold itself. In 2024, the growth rate of Bitcoin supply will decline to 1.26%, which is significantly lower than the growth rate of gold production. The last full-fledged bitcoin will be mined around 2033, and the last piece will be mined around 2140 [27]. This means that Bitcoin has a high stock-to-flow ratio. New supply of bitcoins will never surpass existing stocks. The same cannot be said for gold, which also has a high stock-to-flow ratio but does not have an upper limit on the amount that can be mined. Compare this to the supply of Bitcoin, which has a hard cap on the total supply of 21 million BTC, with several million already (irrevocably) lost. To date, more than 18 million units have been mined.

Predicted Halving Events And Total Bitcoin Supply - 2024-2090

Bitcoin — This is the financial singularity

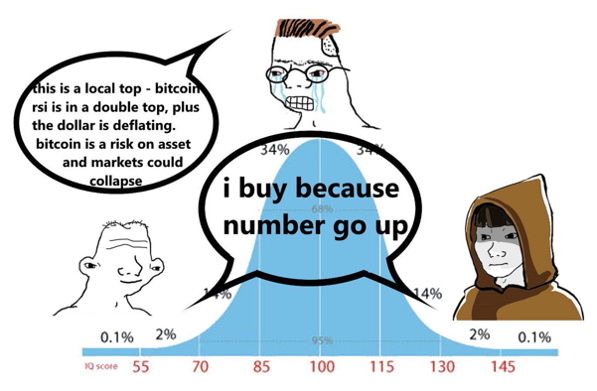

Despite the supply shortage, there ismore than enough bitcoins for the entire planet to use — not at the basic level, that is, in the blockchain, but in secondary layers and in payment systems. The total supply of a currency is always sufficient for it to absorb all existing value in the economy. Renowned economist Murray Rothbard wrote that “once the supply of a commodity is sufficient to establish itself in the market as money, there is no need ever to increase the supply of money. This means that any offer of money, no matter what it is, is “optimal”; and every change in the volume of money supply initiated by the government can only be disastrous” [28]. As we can see from the chart above [29], Bitcoin will reach a supply of almost 21 million units around 2056 AD, and the last Bitcoin will be mined by 2140 AD. Every four years there is a massive supply shock. Because Bitcoin miners will now only be able to produce half the supply they did in previous years, and demand continues to grow as individuals, funds and institutions seek a store of value that is immune to inflation and money creation , a serious supply shock occurs. This has happened with every previous Bitcoin halving, and was seen more recently after the May 2020 halving, which sent the price of Bitcoin skyrocketing.

The concept of the singularity is far from new.Robert Hanson wrote back in 1998: “It therefore seems possible, although not certain, that the continuation of historical trends will lead to an economic singularity.”[31] By the 19th century, a single monetary standard had been established throughout almost the entire planet — gold. However, since 1971 [32], all global economic calculations have been based on various fiat currencies that are not tied to any real assets. As the world economy continued to grow from 1971 to the present, the value of all goods and services in the world was calculated in dollars, but dollars have not proven to be a very good store of value. Thus, retirees had to invest most of their wealth in real estate, the stock market and other assets, rather than saving depreciating dollars in a bank account. Similarly, wealthy people in foreign countries with high rates of inflation and limited property rights began buying up property in the UK, US and Canada, using real estate as a store of value. All of these assets served as a means to escape the rising tide of inflation, like lifeboats in the flood of central bank currencies. However, this wave has now become a flood, and there is only one ark of salvation that can protect people's wealth and property from destruction: Bitcoin.

What does it mean for bitcoin to perform inas a financial singularity? This mainly means that bitcoin is currently going through a monetization process, which includes the absorption of value held in current asset classes. As people come to understand that gold is no longer the optimal store of value in the long run, Bitcoin begins to consume gold's total market capitalization. As popular Bitcoin quantum analyst Plan B tweeted in December 2020:

“If Bitcoin does follow its historicalway, then in 2021-2024 he will remove gold from the game, and in 2024-2028 real estate. After real estate, we can no longer interpolate and must extrapolate, diving into uncharted waters, — hyperbitcoinization?[34]

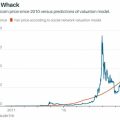

Current capitalization of gold (for 2020)is approximately $10.891 trillion. [35]. Thus, the potential price of Bitcoin varies between $238,095 — $476,190 per BTC approximately between 2021 and 2024. In 2019, he predicted a Bitcoin price of “$100K (2020+), $1M (2024+), $10M (2028+)…”[36] However, in an article published in In April 2020, Plan B updated its model, projecting $288,000 between 2020 and 2024 [37]. This price value, however, is not the absolute maximum that it predicts for the specified time period. According to him, it can exceed this goal by 2-3 times, after which an 80% price collapse may occur [38]. He also warns that “the model is performing just fine at the moment and we have a long way to go until the $288K mark is reached, with the model allowing for 2-3x the projected price. Therefore, I don’t think we will break through in the current cycle” [39]. However, he predicts that “we could break higher/start hyperbitcoinization after the next cycle (S2F100/$100T, ~2028)” [40]. Hyperbitcoinization — a term first coined by Daniel Krawisz back in 2014 in an article entitled “Hyperbitcoinization” [41]. ObiWan Kenobit (2018) defines it as “a theoretical state in which Bitcoin replaces legacy currencies and becomes the dominant, if not the sole, method of exchanging value” [42].

