Bitcoin closes worst quarter since 2011 down 56%, Voyager Digital issues default notice to 3ACobligations due to non-payment of the loan, the market crisis threatened to default on $4 billion in miner loans and other events of the outgoing week.

The second quarter of 2022 was the worst for bitcoin in 11 years

The fall in the price of the first cryptocurrency in April-Juneby 56.2% was the strongest since the third quarter of 2011, when losses amounted to 67%. During this period, Bitcoin fell in price from $45,000 to $19,884. During the bear markets of 2014 and 2018, the quarterly dynamics did not exceed 39.7% and 49.7%, respectively.

Investor Michael Burry, who predicted the 2007 mortgage crisis, admitted that the current market situation is the middle of a bearish cycle for bitcoin.

“Adjusted for inflation in the first half of the yearThe S&P 500 fell by 25–26%, Nasdaq by 34–35%, Bitcoin by 64–65%. It was multiple compression. Next comes a reduction in income. So maybe halfway there,” Burry wrote.

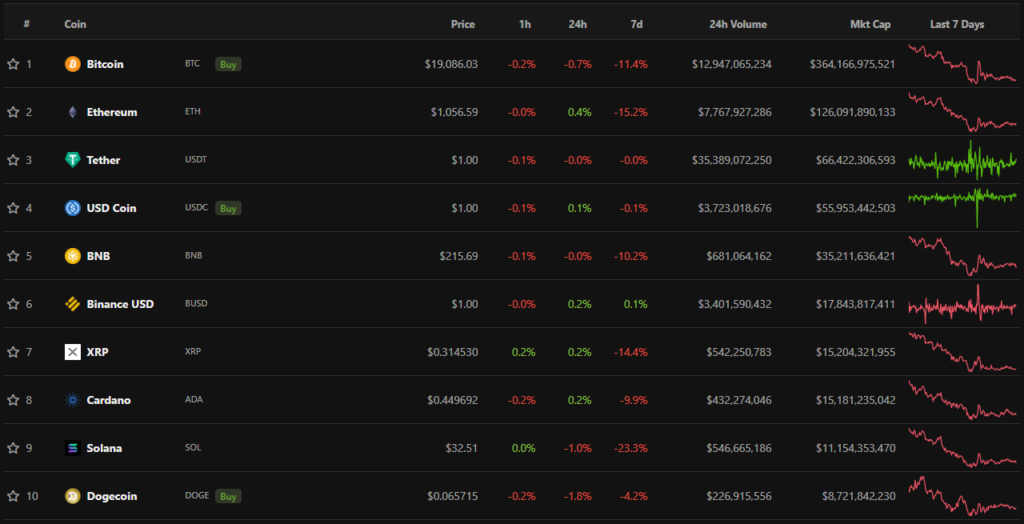

At the time of writing, digital gold is trading near $19,000. Over the past week, the asset’s quotes have fallen by more than 11%.

Hourly BTC/USDT chart on Binance exchange. Data: Trading View.

All cryptocurrencies from the top 10 by market capitalization were in the red zone. Solana (-23.3%) and Ethereum (-15.2%) showed the worst dynamics.

Data: CoinGecko.

