Landing platform Celsius placed approximately $534 million of client funds in “high-risk strategies”Leveraged Cryptocurrency Trading through KeyFi. According to Arkham analysts, this resulted in a $390 million loss.

According to the report, from August 2020 to April 2021year, Celsius transferred digital assets worth $534 million to an address associated with KeyFi. The latter placed most of these funds in various DeFi protocols and invested $6.3 million in NFTs.

Based on Chainalysis' December 2020 audit report, at one point KeyFi controlled 10% of assets under Celsius management ($330M out of $3.3B).

From September 2020 to September 2021 KeyFireturned $1.14 billion in assets to Celsius — a USD-denominated profit of 113%. Analysts noted that, given the market conditions during this time period, the platform would have earned more if it simply kept funds on the balance sheet.

“During the collaboration between Celsius and 0xB1[KeyFi associated address] Bitcoin price rose from $11,000 to $60,000, an increase of more than 400%. Ethereum, another significant asset that the platform entrusted to 0xB1, rose 900% from $400 to $4,000. If Celsius had kept these assets rather than sending them to a counterparty, their value would have been $1.49 billion, $350 million more than what was returned to it,” the analysts wrote.

Earlier, the head of KeyFi Jason Stone said that histhe company filed a lawsuit against Celsius. The latter was accused of non-fulfillment of contractual obligations, market manipulation, illiterate management and organization of the Ponzi scheme.

Arkham said that the landing platformspent more than $300 million to purchase its own CEL token in order to fulfill obligations to users who received profitability in this asset. To do this, the company used centralized exchanges like FTX and Liquid.

Celsius founder and CEO Alex Mashinsky, in turn, regularly sold large amounts of CEL - the total amount of tokens he sold reached 44 million, according to the report.

Mashinsky primarily used DEXs like Uniswap and Airswap, but did some of his sales on the same centralized platforms where Celsius purchased tokens.

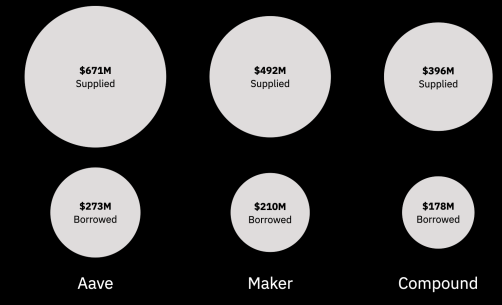

Analysts highlighted that Celsius has been one of the biggest players in the DeFi space. The platform placed most of its funds in the three protocols Compound, Aave and MakerDAO.

For example, the company accounted for 2.5% of all Ethereum staking coins and 10% of the stETH synthetic token supply.

Celsius positions in DeFi protocols as of June 21, 2022. Data: Arkham.

Recall that on July 7, Celsius closed the vault in MakerDAO and withdrew 23,962 WBTC from the protocol. A few hours later, the platform transferred over $500 million in WBTC to the FTX exchange

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.