The Tether company called false rumors that the reserves of the USDT stablecoin were backed by 85% of Chinese commercial entities.securities that trade at a 30% discount.

The company suggested that the information was being disseminated by some «coordinated funds» to generate additional profits in an already «stressed market».

The stablecoin issuer recalled that it is steadily reducing the share of commercial paper in reserves. As of March 31, it was 25%. Whereas US Treasuries accounted for 47%.

Since then, in monetary terms, the volume of commercial paper in the company's portfolio has decreased from $20 billion to $11 billion. It is expected that by the end of June the figure will reach $8.4 billion.

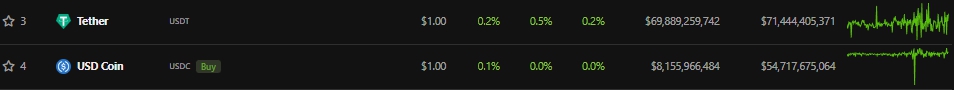

According to CoinGecko, the capitalization of the leading stablecoin is about $71.4 billion. The second largest issuance USDC has $54.7 billion.

Data: CoinGecko.

Tether also emphasized that the liquidation of Celsius positions did not bring losses to the company.

“Tether currently has no relationship with Celsius, other than a small investment in shares of the crypto-lending platform,” the statement said.

The information that Tether is lending to Three Arrows Capital, which allegedly had problems with solvency, was also called false by the company.

Recall that the specialists of the Cumberland cryptocurrency OTC platform admitted that the next asset that is in danger of collapsing will be one of the leading stablecoins.