The road to Bitcoin worth $ 10,000,000

As noted above, the Plan B model predictsthat “BTC’s market capitalization will approach gold’s market value of $5-10 trillion. in 2021-2024, and to the market value of real estate at $10-100 trillion. in 2024-2028" [44]. The next Bitcoin halving will occur in 2024 (when the block reward drops to 3.125 BTC), followed by the next halving in 2028 (when the block reward drops to 1.5626 BTC), and the halving in 2032 (when the block reward drops to 0.78125 BTC and the total number of bitcoins mined will reach 20,671,875 units). Thus, by 2028, the block reward will drop to less than 2 BTC, and by 2032 — to less than 1 BTC per block. Each halving is followed by a “supply shock” as supply fails to meet demand and buyers bid up the price of each bitcoin until it reaches a level that is several times higher than the pre-halving price. What then typically occurs is a bull rally lasting about a year or so, followed by a bear market. These four-year cycles attract more users and Bitcoin holders with each new iteration. As Brandon Quittem explains:

"To the casual observer, most of lifeBitcoin is boring and monotonous - months go by and nothing much happens. Then, when the conditions are right, Bitcoin explodes into life, growing enormously in size and taking over the minds of observers. Its price skyrockets, the media is flooded with enthusiastic hyperbole, and chat rooms are flooded with messages from “normals” … Eventually the market bottoms out. Hodlers cling to each other like “Brothers in Arms,” creating a strong foundation that can withstand future growth. As hodlers accumulate more bitcoins, the float (the number of bitcoins in active trading) becomes increasingly limited. As the available supply decreases, each new user puts more upward pressure on the price. As prices rise, the media brings public attention to it, which attracts new users to Bitcoin, and soon we find ourselves in another hype cycle again.” [45]

Based on current and past market cycles, wewe can state with full confidence that a bull market will come in 2024-2025, followed by a bull market in 2028-2029 and a bull market in 2032-2033. At the peak of the 2016-2017 bull market, the bitcoin price peaked at $ 20,000. This was followed by a price crash and a bear market that lasted until 2020. After another halving occurred in May 2020, the price rallied and eventually reached $ 20,000 again, followed by a new all-time high. We have not yet reached the end of the current bull market. The previous bull market coincided with extreme uncertainty over the election of Donald Trump in 2016. And today's bull market happened at the end of this presidency, with serious uncertainty about the economic impact of the new administration, the ongoing 2019-2020 COVID-19 crisis, massive government spending to stimulate the economy, and widespread lockdowns, including new lockdowns. throughout England, Scotland and Wales (no fixed end date).

As a result of governmentrestrictive measures destroy small businesses, increase unemployment and intensify social unrest and social disintegration. This is happening against the backdrop of an increase in extreme leftist sentiments, in particular, the ANTIFA movement, the growth of racial enmity spurred by Marxist activists, cultural wars over value systems and identity, as well as a massive increase in populism, government encroachments on freedom, interference by social networks in elections and suppression freedom of speech (especially against conservative "wrong thinking") and other "goose steps" towards Orwellian tyranny. As the Federal Reserve, Bank of England, Bank of Canada, European Central Bank and other central banks continue to print fiat currencies as if tomorrow never comes, we are also now on the road to exorbitant inflation and erosion of confidence in the existing monetary system. This situation represents just the perfect storm for Bitcoin. In the midst of a flood of epic proportions, there is no escape from drowning in a sea of hyperinflation other than inside the ark of Bitcoin.

It is unlikely that we will reach the cost level of oneBitcoin at $1,000,000 during the current bull market cycle (2020-2021), but will likely top out somewhere in the range of $100,000 — $288,000, if not 2-3 times that level (i.e. $576,000 — $864,000). Any price in this range would not be a surprise to me. Suffice it to say that $58,000 will not represent the top of the current cycle. What about the next cycle? As noted above, Plan B predicted "$1 million (2024+), $10 million (2028+)…" [48] This coincides with his prediction that Bitcoin will “displace gold in 2021-2024, and real estate — in 2024-2028”, after which “we can no longer interpolate and must extrapolate into uncharted waters” and possibly “hyperbitcoinization” [49]. Hal Finney, one of Bitcoin's original authors, wrote in 2009 that “Current estimates of total global wealth that I know of range from $100 trillion. up to $300 trillion. If we translate this into 20 million coins, then the cost of each will be $10 million.” [50]. According to the S2F model presented by Plan B, this will be achieved by the fifth halving (2028) and the bull market of 2028-2029. After this point, the Plan B model falls apart and he predicts that hyperbitcoinization may occur, which will entail the complete destruction of the current monetary and financial system. That is, establishing a worldwide Bitcoin standard.

The road to Bitcoin worth $ 15,000,000

Regardless of whether the S2F model breaks andwhether the price will reach $10,000,000 by 2028 and then hyperbitcoinization, it seems increasingly likely that this price will inevitably be reached. During the 2018-2020 bear market, people ridiculed the very idea of a $100,000 Bitcoin. Peter Schiff, the "eternal bear" Bitcoin antagonist and ardent supporter of the idea of a single gold standard, went so far as to say that Bitcoin is bigger will never reach its previous all-time high of $20,000 [52]. He constantly urges Bitcoin holders to sell and predicts that the value of Bitcoin will fall to zero. Nouriel Roubini makes similar predictions, saying that Bitcoin — It's a pump and dump Ponzi scheme. As we are increasingly discovering, especially with evidence such as Brexit, the COVID-19 crisis and the failed predictions of climate change alarmists, “experts” are quite often wrong — sometimes they even make quite spectacular mistakes.

One way or another, economists seem to be the mostare wrong when it comes to Bitcoin, lending credence to the notion that Keynesian economics — it is pseudoscience, not real science, and justifying Austrian economic theory as a more accurate school. Despite the sea of negative forecasts, economists, “gold bugs” and “eternal bears” were categorically wrong, and at the moment Bitcoin is only two denominations of the current price away from $100,000. The same will inevitably happen after the emission is halved in 2024. We could very well reach $1,000,000 or more at the peak of the 2024-2025 bull market. This is in no way a guarantee. It may also happen that we reach the $500,000 mark in 2025 and $1,000,000 in 2028-2029. Or maybe we'll hit $10 million in 2029. There are many different factors, which means that it is impossible to accurately predict any of the above. However, I would be extremely surprised if we don't reach $10,000,000 or higher by the 2032 halving and subsequent bull market in 2032-2033. At this stage, it will probably be possible to achieve multiples of this figure — maybe even $15,000,000 — $20,000,000 for one bitcoin. If not, then this will happen after the next halving in 2036.

