The banking giant JP Morgan, which actively commented on the decline of the cryptocurrency market from its highs, keptsilence on this topic in recent weeks, while bitcoin and ether have added more than 50% in price.

At the end of this week, JP Morgan analyst Nikolaos Panigirtzoglu finally released a report in which, among other things, he noted a reversal of negative trends in the digital asset segment.

"The sharp recovery in crypto markets over the past three weeks has taken many investors by surprise, which forces us to think about the drivers of this growth."- he writes.

Panigirtzoglu names the activity of institutional players as one of the main factors behind the rise:

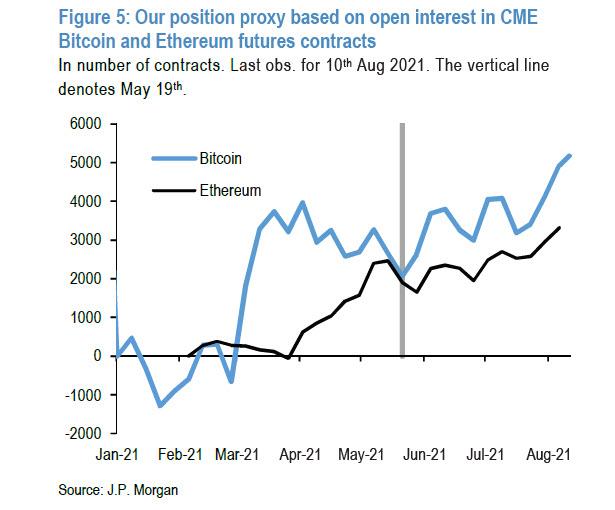

“We have seen significant momentum in futures likeshown in the image below. It shows our estimate of the net change in the volume of investors' positions in Bitcoin and Ethereum futures of the Chicago Mercantile Exchange (CME) (by the number of contracts excluding price changes). The indicator not only reversed after the decline in the previous stage, but also sets new highs. "

Separately, Panigirtzoglu highlights the activity of commodity trading consultants (CTA):

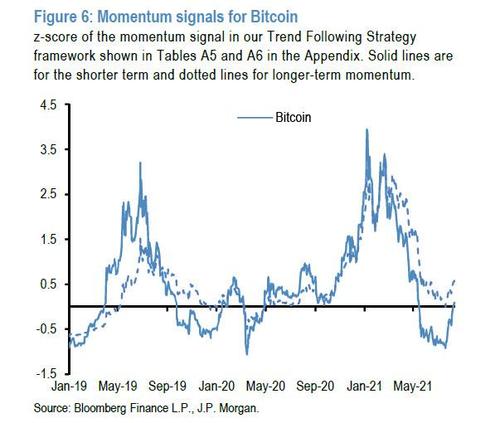

“Impulse traders like CTAs are likely toaccelerated the recent rise in prices. Not only has the fading of impulse signals stopped, but also a trend reversal, which prompts impulse traders to open new positions. "

Recalling his earlier forecast, the analyst writes:

"Bitcoin's Failure to Cross the $ 60 Border000 led to a mechanical shift of the momentum to the bearish side and contributed to the further closing of futures positions. This was probably a significant factor in the correction in previous months, associated with the reduction of positions of CTA and other impulse traders. "

Now that the CTAs have made all the profits they can, those same impulse signals have started to rise again, especially the short-term ones. As shown in the image below, they went out of the negative zone into a plus:

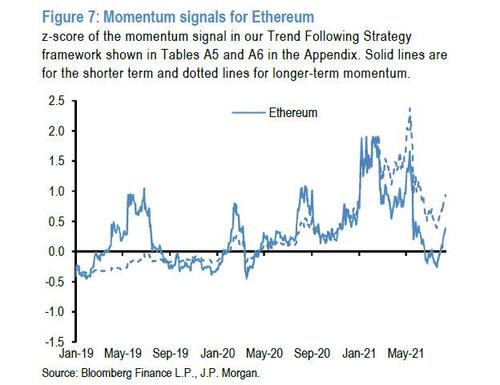

A similar situation can be traced in the ether market:

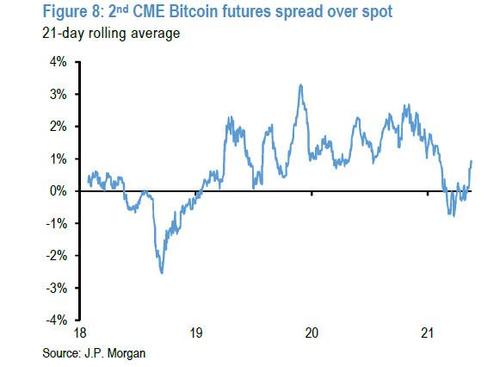

In the past, Panigirtzoglu pointed out the emergence ofdiscount on bitcoin futures as a bearish sign that accompanied the cryptocurrency market throughout the entire decline in 2018. This factor was also eliminated:

“We previously stated that the 21-day averagethe spread indicator should return to the positive zone so that we can talk about the end of the previous phase of weakened demand. Now this condition has been met with a confident exit of the indicator in the positive zone ”.

“There are clear signs of improving demand forfutures market, which indicates an increase in institutional interest in cryptocurrencies. Impulse traders like the CTA have likely amplified recent moves, while shorter-term impulse signals have changed from negative to positive. Usually at this time the impact of impulse traders is felt the most, as they are forced to exit short positions and start building up long ones. ", - the analyst concludes.

A detailed guide to trading Bitcoin futures is available here.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | FTX | https://ftx.com | 7.5 |

| 3 | Bybit | https://bybit.com | 7.2 |

| 4 | OKEx | https://okex.com | 7.1 |

| 5 | Exmo | https://exmo.me | 6.9 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Platform capabilities- availability of additional features: futures, options, staking, NFT, etc.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication