The main advantage of investing in Bitcoin is significant profit in the long term.Falls occur periodically due togames «whales» (large funds and institutional investors), but, as practice has proven, in the end the BTC rate still rises, and in some cases exponentially.

The price of Bitcoin is formed in a very non-standard wayin the same way as for currency: solely due to the desire of people to exchange fiat money for «virtual». At the same time, the total amount of bitcoins in the world is strictly fixed and predetermined (21 million), andmore than 85% of all BTC has already been mined by miners, the remaining 15% will be mined by 2140, which also has an extremely positive effect on the cost.

Toughlimited emissionAnddecentralized blockchain(no one can take away or freeze your coins) are the fundamental advantages of Bitcoin as an asset.

What makes bitcoin a profitable investment asset?

Bitcoin is most often perceived as an optionquick money on the growing rate. And often the strategy for using it comes down to playing on the cryptocurrency market: bought while falling - sold while growing. However, a decentralized cryptocurrency can be regarded as a safe investment in the long term.

Currently, the economies of all countries are experiencingnot the best of times. Experts everywhere note the depreciation of national currencies and the reduction of foreign exchange reserves. In addition, rates on bank deposits are constantly falling, and some European banks place deposits at a negative percentage.

The Russian economy also lacks stability, anda decrease in the key interest rate of the Central Bank led to a large-scale reduction in interest rates on deposits in both rubles and in foreign currency. In addition, a statement by Russian President Vladimir Putin on the introduction of a tax on bank interest made deposits an unattractive offer.

In addition, the situation is complicated by the fluctuationthe cost of oil, therefore, experts do not exclude that by the end of 2020, the ruble will drop in price and the dollar will reach 90-100 rubles. Therefore, savings in rubles cannot guarantee not only profit, but also protection of funds from inflation.

Against this background, bitcoin looks attractive toinvesting in the long run. The cryptocurrency created by Satoshi Nakamoto is not controlled by the financial regulators of any country, which makes it completely independent. At the same time, fears that cryptocurrency cannot be considered money contradict the economic theory that money has a number of functions.

You will be surprised, but all these functions are implemented in bitcoin:

- The measure of value– many goods and services in the global web have a value expressed in BTC (real estate, works of art, exclusive cars);

- Means of circulation and payment– the purchase operation for BTC does not take much time, and immediately after the funds are credited to the seller's wallet, the funds can bebe used at your own discretion;

- World moneyAccording to this indicator, bitcoin is the undisputed leader, since its owner avoidsthe need to exchange the national currency for another for settlements with foreign counterparties.For example, there is no need to exchange rubles for dollars to pay a supplier from Kazakhstan;

- Means of accumulation– Bitcoin can be accumulated by investing free funds in it, and, if necessary, converted into other instruments, for example, rubles, foreign currency or securities.

Thus, bitcoin is fully consistentall the characteristics of traditional money. However, unlike most national currencies, the amount of bitcoin cannot be unlimited. Almost any country in the world can afford to “launch a printing press” and put into circulation a money supply of any volume without providing it with anything. All this accelerates inflation and leads to the depreciation of money and the economic crisis.

The number of bitcoins is limited, new coinscreated by solving complex mathematical problems. It is impossible to artificially increase the mass of cryptocurrencies, so Bitcoin can be considered a deflationary monetary unit. This ensures that the value of the cryptocurrency is not subject to inflationary processes and will increase in the long term. For this reason, the funds invested in it can bring significant income.

Note that numerous statements thatcryptocurrency is a tool of the “shadow market”, not confirmed by statistics. The share of using this cryptocurrency in illegal operations is insignificant, much more criminal payments are made with the help of rubles and dollars. Fears of using bitcoin for investment because someone buys drugs for him are untenable. Every day from the news we learn about the detention of drug dealers who are seized hundreds of thousands of rubles, but this does not make us refuse to make payments in foreign currency.

We add that contrary to the prevailing and widespread belief, Bitcoin is by no means an anonymous currency, therefore, if necessary, the origin and movement of funds can be traced.

Where is it more profitable to buy cryptocurrency? TOP-5 crypto-exchanges

For the safe and convenient purchase of cryptocurrencies, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support the deposit and withdrawal of funds in rubles, hryvnias, dollars and euros.

The most reliable sites with the highest turnoverfunds, for several years the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto-exchange in the CIS as well, since it has the maximum trading volumes and supports transfers in rubles from Visa / MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site evaluation |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Options for trading cryptocurrency on the exchange

There are many types of BTC trading. Crypto exchanges are used as platforms for transactions. Most exchanges are focused on 1-2 types of trading.

