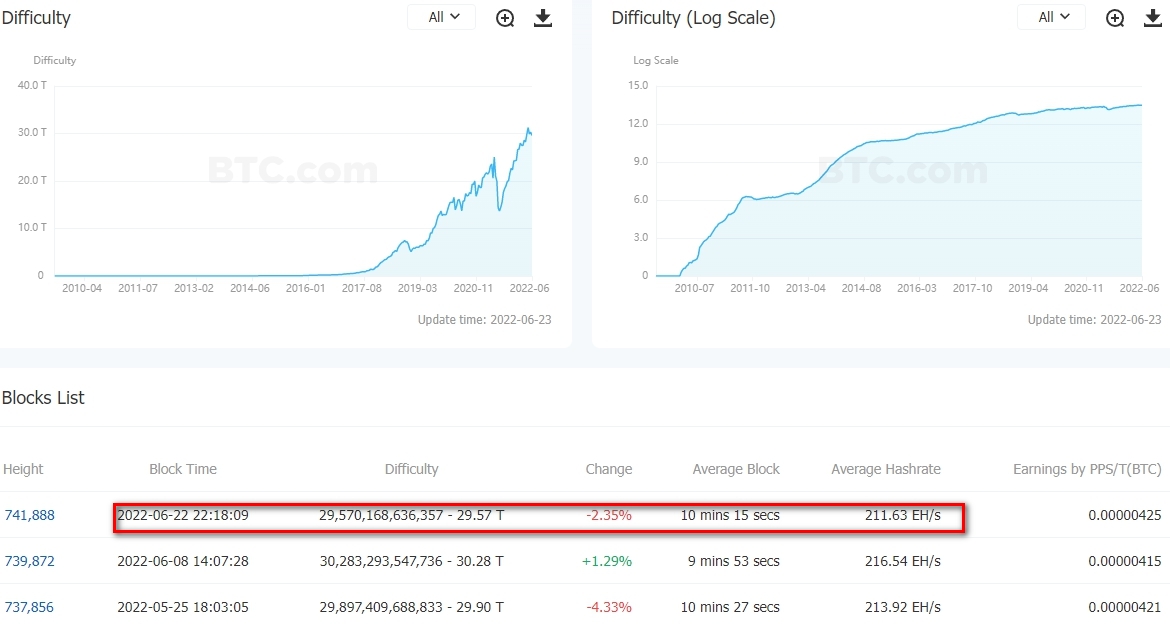

As a result of another recalculation, the mining difficulty of the first cryptocurrency fell by 2.35% to 29.57 tons.The indicator fell to the level that preceded the May collapse of the market.

Data: BTC.com.