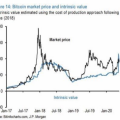

Stock-to-Flow Model (S2F) Plot (Plan B)

If Bitcoin absorbs the total value of the worlddebt ($252.6 trillion) or the total value of global real estate ($280.6 trillion), then 1 BTC could be worth approximately $12 million - $13.361 million (excluding lost coins). Assuming that there are currently about four million lost coins [55], so there are about 16,671,000 BTC in hand, then we get a rough estimated value of about $15,152,060 — $16,831,623 per Bitcoin. Thus, I believe there is a fairly strong case for Bitcoin to reach $15,000,000 by 2033 at the end of 2032-2033 and after the sixth halving (in 2032). This makes sense since the block reward would be 0.78125 BTC, which means the cost of mining 1 BTC (and even 0.78125 BTC) would be huge. The cost of one BTC should always be high enough to take into account the energy and computational costs associated with mining one Bitcoin block. The fee should also be high enough to cover all the costs associated with the Bitcoin transfer. At this point, Bitcoin will serve primarily as a settlement layer. It is unlikely that it will be used to buy coffee on the blockchain. Rather, it will become a way to transfer large amounts of value through a persistent, immutable, censorship-resistant, and antifragile network. This involves the development and implementation of Layer-2 solutions, which will allow for fast or instant payments (including micropayments), which will subsequently be placed on the blockchain. For more information on this and Bitcoin's social scalability, see my article Ten Reasons to Buy Bitcoin [56] and Nick Szabo's article on Social Scalability [57].

Bitcoin Supercycle and Hyperbitcoinization

However, there is an alternative to the above.What if Bitcoin enters a powerful supercycle? What if the existing models fall apart? Currently, the duration of each bitcoin cycle is four years. They all form a series of Gartner hype cycles on Bitcoin's path to monetization. After each halving, a bull market ensues, followed by a price crash and a bear market, much to the delight of Peter Schiff, Roubini, Krugman and other Bitcoin critics, who are further dumbfounded (and vexed) when Bitcoin eventually reaches its previous historical record. high, and a new bull market begins. But what if it suddenly happens that this whole scheme breaks down, and instead of it there is one powerful supercycle of Bitcoin, which will destroy the entire financial system and lead to hyperbitcoinization? From this point on, Plan B's S2F model ceases to be valid, and we find ourselves in truly unexplored waters. Dan Held recently made the following suggestion on Twitter (December 26, 2020):

“Why Bitcoin May Go Through a Supercycle:This time it's different: COVID, the narrative that Bitcoin — this gold 2.0, institutional herd and ease of use heralded the advent of a new phase. Instead of the usual bull/bear cycle, Bitcoin will break all rules and enter a “Super Cycle”. You probably first heard about Bitcoin in either 2013 or 2017, when friends and family started talking about wild price fluctuations. Bitcoin's market cycle is typically around four years, and some speculate that this cycle is caused by halving events (a reduction in new supply). The bottom line is that a decrease in supply + an increase in demand = an increase in price. This could be called the next round of viral marketing for Bitcoin… And yet, in this case, this cycle is completely special. Never before has Bitcoin had such powerful macroeconomic fundamentals that highlight exactly why Bitcoin is needed; its narrative is exceptionally unique, and the opportunities for global value to flow into Bitcoin have never been more accessible.

“Even though the Bitcoin seeds werePlanted during the 2008 financial crisis, their wild flowering largely occurred during the large-scale running of the bulls. During the period 2008-2020, traditional financial markets underwent several minor adjustments, but there was no recession as such. Until COVID came along. When COVID hit, markets crashed. What was the first real test for Bitcoin? Will HODLERS become buyers of last resort? Will Bitcoin Collapse to $0 as the World Heads for Disaster? While Bitcoin suffered a sharp decline during the liquidity crisis on March 12 (which affected all assets), Bitcoin survived and exploded at the end of 2020, reaching an all-time high of $24,000. While Bitcoin was recovering, governments around the world engaged in unprecedented money printing. And when I say unprecedented, I mean — like never before in recorded financial history. More than ten trillion dollars have been printed around the world to support the traditional financial system. This essentially meant that governments were actively devaluing their currencies, which is exactly what Bitcoin was designed to protect against.

"Most people don't even think about buyingEarthquake insurance only until an earthquake occurs. After which, insurance companies find themselves inundated with requests. Bitcoin was specifically designed to serve as a store of value in a world where no government or bank can be trusted. However, events like the 2008 financial crisis don't happen very often... Bitcoin was created for moments like today. It is now easier to grasp and is available for purchase in a variety of places. What happens when the share of Bitcoin owners in the world increases from 0.01% to 1%? What happens when some of the $100 trillion that is managed by institutions moves into Bitcoin for the purpose of preserving wealth? And he's certainly not going to move from $20k to $100k. It could go from $20k to $1M, after which only smaller cycles will remain. And perhaps this is one of the final big cycles.” [58]

Recognizing, however, that the Bitcoin supercycleis entirely possible, I believe that $1 million per BTC represents a fairly low estimate for the end result. Rather, I would probably agree with Hal Finney that $10,000,000 — This is a reasonable target, and also with Plan B, in that it could be achieved sometime between 2028 and 2033. However, the very idea that a supercycle could follow is quite reasonable, since Bitcoin could, in one big leap, break the existing system and become a ark of financial salvation — a financial singularity that will absorb most of the value on the planet. As people invest their worthless fiat savings and earnings into BTC, Bitcoin will begin to absorb much of the value currently accumulated in gold, the stock market, real estate, bonds and government debt. From this point on, even $15,000,000 for one BTC may already seem like an underestimate of its possible potential.

