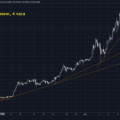

Prerequisites for a new rate jumpBTC/USD was about the same as what contributed to its previous growth: an upward trend, high demand exceeding supply, large investments in Bitcoin by large market players.

After the rate increased to $48.2 thousand.On the news of the acquisition of Bitcoin by Tesla for $1.5 billion, there was a correction to $44 thousand, followed by a return to the level of $48,051 with further testing of the level against the backdrop of a narrowing price corridor and increased pressure. Ultimately, the resistance level was broken andfurther progressive ascent to $50 thousand

We can say that this milestone was taken fromfourth attempt, after which there was a rise to $52 thousand. This was followed by another sideways correction, which allowed market makers to gain the necessary level of liquidity in order to continue the upward movement. Then there was a jump above $55.5 thousand.

Features of the current trend and future prospects

As we see, the situation from the point of view of the schedule inis largely repeated: a jump, a sideways or downward correction, the next jump, and so on. This can continue for quite a long time, since the level of capitalization of Bitcoin allows this.

In the short term we already expectreaching the target level of $57,111, which until recently was a medium-term goal. But with the current growth rates, medium-term goals quickly become short-term, and long-term goals quickly become short-term. medium-term. Therefore, we have revised our forecasts for the medium term based on the upward wave of 2017. The new target was the Fibonacci retracement level of 3.618 at $66361.

As the BTC / USD quotes move to this markwe expect local corrections at resistance levels. One of these levels could be $ 57111. A probable decline from this mark could provide an opportunity to open new long positions. At the same time, one can also consider corrective support levels on the four-hour timeframe as potential entry points.

At the moment, we are seeing support levels inaround $ 55,251 and $ 52,124 based on CEX.IO trading data. Also, the 20-period four-hour moving average may provide support for BTC / USD, as it happened on February 13 at the $ 46,733 line and on February 16 at the $ 47,963 level.

</p>