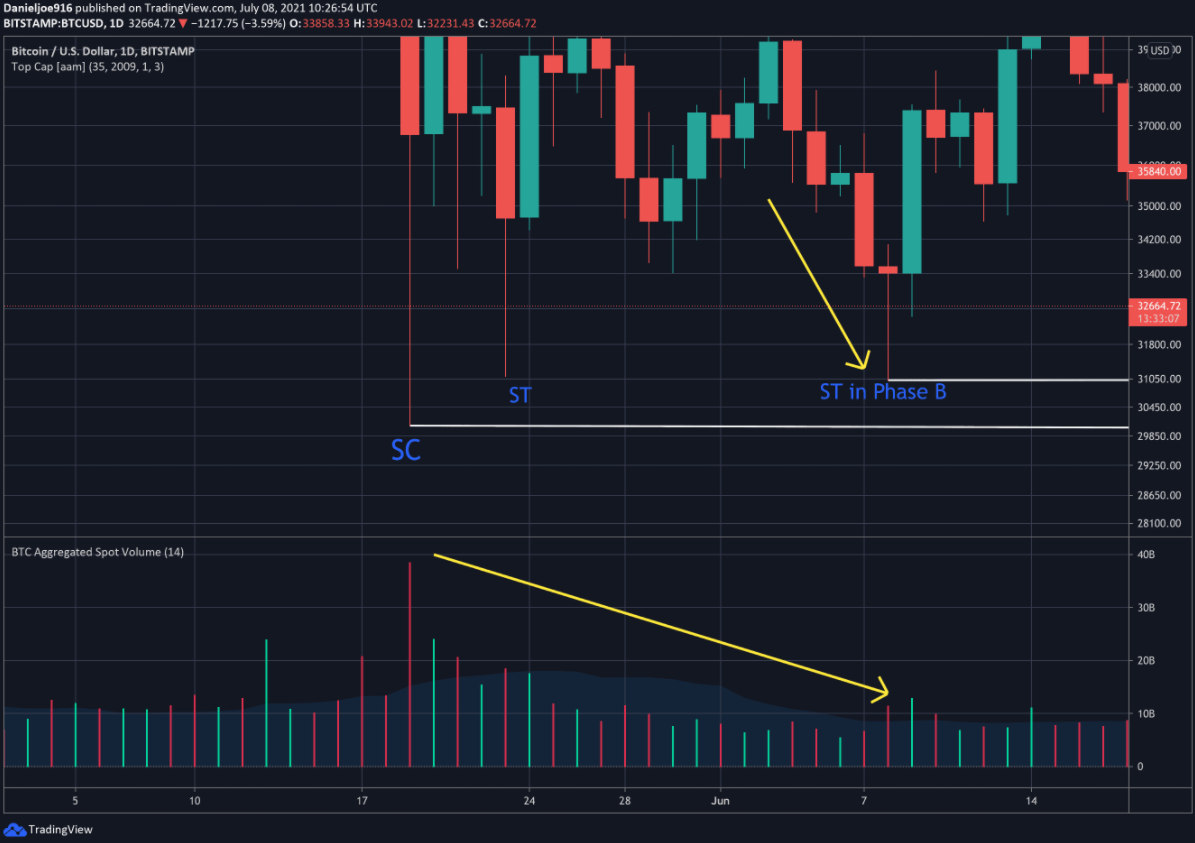

- Bitcoin is forming a Wyckoff accumulation - this is a bullish signal.

- At the moment, 3 phases have already been formedWyckoff accumulation of 5.

- If the figure is confirmed, Bitcoin will begin a new phase of growth.

Recently, Wyckoff Accumulation has been frequently discussed on the network - it is a scheme of accumulation created by Richard Wyckoff that leads to a breakout in the price of an asset after its completion.

Bitcoin has been forming a pattern very similar to the Wyckoff accumulation over the past few weeks, so users are beginning to speculate that the cryptocurrency will soon rise.

We decided to talk about this technical analysis figure and suggest what awaits Bitcoin next.

What is Wyckoff Accumulation?

Wyckoff Accumulation is a price range inwithin which the asset moves without a pronounced trend, but with periodic updates of lows. It is believed that within this range, big capital is trying to "shake out" weak hands by updating local minimums.

The fact is that many adherents of the classicaltechnical analysts set their stop losses just beyond the local minimum. And a stop loss for a buyer is the sale of an asset. Accordingly, a major player lowers the price beyond the local minimum, triggering stop losses, and buys out the entire supply. Thus, he takes a long position at attractive prices.

After the end of consolidation, large capital understands that there are no more offers on the market and lets the price go up.

Accumulation of Wyckoff consists of several stages:

The first phase is the culmination of sales

Wyckoff accumulation begins after a sharpa fall in the price of an asset, in our case Bitcoin. BTC reached its all-time high of around $65,000 in mid-April before starting to fall. On May 19, there was a climax of sales when BTC reached $30,000. Then there were massive liquidations of long positions that were opened with high leverage.

After a sharp fall, the price bounces up.

The next stage of the first phase is level testing. In this case, the price falls again to around $30,000, but with much lower volumes. This indicates depletion of supply in the market.

The second phase is one more level testing

As part of the second phase of Wyckoff accumulation, Bitcoin is trading in the established price range, while the bears are again attempting to push the price down.

Third phase - manipulation

As part of the third phase, major players are included.They are deliberately selling Bitcoin at an accelerated pace in order to sharply reduce the value and force small capital to sell their coins in a panic at low prices. As a rule, quotes in this case fall below the local minimum in order to trigger stop losses. At this moment, large capital begins to buy out the entire supply.

During the third phase, the price does not fall as much as during the panic sales, however, the volumes grow significantly.

After this, the price begins to rise.

Fourth and fifth phase

The next phases of Wyckoff accumulation have yet to be reached in the bitcoin market.

Further, the trading volume should decrease, and the price should rise above $ 40,000.

Then there will be a small pullback, which will form the last support level. And after that the price will begin to rise further.

What could go wrong?

Technical analysis does not give one hundred percent guarantees.that the setup will be worked out. The worst thing at the moment is the price consolidating below $32,700. In this case, the likelihood of a further fall will increase.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)