The cryptocurrency market, unlike traditional stock markets, never stops working. What is he doingalmost impossible to keep track of allfluctuations in 24/7 format. This results in risks that are difficult to hedge even with the strictest trading discipline. This is where trading bots come into play.

What are cryptocurrency trading bots?

A bot is an automated program that performs repetitive tasks on the Internet more efficiently than a human.

A trading bot is a program used toautomatic algorithmic trading. The bot connects to the crypto exchange via the API and allows you to place trades on your behalf as quickly as possible. The reaction speed of the algorithm is incomparable with manual input.

How do crypto bots work?

Crypto bots can keep a close eye on price fluctuations, trading both highs and lows, and profit based on set parameters.

When setting up the bot, you can choose a trading strategy from the already presented popular models, or customize its operation on your own, based on your experience.

Different types of markets, tokens and situationsimply that each case requires its own strategy. Determining an appropriate model requires research, and certainly common sense. This means that the process of trading using bots is not fully automated and requires the participation of the user.

In general, trading bots work in four stages: data analysis > signal generation > risk distribution > execution.

Data analysis

Data is everything, and their analysis is crucialimportant for the success of any cryptobot. Machine learning software identifies, collects and analyzes an incomparably greater amount of information than any financial analyst.

Signal generation

After processing the data, the bot does the job of a trader, making predictions and identifying opportunities based on market data and technical analysis indicators.

Risk distribution

The bot distributes the risk according to a certain set of parameters set by the trader in advance. Including how much money will be used for trading.

Execution

Execution is the stage where cryptocurrencies are bought and sold based on generated signals. The bot generates buy or sell orders and sends this information to the exchange via the API.

Pros of Using Crypto Trading Bots

Cons of Using Crypto Trading Bots

Are trading bots profitable?

Using automated trading strategies,the financial industry, primarily Wall Street, has been making record profits for decades. In fact, today the entire financial world is controlled by algorithms. So the question is not whether the algorithms work, but how well they work.

Technically, bots are not exactly suitable for beginners,since their effectiveness is largely based on the experience of the trader. But if you think you are ready to test trading with a crypto bot, there are several platforms that use, say, less aggressive strategies, which in a sense minimize the risks.

The main risk when using a trading bot isit is the probability that the platform can be compromised and the code transmitted over the API is intercepted, since there is no absolutely impenetrable code. Therefore, when deciding to use a crypto bot to manage your money, you must understand that you trust them to a third party. Albeit with reservations.

The main advice when choosing a bot is to carefullyexplore all its features, find out what other traders have to say about a particular product. There are many Ponzi schemes on the market, masquerading as trading bots, while working solely on the influx of new referrals, going for the “super-profits” of cryptocurrency.

Paid trading bots

Clients of most exchanges can usepaid trading bots. For example, if you are a client of the Phemex, Bybit or Binance exchange, you can connect trading bots such as NapBots or Goose-AX.

NapBots is a platform designed forusers with different trading experience. Trading strategies in NapBots are updated, on average, every three months. The platform currently provides access to 20 algorithmic trading strategies. Access only for registered users of exchanges.

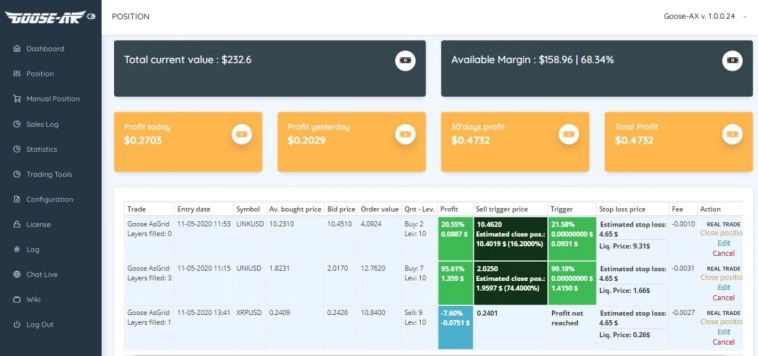

Goose-AX is a fully automated solutionfor trading altcoins on a crypto exchange. The Goose-X control panel allows you to monitor and manage all current positions. Any transaction can be configured individually:

Platforms such as TokenBot or 3Commas are also popular

TokenBot - automated copy tradinga platform for communities that publish signals on networks such as Discord, Telegram and Slack. By connecting to one of the trading communities, the user is given the opportunity to receive real-time trading signals to his exchange account via the API, controlling the efficiency of trading. The bot currently has over 2,000 active daily users worldwide, with peak trading volumes of up to $250 million per day.

3Commas - Russian multiplayera platform that similarly allows you to automate trading using bots, copy the actions of successful traders and track the most profitable portfolios. It has been operating since 2017, legally registered in St. Petersburg. The platform interacts with 23 exchanges and is considered one of the leading ones on the market.

Of course, there are many other worthyautomated trading offers. In addition, now many exchanges are integrating copy trading, which is quite natural. In a world dominated by automation, it is important to have a reliable tool for efficient trading. At the same time, you should not trust algorithms 100% - automate your trading intelligently.

More latest news, as well as bonuses and contests in Telegram

Friday Invitation – Invite your friends, win up to $4,500 USDT! Invite your friends to join Phemex and earn for every successful registration!