On the Theoretical and Practical Aspects of Potential Fully Digital Banking Systems Based onBitcoin

"Beauty is in the attempt" - Dave Chappelle

Introduction

Year 2050.You have a safe at home where you keep partial bitcoin keys to your savings. There is also an intermediary who keeps the other part of the keys in a safe place. You no longer measure the value of a bitcoin in something else - on the contrary, you measure the value of everything else in bitcoins. Each year, the purchasing power of your bitcoins is slightly higher than the previous year, and you no longer call them bitcoins - you calculate them in satoshi and think in them. Sipping chai-lattes at your local coffee shop reminds you of the times when your Satoshi could buy twice as much each year as the year before, and now the pace of deflation has been slowing down for some time now. Thinking about the purchasing power of money reminds you to check your investment accounts, and you open your financial management app. Your investments are divided into three categories: low, medium and high risk. A low-risk account earns interest from providing liquidity to the Lightning Network in the form of money that you do not plan to use in the near future. A medium-risk account is Satoshi deposited with a financial intermediary that provides loans to entrepreneurs and pays you a share of the income. From your high-risk account, you invest in a variety of securities that you hope can generate returns that exceed your Bitcoin holdings. Everything looks good. When you leave the coffee shop, you receive notifications on your phone that you have just been charged 1 Satoshi for a latte.

Bitcoin has not yet reached maturity, but whenreach, what will it look like? Will users store themselves? Will Bitcoin banks exist, and if so, what will the credit system look like?

The word "credit" itself seems to be incredulous.History is replete with cases that have given people reason to be so distrustful.Banks and fractional reserve loans have been linked to one of the worst crises in history.However, financial intermediation is a necessary economic function that provides a link between depositors and borrowers, and creditIt is the nature of the creation of credit that ultimately determines theI believe that in the long run, the level and quality of Bitcoin's relationship with credit will bebe paramount to its ultimate success.

The purpose of this article is to isolate the theory behind existing credit systems and apply it to Bitcoin, following this structure:

- Discussion of the full reserve banking system: a general theory of the system.

- Discussion of the Free Banking System (withfractional reserve), in which there is no central bank, and private markets are free to issue credit money in accordance with market incentives.

- Comparison of the system of full reserve banking and free banking.

- Discussing the concept of the Lightning Network, its technologies and the potential for the emergence of full reserve banking systems and free banking systems based on it.

Full Banking Under the Bitcoin Standard

Once mature, Bitcoin will take over threetextbook functions of money: (1) store of value, (2) medium of exchange, and (3) unit of account. People will save and spend bitcoins. Someone who wants to start their own business will face a dilemma: save money until they have enough to start their own business, or take out a loan and start a business today. The success of an enterprise is largely determined by the time to market, so having capital when you need it can be critical. Some may get the capital they need from friends or family, but many will have to look for alternative sources, and not all will be wealthy enough to finance complex new ventures themselves. On the other hand, many savers will be interested in taking on the risk and investing their savings, desiring a higher rate of return, but lacking viable investment opportunities in the immediate environment. Remember that under the terms of this thought experiment, we have already reached the stage of hyperbitcoinization, and the increase in purchasing power from holding BTC by then will be lower than from investing in riskier ventures, since bitcoin has already consumed and saturated the money market. There will be financial intermediaries to fulfill the Bitcoin lending function, as credit risk assessment requires specialization. Not everyone will know how to issue loans and be willing to do it directly: doctors or lawyers (like many others) will prefer to delegate this responsibility to specialists.

For example, the user can put their moneyto the bank and receive interest on your deposit. The digital equivalent of such a deposit could potentially be the provision of Lightning Network (LN) liquidity, which I will talk about below. For secured loans, if the collateral is provided in the form of digital assets, this will most likely be implemented using an automated protocol. In many respects, financial intermediaries in the form of centralized non-digital companies will also be needed, as not all collateral will be digital, and such centralized intermediaries are needed to assess counterparty risk.

The bank (or financial intermediary) can then takethat money and lend it out to entrepreneurs trying to generate profits. In a full reserve system, banks will not be able to lend beyond what they have on deposit, and therefore will not create money by extending credit. Their investments collectively earn a rate of return, from which interest is paid to depositors, and the rest goes to the bank to cover operating costs and earn its market rate of return.

