When it comes to accepting Bitcoin, there are two almost non-negotiable rules. Everyone always thinks they're late, andalways believe that you had to buy more bitcoins in the past. Any rule has exceptions, but Bitcoin has a surprising effect on the human psyche.

</p>It turns out 21 million is a frighteningly small number, and itin fact, the smaller the more people realize that Bitcoin’s fixed offer is reliably guaranteed and that money networks converge on a single means. The demand for Bitcoin is due to the reliability of its monetary properties and the convergent nature of money, but an increase in demand for hyperbolizes the rarity of its fixed supply. As a result, Bitcoin is increasingly valued as cash. Although this becomes apparent as you move along Bitcoin's rabbit hole, those on the periphery are often stunned by the number of cryptocurrencies. Of course, today Bitcoin is a “leader”, but there are thousands of cryptocurrencies; How to know that Bitcoin is not MySpace? How can you be sure that something new will not crowd him out?

The belief that Bitcoin will become dominantglobal currency, it may seem insane, if you evaluate this possibility from a downward, probabilistic point of view. Today, Bitcoin is one of thousands of competing digital currencies that at first glance seem identical. Its total purchasing power of $ 125 billion is a drop in the bucket compared to a global financial system supporting $ 250 trillion of debt. The purchasing power of gold alone is $ 8 trillion (64 times more than Bitcoin). What is the likelihood that the 11-year-old internet sensation, which has risen from the ashes of the financial crisis of 2008, will turn from empty space into the prevailing global currency?

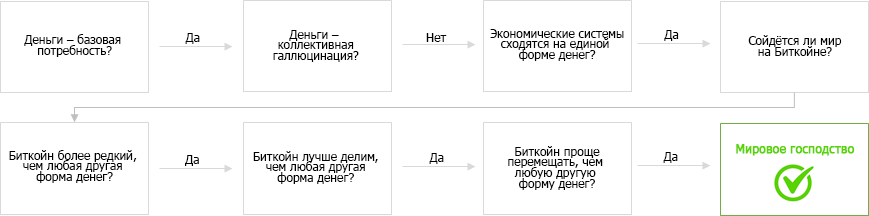

Such a thought sounds funny, or at leastthe probability seems too small to deserve attention. But if you move from bottom to top and build an opinion around a number of fundamental principles, the noise of thousands of cryptocurrencies fades into the background. Just a few fundamental principles together create simplicity and clarity around what seemed too complicated to be understood. If it were necessary to estimate a thousand probabilities in order to come to the right decision, this would be impractical or impossible. But if you can filter out 999 probabilities based on one or more of the initial principles, then the search for a clear answer becomes more practical.

This is the noise screening roadmap andfocusing on what really matters. You can come to different conclusions on any of these issues, but you need to consider them to try to understand why Bitcoin consistently outperforms all other currencies and whether it will do it further. Money is a basic need, but not a collective hallucination or a common belief system. People accept Bitcoin because it has unique properties that make it the best form of money compared to all other currencies. Since money is a solution to an intersubjective problem, monetary systems tend to converge on a single medium. Or rather, economic systems naturally arise from a single means due to the function of money. The properties inherent in Bitcoin encourage the market to converge on it as an instrument of communication and measurement of value, because it represents a stepwise improvement in comparison with all other cash. If you agree that money is a necessity and that money systems naturally converge on a single tool, then the question is whether Bitcoin is optimized in order to perform the monetary function better than all competitors.

Money is a must

illustrations: BitNews

Civilization, as we know it, did not existwould be without money. Without money, there would be no planes, cars, iPhones, and the ability to satisfy the most basic needs would be very limited. Without the function of money, millions of people could not live peacefully in one city or one state. Money is an economic product, thanks to which there is food on the shelves of stores, and gasoline at the gas stations, houses are provided with electricity, clean water is available in sufficient quantities, etc. It is money that allows the world to develop, and without the function of money there wouldn’t be all that that most takes for granted. This is a highly underrated and poorly understood function, because usually they don’t think about it. In the developed world, reliable money is taken for granted. The same applies to basic needs, met through the coordinating function of money.

: Unsplash

Take, for example, a local supermarket andpresented in it a wide selection of products. The number of people without whose participation and without whose skills all this would have been impossible is amazing. From managing the store itself to packing goods, technology suppliers, logistics and transport networks, payment systems and individual products. Next, also think about the unique work put into each product on the shelf. A supermarket is only a place of ultimate satisfaction of needs; Each product has its own supply chain. And this is just one of the modern wonders. An equally sophisticated contribution is required for the operation of modern telecommunication and electric networks, a water supply system or a waste recycling system. Each network and its participants rely on others. Food producers rely on energy and telecommunications services, logistics, clean water, etc., and vice versa. Almost all networks are interconnected, and all this is possible thanks to the coordinating function of money. Everyone is able to share their skills based on personal interests and preferences, receive money in exchange for the value provided today, and use it to acquire value that will be created by others in the future.

And all this does not happen by chance. Some not too impartial thinkers suggest that either money is a collective hallucination, or the government gives them value. In reality, money is a tool invented by man to satisfy a very specific market need - to facilitate trade. Money contributes to this activity by acting as a mediator in a number of current and future exchanges. Without any conscious control or management, market participants value various products and converge on an instrument whose properties are best suited to exchange today's value for the future. While individual consumer preferences vary from person to person and are constantly changing, the need for exchange is almost universal, and the function of money is unequivocal and unchanging. Money is allowed for each individual to convert the value produced today into future consumption. The value that someone assigns to home, car, food, recreation, etc., changes over time and varies from person to person. But the need to consume and communicate their preferences does not change and is common to all individuals on an intersubjective basis.