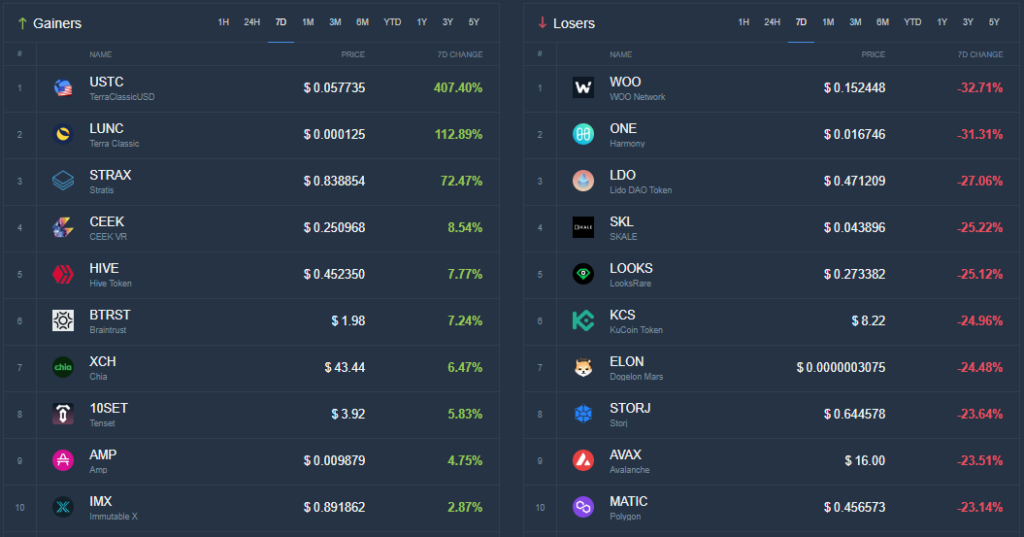

According to the service CoinCodex, for a week fromdigital assets with moderate capitalization, the algorithmic stablecoin TerraClassicUSDT has risen in price the most. The USTC price rose 407% amid increased trading volumes.

The token of the WOO Network project fell in price more than others. WOO shares fell by almost 33%.

Data: CoinCodex.

The total capitalization of the cryptocurrency market amounted to $920 billion. The Bitcoin dominance index decreased to 40.5%.

Voyager Digital Issues Default Notice to 3AC, Virgin Islands Court Orders Liquidation of Fund

Cryptocurrency broker VoyagerDigital has issued a notice of default to hedge fund Three Arrows Capital (3AC) due to non-payment of a loan. The broker issued a loan to 3AC for 15,250 BTC (more than $320 million) and 350 million USDC. On June 24, the company asked to close part of the debt in the amount of 25 million USDC, and then demanded that the entire loan be repaid in BTC and stablecoins by June 27.

British Virgin CourtOstrov decided to liquidate the hedge fund. Later it became known that among the creditors demanding this step were the platforms Blockchain.com and Deribit.

At the same time, the Central Bank of Singapore condemned the fund's actions and reprimanded it for providing false information and exceeding the permitted threshold of assets under management.

3AC, in turn, filed for bankruptcy in New York court. Chapter 15 of the U.S. Bankruptcy Code can protect a foundation from seizure of assets in the United States during a liquidation.

The fall of bitcoin put $4 billion in miner loans at risk of default

Bloomberg reported that some miningcompanies have encountered problems servicing loans, the collateral for which is Bitcoin mining equipment. According to the publication's estimates, loans worth $4 billion are at risk of default.

JPMorgan analysts believe that those in needIn terms of liquidity, mining companies are able to continue to exert downward pressure on the Bitcoin rate in the third quarter if mining profitability does not improve. Public players today account for about 20% of the hashrate.

This week Dynamics hosting providerMining terminated its agreement with Bitcoin mining equipment and service provider Compass Mining due to unpaid invoices. The latter announced the resignation of CEO Whitt Gibbs and CFO Jody Fisher.

MicroStrategy and El Salvador buy bitcoin

Analytics software provider MicroStrategy purchased an additional 480 BTC at an average price of $20,817. The company owns 129,699 BTC, purchased for $3.98 billion at an average price of $30,664.

The government of El Salvador also purchased an additional 80 BTC for a total of $1.52 million.

Harmony offered a reward for the return of stolen $ 100 million. Analysts admitted that Lazarus was behind the hack

At the beginning of the week the protocol teamHarmony offered a reward of $1 million for the return of $100 million worth of crypto assets stolen from the Horizon cross-chain bridge or information that leads to hackers. After criticism from the community, it was increased to $10 million.

Elliptic specialists stated thatThe North Korea-linked hacker group Lazarus may be behind the attack on Horizon, based on a similar attack vector to the Ronin sidechain. According to analysts, hackers have already sent 41% of stolen crypto assets to Tornado Cash.

At the same time, Reuters noted thatThe fall of the crypto market jeopardized the financing of the DPRK’s weapons program, since digital assets stolen by hackers could have sunk “hundreds of millions of dollars.”

What to discuss with friends?

- The FBI has included OneCoin founder Ruja Ignatova among its top most wanted criminals.

