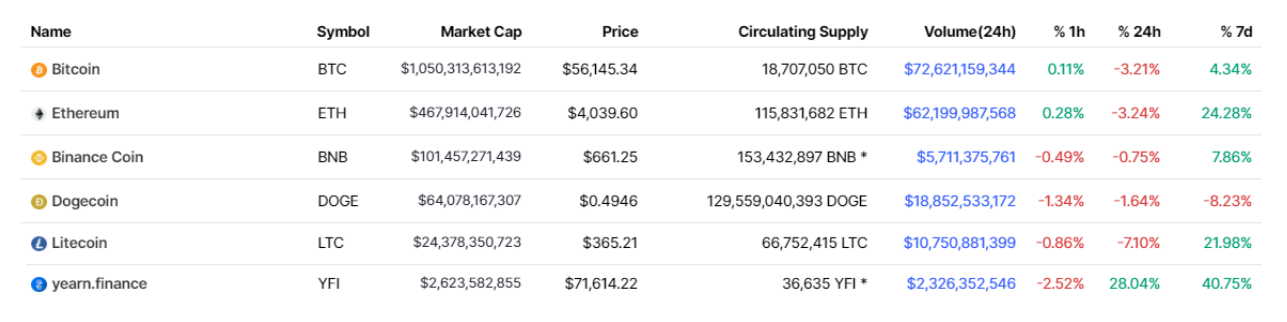

This week CredAnd DonAlt, mailing list authors Technical Roundup, discuss “haircut” in a narrow range onBTC market under resistance of $60 thousand., analyze Ethereum, which continues to show strength, and also revisit the charts from the last issue (Litecoin and Binance Coin) after the volatility at the beginning of the week. The review ends with a short “opinion column” from DonAlt, in which he shares his vision of trading altcoins at current price levels.

https://coinmarketcap.com/coins/views/all/

The idea behind this weekly roundup is simple: you get charts for the most important digital assets in one place, at the same time, every week.

Are you a short term trader looking tocheck your vision of the trend and the levels that are important from the point of view of market structure, or as a cautious investor trying to understand this new asset class, we hope that you will find something useful in these reviews.

There will be no signals here, it's pretty obvious. But we can offer something better: logical structure, consistent method and reliable analysis.

We're not perfect. We make mistakes.And when we make a mistake, you will know for sure about it, because we will discuss our mistakes here. If the situation in the markets from the point of view of TA seems vague or not of interest, we will not suck from the finger an analysis that we ourselves would not consider convincing. And although we cannot promise perfection, we will try to be as honest and transparent as possible.

Waiting room for demand in the BTC market

Chart executed in TradingView

The Bitcoin market continues to move uncomfortably within a narrow range. Today’s latest attempt to set a higher high above $59K was promptly rejected.

In our opinion, the current market structure is more important than the factors of technical analysis applicable in this situation.

Speaking of big capital, Ethereum seems tousurped an infinite supply. And there is no trickle-down effect to other large-cap coins, sidechains, DeFi, etc. with rare exceptions. For the most part, all capital is deposited exclusively in Ethereum.

As for retail players, they are spilling overinto ephemeral but fun projects based on the Binance Smart Chain (mainly due to the relatively high prices in Ethereum, especially for retail participants).

$60 thousand is a strong resistance (both from the TA point of view and psychologically), and attempts to break through it have not yet been successful.

The market capitalization of bitcoin is high. Serious capital is needed to move such a lump from its place. Current demand is still insufficient and the range remains in place.

But this is Bitcoin, and things can change very quickly here. Significant placements of corporate funds can lead to capital rotation in the market, and it would be risky to miss such a movement.

But be that as it may, the areas of greatest interest for buying BTC, in our opinion, remain either a breakout of resistance ($60+ thousand) or a support level around $40 thousand.

Ethereum continues to show strength

Chart executed in TradingView

Chart executed in TradingView

Ethereum still looks stronger than any other asset in the crypto market.