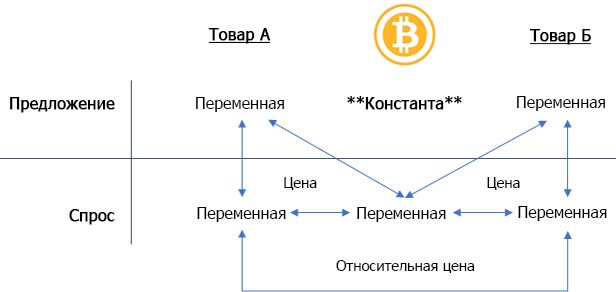

Money exists to communicate preferences and ultimately value. But since any value is subjective(and not inherent in the beginning), money forms the basis for expressing value,or rather, relative value. Money represents a collective recognition that everyone benefits from having a common language for communicating personal preferences. Money combines and measures the preferences of all participants in the economy at any given time, and communicating value is impossible, or at least extremely inefficient, without a constant that everyone agrees with. Imagine money as a constant against which all other goods are valued. If it did not exist, everyone would almost be at an impasse and could not agree on the value of something. Comparing with a single constant, it is easier to determine the relative value of two goods. There are billions of goods and services produced by billions of people who have their own unique preferences. When everyone converges on a single form of money, uniting and communicating all preferences, as a result, a price system arises. By measuring and expressing the value of all goods with a common means (money), it becomes possible to understand how much one product (or resource) is relative to any other.

Without a common currency, there would be no concept of price. And without the concept of price, economic calculations are impossible. Economic calculations allow individuals to take independent actions, relying on the information provided by the price system and to best meet their needs, understanding the needs of others. In fact, it is the pricing system that allows the formation of supply and demand structures, so it is necessary because it provides the communication of information, without which it would be impossible to satisfy basic needs. Imagine that nothing you consume has a clear price. How will you know what you need to produce in order to receive your preferred products? And then admit that your own idea of the value you produce, as well as the very existence of goods and services produced by others, would not have been possible without one or another expression of price. We have to repeat ourselves, but money is a commodity that allows the fundamental structures of the economy to form through a pricing system. Although often called the root of all ills, money is perhaps the greatest random human invention that could not be consciously created.

“I deliberately used the word “miracle” toto save the reader from the complacency with which we often take the operation of the price mechanism for granted. I am convinced that if it were the result of human design, and if the men who are moved by changes in prices understood that the significance of their decisions went far beyond their immediate goals, then this mechanism would be extolled as one of the greatest triumphs of the human mind. The problem is that, firstly, this is not a product of human intent, and secondly, people guided by this mechanism usually do not know why they act this way and not otherwise. But for those who cry about "conscious management" - and who cannot believe that something that evolved without design (and even without our understanding) should solve problems that we should not be able to solve consciously - should remember this: the task is precisely is how to take our use of resources beyond the control of any one mind and therefore how to get rid of the need for conscious control and provide incentives that will encourage individuals to take desired actions without anyone telling them what to do ", - F. A. Hayek "The use of knowledge in society"

Economic systems converge on a single cash

: Unsplash

Silicon Valley Thinking Encouragesmany believe that in the future there may be hundreds, or even thousands, of currencies. All calculations will be performed by machines! Artificial intelligence and quantum computers will take care of everything. The intellectually "safe" view is that 95% of cryptocurrencies will probably fail, but there are some "interesting" projects out there."It is impossible to know which one will be successful." “As with venture capital investments, the majority will fail, but the winner will hit the big jackpot.”At least that's what most people thinkSilicon Valley because it resonates with the historical experience of investing in companies. In reality, this is a superficial view, divorced from the fundamental principles. Moreover, here the familiar formula is applied to a completely different kind of problem.

While it may seem logical to think about Bitcoin in relation to the repeating history of tech startups, no comparison is possible.Bitcoin is money, not a company.It is illogical to assume that competition betweentwo (or several) funds will resemble a competition between two companies. Companies compete in the race to accumulate capital and need money to coordinate economic activity. Where do they get the money? Using money to coordinate the production of goods and services and selling products to make more money (profit). Essentially, companies compete for the same pool of money in order to accumulate capital. Money is the instrument on which everything rests. Without money, it would simply be impossible to coordinate the various skills required in today's complex supply chains for most goods and services. This would also not be possible unless a large group of people accepted the same form of money.

“Having a single means of exchange allowsthe size of the economy matches the number of people willing to use this medium of exchange. The larger the size of the economy, the greater the opportunity to benefit from exchange and specialization, and, most importantly, the larger and more sophisticated the production structure can become." - Seyfedin Ammous "A Brief History of Money"

In production supply chains, moneyperform a function different from other goods and services. It's all about the difference between satisfying preferences (production of goods and services) and coordinating preferences (money). Satisfying preferences depends on their coordination, and coordination depends on the pricing system, which is possible only as a result of mass convergence on a single monetary means. Without a price system, there would be no division of labor, at least on the scale necessary for the functioning of complex supply chains. This is the root principle that most overlooks when talking about a world of multiple currencies. Any pricing system is based on a single currency. The concept of price would not exist if a critical mass of individuals producing various goods and services did not communicate the value of these goods and services by a common means. To enjoy the benefits of money and prices, you must first come to a single remedy. Consequently, it may be more accurate to say that economic systems do not converge on a single monetary means, but arise on its basis. Individuals come to a single monetary means, as a result of which an economic system arises.

