Due to the fact that the traditional financial world is engulfed by the collapse of Credit Suisse and the bankruptcy of a number of Americanbanks, investors are turning to the largest stablecoin, Tether (USDT).

However, the problems of Silicon Valley Bank, SignatureBank and Silvergate Capital, acting as tripartite lenders who received deposits from cryptocurrency companies, simultaneously shook the stability of individual stablecoins.

Fintech company Circle admits it has invested inSilicon Valley Bank $3.3 billion, and as a result its USDC token lost its depegging to the dollar. The token recovered its value thanks to a lifeline provided by US regulators who guaranteed the safety of deposits at Silicon Valley Bank.

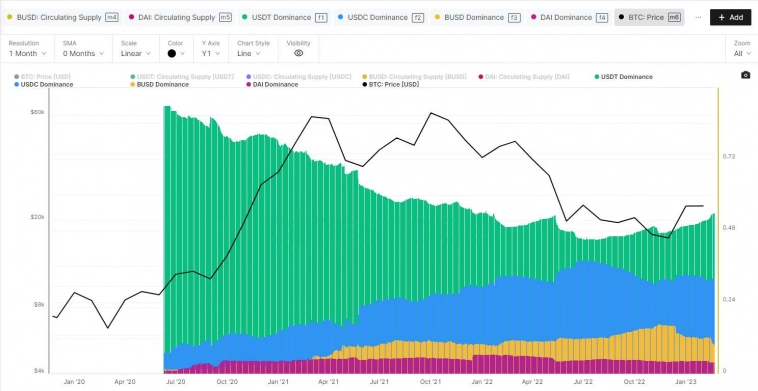

USDC is the second-largest stablecoin by market capitalization, with its market capitalization down nearly 21% this year.

A similar trend was observed with Binance USD (BUSD), the issue of which was stopped at the request of the US SEC. As a result, the capitalization of this crypto asset decreased by more than half to $8 billion.

Meanwhile, the marketTether's capitalization has reached levels last seen in May 2022. USDT continues to follow a steady upward trajectory, increasing its value year-to-date by more than 17% to $77 billion.

Part of Tether's success is due to the fact thatthe organization is not affiliated with Silicon Valley Bank or Silverbank. As a result, stablecoin dominance is at its highest level in 18 months at 60%, according to Glassnode data.

News and notes about cryptocurrency and traditional financial markets, politics and technologies in Telegram.