Neo: Are you saying that someday I will be able to sell my bitcoin for millions?

Morpheus: No, Neo.I mean, when you're ready... You won't need tosell it.

As Michael Saylor, CEO of MicroStrategy, a company that now owns over 70,000 BTC, explains,

"#Bitcoin is not a train leaving the station, it is an ark designed to save people from theMissing the train is just a missed opportunity.To miss the ark is to lose everything."[60]

Knut Svanholm, a Bitcoin writer, tweeted:

"Imagine everything that is, and everything that will ever be, divided by 21 million.In an article entitled "You're Not Ready," Knuth"Imagine that the price of bitcoin doubles every week – $10k, $20k, 40, 80, 160, 320, 640, $1 million, $2 million, 4, 8, $16 million, and so on.At first, you will be very happy to know that the value of your Bitcoins is nowenough to pay off the mortgage in full, but what happens when you can afford it?When will they be able to buy you not only friends, but also an army?When will you realize that you are richer than, say, Tibet?" [62]

Divide everything by 21 million

And what is meant by "absolutely everything divided by 21 million"?In another Twitter thread, Svanholm elaborates"Hyperbitcoinization doesn't have an endpoint. It's not just about the value of all the money in the world that canabsorb #Bitcoin, and not even in the value of everything else.to the standard of sound money, the world economy will becomemore efficient and less wasteful... Theoretically, the purchasing power of #Bitcoin canonly to grow, steadily striving towards infinity, at an ever-increasing rate.As Albert Allen Bartlett once said:

"Humanity's greatest flaw is our inability to understand the exponential function." #Биткойн will proveYou won't believe your eyes.

Everything is already quite unusual, but we haven’t even come close to seeing what should happen in the near future. Fasten seat belts. The engines are already warmed up ”[63].

Divided by 21 million, what are weget it? If we take the total money supply of $ 80.9 trillion [65], together with the total value of the global real estate ($ 280.6 trillion), the world stock market ($ 70.75 trillion) [66], the world bond market ($ 128.3 trillion) [ 67], and the derivatives market ($ 640 trillion) [68], we get a total value of 1.11965 quadrillion US dollars. According to a more thorough assessment of global wealth, according to Credit Suisse, it amounted to about $ 399.2 trillion, there are 52 million millionaires in the world (as of the end of 2019) [69]. Even if we use the Credit Suisse estimate and divide the $ 399.2 trillion. by 21 million, we get $ 19,009,523.81 per BTC. With an estimate of $ 1.11965 quadrillion, we get roughly $ 53.316 million per BTC. Since Bitcoin will be used to value everything, and since huge inflation is on the way, the future estimate of $ 100 million for BTC does not seem to be unreasonably high.

At the moment, bitcoin istrue singularity. It has already absorbed all the available value in the world, since any economic calculation is made with reference to bitcoin. The value of all goods and services is expressed in bitcoins, and bitcoins become the main, or even the only medium of exchange, as well as a store of value. The constant increase in the value of bitcoin, as the world's population grows and the global economy strengthens, will lead to lower prices over time. Instead of price inflation, we get price deflation, since over time, prices for all goods and services will decline, not rise. This will provide an incentive to save money rather than spend it, which will lead to less time preference, better incentives and longer-term thinking, which will result in better policies, better culture, and a richer civilization. These difficult times will lead to strong people, and strong people will lead to better times. As post-apocalyptic writer G. Michael Hopf notes, quoting a meme he saw on the Internet many years ago: “In recent years I've become a kind of philosopher, and here's one of the undeniable truths. Tough times create strong people. Strong people create good times. Good times create weak people. And weak people create difficult times ”[71] (see also Giacomo Zucco's article“ Bitcoin and Internet Hopf Cycles ”) [72].

Summing up

As Neil Howe / William Strauss, authors of The Fourth Transformation, explain:

"We prefer to refer to these four main types of generations by abbreviated archetypes:prophet, nomad, heroAndpainter"[74].Generations of heroes “are born after spiritual awakening, in times of individual pragmatism, self-reliance, free competition and national (or group, or ethnic) chauvinism. Heroes grow up as highly guarded post-Awakening children, come of age as young, group-minded optimists during the Crisis, become energetic and extremely self-confident adults, and become politically powerful seniors facing another Awakening. Because of their historical position, such generations tend to be remembered for their collective triumphs as they entered adulthood and for their arrogant accomplishments in adulthood. Their main talents are related to community, wealth and technology ”[75].

This also includes the current generation of "heroes"millennials. They are followed by a generation of artists “born after the Recession, during the Crisis, when serious threats oversimplify social and political complex schemes in favor of social consensus, ethics and individuality sacrificed” [76]. We are currently in the midst of that "great war or other crisis." The result will be a new era of prosperity and success. This will be “a time of renewed social life and consensus around a new social order” [77]. As Melik Manukyan put it (describing the picture below, ie The Completion by Thomas Cole (1833)):

Completion - painting by Thomas Cole (1833)

“Do you think it was lost forever? You are heartless!

12 years ago # Bitcoin sparked a great renaissance. " [79]

If we divide everything by 21 million, as KnutSvanholm tweeted above, then we get the value of a BTC unit that is much higher thanRegardless of whether there will be any current assessment.whether it's $10,000,000 or whether we reach dollar-satoshi parity of $100,000,000 per BTC, eventually these measurements will loseWhen bitcoin achieves an infinite stock-to-flow ratio, as well as when the U.S. dollar and other world currencies moveto zero, we get an estimate of the value of 1 BTC equal to an infinite number of dollars.21 million is the absolute supply cap of Bitcoin, which meansthe existence of an absolute shortage of funds and, being a financial singularity, it will absorbAs we move beyond the present stage of our civilization, that is, from theType 0 to Type 1 civilization on the Kardashev scale, we can expect the value of Bitcoin to beThus, the era we are approaching may well be called a new Belle Époque, a new Golden Age of sound money and civilization.

