A number of ASIC miners will be turned off forever after the Bitcoin halving. Poolin pool representatives figured out whatdevices will go offline and how much the hash rate of the first cryptocurrency will drop.

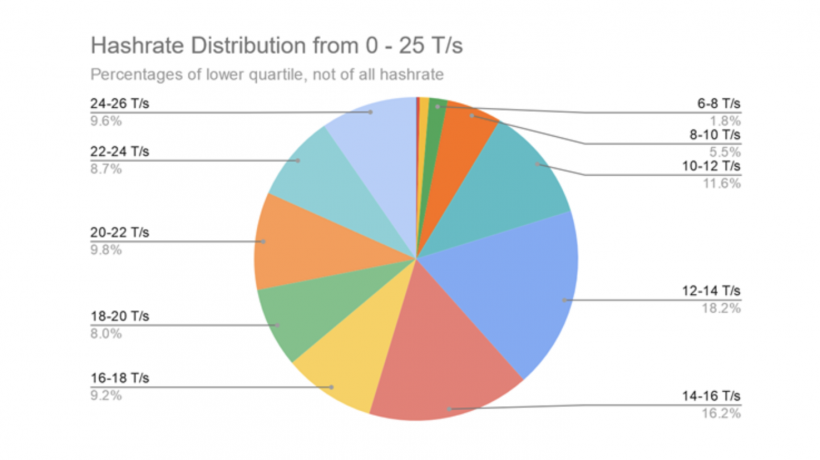

</p>Poolin Vice President Alejandro de la Torreexamined the lower quartile of the total bitcoin hash (from 0 to 25 T / s) and divided it into intervals of two terahs per second. This quartile contains most devices with 16- and 10-nanometer chips.

The most popular miner of the last fouryears was Antminer S9 from Bitmain. All of its versions fall in the range of 12-22 T / s, and the standard model generates 13.5 T / s. They are responsible for almost all of the computing power in the range of 12-14 T / s, which is 15-30% of the network’s hashrate, writes de la Torre.

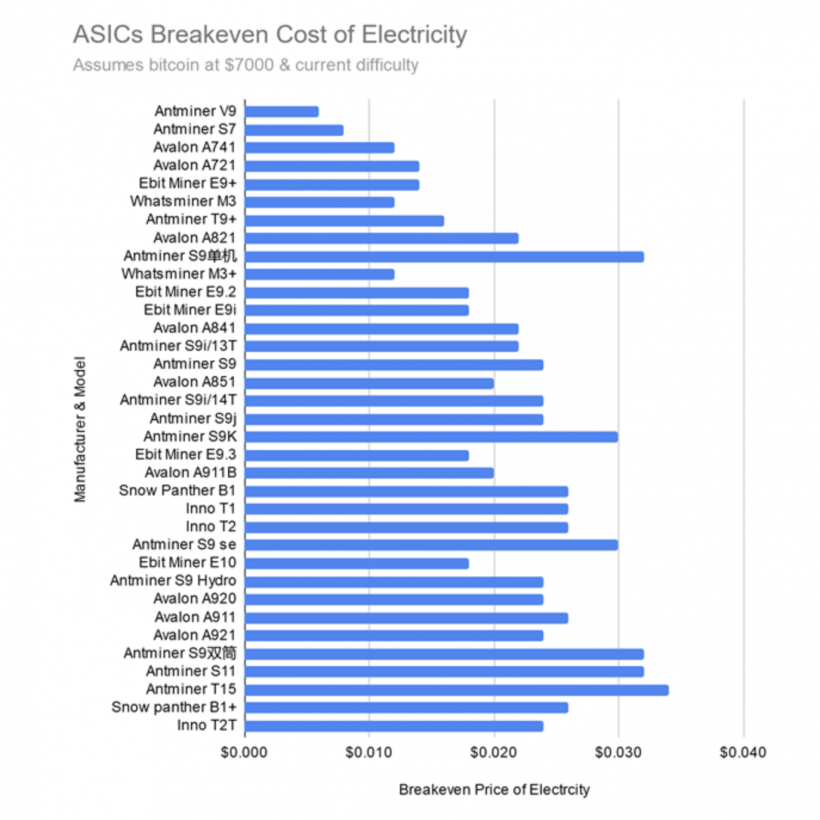

In the pool, it was calculated at what prices for electricity the miners of the lower quartile will remain profitable. The calculations took into account the bitcoin price of $ 7,000 and the current mining difficulty.

The maximum tariff for the most powerful devicesof the lower quartile is 3.4 cents per kilowatt. Devices in the range of 0-10 T / s will remain profitable only with free electricity and no other costs.

In the range of 10-16 T / s at 3 cents per kilowattonly the Antminer S9K will survive. This range is 46% hash in the lower quartile. Most devices require a rate of no higher than 2 cents per kilowatt. And even if they survive, de la Torre emphasized, the increase in complexity will eventually force them to leave to go offline.

In the range of 16-26 T / s, chances to survive halving and maintain profitability are higher in the short term. Devices are suitable tariffs of 3-3.5 cents per kilowatt.

Poolin expects from the lower quartile afterhalving will remain less than 15% of the hashrate. The situation for these devices can be worsened by the recalculation of complexity in anticipation of halving. The indicator is expected to rise.

De la Torre added that the new 5-nanometer devices will remain profitable over the next four years as the industry has come to the limit of Moore's law.

Halving will take place at block # 630,000. It should be mined on May 12, if an abnormal production acceleration does not introduce adjustments.

</p>Recall about Bitcoin mining, equipment, the situation in the industry and the upcoming halving, read in the special project of the ForkLog magazine.