While the value of all other goods and services is in consumption, the value of money is in exchange. An exchange occurs when someone decides to convert the value(subjective assessment of time, labor and physical capital)into a monetary commodity. Everyone has their own unique consumer preferences, but money performs a single function for all market participants: it connects the present with the future.(whether in a day, week, year or more). With any exchange of real value passessome time until the future exchange. At the time of the exchange, everyone must decide which monetary product will better fulfill the function of preserving the future value created in the present. A or B? Although you can hold a lot of currencies, one will perform this function more efficiently. One currency will maintain purchasing power better than others. All this is intuitively understood and made decisions based on a comparison of the properties of each tool. In determining which monetary commodity to use, the preferences of each individual are influenced by the preferences of others, but each independently assesses the comparative advantages of different monetary goods. The market converges on a single medium, because everyone is trying to solve the same problem of future exchange, depending on the preferences of others.

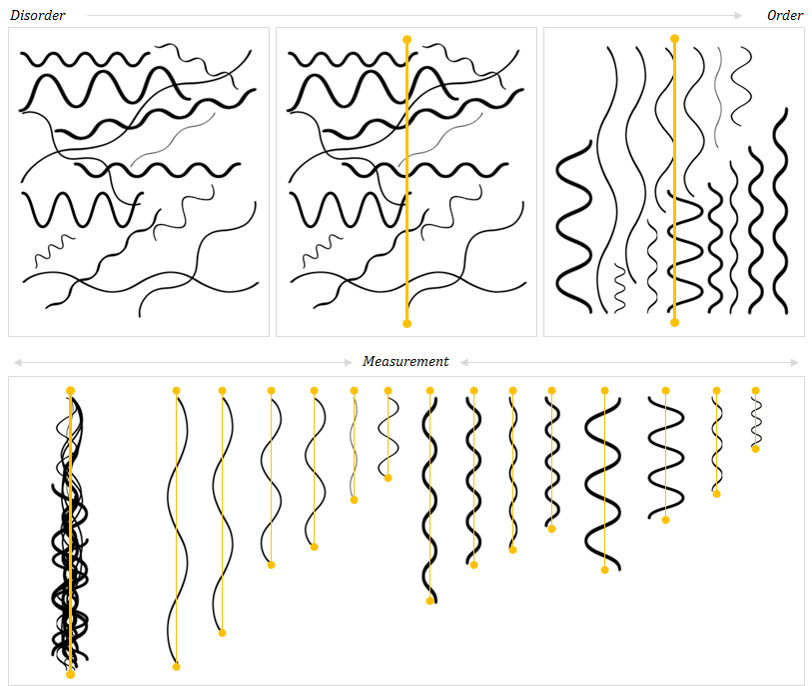

The ultimate goal is to reach consensus so that everyonecould communicate and exchange with as wide and relevant a range of trading partners as possible. This is an objective collective assessment of tangible goods based on intersubjective needs. The whole point is to find one product that everyone agrees on:1) relatively constant; 2) we measure; and 3) functional in exchange. The presence of a constant creates order where itit wasn’t before, but this constant should also be functional as a measuring tool and a medium of exchange. The combination of these characteristics, often described as combining the properties of rarity, durability, interchangeability, divisibility and portability, is a unique feature of money. Very few goods possess all these properties, and each product is unique and has features that make it better or worse to perform certain functions in the economy. A is always different from B, and the combination of properties that bring the money product closer to the ideal is so rare that the difference should never be neglected.

: Medium

In a practical sense, everyone agrees on a singlea monetary product through which value is expressed, because it is in their best personal and collective interests. The challenge is to communicate value to other market participants. Without consensus, the whole process would be counterproductive. But convergence and consensus are possible due to the properties of the money product. The imaginary world of thousands of currencies does not take these fundamental principles into account. In order to receive the desired information, a critical mass of people must converge on a common medium. And the cost of a common tool only grows when more and more people converge on it as a tool to facilitate exchange. The fundamental reason is that when more people converge on a single tool, this tool accumulates more information and becomes more useful.

