Bitcoin has lost its mojo in recent weeks. 25% below maximum. Some people need a 33% increase in price,to break even.We have pointed this out over the past weeks when it comes to iconic assets; people don't understand how to manage profit / loss when volatility is declining.

Another parabolic asset that has become iconic isthis is Tesla. Bitcoin and Tesla have moved in a similar fashion as the group psychology of missing out on growth continues to be a huge force in this market. Tesla's shorts have been painfully carried over (although there has been a slight rise in the shorts lately) and this iconic name has remained, which has surpassed most assets, including Bitcoin. Chart showing Tesla and Bitcoin.

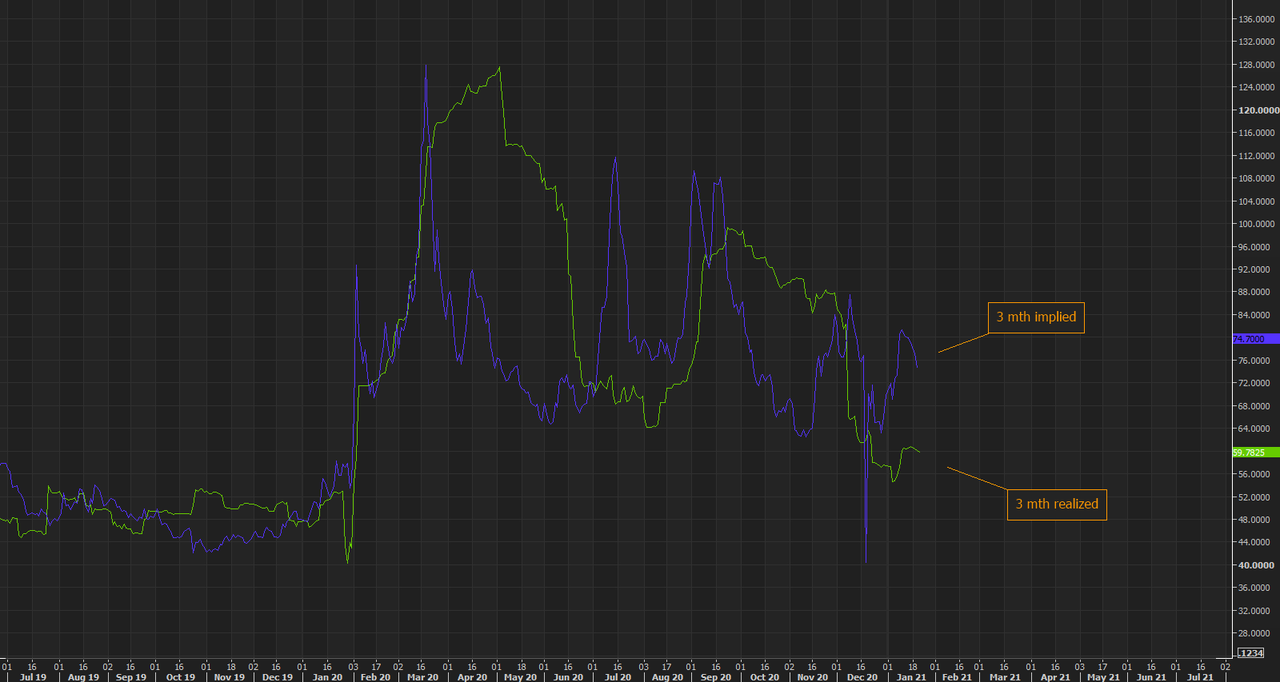

Tesla has been showing a desire latelyat least take a break. There are many institutions these days that are stuck with Tesla longs, whether they like it there or not. One way for these long guys is to look at options writing strategies. Implied volatilities are still trading at fairly high levels against realized volatilities as Tesla's realized volatilities seem to have evaporated and moved to hot things like GM as of late.

A note about some growth potential looks likeattractive as Tesla hasn't seen much of a push lately. If you want to be more aggressive, you can use some downgrade protection, although the premiums are very cheap. Why not finance some of the decline by selling high-strike calls to "active managers"?

Chart showing imputed and realized volatility over 3 months.

translation from here

Free access to analytics of US markets at elliottwave com

This is why Bitcoin "rejected" the $ 42,000 mark

Crypto Trading Guide: 5 Simple Strategies To Watch Out For New Opportunity

Now the handbook for wave enthusiasts, “The Elliott Wave Principle,” can be found in free access here

And don’t forget to subscribe to my telegram channel and YouTube channel

Free Guide “How to Find High Potential Trading Opportunities Using Moving Averages”

If you find the article interesting, put pluses and add to favorites.