The volume of bitcoins unavailable for trading has reached its highest level in three months. Bitcoin supporters or soso-called hodlers continue to hoard cryptocurrency despite its periodic rollbacks. Many analysts often pay attention to this trend.

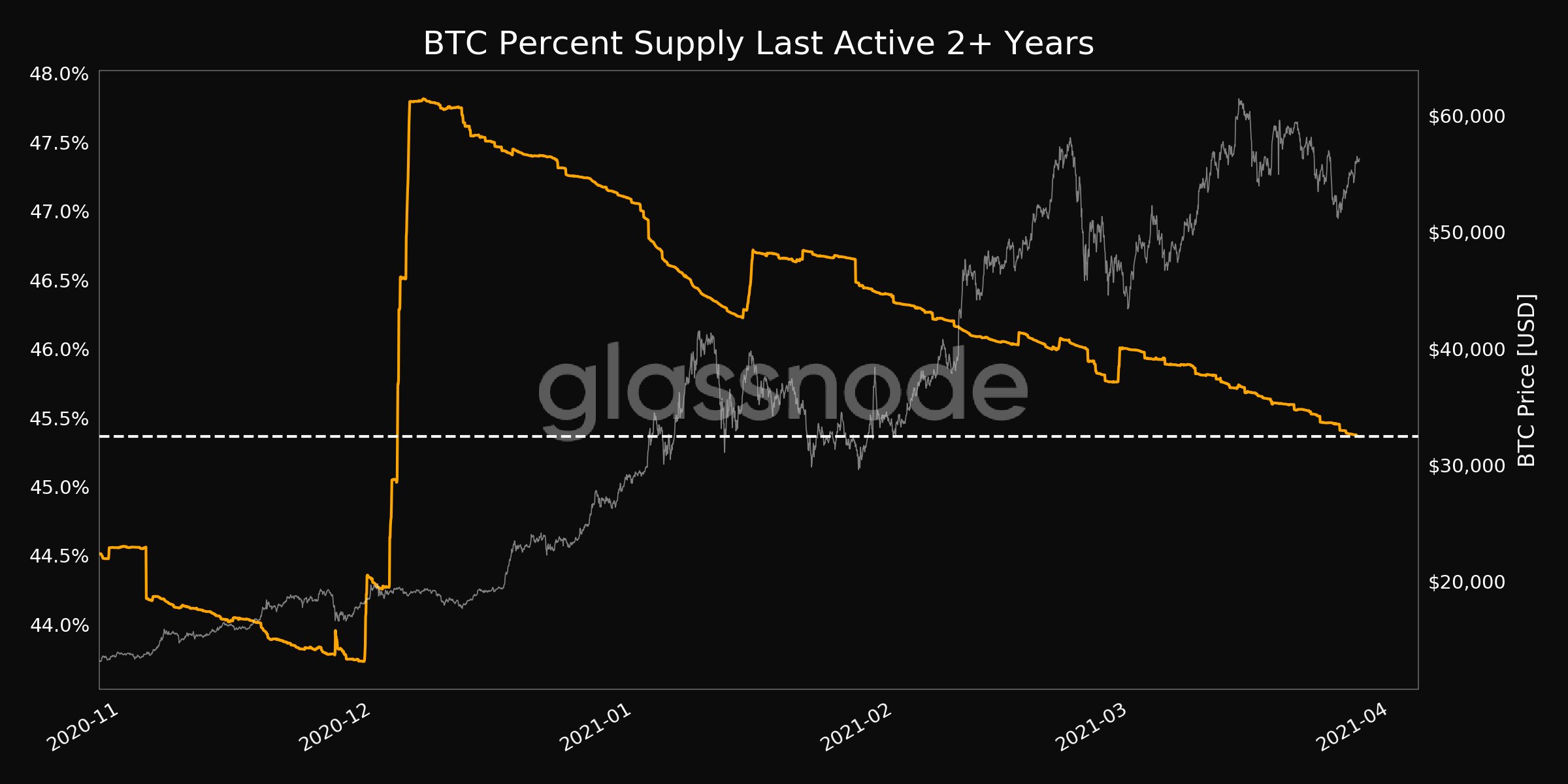

According to a research companyGlassnode, the volume of bitcoins that investors do not withdraw for purchase and sale on the market, peaked in the last three months. At the same time, the volume of bitcoins that have not moved from digital wallets for more than two years now accounts for 45.364% of the total supply of cryptocurrency # 1.

More than half of BTC is now stored in addressesaccumulating funds since January 2018. This suggests that those investors who bought bitcoins in 2018-2019 came to the conclusion that the exit of cryptocurrency # 1 beyond the $ 55,000 level indicates its ability to grow further.

Hodlers who bought at the turn of 2017-2018“woke up” at the end of last year. They dumped some of their reserves in December when Bitcoin broke back above $20,000, allowing them to recoup losses incurred during the bear market.

However, there was no massive sell-off, although the volatility under the influence of the Hodlers still exacerbated.

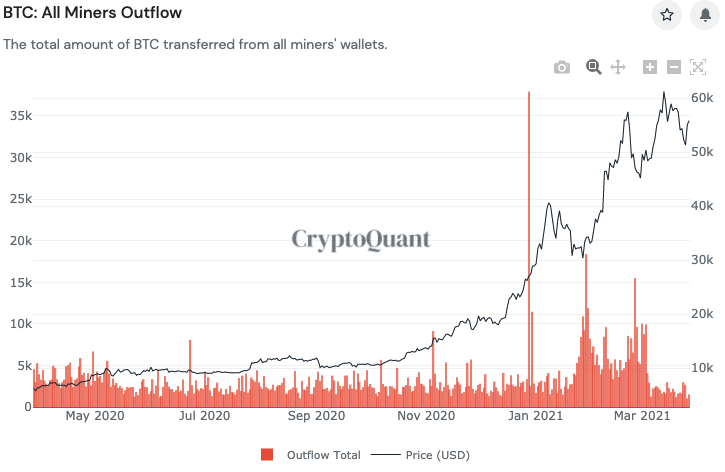

Miners in recent months have also reducedsales and moved on to accumulation. As noted by the CEO of CryptoQuant, Ki Yang Joo, mining pools have sent the lion's share of bitcoins to offline storage. Most likely, they are waiting for the next leap in cryptocurrency in order to maximize their profits.

The accumulative strategy of BTC holders has already yielded the first positive results. The pressure eased at the end of last week, allowing Bitcoin to hold above $ 50,000.

This mark has become a kind of local bottom for BTC, according to the Rekt Capital team. Having touched it, the coin should have bounced up, which then happened.

On Tuesday, March 30, the BTC rate rose to $ 57,700.Bitcoin capitalization stays above $ 1 trillion. Analysts such as Willie Wu believe that the value of all BTC is unlikely to fall below this level for a long time.

Bitcoin's return since the beginning of the year has been 78.3%.This is significantly more than the gain for the S&P 500 (+6.58%). Investments in the SPDR exchange-traded fund (the largest ETF in the world), focused on the price of gold and shares of gold mining companies, showed an average negative return of minus 9.3% since the beginning of the year.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)