…with which the Bitcoin market correlates. In this post we look at the dynamics of bearish markets in general terms.trends in traditional markets, with a focus on the US stock market.

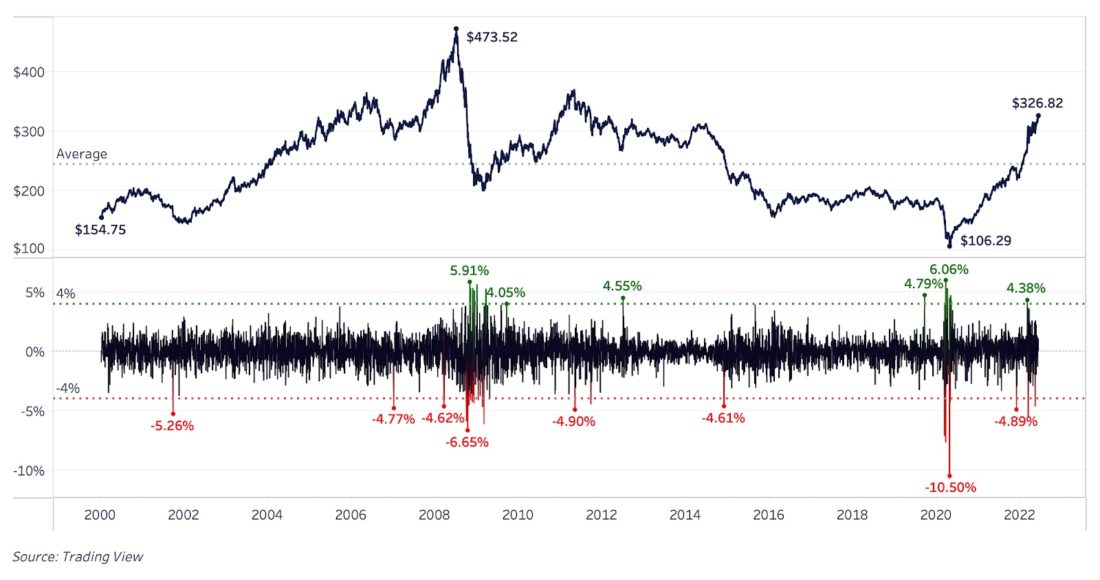

At the time of writing, the S&P500 index has risen by8% off the lows, still trading 14% below the all-time high. While nothing is certain, our base case scenario is that the stock market undergoes a rebound/rally as part of a bearish trend. Below, the trajectory of the current drawdown from the all-time high is superimposed on the trajectories of major bearish trends of the past: the 2008 recession and the dot-com bubble of the 2000s.

The purpose is not to scare you, but toto provide some context and insight as to the likely magnitude and duration of market declines. Bearing in mind the historical data and given the current conditions, the Fed said that through monetary policy it is trying to put pressure on welfare in order to suppress consumer price inflation. Based on this, it is likely that the worst for the stock market is yet to come.

In particular, it must be understood that, historically,In the bear markets, there were many local price rallies that convinced many that the worst was over, only to turn around and continue to decline.

Below are charts of S&P500 bear markets during the dot-com bust and the global financial crisis (links open interactive versions).

