On his telegram channel, Sergei Grigoryan spoke about the strong growth of bitcoin.

Myspeculations about the growth of interest in investing in bitcoin from the side of large players continue to be confirmed.

In September, I wrote about Fidelity's activity in this new market for the company. The reaction of the main competitor, Blackrock, was not long in coming.

In a recent interview, one of the topThe world's largest asset manager said investors could begin to partially replace gold in their portfolios with bitcoin. The market could not ignore such recognition from a company that manages almost 8 trillion dollars. It seems that the increase on Friday was caused by this very statement.

But in truth, this particular newsnotable, but not that important. I wrote about the fact that Bitcoin could test the all-time high of 20k in May, when it was worth about 9k. A possible period of 12 months was indicated. But judging by the dynamics (2x in six months), this level can be reached much earlier. Not surprising, given that the big industry's numerous efforts to create the right infrastructure are beginning to bear fruit.

The result of this work is a gradual(but accelerating) acceptance by categories of investors who are considered conservative. I wouldn't be surprised if at some point there is a rush like 2017, caused this time by an imbalance in supply and demand. Even if it has arisen for a short time, it can become a reason for a sharp renewal of the historical maximum. This is not a forecast, but reasoning.

Criticism from haters like Rubini and a numberother economists (including our homegrown ones) turned out to be unfounded, if not dangerous. This is probably why their public attacks against Bitcoin have disappeared somewhere. Or maybe they managed to buy it and are now quietly happy?

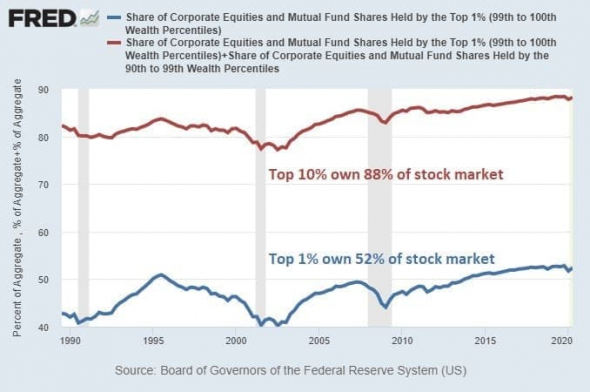

One of the arguments "against" was the highconcentration of bitcoin ownership, which allows a small group of large holders to manipulate the market. To conclude this post, I suggest taking a look at the chart from the Federal Reserve for comparison, which shows the concentration of the stock market. For a moment, this market is 100 times more capitalized than Bitcoin. Nevertheless, 1% of investors "hold" 52% of the market, and it never occurs to anyone to accuse the stock market of being a fraud and a scam.

In one of the following posts I will write how you can theoretically get exposure to Bitcoin where direct purchase carries increased regulatory risks.