In his book “A Brief History of Money, or Everythingwhat you need to know about Bitcoin ”Seyfedin Ammus describes it as“ a society in which people bequeath to their children more than what they received from their parents, ”which is the hallmark of a civilized society [81]. He further notes that such a society “is a place where the quality of life is improved, and people live in order to make the life of the next generation more prosperous. As the level of capital in a society grows, labor productivity grows, and with it the quality of life. By ensuring that basic needs are met and environmental hazards are averted, people are shifting their focus to deeper aspects of life than material well-being and hard work. They work to strengthen family and social ties; carry out cultural, artistic and literary projects; strive to make a lasting contribution to the life of their community and the whole world ”[82].

This is reminiscent of one of the golden ages of Athensculture (449-431 BC); and the even earlier golden age of the Minoan civilization in the Aegean Islands (3000-1450 BC); Pax Romana (27 BC — 180 AD), which began during the reign of Caesar Augustus (63 BC — 14 AD .) and continued until the reign of the Stoic philosopher Emperor Marcus Aurelius (121-180 AD), [84] the last of the "five good emperors"; Islamic Golden Age (786-1258 AD), and even the later "Golden Age of Sound Money" (as I describe it) (1418-1914 AD), which coincided with the Renaissance (14-1914 AD) 17th centuries), the Enlightenment (17th-18th centuries), the Industrial Revolution (1760-1840) and the rise and flowering of the British Empire (1584-1926 AD). Is it possible that a new Age of Safe Money is on the horizon? Will Bitcoin bring a new Bitcoin era of prosperity and economic growth? I believe this will happen within our lifetime, when crisis will be followed by victory, and the current economic and political turmoil will be replaced by a new world order, followed by prosperity and social harmony. As the crumbling central banking system collapses, a new standard, Bitcoin, is emerging to replace it. And only time will tell what the final result of the functioning of this system will be. One may recall the words of Pericles (495-429 BC), who glorified Ancient Athens in its golden age, which Thucydides (c. 460 - c. 400 BC) quoted in his masterpiece"History of the Peloponnesian War":

“For our state structure, we are nottook as a model no foreign institutions. On the contrary, we are more likely ourselves to be an example to others than to imitate someone else in anything. And since our city is governed not by a handful of people, but by the majority of the people, our state system is called the rule of the people. In private matters, everyone enjoys the same rights under the law. As for the affairs of state, then everyone is nominated to honorary state positions according to his merit, since he has distinguished himself in something not because of his belonging to a particular class, but because of his personal prowess. Poverty and dark origin or low social status do not prevent a person from taking an honorary position if he is able to provide services to the state. In our state, we live freely and in everyday life we avoid mutual suspicion: we do not harbor hostility towards our neighbor if he follows his personal inclinations in his behavior, and we do not show him, although harmless, but painfully perceived annoyance. Tolerant in our private relationships, in public life, we do not violate the laws, mainly out of respect for them, and we obey the authorities and laws, especially those established to protect the offended, as well as unwritten laws, the violation of which everyone considers shameful.

We have introduced many different entertainment options forrest of the soul from work and worries, from year to year we repeat games and festivities. The decorum of the home is enjoyable and helps to dispel the worries of everyday life. And from all over the world to our city, thanks to its greatness and significance, everything we need flows to the market, and we use foreign goods no less freely than the products of our country.

In military care, we are guided by otherrules than our opponents. So, for example, we allow everyone to visit our city and never interfere with acquaintance and inspect it, and we do not expel strangers for fear that the enemy might penetrate our secrets and benefit from it. After all, we rely mainly not so much on military preparations and cunning as on our personal courage. While our opponents, with their way of upbringing, strive from early childhood to temper the courage of young men with brutal discipline, we live freely, without such severity, and nevertheless we are waging a brave struggle with an opponent equal to us. And here is proof of this: the Lacedaemonians invade our country not alone, but with their allies, while we ourselves only attack neighboring lands and usually defeat them without much difficulty, although their warriors are fighting for their property. The enemy has never dealt with all our military might, since we always had to simultaneously take care of both the crew for the ships and on land to send our soldiers to different ends. Should the enemies win a victory somewhere in a skirmish with our detachment, they already boast that they have put the whole Athenian army to flight; so even in case of failure, they always assure that they have lost only all our military might. If we are ready to face danger more due to our inherent liveliness than due to the habit of painful exercise, and rely not on the prescription of the law, but on innate courage, then this is our advantage. We are not disturbed in advance by the thought of impending dangers, and experiencing them, we show no less courage than those who are constantly subjected to exhausting toil. " [85]

You can always thank the translator for the work done:BTC:1CvdCVGXEdfgjRKJS7fZWXgyYTovb5vx96ETH:0x1D1d0d1e84496953bd03B83b4533F717e482Ed4B

List of sources used

[1] See: Michael Saylor, tweet, October 16, 2020. URL: https://twitter.com/michael_saylor/status/1317074966945406979?s=21 (accessed 05/01/2021).

[2] See: “Now they want some BTC” by Mari0805. URL: https://twitter.com/btcArtGallery/status/1345490065036722176/photo/1 (accessed 05/01/2021).

[3] See: Clem Chambers (2020) Bitcoin To $1,000,000 Might Sound Crazy, But Is It?Forbes, Jun 16, 2020, 11:26 am EDT. URL: https://www.forbes.com/sites/investor/2020/06/16/bitcoin-to-1000000-might-sound-crazy-but-is-it/?sh=218209251c59 (accessed 05/01 / 2020).

[4] See: Ludwig von Mises (1998 edition)Human Action: A Treatise on Economics(Auburn, Alabama: The Ludwig von Mises Institute), p. 570. Available online at: https://cdn.mises.org/Human%20Action_3.pdf (accessed 01/05/2021).

[5] See: NJ Bridgewater (2018) The Origins of Money (Part 1 of 2),Crossing the bridge, 22 November 2018. URL: https://nicholasjames19.blogspot.com/2018/11/the-origins-of-money-part-1-of-2.html (accessed 05/01/2021).

[6] See: NJ Bridgewater (2018) The Origins of Wealth (Part 1 of 4),Crossing the bridge, 5 July 2018. URL: https://nicholasjames19.blogspot.com/2018/07/the-origins-of-wealth-part-1-of-4.html (accessed 05/01/2021).

[7] See: NJ Bridgewater (2018) The Origins of Bitcoin,Crossing the bridge, 5 December 2018. URL: https://nicholasjames19.blogspot.com/2018/12/the-origins-of-bitcoin.html (accessed 05/01/2021).

[8] See: Nick Szabo (2002) Shelling Out: The Origins of Money,Satoshi Nakamoto Institute... URL: https://nakamotoinstitute.org/shelling-out/ (accessed 05/01/2021).

[9] See: Nick Szabo (2018) The many traditions of non-governmental money (part i),Unenumerated, March 23, 2018. URL: https://unenumerated.blogspot.com/2018/03/the-many-traditions-of-non-governmental.html (accessed 05/01/2021).

[10] See: Nick Szabo (2017) Money, blockchains, and social scalability,Unenumerated, February 09, 2017. URL: https://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html (accessed 05/01/2021).

[11] Image source:The moorish bazaarby Edwin Lord Weeks, 1873. URL: https://upload.wikimedia.org/wikipedia/commons/5/57/The_Moorish_Bazaar.jpg (accessed 01/05/2021).

[12] See: Mises,Human action, p. 209.

[13] See: Mises,Human action, p. 407.

[14] See: Nick Szabo (2017) Money, blockchains, and social scalability,Unenumerated, February 09, 2017. URL: https://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html (accessed 05/01/2021).

[15] See: Adriana Hamacher (2020) How Bitcoin’s Antifragility Makes it Almost Unstoppable,Decrypt, Oct 30, 2020. URL: https://decrypt.co/46719/how-bitcoins-antifragility-makes-it-almost-unstoppable (accessed 05/01/2021).

[16] Image source: Getty Images. From: https://www.bbc.co.uk/news/technology-47867031 (accessed 05/01/2021).

[17] Richard Cantillon, Henry Higgs (translator)(1755, 1959) Essay on the Nature of Trade in general (London: Frank Cass and Co. Ltd). URL: https://oll.libertyfund.org/title/higgs-essay-on-the-nature-of-trade-in-general-higgs-ed#lf0039_label_002 (accessed 04/01/2021).

[18] Image source: Image by @femalelandlords. URL: https://knowyourmeme.com/memes/money-printer-go-brrr (accessed 05/01/2021).

[19] See: Richard Henry Timberlake, Kevin Dowd (2017)Money and the Nation State: The Financial Revolution, Government and the World Monetary System(London: Taylor and Francis), p. 26.

[20] See: Timberlake, Dowd (2017), p. 26.

[21] See: NJ Bridgewater (2018) The Origins of Money (Part 1 of 2),Crossing the bridge, 22 November 2018. URL: https://nicholasjames19.blogspot.com/2018/11/the-origins-of-money-part-1-of-2.html (accessed 05/01/2021).

[22] Livius.org (2006/2020) Xenophon on the surrender of Athens,Livius.org... URL: https://www.livius.org/sources/content/xenophon-hellenica/xenophon-on-the-surrender-of-athens/ (accessed 04/01/2021).

[23] Phil Gramm, Mike Solon (2020) Welcome to the Era of Nonstop Stimulus,The wall street journal, Jan. 3, 2021 1:18 pm ET. URL: https://www.wsj.com/articles/welcome-to-the-era-of-nonstop-stimulus-11609697936 (accessed 05/01/2020).

[24] “Destruction,” Painting by Thomas Cole (1833). URL: https://upload.wikimedia.org/wikipedia/commons/6/64/Cole_Thomas_The_Course_of_Empire_Destruction_1836.jpg (accessed 05/01/2021).

[25] See: Nassim Nicholas Taleb (2016)Antifragile: Things that Gain from Disorder(New York: Random House).

[26] Image from Dr. Saifedean Ammous (2018)The Bitcoin Standard Research Bulletin, November 2018, Volume 1, Issue 3: Bitcoin Mining: Energy and Security, p. 3.

[27] See: Ammous (2018), p. 172.

[28] See: Murray Rothbard (1973) The Essential von Mises,Mises Institute - Online Texts, 06/15/1973. URL: https://mises.org/library/essential-von-mises (accessed 24/01/2019).

[29] Information gleaned from: Controlled supply (Bitcoin Wikiarticle).

[30] Image source: Black hole with corona, X-ray source (artist's concept). URL: https://upload.wikimedia.org/wikipedia/commons/f/f0/Black_Holes_-_Monsters_in_Space.jpg (accessed 05/01/2021).

[31] See: Robin Hanson (1998) Is a singularity just around the corner? What it takes to get explosive economic growth,Journal of Transhumanism, 2, June 1998. URL: http://mason.gmu.edu/~rhanson/fastgrow.html (accessed 12/30/2020).

[32] See: Nixon shock (Wikipediaarticle). URL: https://en.wikipedia.org/wiki/Nixon_shock (accessed 05/01/2021 22:25 GMT).

[33] Image source: https://2012movie.fandom.com/wiki/Ark?file=2012_ship05new4_copy_263.jpg (accessed 05/01/2021).