The ETH / USD pair is in steady growth mode.On the chart, we have added new support at $ 3300. This is the first and closest area that is important to hold in order to continue the bullish trend if the market suggests a correction.

When the pair to USD is in the mode of price determination in new territories, it makes sense to turn to the pair / BTC in search of resistance levels.

In the case of ETH, the rate to BTC returned to the range fromthe lower border at ₿0.055 and the upper one at the level of ₿0.084. Technically, the middle of the range and, accordingly, the potential "friction point" falls on ₿0.07. Our expectations here are the movement of the ETH rate towards ₿0.084 until the opposite is proved, especially if the market overcomes the mentioned middle of the range (₿0.07) without stopping.

To summarize, Ethereum looks strong and doesn'tshows no obvious signs of weakness. For ETH / USD, the loss of support at $ 3,300 will be a significant signal for profit taking. For the ETH / BTC pair, the behavior of the rate in which can be extrapolated to the pair to USD, the important levels are ₿0.055 (support) and ₿0.084 (resistance), with ₿0.07 as a potential stumbling level in the middle of the range.

Litecoin breaks through resistance

Chart executed in TradingView

The bet offered by DonAlt worked out great. Litecoin broke through the key resistance levels in both pairs: / BTC and / USD. We now wait for the trend to continue until proven otherwise.

In the pair against USD, we saw the highest weeklyclosure in history. From the point of view of TA, there are no significant levels of resistance in these territories, and the record maximum is still at $ 420. Immediate support on the daily timeframe is in the $ 345-356 zone. Below this level, a more serious drawdown can be expected, with the next stop at $ 309.

In the pair to BTC, the resistance of ₿0.0056 was broken.The next level of interest is ₿0.0074. Overall, the picture looks very favorable given that this is the first impulse breakout of the market structure (higher high) on a weekly timeframe in a long time. The bullish scenario will be questioned if, in the event of a retest, the level of ₿0.0056 does not work out as support.

To summarize, the picture is bullish until proven otherwise. The loss of support in the pair against USD ($ 345-356) and / or BTC (₿0.0056) nullifies the bullish thesis.

BNB rate "spreads" along the breakout level

Chart executed in TradingView

Last week we wrote about the breakout of the resistance in BNB / USD.

But the market hasn't budged since then. In a way, this is also a variant of the norm.

Generally speaking, the less time is spent onthe breakdown of significant levels, the better. The Monday selloff in the altcoin market in the case of BNB was quite effectively bought back and the $ 600 level was held under the daily close.

If large altcoins receive this weeksome momentum, then Binance Coin / USD looks pretty well positioned to take advantage of it. There is a clear level ($ 600) with a clear criterion for invalidation of the thesis (closing below this level).

Last week we also wrote about the coupleTHORChain / USD. The setup logic was similar, holding above $ 16.60 as a bullish signal. Monday closed just below this level and overall the situation today is less confident than in BNB / USD, so we omitted this chart in today's review.

DonAlt about recognizing bubbles and trading within them

Retail players are coming en masse tocryptocurrency market. The simplest confirmation of this is the increase in the number of registrations of new accounts on crypto exchanges. Robinhood's number of cryptocurrency trading customers grew by 9.5 million in the first quarter of this year, and Coinbase added 13 million new users between January and March.

An even more convincing sign thatRetail demand has finally arrived in the crypto market, which could serve as an influx of capital into memcoins. DOGE is up 10,300% year to date, coins like SHIBA and SAFEMOON are making multiple 100% rallies a day, and the TikTok crowd seems to be making millions off of it all.

The new "investor" -the amateur is afraid to enterbitcoin, because it has already grown a lot, and instead invests in altcoins (the shittier, the more attractive), completely unaware that altcoins by and large repeat the movements of bitcoin, only with a greater amplitude. Trading them in this sense is akin to trading bitcoin with leverage.