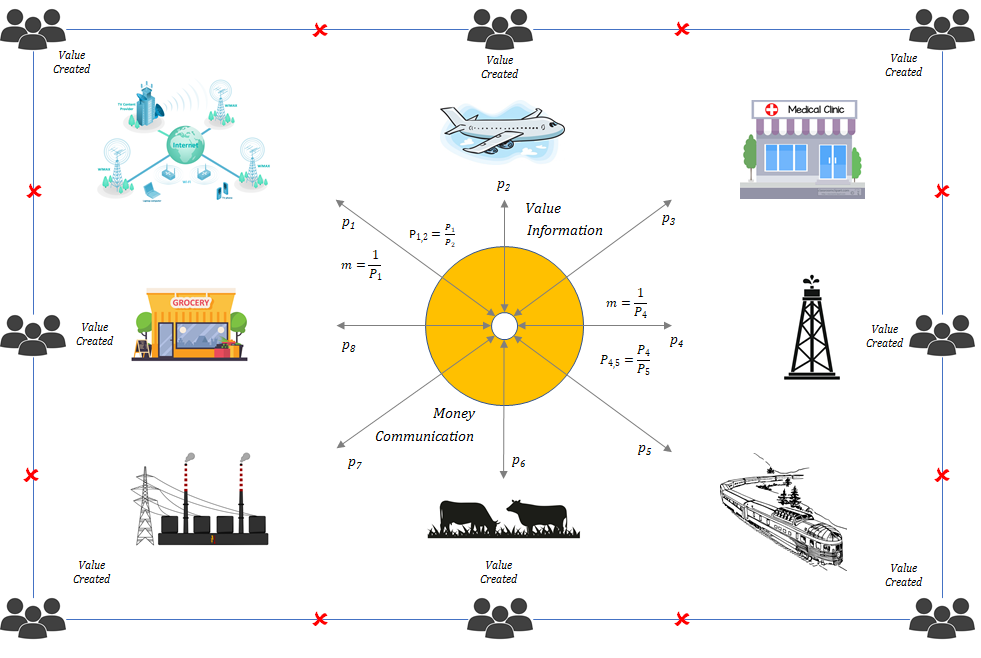

Imagine each person aspotential trading partner. When people accept a common medium as a standard of value, all existing network members receive new trading partners, as do those who join the network. There is mutual benefit, and the range of choice is expanding. In addition, when the network expands, more goods are valued in a common medium of exchange. There are more prices and, as a result, more relative prices. More information is combined in a common medium that all network participants (and the network as a whole) can then rely on to better coordinate resources and respond to changing preferences. The constant becomes more valuable and reliable, giving more information about more products produced by a large number of people. The more variable information is communicated through it, the more constant the constant becomes.

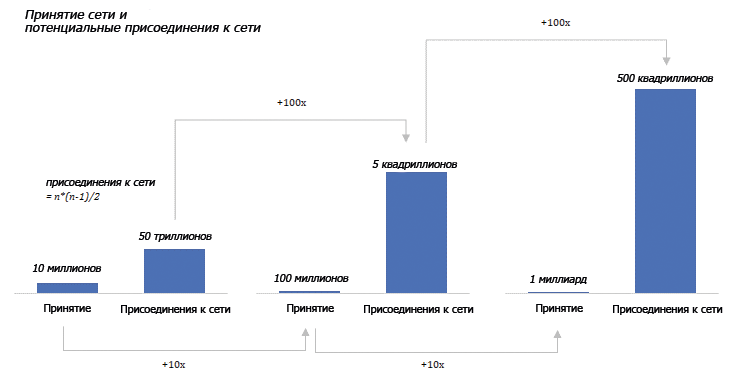

When the adoption of the money network increases byone order (10 times), the possible number of network connections increases by two orders of magnitude (100 times). This not only helps demonstrate the mutual benefits of adoption, but also highlights the consequences of converting value to a smaller money network. A network whose dimensions are 10 times smaller has only 1% of potential connections. Not all networks have equal distribution, but a large money network means a more reliable constant that reports information - a higher density, more relevant information and, ultimately, a wider choice. The size of the monetary network and its expected growth are critical components of the intersubjective A / B test, when each one determines which means to use. Although the number of people with whom each individual can maintain social connections is inherently limited, this restriction does not apply to money networks. Money allows people to break free of Dunbar number limits. The money network allows millions (or even hundreds of millions) of people who do not know each other to contribute value at the end points of the network, and relatively few direct connections are required.

Money networks eventually accumulatethe value of all other networks because their network effect would not exist without the money network. Complex networks cannot be formed without a common currency coordinating the economic inputs needed to give rise to positive price feedbacks. A common currency is the foundation of any monetary network, allowing the formation of other value networks. It provides a common language for communicating value, which ultimately leads to trade and specialization and organically creates the ability to expand the use of resources beyond "conscious control."(using Hayek's expression). When considering the social network effect,logistics, telecommunications, energy networks, etc., add them up and get the value of the money network. A monetary network not only provides the foundation upon which all other value networks are built, but its currency provides access to all derivative networks. The common currency is engine and fuel.

Yes, dollar, euro, yen, pound, franc, yuan, ruble,lyre, peso, etc. today coexist, but this is not a natural consequence of an open global economy. All fiat currencies that exist today have emerged as a partial analogue of gold, on which the world previously converged as the monetary standard. None of them would have existed without government intervention, and likewise, no fiat currency would have arisen without the previous existence (and limitations) of gold as cash. Both the proponents of modern monetary theory and the proponents of gold will never admit this, but the catastrophe that all fiat systems represent is nothing but a manifestation of the insolvency of gold as a cash. The gold standard was formally abolished in 1971, and since then the existence of local fiat systems has only represented a temporary deviation from free-market monetary forces. Modern fiat systems still exist, because until recently there was no solution to the problem they create. Bitcoin is just such a solution, and since it appeared, people have converged on it as a new monetary standard. And this trend will continue as awareness naturally spreads.