Spot

The spot market is characterized by tradingfinancial instruments (in particular, cryptocurrencies) on the condition that the asset will be immediately transferred to the buyer. The exchange of funds is called delivery, and transactions and prices in such a market are also called spot.

The current price of Bitcoin is called the spot price.This is the cost at which you can buy cryptocurrency right now and on this exchange. The spot price is formed when buyers and sellers place their buy / sell orders. On highly liquid exchanges, the price therefore changes every second, while old orders are executed and new ones appear.

Futures

Bitcoin Futures - Financial Derivativean instrument that can be described as a contract with the following conditions: the asset will be sold on a certain date in the future, but at the current price. During the creation of the contract, the price of the coin is fixed.

Futures are deliverable and settlement.Delivery is easier - this means that if the purchase of Bitcoin at the current price in a month is agreed, then it will be so. And settlement futures does not imply any delivery at all. When the contract expires, then there is a recalculation of profit and loss between the participants, as a result of which they receive or lose funds.

Margin

Margin trading — this is the conclusionexchange transactions using borrowed funds. Not entirely at their expense, but only with use, that is, in order to use this function, the trader must have a certain minimum amount of funds in his account and provide them as collateral.

Using margin gives the trader the opportunityopen positions for amounts much more than he could with only his assets. This type of trading is also called leveraged trading. Leverage is the ratio between the market participant's own funds and the amount available to him to open a position. For example, if the exchange offers a leverage of 1:10, then this means that you can trade in volumes 10 times the trader's capital.

Where can you invest BTC for more profit?

We figured out how, when and where to buy Bitcoin. Now let's look at all the ways to make money on investments in Bitcoin and figure out where to invest Bitcoin.

- Investing in Bitcoin with a Buy and Hold (HODL) strategy... Most crypto investors just keepBitcoin in cold wallets or exchanges. This type of investment involves a long period of expectation of profit, from several months. There are practically no risks, in the long term, Bitcoin has always risen in price, therefore, in my opinion, the "Buy and Hold" investment strategy is the most profitable and reliable way to invest in Bitcoin. I recommend to all my readers to invest most of the Bitcoins in the long term, that is, bought and forgotten for six months. Six months later, they sold it and made a good profit.

- Trade Bitcoins on the cryptocurrency exchange.If you want to make a quick profit frominvestment, then you need to start trading Bitcoin on the exchange. Binance is the best exchange for trading Bitcoin. How to trade cryptocurrency and Bitcoin is discussed in detail in the article “Trading on the cryptocurrency exchange step by step.” The main task: buy Bitcoin cheaper and sell it more expensive. The more often this task is performed, the more you will earn. Given the constant change in the Bitcoin rate, such transactions can be made several times a day. Profit is unlimited and can reach up to 50% per day! Remember, trading Bitcoin comes with risks. If you enter the market incorrectly and the price goes against you, the trader will inevitably lock in a losing trade. Therefore, analyze the market and approach trading responsibly. This method of investing in Bitcoin is the most profitable.

- Investment in cloud mining.Such sites are engaged in real miningBitcoin. We conclude a contract and invest Bitcoin, buying power from the site. That is, we rent mining equipment from the company, making money on it. Essentially, cloud mining is an investment in Bitcoin at interest. Today there are several cloud mining service providers on the market (IQmining, Genesis, Hashflare, etc.). All these companies provide computing power for rent. You can buy them from anywhere in the world and receive income from mining, which is physically carried out on the other side of the planet. The rating of cloud mining services is available here.

- Investments in other cryptocurrencies and ICOs.Typically, an investor buys Bitcoin on an exchangecryptocurrency, and then buys other altcoins for it. That is, by investing in Bitcoin, you have the opportunity to quickly and with a minimum commission exchange it for other cryptocurrencies. Like Bitcoin, top cryptocurrencies always increase in value over the long term. Therefore, in my opinion, investing in cryptocurrencies is one of the most profitable ways to invest in Bitcoin. After the cryptocurrency you purchased increases in price, you can buy, for example, dollars for it and take a profit, or you can buy Bitcoin, thereby increasing its quantity. When it comes to investing in ICOs, this is a very controversial topic. On the one hand, an ICO can increase your capital several times or even several dozen times. During the ICO, developers attract investments to develop the coin. If you recognize and buy a really high-quality coin during its initial offering, you can make very good money. But on the other hand, any ICO may turn out to be a dud created to raise money, and you will lose all the funds invested in the ICO.