These new retail players are essentially saying, “Bitcoin is too expensive for me, so Iadd“I’ll take a little risk and bet on those altcoins that will show sustainable long-term growth only if Bitcoin doesn’t fall.”

Fundamental indicators? Does not matter.Market capitalization? It doesn't matter either. The only thing that matters in such a market is memes and the next hype object. This sounds more like a contest to predict successful memes than technical or fundamental analysis.

The fact that retail players are attracted to successBitcoin, creates a gap between altcoins and BTC. Altcoins usually move in unison with BTC, but this is not necessary during the “alt season”. The general public is more likely to be late to the “party” and start buying small-cap coins while buying large coins is already slowing down. Smaller altcoins can go up as long as retail players have money to spend on them. At some point, the market catches them up and catches them by surprise, but not before it offers opportunities to earn staggering profits.

Most of the new entrants to the market are losing, some are losing big.

With all of this, as well as current market conditions, it is helpful to have some understanding of how best to operate within a market bubble.

You have several options to choose from:

Frontrunning memes

Pump in DOGE?We look for DOGE clones and buy them before everyone else does. Pump to ETH? This means that the "ETH killers" are likely to follow him too. Anonymous coin pump? Other anonymous coins are likely to grow as well. Well, you get the point.

Trade as usual

This is the most "professional" line of conduct in such a situation, but be prepared for the fact that the most complete ignoramuses and idiots will make much more profit than you.

Go into complete ignorance, telling yourself that the main and most profitable part of the viola impulse has already passed.

This is possibly the worst course of action possible because you will be FOMO-prone.

Usually the situation develops as follows: “DOGE is a scam!” at the level of 100 sat; "Why does it keep growing?" at 500 sat; and “To hell with everything, I’m going all in!” at 1000 sat. And then everything collapses.

Try to understand as early as possible whether you really want to try to make it to this holiday. Otherwise, you are likely to turn into your own worst enemy.

And no matter what you decide and howcope with the consequences, you must understand that most of the coins in the pump will trade below current levels in the future. This means that the exit strategy from the markets is of paramount importance.

The most common ones are as follows:

Sell at an arbitrary price level that you have determined for yourself.

It may sound stupid, but in some of its ownthe best sales, I proceeded from the logic "I already made a 10-fold profit, I did not expect that it could go that far, so I guess I'll take the money now." The big disadvantage of this strategy is that coins can rise in value much higher than you might think. Watching an asset grow 10 times after you get rid of it can be very, very painful. And you will definitely have to go through it if you decide to stick to this strategy.

Sell on the first bounce after a hard crash.

The top of this crypto and altcoin bubble is more likelyin all, it will again be quite explosive and dangerous. And the big disadvantage of this strategy is that you will lose most of your paper profits. And the big advantage is that you don't sell too early, and you don't have to watch an asset rise 10x from your point of sale from the outside.

Raise the level of invalidation of the strategy until the market structure is broken.

This is very similar to the second option, but this is how yousell during the fall. The advantage is that you don't have to grimly watch the entire sale, waiting for a reasonably convincing bounce. The big disadvantage, on the other hand, is that you will have to sell the asset (s) “under the market”, given that you will be getting rid of them amid general panic.

The start and end points of a typical crypto bubble can be surprisingly close. DOGE fit all its colossal movement into 100 days. During this time, the price has risen unimaginably.

The key aspect in speculation, and especially onaltcoin market, this is timing. Most of the time, the altcoin markets will bring nothing but pain - only to then reward you with a quarter of the positive price movement. When your family or acquaintances come up to you asking which altcoins they should buy, this is definitely NOT the best time to invest in altcoins. But that could still be a good moment for short-term speculation, given how profitable altcoins can be towards the end of the cycle.

In my opinion, in terms of timing, we are alreadyvery close to the peak of the current altcoin bubble. But this does NOT mean that we are in the slightest degree close to the maximum possible price levels. The last stage of the bubble is usually the most profitable (assuming you take profits at the peak :) and I expect it to be pretty much the same this time around.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>