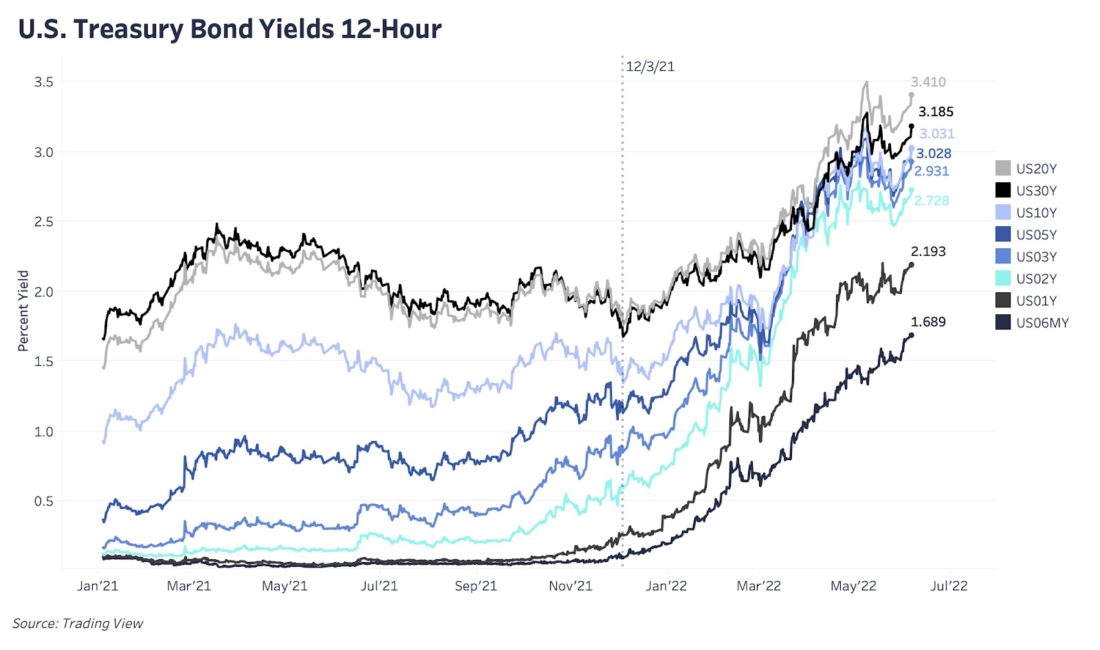

Treasury still under pressure

Despite the recent rally in equities, the bond market has largely returned to sell-off mode, with treasury yields continuing to rise across the duration curve amid inflationary pressures.

This is a strong signal that investorsbelieve that inflation at this stage is still higher than expected, causing bonds to fall. At the time of writing, 10-year Treasuries are trading at a yield of 3.03%, just below the 2022 high of 3.20%.

As returns continue to rise (whichmeans that bonds continue to sell off) in an inflationary environment, markets will have to continue to adjust to conditions of a significantly higher discount rate and cost of capital.

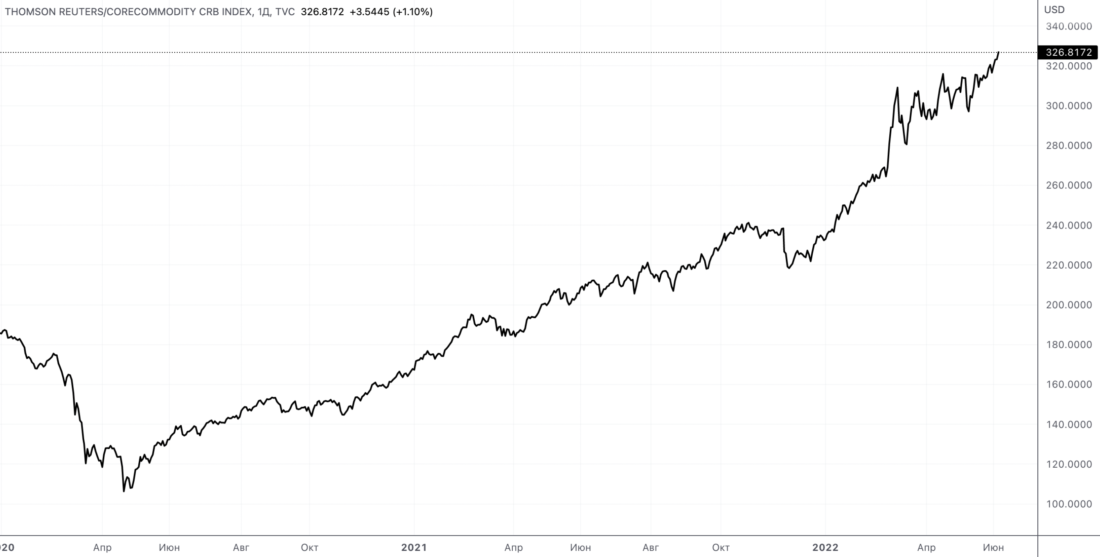

Many signs point to a further pullback“liquidity surge” as oil continues to rise to new highs and the broader basket of commodities continues its epic rise as well. This rise in energy prices has a major impact on consumer spending as well as corporate profits, leading us to believe that the next round of decline in equity markets will be driven by lower corporate earnings and higher credit risk due to monetary tightening.

Although bitcoin is still dependent on the dynamics andforces of its own market (as highlighted in the latest edition of the Deep Dive), Bitcoin’s strong correlation with the US stock market is likely to continue for the foreseeable future as all global assets are subject to ebb and flow in global liquidity.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.