In addition, the fully reserve system requires that banks do not lend from the amount of demand deposits, using only term deposits.Demand deposits allow depositors to withdraw funds on demand, whereas term deposits effectively blockdepositor's funds in the bank for a certain period of time.Loans only for the amounts and with the same maturity that coincidewith the maturity of their term deposits, thenmaturity discrepanciesIf the banks will not be able to do so, there will be noIn order to issue loans from the amount of demand deposits, there is a possibility that if depositors demandreturn of funds on their deposits, banks will not be able to fulfill this requirement, since this money will beloaned.

There is disagreement over how full reserve banking should be defined.We don't have many examples of full reserve banking systems, but the idea is that the bank remains resistant to capital flight.There is a possibility of bank bankruptcy due to the issuance of low-quality loans, but not due to inconsistencies in repayment terms or "runs" of depositors.For the purposes of this discussion, we will define a fully reserve bank as one that does not generatediscrepancies between maturities, and therefore issues loans (assets) only from liabilities (deposits) with the appropriate maturity.

Under the bitcoin standard with full redundancybanks will act as credit intermediaries specializing in due diligence of credit risk, as well as other digital functions, which we will discuss below. Investment firms will also play a larger role as capital allocators for more complex credit and equity structures. Different types of lenders can use digital protocols and smart contracts to perform some of these functions.

Bitcoin Innovation Creates Incentive for Full Reserves

Credit is the oldest form of money.Deferred mutual altruism (the essence of credit) was used as a trust-based currency long before the advent of commodity money. Bitcoin is a synthetic commodity money with a precisely defined quantity and quality. What were the advantages of credit money over commodity money before Bitcoin, and what are they now that Bitcoin has made many of them obsolete?

Consider six general properties of money:

- scarcity– limited supply compared to other products;

- durability– can be reused without loss of functionality;

- acceptability– are accepted by others and widely used;

- portability– easy to move over long distances;

- divisibility– easily divided into smaller units;

- InterchangeabilityUnits of account are identical and equivalent to each other.

Paper (credit) moneywere superior to gold (commodity money) in terms of portability and divisibility. Nobody wanted to carry gold, so paying with paper receipts instead of gold increased portability and divisibility. In the era of digital money, this contrast is even more obvious. With Bitcoin and the Lightning Network, this cost of commodity money has been eliminated—a true innovation. There is no obvious reason to create bitcoin digital receipts for settlement (fully backed by bitcoin, as opposed to more complex financial instruments) in the presence of an advanced scaling mechanism such as the Lightning Network. People are more likely to want real bitcoins for their loans, rather than contractual derivatives (digital receipts).

This should be suggestive:if bitcoin has robbed credit money of this advantage, why else do we need such a system? Since Bitcoin innovatively eliminated many of the trade-offs between commodity and credit money, this makes a strong case that the Bitcoin standard reduces the need for credit money. It is likely that credit money and fractional reserve banking will become less relevant (more on that below).

Here it is appropriate to distinguish between credit andcredit money (i.e. fiduciary, non-guaranteed means of payment). In its broadest sense, the concept of credit covers any form of deferred payment. Within the framework of this article, I will talk about a loan in the formal sense of the word, when its provision is legally binding. This includes, in general, any form of lending in which one party makes a cash loan to the other party, who undertakes to repay the loan amount with interest specified in the contract. This definition of credit differs from fiduciary means of payment (i.e., credit money), where units of account are created that are not commodity money, but only a promise to pay commodity money on demand. In the latter case, the money itself is created on the basis of credit.

With a basic loan, its provision is notleads to an increase in the money supply, since it is simply a transfer of savings from one side to another - no new money is created. With fiduciary settlements, the money supply increases because it does not require the savings of the other party to expand it. A full reserve system, as defined above, will not increase the money supply by issuing credit; it simply redistributes capital. Fractional backing would increase the money supply by issuing new money backed by the promise to provide commodity money at some point in the future.

Free banking under the bitcoin standard

In 2010, Hal Finney wrote on bitcointalk.org:

“There is actually a very good reason forthe existence of banks backed by bitcoin and issuing their own digital currency to be exchanged for bitcoin. By itself, Bitcoin cannot scale to such an extent that every financial transaction in the world is broadcast to all nodes of the network and recorded on its main blockchain. Some secondary level of payment systems is needed, easier and more efficient. Likewise, the time it takes to finalize bitcoin transactions will be impractical for medium to large value purchases.

Bitcoin-collateralized banks will solve theseProblems. They can work as banks did before the nationalization of currencies. Different banks may have different policies, more aggressive or more conservative. Some of them may be partially reserved, others will be 100% backed by bitcoins. Interest rates may vary. Units of account issued by some banks may trade at a discount to others.

George Selgin elaborated on the theory of competitive free banking and argues that such a system would be stable, inflation resistant, and self-regulating.