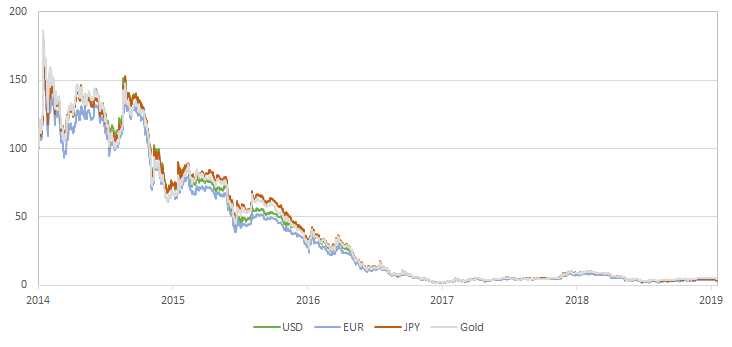

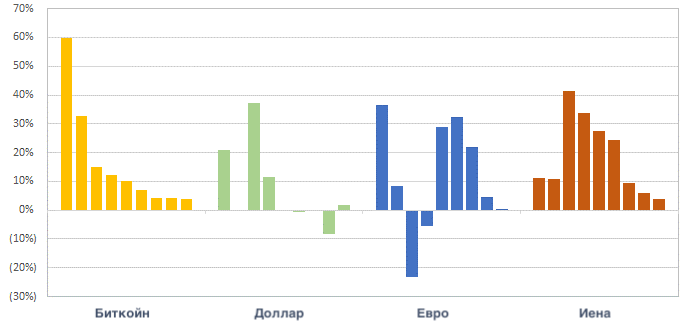

Indexation of the US dollar, euro, yen and gold against Bitcoin (2014 = reference 100, values <100 indicate depreciation). : Medium

All roads lead to Bitcoin.

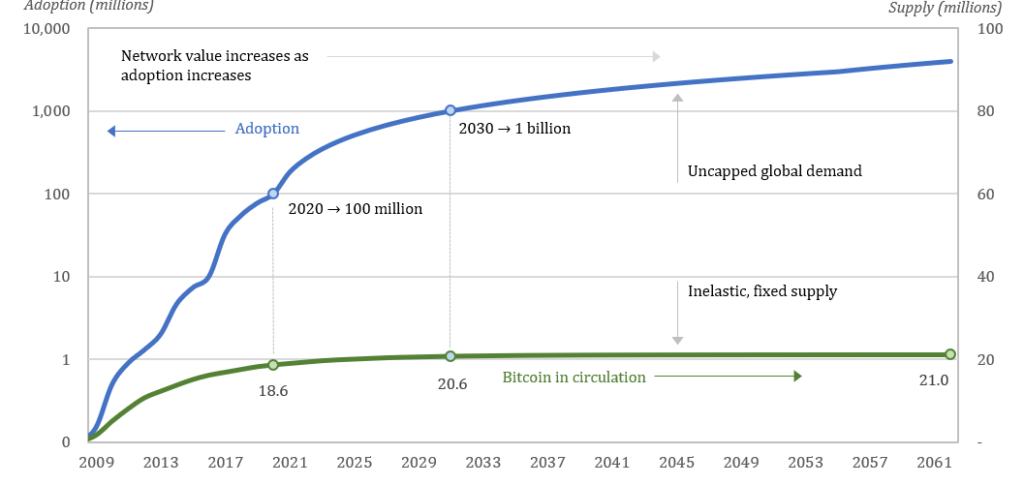

Greatest Constant - Ultimate Rarity

The market is gradually converging on Bitcoin, and itsvalue continues to grow because it represents a constant that is better than all other forms of money. Bitcoin has an optimal monetary policy, which is reliably ensured on a decentralized basis. Only 21 million bitcoins will exist, and the element of trust is completely excluded from the equation. Bitcoin's fixed offering is guaranteed by a decentralized network consensus mechanism. Nobody trusts anyone, and everyone independently monitors compliance with the rules. Thanks to these two features, Bitcoin is becoming the rarest form of money that has ever existed. Ultimate rarity is a property that no form of money has previously reached, and this rarity drives demand for bitcoin. However, rarity has two sides. Fixed supply is perhaps the main component, but demand is also a critical and often underestimated aspect of rarity. It is demand that makes a rare product useful as a constant in exchange. Bitcoin is becoming increasingly rare due to rising demand with a completely inelastic supply. The rarity of its fixed supply creates demand, but then the growth of demand creates even greater rarity. And so in a circle. If there were 21 million bitcoins and only one person valued them, then bitcoin would be neither rare nor useful. But if 100 million people value Bitcoin, then 21 million bitcoins are starting to become rare. And if the network grows to a billion users, then 21 million will be extremely rare and bitcoin will be more useful as a constant.

