Anchor, the largest protocol in the Terra ecosystem, continues to increase TVL amid continued demand forUST stablecoin. The latter has already surpassed Binance USD in terms of market capitalization, taking the third place in the stablecoin rating in this indicator.

Obviously, the popularity of the algorithmic stablecoin is largely due to the almost 20% annual yield offered by the Anchor protocol. In this regard, a number of questions arise:

- How long will such a high rate last?

- How sustainable is Terra's economy?

- Won't a potential cut in the Anchor rate lead to an outflow of funds to other protocols and a deviation of UST from the target level of $1?

- Will LFG's Bitcoin Reserve Help a Stablecoin?

ForkLog figured out these and other issues.

Resounding success

In just one year, the TVL of the Anchor protocol grew by almost25 times - from $0.6 billion to $16 billion. Now the platform is in third place in the overall ranking, behind only Curve and Lido. The latter support a wider range of networks.

DeFi Llama data as of 04/24/2022.

Given the high growth rates, it is highly likely that Anchor will soon become a leader among all projects in the DeFi ecosystem.

The protocol has recently added support for Avalanche. However, the share of this network in total TVL is small - only $158 million.

The figures show the extremely high importanceAnchor for the Terra ecosystem. The TVL of the latter is $29.29 billion (as of April 24, 2022). At the same time, the Anchor dominance index is $54.45%.

In other words, most of the activity in the Terra ecosystem is tied to Anchor, where 72% of the total UST supply is concentrated.

Data: Anchor Protocol.

In total, users have deposited 13 billion UST with Anchor. According to CoinGecko, the stablecoin has a total market supply of $18.1 billion.

Steady demand for UST is driven by highyield on Anchor. And this has a positive effect on the LUNA rate, since in order to issue UST, it is necessary to withdraw the corresponding amount of the native Terra cryptocurrency from circulation. The mechanism, largely based on arbitrageurs, helps maintain parity with the US dollar.

In other words, the more UST is issued and enters Anchor, the more LUNA is burned and the more its price rises.

Weekly LUNA/USDT chart of the Binance exchange. Data: Trading View.

Because of this, the dynamics of UST capitalization and LUNA prices are quite closely correlated.

At the beginning of November, the total market value of the stablecoin was less than $3 billion, now the figure is over $18 billion. During the same period, the market value of LUNA has approximately doubled.

It won't always be like this

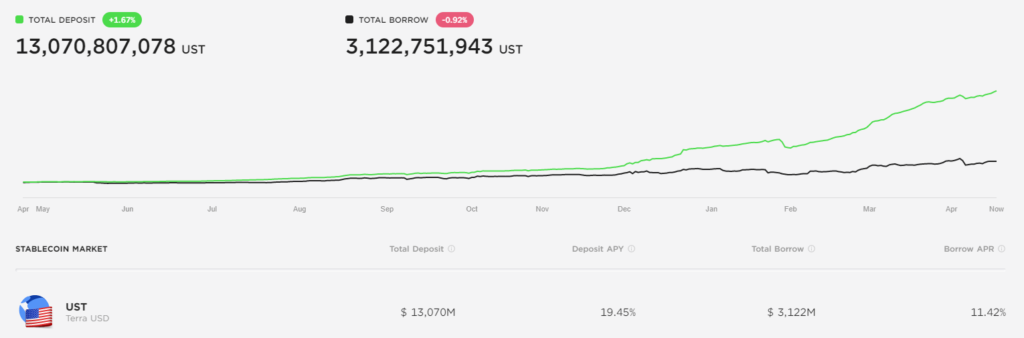

Digging deeper, the prospects for the Terra ecosystem are not rosy. The Anchor dashboard indicates that the total volume of deposits exceeds the value of borrowed funds in circulation by more than 3 times.

The project is experiencing an acute shortage of assets,necessary for the stable calculation of interest income to creditors. The distribution of the native ANC token among borrowers does not bring much effect and does not smooth out the existing imbalances.

