If your glass is half full, then market drawdowns are not necessarily bad. Beware of euphoria.

I'm not going to "sell you the apocalypse".Without a doubt, the macroeconomic situation is still very difficult.Because of this, it may seem that I have been broadcasting all gloom and gloom here for the past year.But I'm certainly not trying to make you depressed, panicked, or desperate about what might beto happen or not to happen in the near future.

I only offer a fair, from my point of view, assessment of the current situation and I hope that this will help someone manage their risks more adequately.

However, if you are tired of the negativity, you can always go the other way and look at the drawdown as an opportunity.

Bitcoin fell by 70%, Ethereum by 68%, Amazon by 45%, Meta* by 75%, the stock market as a whole by 20%. And looking at such graphs, it’s no wonder to be sad, in general.

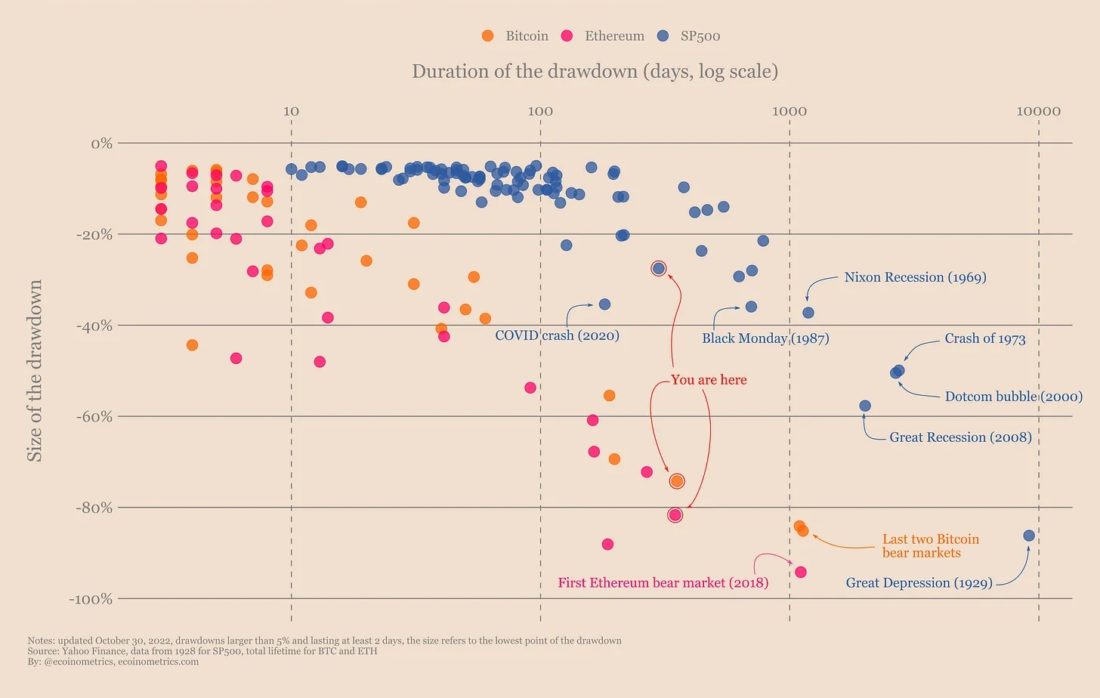

Comparison of the size and duration of drawdowns: BTC, ETH, and S&P500.The current drawdown of the S&P 500 lasts for 298 days, and its depth isBitcoin's current drawdown has been going on for 353 days, with a depth of -74.3%Ethereum's current drawdown has been going on for 347 days, with a depth of -81.7% ofall-time high.

But in the longer term, if you view assets as long-term investments, you can look at the current situation in a different way by simply flipping the numbers.

One way to think about it systematicallyis that with a long investment horizon, you are likely to expect at least the asset you are betting on to recover from the current drawdown in the future.

So the standard way to evaluatethe opportunity offered by this correction is to imagine the potential profit that you will make if you buy today and sell when you exit the drawdown.

