This technique is high level scalping. Under all the conditions described below, it allows you to take partsvolatile movements with moderate risk.

Let's figure it out :)

Mechanics of movement and reception.

</strong>After any impulse, an imbalance forms in the market: the pressing (from the side of the impulse) participants run out of strength to push the price further, and they close positions.

At the same time, counter-momentum traders open positions in anticipation of a market reversal.

Our task is to take the first correction after the impulse. You can also pull out a deal if there are prerequisites for the development of a reverse movement.

When can this technique be used?

</strong>

It is best to use this technique on the rebound (the first touch of the level) and false breakdown.

The main criterion is an impulse approach to the level, and a weak initiative of the attacking side will also be a plus.

We enter from the density in the glass.</p>

The impulse always finds its end. Most often, the price bounces off large orders (densities) in the order book.

In this case, it doesn't matter if we trade long or short, we take a counter-momentum position and pull the trade to the retest zone of the broken level.

It is better to always rely on levels, because. there, most likely, there will be real densities. Well, about the signs of real densities, too, do not forget :)

Important points.</p>

</strong>

- Set a short stop loss;

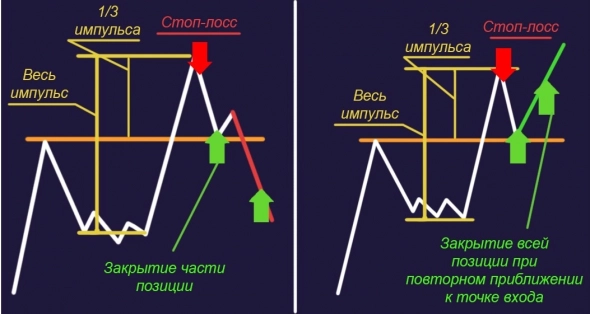

- Close part or all of the position in the retest zone, but no further than 1/3 of the impulse;

- When the price moves to the entry point again, close the position, do not rely on a rebound;

- If you plan to pull out a deal, close 50% of the position according to the second paragraph and move the stop loss to breakeven.

When can you try to pull a deal?</p>

</strong>

A trade has a lot of potential in the event that momentum occursin the opposite direction of the trend on a higher timeframe.

You can close part of the position, move the stop loss to breakeven and try to pull the profit.

Join us on Telegram - there is a lot of interesting things :)

And don't forget about VKontakte!