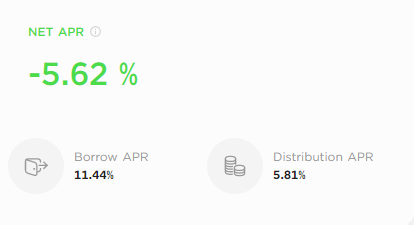

As of 04/24/2022, Anchor's actual borrowing rate is -5.62% (UST loans are issued at 11.44%, and the ANC accrual yield is 5.81% per annum).

Data: Anchor Protocol.

In March, the project community voted for a proposal according to which the rate of return on deposits could change once a month by a maximum of 1.5%, depending on the volume of reserves on Anchor.

The current state of the cryptocurrency market is notis characterized by high activity of participants. With fear prevailing over greed, many investors are turning to stablecoins, reluctant to borrow against cryptocurrencies due to the risk of liquidations.

Index of fear and greed. Alternative.me data as of 04/24/2022.

Low business activity, often replacedpanic will only contribute to the predominance of deposits over loans and a further reduction in reserves. Therefore, the rate of return is very likely to fall by 1.5% soon.

Critics of Terra believe that the decline in the attractiveness of UST deposits will lead to an outflow of funds from Anchor to other protocols, increasing the demand for alternative stablecoins.

This, in turn, can reduce motivation.arbitrageurs to maintain parity between the UST and the US dollar. As a result, its volatility will increase, which will lead to even more outflows of funds and, possibly, to catastrophic consequences for the entire ecosystem due to the irreversible loss of the link to the $1 target.

"As soon as the chance of a further fallthe value of stablecoins becomes high enough, arbitrageurs will refuse to maintain the price peg and may resort to withdrawing funds from the ecosystem. With further deterioration of the situation, the owners of Terra stablecoins will massively get rid of assets. As soon as the UST exchange rate drops significantly, the price peg will be completely lost,” Sergey Strutinsky, an expert in the field of mathematical modeling and a regular ForkLog contributor, shared his opinion.

Tether CTO Paolo Ardoino is convinced that USTdangerous for the cryptocurrency market. According to him, an asset with a capitalization of $5 billion or $10 billion does not pose a big threat to the industry, but the situation changes with a larger amount of coins in circulation.

"If you are going through liquidationalgorithmic stablecoin on the scale of UST, then the market can handle it. But imagine if you have a stablecoin like Tether with a capitalization of $80 billion or $100 billion, which is primarily backed by digital assets. It's hard to imagine what will happen and be sure about sufficient liquidity to stop the cascading effect,” Ardoino said.

Ways to improve ecosystem resilience

In January 2022, the Terra behind the blockchainTerraform Labs created the non-profit organization Luna Foundation Guard (LFG) and provided it with funding of 50 million LUNA. The goal of LFG is to develop the project ecosystem and increase the sustainability of UST.

In March, Terraform Labs sent organizations 12million LUNA. In the same month, the organization began creating a fund that is designed to “promptly” provide the necessary liquidity in bitcoin to maintain a stable price of UST.

In the second half of April, the volume of the fund exceeded 42,500 BTC (~$1.69 billion).

Arca Chief Investment Officer Jeff DormanI am convinced that the creation of such a tool points to the systemic problems of the Anchor protocol. The latter, he said, now requires constant capital injections.

The expert is sure that a change in tokenomics aimed at maintaining the stability of the ANC token can mitigate the situation.

“We are proposing a change to tokenomics that would oblige UST investors with more than $100,000 in their account to hold at least 10% in ANC tokens,” Dorman suggested.

Failure to comply with this condition would lead to a decrease in the profitability of large deposits.

“If this threshold is not reached, investorswill receive only half of the rewards or 10% return on invested UST. The savings will be accumulated in the Yield Reserve, increasing the sustainability of the protocol.”

The LFG website states that a “decentralized UST-reserves protocol” is created to support the Terra ecosystem. However, there is little information about various aspects of the operation of the mechanism itself.

According to LFG Reserves, the structure of the fund as of 04/24/2022 is as follows:

- 69.3% - bitcoin;

- 16.3% - centralized stablecoin USDC;

- 8.2% - LUNA, the native cryptocurrency of the Terra ecosystem;

- 6.2% - "stablecoin" USDT from Tether.