[34] See: Plan B (2020), Twitter post, December 29, 2020. URL: https://twitter.com/100trillionUSD/status/1343879012729421827 (accessed 12/30/2020).

[35] See: Jeff Desjardins (2020) All of the World’s Money and Markets in One Visualization,Visual capitalist, May 27, 2020. URL: https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/ (accessed 12/30/2020). The whole precious metals market is worth $182.1 billion. See: Grand View Research (2020) Precious Metal Market Size, Share & Trends Analysis Report By Product (Gold, Silver, PGM), By Application (Jewelry, Industrial, Investment), By Region And Segment Forecasts, 2020–2027. URL: https://www.grandviewresearch.com/industry-analysis/precious-metals-market (accessed 01/05/2021).

[36] See: Plan B (@ 100trillionUSD), tweet (Jul 14, 2019). URL: https://twitter.com/100trillionUSD/status/1150385076041109504 (accessed 29/12/2020).

[37] See: Plan B (@100trillionUSD) (2020) Bitcoin Stock-to-Flow Cross Asset Model,Medium, Apr 27, 2020. URL: https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12 (accessed 12/29/2020).

[38] He writes:“S2FX model predict 288k mean (cluster center) and allows for 2–3x overshoot (and 80% crash after that)”. See: Plan B (@ 100trillionUSD) (2021) Tweet, January 3, 2021. URL: https://twitter.com/100trillionUSD/status/1345711446857052164?s=20 (accessed 05/01/2021).

[39] See: Plan B (@ 100trillionUSD) (2021) Tweet, January 3, 2021. URL: https://twitter.com/100trillionUSD/status/1345712357830504451?s=20 (accessed 05/01/2021).

[40] Ibid.

[41] See: Daniel Krawisz (2014) Hyperbitcoinization,Satoshi Nakamoto Institute, March 29, 2014. URL: https://nakamotoinstitute.org/mempool/hyperbitcoinization/ (accessed 02/19/2019).

[42] See: ObiWan Kenobit (2018) Hyperbitcoinization: Winner Takes All,Coinmonks, Medium, Jun 25, 2018. URL: https://medium.com/coinmonks/hyperbitcoinization-winner-takes-all-69ab59f9695f (accessed 01/24/2019).

[43] Image source: IQ bell curve. URL: https://twitter.com/BitcoinEdu/status/1344565716226289665/photo/1 (accessed 05/01/2021).

[44] See: Plan B (2020), Twitter post, December 4, 2020. URL: https://twitter.com/100trillionusd/status/1334834429177507844 (accessed 12/30/2020).

[45] See: Brandon Quittem (2018) Bitcoin is a Social Creature (Mushroom) — Part 2/3,Medium, Dec 28, 2018. URL: https://medium.com/@BrandonQuittem/bitcoin-is-a-social-creature-mushroom-part-2-3-6a05c3abe8f0 (accessed 01/18/2019).

[46] Image source: https://www.reddit.com/r/PoliticalCompassMemes/comments/kqhde2/oi_mate_you_got_a_loiscense_to_be_walking_around/ (accessed 01/05/2021).

[47] Image source:

Piles of newNotgeldbanknotes awaiting distribution at theReichsbank during the hyperinflation. URL: https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic#/media/File:Bundesarchiv_Bild_183-R1215-506,_Berlin,_Reichsbank,_Geldauflieferungsstelle.jpg (accessed 01/05/2021).

[48] See: Plan B (@ 100trillionUSD), tweet (Jul 14, 2019). URL: https://twitter.com/100trillionUSD/status/1150385076041109504 (accessed 29/12/2020).

[49] See: Plan B (2020), Twitter post, December 29, 2020. URL: https://twitter.com/100trillionUSD/status/1343879012729421827 (accessed 12/30/2020).

[50] See: Hal Finney (2009) Re: Bitcoin v0.1 released, Sun, 11 Jan 2009 10:22:14 -0800. URL: https://www.mail-archive.com/[email protected]/msg10152.html (accessed 01/22/2019).

[51] Image source: “Bitcoin please go to moon” by @ 1thousandx. Image URL: https://i.ytimg.com/vi/_PXU0thDHCU/maxresdefault.jpg (accessed 05/01/2021).

[52] See: Peter Schiff (2020) tweet, Jun 28, 2020. URL: https://twitter.com/PeterSchiff/status/1277288032790548480 (accessed 05/01/2021).

[53] Image source: https://twitter.com/hodldeeznutz/status/1330923013458386944 (accessed 05/01/2021).

[54] Image source: digitalik.net (2020) Bitcoin stock to flow model live chart. This page is inspired by Medium article Modeling Bitcoin's Value with Scarcity written by Twitter user PlanB. URL: https://digitalik.net/btc/ (accessed 05/01/2021).

[55] See: Jeff John Roberts, Nicolas Rapp (2017) Exclusive: Nearly 4 Million Bitcoins Lost Forever, New Study Says,Fortune, November 25, 2017. URL: http://fortune.com/2017/11/25/lost-bitcoins/ (accessed 09/23/2018).

[56] See: NJ Bridgewater (2018) Ten Reasons to Buy Bitcoin,Crossing the bridge, September 24, 2018. URL: https://nicholasjames19.blogspot.com/2018/09/ten-reasons-to-buy-bitcoin.html (accessed 05/01/2020).

[57] See: Nick Szabo (2017) Money, blockchains, and social scalability,Unenumerated, Thursday, February 09, 2017. URL: https://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html (accessed 09/23/2018).

[58] See: Dan Held (2020) Tweet. URL: https://twitter.com/danheld/status/1342878164926799873?s=20 (accessed 05/01/2020).

[59] Image source: https://twitter.com/DzhambalaHODL/status/1343670829700276224/photo/1 (accessed 05/01/2021).