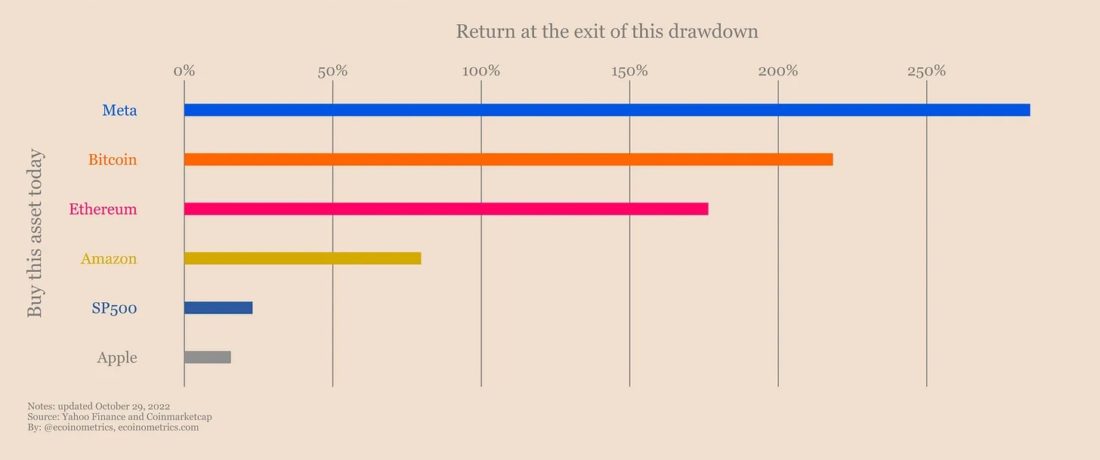

For example, bitcoin is now down 70% from its peakprices. This means that if you buy today, when it recovers to the previous all-time high, your investment will be up 232%. From this point of view, it doesn't look so bad anymore, does it?

And this, of course, does not mean the needsell as soon as BTC hits its previous high. But at least that's how much you expect to earn by betting when everyone else is selling (if you're sure about the asset, of course).

Another example is Meta.Facebook has made a big bet that the company's future lies in creating its own version of the metaverse. The market did not like this turn, and now Meta shares have already fallen by 75%. But if you think that Zuckerberg has a chance of success in this case, then if the stock price recovers to its previous high, your profit will be 290% of today's price.

I'm not saying that you definitely need to do this, and personally I'm not very attracted to the enterprise version of the metaverse, but that doesn't mean that Meta isn't an asymmetric bet.

And Bitcoin and Meta are not the only options. Take a look at this chart which shows the range of opportunity this drawdown offers so far.

Drawdowns are opportunities. If you buy these assets now, what will be your profit in recovering them from the current drawdown?

I mean, if you look a little further,rather than looking forward to the next few months or maybe years, then you should think about the fact that opening a market position during a correction simply increases your profit.

Take a look at Amazon.Unless you think that the exponential trend has run its course completely, there is every chance that it will recover from the drawdown and hit its all-time high, and then another and another.

And in fact, now is a good time to pay attention to what I've often heard about this "over and over again."Can we say that the deeper the correction, the stronger the subsequent bull market?

If this were the case, this information could be used to make some guesses about target levels for the next bullish trend.

Let's try to look at this relationship.

First, some methodology.A drawdown is simply a period of correction between two consecutive all-time highs. In practice, this means that there are many relatively small drawdowns in the overall bull market. What will the big picture look like if we try to ignore these small drawdowns? This leaves us with quite a few data points to work with.

But from them we can calculate the ratio betweenthe depth of the major drawdown (from the all-time high to the market bottom) and the size of the subsequent bull market (from the low of the drawdown to the peak of the next uptrend).

And here's what we get...

The ratio of drawdown to subsequent growth. Is there a relationship between the depth of the drawdown and the size of the subsequent bull market?

That's right, we didn't find anything.This is not to say that the deeper the drawdown, the stronger the subsequent bull market. And if you're wondering, the converse is also not true. That is, that the stronger the bull market, the deeper the drawdown that follows it, cannot be said either. There is simply no connection between the two.

And to be honest, this is what happens most often in my work: I hear things like "And they say that...", but when we look at the real data, we find that in fact the statement is based on nothing or the data is completely contradictoryexpectations of the majority.

So, in summary, if you're investing for the long term, then obviously you're assuming that we haven't gone through some last bull market yet.

This means that the current bearish trend is nothing more than a market positioning opportunity for the next 5-10 years.

The positive approach is to look at current prices in the context of how much profit buying now can generate in the long run.

For bitcoin:

- buying now will bring 230% profit when exiting the drawdown;

- a purchase of $15 thousand will bring 362%;

- a $10k purchase will return 588%.

Similarly for ETH:

- buying now will bring 200% profit when exiting the drawdown;

- buying at $1000 will bring 387%;

- buying at $500 will bring 880%.

And the overall growth potential, of course, is much higher than these values.

So I will reiterate three strategic tips that I think should be followed in this bear market:

- Make sure your position is sufficientsecurity and will not be liquidated in the event of a collapse. That happens. Needless to say, if the position is liquidated, the upside potential for it will be zero.

- At the correction stage, wait for either «fullcollapse», or the first improvements at the macroeconomic level, before opening new positions. It is at these moments that the risk/return ratio will be best.

- When choosing positions, give preference to asymmetric rates. Life is too short to trade it for a bunch of small victories.

* Recognized as an extremist organization in Russia.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>