Bitcoin supply and demand ratio

: Medium

Average Bitcoin Savings Per User

: Medium

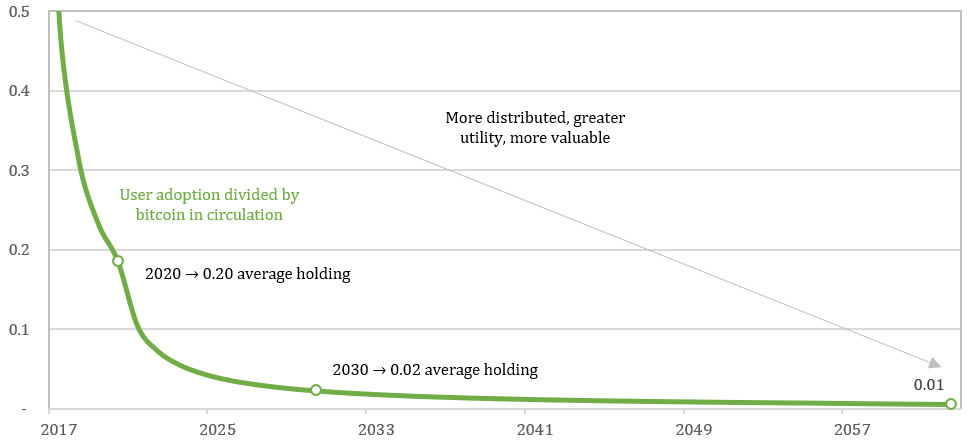

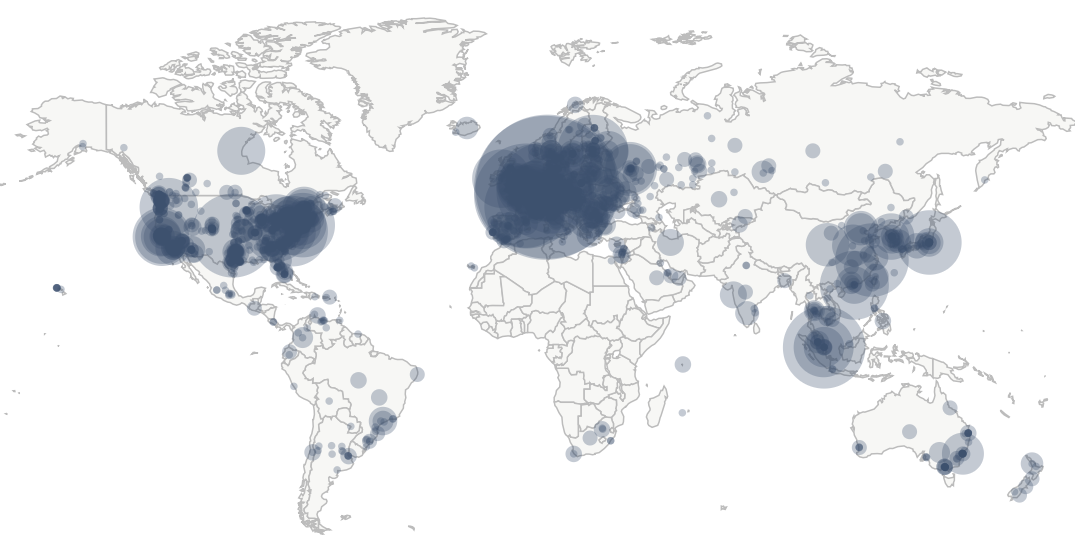

With a fixed supply, demand growthnaturally leads to the fact that bitcoin is becoming more distributed. A non-growing supply is divided into ever smaller shares, which are owned by more and more people. When Bitcoin appreciates more and more people, the network becomes not only more useful, but also more secure. It becomes more useful because more people communicate in the same language of value with the help of a more reliable constant. And the more people participate in the network consensus mechanism, the more resistant to distortion and, therefore, the more secure the whole system becomes. I must admit that nothing in the blockchain guarantees a fixed offer, and the Bitcoin offer schedule is reliable not because the software dictates this. The 21 million supply is reliable only because the network is managed on a decentralized basis and with an increasing number of participants. 21 million becomes the more reliably fixed the number, the more people participate in consensus, and, ultimately, the constant becomes more reliable when everyone controls an ever smaller share of the network. With increased adoption, safety and utility are simultaneously improving. If we consider the distribution and relative density of adoption of bitcoin in the world, then Bitcoin becomes the more solid the constant, the greater its spread and the more markets it covers.

Map of Bitcoin nodes (nodes) distributed around the world. : Bitnodes.io

As more and more people join the network,The supply of 21 million is becoming more and more reliable, and for those who have adopted Bitcoin, the ultimate rarity becomes what sets it apart from other forms of money - both older currencies and competing cryptocurrencies. All other currencies are either centralized over time(dollar, euro, yen, gold, etc.)or were originally too centralized(all other cryptocurrencies)to compete reliably with a fixedwith an offer of 21 million. Centralization inevitably creates the need to rely on trust, and trust exposes the supply of any currency to risk, which, in turn, harms demand and affects the usefulness of the currency in exchange. While all other currencies rely on trust, the constant that bitcoin represents does not require trust. The 21 million offer is reliable only because bitcoin is decentralized, and over time, bitcoin becomes more and more decentralized. Other forms of money can, at best, compare with bitcoin, but in practice this is not possible because everyone converges on a single medium, and bitcoin is superior to all other currencies. All other currencies ultimately compete with an ideal constant, unchanging and not relying on trust.