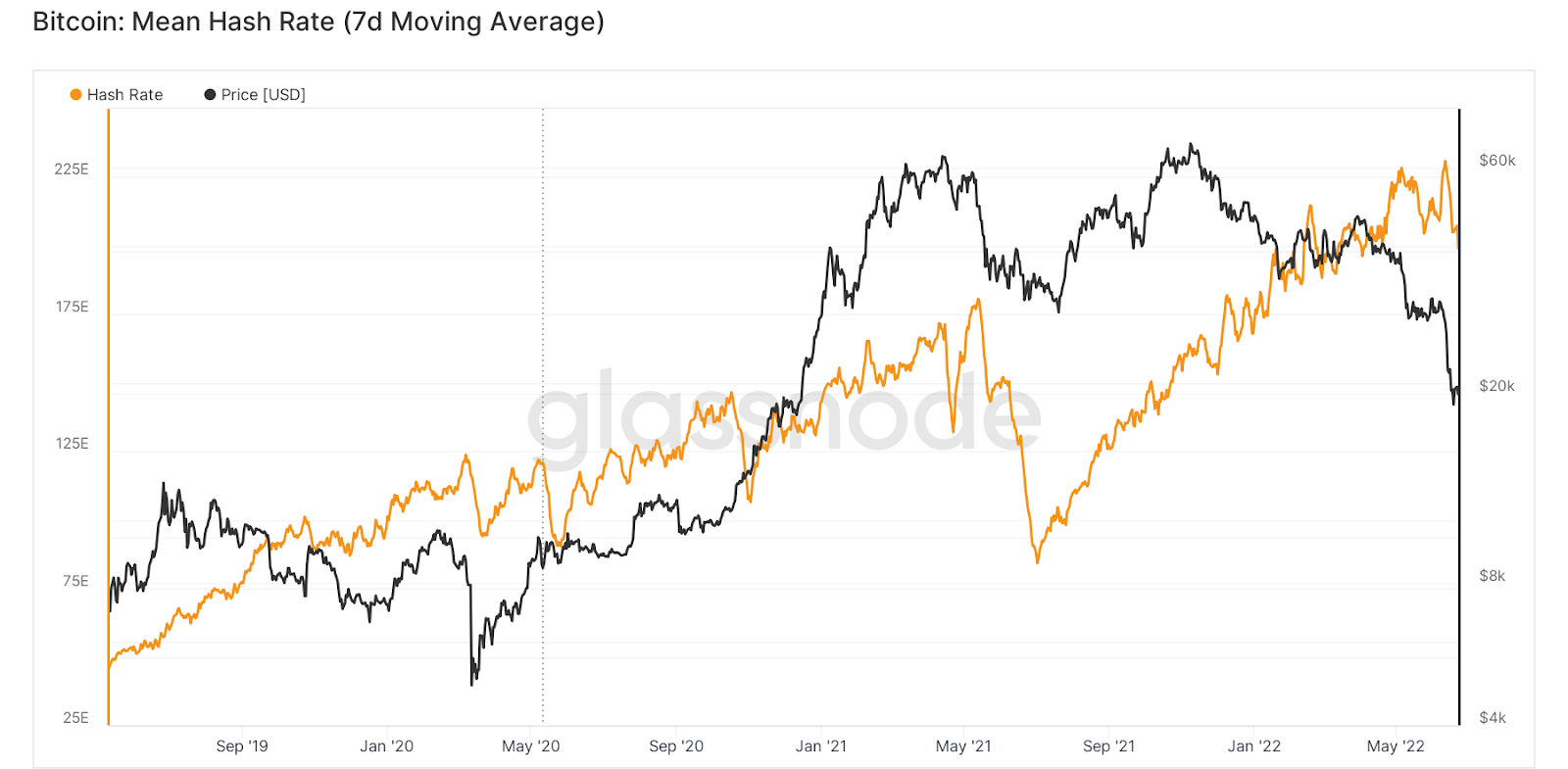

Average hashrate over a two-week period fromthe last change of the indicator was 211.6 EH/s. On June 11, the network computing power (smoothed by the 7-day moving average) peaked at 231 EH/s.

Data: Glassnode.

As of June 22, the hashrate has dropped below 200 EH/s.

Analysts at Arcane Research noted that withAt the current price of bitcoin, the cash flow of miners has decreased by 80% from the peak in November 2021. The latest generation ASIC miner Antminer S19 brings in about $13,000 per BTC mined (at an electricity cost of $40 per MWh). The outdated Antminer S9 is already operating at a loss.

According to Arcane Research experts, in May, public mining companies sold all bitcoins mined in a month for the first time. Typically, the share of sold coins ranged from 25% to 40%.

Against this background, the Canadian firm Bitfarms saidabout abandoning the strategy of accumulating the mined cryptocurrency. The company sold 3,000 BTC and did not rule out selling approximately 14 BTC mined daily.

Marathon Digital Holdings, on the contrary, confirmed its commitment to the policy of storing generated bitcoins.

Recall that the fall in the price of the first cryptocurrency below $20,000 in June led to the capitulation of miners and long-term investors, according to Glassnode analysts.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.