I believe that this will be the ultimate fate of Bitcoin – to become "reserve money" for banks issuing their own digital currencies.Most bitcoin transactions will be bank-to-bank settlements.as rare as... well, like buying directly with bitcoin today."

Bitcoin Full Reserve Talksuggests that Bitcoin has reached full maturity, and is therefore accepted as money in all its functions. This is important because the dynamics of the monetary system, when it has not yet reached maturity, is different. The same logic applies to the free banking system. It starts with an initial expansion of the fiduciary supply, but eventually matures and finds an equilibrium price level at which the volume of the fiduciary supply fluctuates only modestly under the influence of market factors.

Austrian School of Economics and Free Banking Theory

Imagine a world where banks are allowedto issue their own private money competitively, and for the markets to decide whether that money has value. This system is built on the assumptions that: (1) information transparency is high, (2) the system exists in a competitive market environment, and (3) its regulation is minimal. If such a system emerges and is based on voluntary agreement and exchange between market participants, who is to say that it will not be fair?

Many representatives of the Austrian economicschools disagree with this and are proponents of a full reserve banking system, like Murray Rothbard, for example. Ludwig von Mises was of two minds about free banking throughout his career. In «Theory of Money and Credit» Mises wrote:

“Fiduciary means of payment are hardlydiffer in nature from money… Consequently, logically they should be subject to the same principles that were established in relation to money itself; and the same attempts should be made with regard to them, in order to eliminate, as far as possible, the influence of man on the relation of exchange between money and other economic goods… Obviously, the only way to eliminate human influence on the credit system is to eliminate any further fiduciary issuance. The basic concept of Peel's Law should be reformulated and implemented more fully than it was in England at the time, by including a legal ban on the issuance of loans in the form of bank balance sheets.

In this quote, Mises advocates thatregulators have eliminated the option for private markets to opt for a fractional reserve system (fiduciary tenders are notes with fractional reserve coverage). However, this quote must be seen in context, since he was referring to the actions needed to reconstruct monetary institutions after World War II. But let's put aside the arguments for or against regulators restricting the voluntary contractual arrangements of private markets and focus on Mises's thoughts on free banking (translated from Human Action, Ludwig Von Mises, Yale University Press, 1949):

"The creation of a free banking system has never been seriously considered precisely because it would be too effective in limiting credit expansion."

"Today, no government is willing to consider a free banking program because no government is willing to give up what it considers a convenient source of income."

“Free banking is the only available methodpreventing the dangers inherent in credit expansion… Only a free banking system can provide a market economy with protection from crises and depressions.”

“Credit expansion does not in itself expandthe bank's clientele, i.e. the number of persons who give the demand receipts issued by that bank the character of money substitutes. Since excess fiduciary issuance by one bank, as shown above, increases the amount that the customers of that bank must pay to other people, it simultaneously increases the demand for repayment of its money surrogates. This encourages the issuing bank to return to limiting issuance.”

Mises believed that free banking providedto limit credit expansion, allowing the market to find a natural price level. Therefore, he believed that such a system was superior to fiat money and the gold standard system with central bank intervention. However, he did not consider the free banking system to be perfect because (1) the elasticity of the money supply (when defined as the volume of fiduciary means of payment) distorts the pricing feedback loop required by entrepreneurs, and (2) this system will inevitably be captured by state regulators and used as centralized control tool.

I will return to this topic later, becausewe first need to understand how free banking naturally limits credit expansion. The ideas on which I will draw are taken from the work of George Selgin and Lawrence White.

The Emergence of Free Banking and Credit Expansion

The emergence of free banking would lead toinitial credit expansion, but would eventually plateau under natural market forces. Let's start by describing the emergence of free banking and how it self-regulates in traditional banking (the Bitcoin standard will have significant differences from this description, but for the sake of clarity, let's leave those differences aside for now).

There are private banks that acceptbitcoin deposits against a full reserve and subsequently lend those reserves to capitalize on the interest rate and pay back a portion of that amount to savers. The amount of outstanding loans should not exceed the bank's reserves.