Schedule of changes in the supply of currencies from 2011 to 2019: Medium

All forms of money compete with each other forevery exchange. If the main (or only) usefulness of an asset is an exchange for other goods and services, and if it does not constitute a right to a stream of income from a productive asset (as in the case of stocks and bonds), then it claims to serve as money. As a result, any such asset directly competes with Bitcoin for the same application, and no other currency will provide a more reliable constant, because Bitcoin already exists and is finite. Since everyone converges on a single tool, the rarity of Bitcoin will constantly increase both on the supply side and on the demand side, while for all other currencies the opposite force will act due to the reflex nature of monetary competition. The distinction between two monetary goods is never secondary and is not the result of individual decisions on the use of a particular exchange. Money is an intersubjective task where a choice is made in favor of one money and a rejection of another, as a result of which one network increases the cost (and utility) directly at the expense of others. When Bitcoin becomes a rarer and more reliable constant, other currencies become less rare and less constant. Money competition is a zero-sum game, and relative rarity, a dynamic function of supply and demand, creates a fundamental difference between two money resources, which over time only grows and becomes more obvious.

But remember that rarity for the sake of rarity is notis the goal of money. Money, which is the best constant, most effectively promotes the exchange. The monetary commodity with the greatest relative rarity best of all preserves the value between the current and future exchange. The relative price and relative value of all other goods - this is the information that is actually expected from the coordinating function of money, and in any exchange everyone is motivated to preserve the current value for the future. Bitcoin’s ultimate rarity provides the best guarantee that the value exchanged in the present will be saved for the future, and when more and more people are convinced that bitcoin is a monetary commodity with the greatest relative rarity, the result will be price stability (see “Suddenly: Bitcoin is not so and volatile ”).

The Greatest Measuring Tool - Divisibility

While rarity is the cornerstone, not everythingrare goods are functional as money. To be a functional instrument for communicating value, a monetary commodity must be relatively constant, easily measurable, and practical in exchange. A ruler may be an effective measuring tool, but rulers are not rare and difficult to divide into larger or smaller units to facilitate sharing. In exchange, a commodity that is rare and easily measurable allows all other commodities to be measured. The ability to easily divide and move a currency unit gives it practical utility in exchange. Bitcoin combines finite scarcity with the ability to divide each unit down to eight decimal places(0.00000001, or 1/100,000,000 Bitcoin)and send any amount, large or small.Scarcity itself is not necessarily valuable in the context of money, and neither is divisibility. Their combination is valuable, especially when each unit is interchangeable with any other and its parts are indistinguishable from each other. Together, these qualities allow Bitcoin to not only be an ideal constant, but also an effective measure of value that facilitates exchange.

In the code, each Bitcoin is actually represented as 100,000,000 tiny units called satoshis.That is, 1 Bitcoin = 100,000,000 Satoshi.Basically, anything can be exchanged for bitcoins.price. Bitcoin, like any money, is designed for one purpose - storing value between a number of exchanges. Get Bitcoins for the value produced today and spend in the future in exchange for the value produced by others. It will perform this function regardless of the amount. The practical consequence of divisibility is that Bitcoin can measure any value, which means it can be used anywhere. People produce different amounts of value, and divisibility allows everyone to use Bitcoin as a savings mechanism, whether to store the equivalent of $50 or $50,000. For a monetary commodity to be an effective communication tool, it must be able to measure the full range of value produced by people, and Bitcoin does this flawless. The ability to divide Bitcoin and transfer any amount makes it available to all people and all goods produced, no matter what value is assigned to them.

In a monetary competition A/B test, if A > B,any amount of A will function as money better than any amount of B. Over time, the purchasing power of A relative to B will increase, whether it's the equivalent of $50 or $50,000. Don't be fooled by the list of cryptocurrencies on Coinbase that seem to be the "best deal" ” because they are “cheap” while Bitcoin looks “expensive”. Always remember that Bitcoin can be divided into smaller or larger units to store less or more value. One Bitcoin is an inherently arbitrary unit, just like a unit of any currency. The market tests whether A functions better as money than B. This is an intersubjective decision, and while the market communicates which network it believes performs the money function more efficiently through price and value, network value is an output, not an input data. Input data is each individual’s assessment of the properties of one monetary good in comparison with others. If Bitcoin is an A in your valuation, then it cannot be “too expensive.” Bitcoin may be over- or under-valued at any given moment, but everyone who accepts Bitcoin increases the value of the network(remember the discussion of trading partners and network connections). And the ability to easily divide into very smallunits allows an almost unlimited number of people to convert and communicate value through the network. If A is better than B, and if A can support unlimited adoption, then sooner or later the need for network B will disappear.

As everyone independently conducts suchA / B test, more and more people are taking Bitcoin and it is divided into smaller and smaller units (on average). This is the result of increased demand combined with fixed supply, and as a result of this process, the cost of the network is growing. The Bitcoin network is becoming more valuable as more people value it. In fact, when 0.1 bitcoin = $ 1000, it is more valuable than when 1.0 bitcoin = $ 1000, despite the equal value in dollars. The more valuable Bitcoin as a whole becomes, the more exchange (and, as a result, commerce) is possible, but the cost is actually the result of the fact that more and more people decide to accept Bitcoin as a medium of exchange. Each person owns less and less nominal amount of currency, but the purchasing power of each corresponding unit grows with time. With each exchange, each individual transfers to the network its value directly from a competing monetary network. Through this process, a new price is determined corresponding to the value created and the information coming from a more diverse set of trading partners.