Three of the four assets listed above are notare provided in the white paper of the Terra project to support the operation of the algorithm that provides a link to the target level of $1. This creates even more confusion, provokes lively disputes among members of the crypto community and gives rise to many interpretations.

“To me, the LFG reserve seems to be something in betweenbetween an insurance policy and a support mechanism of last resort,” said Felix Hartmann, head of Hartmann Capital. “It’s a psychological restraint, akin to the FDIC, giving people confidence that this is not a house of cards.”

In March, Terraform Labs founder Do Kwonwrote that the replenishment of reserves will continue until their volume reaches $10 billion. According to him, this approach "opens a new monetary era of the bitcoin standard", and the accumulated funds will be used for "short-term repayments of UST."

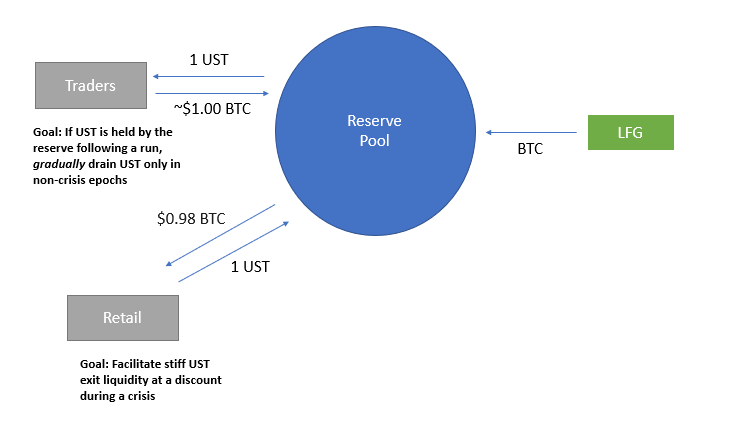

On March 23, Jump Crypto, which previouslyled LFG's $1 billion LUNA token sale, and submitted a proposal to the community to create a reserve Bitcoin fund to ensure a sustainable peg of UST to the US dollar.

The model assumes that the fund will be able to “promptly” provide the BTC liquidity necessary to maintain a stable UST price:

- when the stablecoin price drops below $1, LFGputs accumulated assets into a BTC/UST pool, which trading platforms can access at a slight discount. For example, provide 1 UST in exchange for $0.98 in BTC;

- when the situation stabilizes, outside traders can purchase UST with BTC.

The model of the reserve pool. Data: Agora.

This creates a floor for the price of UST, provided by arbitrageurs and Bitcoin.

However, it is clear that the current volume of the fund is unlikely to provide serious support to UST in the face of strong market fluctuations.

“Can $2 billion in reserves really protect a $17 billion stablecoin from collapsing? No, of course not,” Hartmann stressed.

Researcher Ryan Clements is convinced that theAlgorithmic stablecoins must be driven by continued demand for ecosystem products. The efficiency of the arbitration mechanism depends on the latter.

Parity with the dollar could be broken if peg traders lose confidence in the system. This is fraught with the risk of a "death spiral".

Clements also doubts whether UST can be considered a decentralized asset.

“The fact that Terraform Labs needsa centralized structure (LFG) to inject capital, buy reserve assets and constantly take action to strengthen the Terra ecosystem (and create more and more use cases for UST) casts doubt on the decentralized nature of Terra,” Clements noted.

Messari analyst Dustin Tiander, on the contrary, believes that UST remains decentralized despite the above processes.

“BTC is actually taken into account only afterimplementation of the offer from Jump Crypto. And when this happens, bitcoin is involved in a decentralized protocol, and not in a centralized organization, ”he emphasized.

findings

The success of Terra has inspired various projects tocreation of similar stablecoins and reserve crypto funds. However, potential problems with Anchor, including lowering the rate of return and capital outflows, could lead to serious consequences for the ecosystem, the DeFi segment, and the entire crypto economy.

The largest Terra platform and UST stablecoinneed changes in tokenomics that are focused on the long term. Otherwise, growing imbalances may lead to an outflow of capital to other projects, coins and ecosystems.

This will most likely shake the UST rate and lead to a “death spiral”, as it will deprive arbitrageurs of the motivation to maintain the parity of the coin with the US dollar.