Having earned a sufficient reputation and trust withon the part of depositors and the general public, these banks can start issuing their own banknotes (tradable for bitcoin on demand) to borrowers instead of issuing bitcoin directly to them. Borrowers, when paying someone, instead of claiming bitcoins on their banknotes, can pay off the seller and the banknotes themselves - this is more efficient. With a sufficient level of public confidence in the bank, its banknotes will begin to circulate as de facto money, without the need to exchange for bitcoins. Once this level of trust is established, banks can begin issuing banknotes for use as money in excess of the bank's reserve collateral while continuing to ensure that these banknotes can be exchanged for bitcoin on demand. Why wouldn't borrowers just want to get bitcoins instead of these bank receipts? This is an important issue that can indeed be a significant barrier to the actual emergence of a fractional reserve system based on Bitcoin. To explain the theory, for now let's assume that receiving banknotes in the public mind seems preferable. I will discuss this issue in more detail later in this article.

Such a system is based on trust, and banknotesissued by different banks will compete with each other, trading either as equals or at a discount. Individuals will have an incentive to check that the level of reserves of the bank issuing particular banknotes is sufficient to meet their redemption requirements. Of course, not everyone will want to constantly monitor this, and traditionally such a check was carried out by a class of brokers who arbitrated various bills and banknotes between countries. For example, brokers can buy less trusted banknotes at a discount and go to the issuing bank to redeem them at full value, capitalizing on the difference. Thus, by looking for arbitrage opportunities, brokers inadvertently increase information transparency, create an incentive to maintain bank reserves at an adequate level, as well as to widely distribute various banknotes.

Perhaps in the end banks will take over the functionsbrokers and start accepting each other's banknotes at face value. If banks do not accept the notes of other banks, this will eventually lead to the depletion of the reserves of such banks, since their notes will be redeemed in other banks faster than they themselves will redeem the notes of other banks for the reserves. Thus, market incentives encourage the expansion of banknote acceptance by other banks, and this is due to the constant checking of the sufficiency of bank reserves.

Duel of banknotes:an interesting practice characteristic of freebanking, there was a note duel - banks accumulated large quantities of a rival bank's notes and redeemed them all at once in an attempt to deplete the competitor's reserves and force its insolvency. During the first half of Scotland's free banking period, banks maintained relatively high reserves to protect themselves from such attacks, which benefited depositors. These attacks then required large operational costs, which placed limits on the extent to which banks could attack each other. As we will discuss later in this article, Bitcoin's free banking system allows algorithmic and much larger-scale execution of such attacks in principle, which may limit the proliferation of fractional reserve systems.

This constant banknote redemption process is complicatedand requires high transaction costs, so banks need a way to offset redemption claims in order to reduce the transaction burden on the system by settling them in one place (or at least in fewer instances). This leads to the creation of clearing houses where all banks go to settle their obligations to each other in order to clear only the net difference between them. Centralized debt clearing puts clearing houses at the center of the system and they eventually evolve to take on more functions:

- act as credit controllers for banks, excluding from their membership those who engage in improper banking practices;

- contribute to the harmonization of common reserve ratios, interest rates, exchange rates and tariff schedules for market participants;

- in the event of a crisis, they help provide short-term liquidity by lending from more liquid institutions to less liquid ones.

With the creation of banks and clearing housesacceptance of banknotes is significantly expanded, settlements are carried out efficiently and information transparency is increased. All the while, credit expands, and so does the money supply, raising the general price level. However, this system eventually reaches a point of maturity when credit expansion plateaus and the system maintains long-term equilibrium.

At maturity, the demand for reserves and the availablethe supply of bitcoins will be equal, and the supply of banknotes will be equal to the demand for them. There is a market level of demand for credit notes and bitcoin reserves, constantly tested by market forces. The principle of adverse clearing is that if some banks try to expand credit and others do not, the clearing balances will ultimately benefit the more conservative banks rather than the expanding ones. Banknotes of credit-expanding banks will be redeemed more frequently, which will quickly force them to limit their expansion. As a result, banks that lend cheaply to capture market share end up losing reserves to competing banks—the penalty for over-expansion. There is a downside to scale in such a system: the system can only be effectively scaled up by increasing the level of reserves.

In general, if the volume of credit money exceedsthe equilibrium level, prices and demand for reserves will increase. Rising prices will further increase the demand for money, and reserves will fall below sustainable levels. Bank solvency will be tested by reserve requirements, credit will contract to sustainable levels, and prices will subsequently fall. These market dynamics maintain a price level at which the demand for reserves and credit money remains stable. In an equilibrium state, aggregate credit expansion can only occur if additional reserves appear from outside the system (for example, the supply of Bitcoin increases during mining). Reserves in the Scottish free banking system were 10-20% in the second half of the 18th century and fell to 1-3% in the first half of the 19th century («Free Banking in Britain», Lawrence H. White, Cambridge University Press, 1984 ). This change was largely due to the practice of note dueling and its subsequent decline as private clearing houses maintained the system.

