Article Reading Time:

2 minutes.

Solend, a cryptocurrency lending platform on the Solana blockchain, is seeking to avoid a liquidity crisis amid the collapse in SOL prices and huge margin calls on whale accounts.

Turmoil in the cryptocurrency sectorlending continues as the general decline in the market, the search for sources of financing to maintain liquidity, the remortgaging of assets, and the high share of margin requirements from investors lead projects to the brink of closure.

Fearing the risk of lack of liquidity and collapseSOL, Solend submitted proposal SLND3 to a vote of project participants, which aims to introduce a per-account borrowing limit of $50 million and reduce the maximum number of liquidations.

Any debt over this limit will havethe right to liquidation, regardless of the value of the collateral. It is also proposed to temporarily reduce the maximum liquidation close ratio from 20% to 1%, which would limit the amount that can be liquidated in a single transaction and also reduce the SOL liquidation penalty from 5% to 2%.

In addition, Solend has sought the assistance of market makers to help provide better liquidity on the network and reduce pressure on the DEX market to a manageable level.

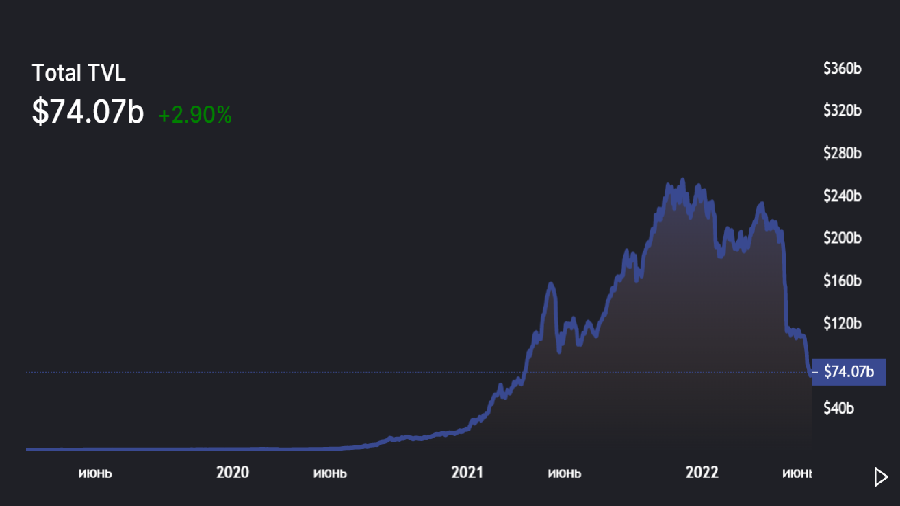

Note that from April to June the volumeblocked funds in DeFi protocols decreased by 3 times - from $229 billion to $74 billion. This suggests that business rescue methods undertaken by cryptocurrency lending platforms cause more concern among investors than hope.

The Solend community had mixed reactions tothese proposals, considering that they are ineffective. Thus, some participants believe that the platform’s limit restrictions can easily be circumvented by creating additional accounts. Additionally, Solend's reference to negative impacts from whale margin calls does not hold up to constructive criticism.

“If large loans representsystemic risk, they should be overcollateralized. This is cryptocurrency, not Tesla. Most of us are not whales, and if the platform cannot function without a single whale, then it is still garbage,” says comments on the project’s website.

Recently it became known that cryptocurrency broker Voyager Digital Voyager turned to Alameda Research for a loan of $500 million to cope with market turmoil.