Cryptocurrency hedge fund Adaptive Capital plans to close after the market collapse that occurred on March 12-13, reportsThe block.

“Adaptive decided to suspend operations and return the remaining funds to the fund participants. We are convinced that the risks of working in such an unstable environment exceed the potential benefits ”, - says a letter addressed to investors.

The company complains about the "inferiority of the infrastructure", which makes it difficult to properly respond to the movements of the volatile market:

“A number of reputable exchanges, platforms and services that we use daily suspended operations amid a sale, significantly limiting our ability to respond appropriately.”

In particular, during the fall of the price of bitcoin belowThe $ 4,000 BitMEX platform experienced severe disruptions for approximately 45 minutes, during which the user’s trading orders were not processed. Representatives of the popular crypto derivative exchange explained these problems by distributed denial of service (DDoS) attacks.

Sources familiar with the situation told the publication that Adaptive Capital used BitMEX for operations, and as a result of the recent collapse, the fund's assets decreased by 50%.

Note that earlier the fund showed a goodprofitability. For example, from October 3, 2018 to May 3, 2019, Adaptive Capital's assets grew by 552.77%. To predict market movements, the company used its own tools based on on-chain analysis of popular cryptocurrencies.

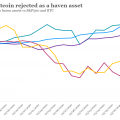

The fund was managed by well-known analysts in the crypto community - Murad Mahmudov, an ex-employee of Glencore and Goldman Sachs, and Willy Wu, creator of a number of on-chain indicators.

Recall that last year, about 70 large cryptocurrency hedge funds closed.