- Investments in mining BTC on your equipment.You can mine Bitcoins yourself using:called mining. All investments are aimed at purchasing equipment with which Bitcoins will be mined. Today, mining is not particularly profitable. Every year the difficulty of mining becomes more complex, the reward per block decreases, equipment becomes more expensive, and so on. In addition, equipment already purchased may break. I would not recommend starting mining today. The period for reaching break-even (excluding various force majeure circumstances) is more than a year.

- Give it to the trader for remote control (trust management).You need to find a trader to whom you will transfermoney, and he will trade Bitcoins for a certain percentage of the profits. In this case, the profit will come from full liabilities. But remote control is quite a risky way of investing. A trader can steal your money because he has unlimited access to it. Also, the trader may turn out to be incompetent, which will lead to a complete or partial loss of the deposit. Give money to trust management only if you are one hundred percent confident in the trader.

So we looked at the main waysinvesting in Bitcoin. Always remember the golden rule of the investor, which is, "Don't keep all your eggs in one basket." What does it mean? Don't invest all your Bitcoins in any one of the ways! Distribute your investment capital evenly across all investment instruments.

Features of investing in bitcoin

Planning an investment in Bitcoin is worthconsider that technically managing digital coins is a more complicated process than with fiat currencies. It requires attention when performing any operations. Mistakes made in indicating the address of the recipient cannot be corrected, as well as returning your coins.

Undoubtedly, in the future, a solution will surely be developed that will eliminate such things, for now, users should take this specificity into account.

According to many cryptanalysts havingextensive experience in traditional finance, today bitcoin as a means of saving is the most interesting financial instrument. It allows you to securely invest free cash, not only to protect against inflation, but also to make a profit.

You will need to create a cryptocurrency wallet or create an exchange account

In order to get bitcoin, you should createa wallet for storing cryptocurrency: either download the application to a computer or smartphone, or create an account on the exchange. Both options can be selected. Usually, experienced traders keep a part of the assets on trading floors that are needed for operations. The remaining funds are stored in over-the-counter wallets.

Cryptocurrency wallets are divided into three main types:

- online wallet,

- cold (local) wallet,

- wallet on a cryptocurrency exchange account.

For those who want to familiarize themselves with all types of crypto-wallets, we have prepared a detailed description of the features of each type in a separate material: Best wallets for cryptocurrency for 2021.

How Bitcoin transactions take place: address and private key

There are concepts such as a private address(key) and public address (key). It is their combination that makes Bitcoin the safest decentralized currency. To understand what these concepts are for, you can give an example from real life.

There is a physical mailbox where you receive mail (letters, notices, etc.). It has a specific address and number. The postman needs to know the house and apartment number in order to deliver mail.

And you have the key to the box, thanks to which itcan open it and pick up the received letters. This key is not given to anyone unknown and is always kept safe so that the confidentiality of the contents of the box is safe.

The same thing happens in the Bitcoin world:The public address must be known to the person who is going to send you cryptocurrency. And to use the funds received, you need a private key to the wallet. It is kept in a safe place and not shared with anyone.

From a technical point of view:

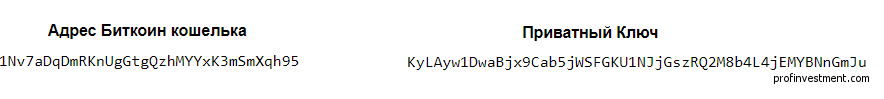

- Private key– password, consisting of letters and numbers, longA 256-bit number that is randomly generated when the wallet is created. The degree of randomness is determined by cryptographic functions. An example of the appearance of a private key: KyLAyw1DwaBjx9Cab5jWSFGKU1NJjGszRQ2M8b4L4jEMYBNnGmJu. Private keys are used to make irreversible transactions, providing a mathematical signature for each transaction that prevents it from being copied.

- Public keyor address - another number that, usingcryptographic functions are generated from the first (but decryption in the opposite direction is impossible, that is, no one can, having only a public address, find out a private one). In "base 58" encoding, it starts with "1" or "3" and is 33-34 characters long. An example of the appearance of a public address: 1Nv7aDqDmRKnUgGtgQzhMYYxK3mSmXqh95. This address is needed by the one who transfers Bitcoins. It is noteworthy that an unlimited number of public keys can be linked to one private key.

Risks and possible problems

- A gradual trend towards the centralization of cryptocurrency.

- Despite the fact that no one knows the recipients of bitcoins, the information itself about the amount of transactions is recorded in the blockchain.

- Formally, cryptocurrency is not backed by anything, except for the value that people invest in it (by analogy with gold).

- In Russia, all of the above is addedlack of a clear regulatory framework. However, the fundamental legislative acts have already entered into force on January 1, 2021, in particular, bitcoin in the Russian Federation is classified as property.

5

/

5

(

2

vote

)