- Meta will close the Novi digital wallet.

- The fall of Bitcoin deprived 82,600 (75%) investors of their millionaire status.

- Popular TikTok blogger Xabi Leim has become a Binance ambassador.

OpenSea reported a leak of user data

Leading NFT marketplace OpenSea reported a leakuser data by an employee of Customer.io, an email delivery service. He transferred customers' email addresses to a third party. OpenSea warned of possible consequences in the form of phishing attempts.

FTX CEO warns of 'hidden insolvency' of some crypto exchanges

FTX CEO Sam Bankman-Fried believes thatSome third-tier Bitcoin exchanges are close to bankruptcy. The billionaire himself is far from altruistic and is not ready to “save” all troubled companies that have “gone too far” by attracting new clients by paying generous interest on deposits.

About hard times forcrypto exchange and Kaiko analysts stated. In their opinion, the platforms will be tested by non-native market conditions, a reduction in client activity and the problems of a number of industry participants.

CoinFLEX Sends Default Notice to Bitcoin.com Founder Roger Ver

Bitcoin.com founder Roger Ver owes $47 million to cryptocurrency derivatives platform CoinFLEX. The latter sent a notice of default to Bitcoin-Jesus.

Earlier, the head of the company, Mark Lamb, said thatthe company had problems because of a “long-term” client who was given a loan on unique terms. There is no liquidation price for his position - in return, he provides liquidity to the platform. However, against the background of the crisis, his position became unprofitable.

To pay off this client's debt and resume withdrawals of user funds, CoinFLEX announced the Recovery Value USD (rvUSD) token.

Ethereum Developers Delay Activation of Difficulty Bomb

On June 30, the Gray Glacier hardfork occurred on the Ethereum network at block #15,050,000. The only goal of the update was to delay the activation of the difficulty bomb by 700,000 blocks.

Binance is in "rescue talks" for over 50 companies

Cryptocurrency exchange Binance intends to helpto industry participants experiencing "slight liquidity shortages" and is negotiating with more than 50 companies. This was stated by the head of the platform, Changpeng Zhao.

Earlier, the head of BlockFi, Zach Prince, said thatThe American division of the FTX exchange will issue a revolving loan to the landing platform for $400 million and will receive an option to buy out the company for $240 million.

Zhao noted that Binance could have been the first to take advantage of the acquisition opportunity, but did not do so.

US Extradites Ex-Monero Developer Ricardo Spagni to South Africa

The court ordered former lead Monero developer Ricardo "Fluffypony" Spagni to surrender to the US Marshals Service on July 5 for extradition to South Africa.

In July 2021, law enforcement officers detained Spagniat the Nashville airport (USA) at the request of the South African authorities, who accused him of fraud for $ 100,000. The case is not related to Monero, but to his work in the South African company Cape Cookies in 2009-2011.

Also on ForkLog:

- The head of the US SEC confirmed the classification of Bitcoin as a commodity.

- Mark Cuban, Snoop Dogg and Mike Novogratz named guidelines for the end of crypto winter.

- Grayscale sued the SEC for refusing to convert GBTC into an ETF.

- Polkadot is modernizing its governance structure.

What else to read and see?

ForkLog analyzed the most relevant on-chain metrics and found out what to expect from the price of the first cryptocurrency in the short and medium term.

The educational cards explained what DEX, staking and moving average are. They also explained why the Stock-to-Flow(S2F) model is criticized and what happened to the Ronin sidechain.

Traditional digests have collected the main events of the week in the fields of cybersecurity and artificial intelligence.

The cryptocurrency industry is attracting more and morenumber of institutional players. This is evidenced by new investments in infrastructure, and the increasing attention that companies are showing to bitcoin as an asset class. The most important events of recent weeks are in the ForkLog review.

On June 27, live on ForkLog LIVE, we discussed current news and talked about Bitcoin and the market. Visiting traders were Vladimir Cohen and Ton Weiss.

On June 29 we conducted another broadcast, the main topicwhich altcoins became. Guests were trader Vladimir Cohen, CEO and CTO of HyperFlex Nikita Inshakov and Vladimir Maslyakov, as well as the host of the “Basic Block” podcast Sergei Tikhomirov.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.