Although prices are not yet quoted in bitcoins today,every time someone converts value to bitcoin, a pricing system is formed. Even if the dollar is the intermediary, the value produced somewhere in the world for a particular individual is expressed in bitcoin. When more and more people prefer to do this, the cost (on average) is converted to an ever smaller share of bitcoin. The consequence is that an increasingly smaller face value of Bitcoin can be used by an increasing number of people to convey the same value, and when more and more people are evaluating in Bitcoin, its ability to measure relative value only increases. Since bitcoin can measure any value and can be accepted by an unlimited number of people, in the long run it virtually eliminates the need for any other network to transfer value, because the form of money with the least volatility ultimately provides better information. Ultimate rarity combined with divisibility creates a very powerful medium of exchange. Bitcoin, due to its absolute rarity, has the lowest possible rate of change and can be divided up to a very small value, which allows it to measure value much more accurately than any other currency.

The Greatest Exchange Tool - Portability

One of the types of ancient money - huge roundedstones that cannot be moved. Such a payment system (rather, an exchange system) was completely built on information about ownership and belief in such information.

Given this basis, the decisive argumentit becomes a fact that Bitcoin can be irreversibly sent over a communication channel without the need for a third party. This is fundamentally different from digital payments in fiat systems that depend on trusted intermediaries. In total, bitcoin is a better constant than any other form of money, and it is well-divided (and measured) and can also be sent over the Internet. Try to find another product that would have the following properties: ultimate rarity (the greatest constant) + divisibility and interchangeability (measurability) + the ability to send via a communication channel (ease of movement). This is what all other monetary goods competing to become one money compete with. Almost the only way to truly appreciate the power of such rare dynamics is to experience it in person. Anyone can access the network without having to get permissions by running the Bitcoin node on their home computer. The ability to turn on a computer anywhere in the world and send of course a rare resource to anyone, without obtaining permissions and dependence on trusted third parties, significantly expands freedom of action. It is very difficult to fully understand how hundreds of millions of people can do this in unison without having to trust other network members.

Bitcoin is often described as digital gold, butthis is actually an incomplete picture. Bitcoin combines the benefits of physical gold and digital dollar without their limitations. Gold is rare, but it is difficult to divide and move, and the dollar is easy to move, but it is not rare. Bitcoin is of course rare and easy to share and move. In their current form, gold and all fiat money systems rely on trust, while bitcoin does not require trust. Bitcoin is optimized for their strengths and weaknesses, and that is why the market converges (and will continue to converge) on Bitcoin to fulfill the functions of money.

Bitcoin makes all other money obsolete

If a person comes to three main conclusions:1) money is a basic need; 2) money is not a collective hallucination; and 3) economic systems converge on a single means, – then he will more consciously look for the bestform of money. This is money that stores value for the future and allows you to convert your time and skills into a wider range of opportunities that previous generations would have had difficulty imagining. Ultimately, a secure form of money provides freedom:freedom to pursue personal interests (specialization) and convert the value you created into the value created by others (trade). Even those who don't ask themselves these questionsconsciously, will be naturally forced to respond to them with their actions. And they will come to the same answers as those who consciously ask these questions. Conscious and subconscious come to the same conclusion because the fundamental truths do not change, and the function of money is the same: to mediate a number of current and future exchanges and provide a basis for communicating subjective value to a wide group of individuals who want to benefit from trade and specialization.Money is a necessity.There are distinctive properties that make certain goods more or less functional in exchange, and exchange is, at its core, an intersubjective issue.

Bitcoin ownership becomes the cost of enteringwhat could become the largest and most diverse economy in history. Bitcoin is global and accessible without the need for permissions. As bitcoin becomes a common language of value for all participants, anyone who is part of the network can communicate and trade with other network participants. The more trading partners, the greater the cost each unit provides to those who hold the currency. Although trade may encounter legal obstacles, access to one common currency eliminates the main source of interference in the communication of value, and a fixed offer of bitcoin will allow its price mechanism to accumulate and communicate the most perfect information with less distortion compared to all other forms of money. And the more people choose to store value in Bitcoin, the more reliable is its fixed offer and the more reliable and relevant is its price mechanism. New participants in the money network both add and receive value as a result of acceptance, therefore it is never too late to join Bitcoin and Bitcoin will never be too expensive.

The difficulty of Bitcoin doesn't matter.Ultimately, Bitcoin becomes an A/B test of sorts. The need for money is real, and people agree on the form of money that best performs the function of exchange. No other currency in the world can become scarcer than Bitcoin, and scarcity will act like gravity to drive the acceptance and communication of value. Most billionaires today don't understand Bitcoin. Bitcoin is equally difficult for everyone. But even those who don't understand Bitcoin will come to rely on it. There are many fundamental questions. It is argued that Bitcoin is volatile, slow, doesn't scale well, has little use for payments, consumes a lot of energy, etc. Stability is an emergent property that follows adoption, and all other perceived limitations will be solved by the value that follows from finite scarcity combined with the ability to measure, divide and move value. This is the innovation of Bitcoin. Currency A has a fixed supply. Currency B – no. Currency A increases in value relative to currency B. Currency A increases purchasing power relative to goods and services, and currency B does the opposite. Which one will I prefer? A or B? Make the right choice because the opportunity cost is your time and cost. Everything else simply explains why people will increasingly choose A over B, but in practice it comes down to simple common sense and survival instinct. Bitcoin makes all other money obsolete because economic systems are converging on a single currency, and Bitcoin has the most reliable monetary properties.

“I don’t think we will have good money again,until we tear them out of the hands of governments. That is, we cannot force them to take them from the governments, but we can create something in some cunning district way that they cannot stop, ”- F. A. Hayek