[60] See: Michael Saylor, tweet, November 17, 2020. URL: https://twitter.com/michael_saylor/status/1328772219372253184?s=21 (accessed 05/01/2021).

[61] See: Knut Svanholm (2020), Twitter post, October 16, 2020. URL: https://twitter.com/knutsvanholm/status/1316976860111265793 (accessed 12/30/2020).

[62] See: Knut Svanholm (2020) You are Not Prepared,Citadel 21, vol. 2, May 21, 2020. URL: https://www.citadel21.com/you-are-not-prepared (accessed 12/30/2020).

[63] See: Knut Svanholm, Twitter thread, December 19, 2020. URL: https://twitter.com/knutsvanholm/status/1340319075940130817 (accessed 12/30/2020).

[64] Image source: https://twitter.com/omgbruce/status/1345930479984230402/photo/1 (accessed 05/01/2021).

[65] See: Jeff Desjardins (2015) This stunning visualization shows all of the world’s money,Business Insider, Dec 20, 2015, 5:53 PM. URL: https://www.businessinsider.com/all-of-worlds-money-in-one-chart-2015-12 (accessed 05/01/2021).

[66] See: Stock market (Wikipediaarticle). URL: https://en.wikipedia.org/wiki/Stock_market (accessed 05/01/2021 17:00 GMT).

[67] See: ICMA (International Capital Market Association) (2020) Bond Market Size (As of August 2020),ICMA... URL: https://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/Secondary-Markets/bond-market-size/ (accessed 05/01/2021).

[68] See: J.B. Maverick (2020) How Big Is the Derivatives Market?Investopedia, Updated Apr 28, 2020. URL: https://www.investopedia.com/ask/answers/052715/how-big-derivatives-market (accessed 05/01/2021).

[69] See: Credit Suisse (2020) The Global wealth report 2020,Credit suisse... URL: https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html (accessed 05/01/2021).

[70] Image source: https://twitter.com/1e9petrichor/status/1345500889839263746/photo/1 (accessed 05/01/2021).

[71] See: G. Michael Hopf (2016)Those Who Remain: A Postapocalyptic Novel(CreateSpace Publishing Platform: North Charleston, South Carolina), Prologue. The novel takes place in the year 2066.

[72] See: Giacomo Zucco (2020) Bitcoin & the HOPF Cycle of the Internet,Bitcoin Times Edition 3... URL: https://medium.com/the-bitcoin-times/bitcoin-and-the-hopf-cycle-of-the-internet-f351f1b7c1e3 (accessed 05/01/2021).

[73] Image source: “Strong Men Create Good Times” (Western version) URL: https://twitter.com/RationalEtienne/status/1279898335168606209/photo/1 (accessed 05/01/2020).

[74] See: Neil Howe and William Strauss (2007) The Next 20 Years: How Customer and Workforce Attitudes Will Evolve,Harvard Business Review, July-August 2007. URL: http://download.2164.net/PDF-newsletters/next20years.pdf (accessed 05/01/2021).

[75] See: Neil Howe and William Strauss (2007).

[76] See: Neil Howe and William Strauss (2007).

[77] See: Neil Howe and William Strauss (2007).

[78] Cole’s 1833 sketch for the arrangement ofthe paintings around Reed’s fireplace: the sketch also shows above the paintings three aspects of the Sun: left (rising); center (zenith); right (setting) The Savage State The Consummation Destruction The Arcadian or Pastoral State Desolation. URL: https://upload.wikimedia.org/wikipedia/commons/1/1a/Cole_Thomas_The_Consummation_The_Course_of_the_Empire_1836.jpg (accessed 05/01/2021). See also: “You think this was lost forever?” URL: https://twitter.com/melikmanukyan/status/1345504945299050496/photo/1 (accessed 05/01/2020).

[79] Melik Manukyan (2020) tweet, January 2, 2021. URL: https://twitter.com/melikmanukyan/status/1345504945299050496?s=21 (accessed 05/01/2021).

[80] Image source: https://twitter.com/100trillionUSD/status/1103399882998640644/photo/1 (accessed 05/01/2021).

[81] See: Saifedean Ammous (2018)The Bitcoin Standard: A Decentralized Alternative to Central Banks(Hoboken, New Jersey: Wiley), pp. 78–79.

[82] See: Ammous (2018), p. 79.

[83] Image source: https://knowyourmeme.com/photos/1892689-soomer (accessed 05/01/2021).

[84] “His meditations, composed in the tumult ofthe camp, are still extant; and he even condescended to give lessons of philosophy, in a more public manner than was perhaps consistent with the modesty of sage, or the dignity of an emperor. 47 But his life was the noblest commentary on the precepts of Zeno. “He was severe to himself, indulgent to the imperfections of others, just and beneficial to all mankind.” — Edward Gibbon (1782, revised 1845)History of the Decline and Fall of the Roman Empire, Vol. I(Philadelphia: Porter & Coates), Chapter III. URL: https://www.gutenberg.org/files/25717/25717-h/25717-h.htm (accessed 01/05/2021).

[85] Pericles, quoted in Thucydides’ History ofthe Peloponnesian War. Translated by Benjamin Jowett. URL: https://en.wikisource.org/wiki/Pericles%27s_Funeral_Oration_(Jowett) (accessed 01/05/2021). Thucydides (author), Benjamin Jowett (translator) (1881)History of the peloponnesian war(Oxford: The Clarendon Press), Book II, Chapter 37. Available online at: http://www.perseus.tufts.edu/hopper/text?doc=Perseus:text:1999.04.0105 (accessed 01/05/2021 ).

[86] Image source:Pericles' Funeral Oration(Perikles hält die Leichenrede) by Philipp Foltz (1852). URL: https://upload.wikimedia.org/wikipedia/commons/f/f1/Discurso_funebre_pericles.PNG (accessed 05/01/2021).