Demand for money and constraints on inelastic money

The concept of money demand is often identified withthe need of bank borrowers to receive money and immediately spend it on goods and services. When banknotes are created and provided to private market participants, and then those banknotes are immediately exchanged for goods and services and redeemed at the bank, there is no long-term increase in credit. Thus, the demand for credit money should be understood as the desire to hold this money, and not to receive it and immediately repay it. It is like the desire to keep, or save, money, which fluctuates depending on expectations about the future economic situation. On this occasion, Selgin writes («The Theory of Free Banking», George A. Selgin, Rowman & Littlefield, 1988):

“The bank borrower contributes to the demand for money notgreater contribution than a ticket agent to the demand for performances and concerts; only the holders of the money or the actual attendees of the performances contribute to the real demand.”

This demand exists for the underlying (Bitcoin) andcredit money (banknotes). In this discussion, I am referring to credit money, and the demand for it is defined as an increase in the aggregate demand for bank liabilities. Monetary equilibrium exists when there is neither an excess demand for money nor an excess supply of money at the existing price level. If the short-term change in the money supply satisfies the short-term excess demand for them, this helps to satisfy the demand and maintain monetary equilibrium.

Elastic money defined as abilitymoney supply to respond to changes in demand have advantages that can most clearly be shown by highlighting the limitations of money with inelastic supply. Selgin in «Theory of Free Banking» uses an employee as an example («The Theory of Free Banking», George A. Selgin, Rowman & Littlefield, 1988):

“Employees are trying to increase theircash balances by reducing purchases of consumer goods, but there is no compensating increase in demand for goods due to increased bank-financed spending. Therefore, a decrease in demand leads to the accumulation of inventories. The nominal revenue of enterprises becomes insufficient in relation to the cost of production factors. Since each entrepreneur notices a deficit only in his own income, and does not perceive it as just a prelude to a general fall in prices, including the prices of factors of production, he considers (at least in part) the fall in demand for his product as a sign of a long-term decline in the profitability of his particular line of business. If all entrepreneurs reduce output, the result will be a general recession, which will end only when the general fall in prices raises the real money supply to the desired level.

I think the best way to deal with thisthe concept is this: Entrepreneurs are forced to plan for the future, and their expectations about this future fluctuate. They invest their money in productive capital that will meet their expectations of future demand. If this demand exceeds their expectations, they need to invest in more productive capital to meet it. But if demand falls below their expectations, they are now sitting on non-income capital and its associated costs, which creates a financial burden. For entrepreneurs who are on the verge of solvency, such a decrease in demand can lead to insolvency. Therefore, they are forced to sell off their productive capital in response to their expectations of future demand. Only after prices eventually decline, which takes time, will the decline in demand within the economy even out. Thus, elastic credit money is more responsive to supply and less to price. This quality can ultimately reduce the costs associated with a short-term decline in demand, since it does not provoke insolvency. Consequently, greater price stability is achieved due to the elasticity of the supply of (credit) money. The trade-off is that this increases the likelihood of inefficient investment in the economy.

At the individual level, entrepreneurs havea cost structure based on their expectations, rather than having to lay off staff or become insolvent due to short-term fluctuations in that cost structure, an elastic supply of credit money helps them weather the storm. On a general level, the banking system's elastic credit money cushions the costs of emerging natural business cycles. The key is to keep credit as a short-term solution without continually accumulating credit to unsustainable levels in the long term. The natural corrective market mechanisms of free banking allow the money supply to respond to short-term fluctuations in demand without the negative effects associated with long-term expansions and contractions of credit.

Selgin in his “Theory of the Free”banking» writes on this subject: "Nevertheless, deflation has historically been an important factor in business cycles, and a banking system that promotes deflation undermines economic activity as surely as one that promotes inflation."

Friedrich Hayek agreed that the adjustmentmoney supply is desirable: «Any change in the velocity of circulation must be compensated by an inverse change in the quantity of money in circulation if money is to remain price neutral» («Price and Production», Friedrich Hayek, Ludwig Von Mises Institute, 2008). However, he did not believe that monetary elasticity could be formulated in practice.

In addition, an inelastic money system can still respond to economic shocks with credit (not credit money—credit!). However, she is more limited in this.

If a full redundancy system (withoutmaturity discrepancy) has an amount of deposits X, then theoretically X amount of loans can be directed to alternative purposes. If only 50% of X was allocated as a loan and an economic shock occurred, then more credit can be allocated to the relevant sectors so that economic agents can survive the shock. However, if 100% of X has been issued, then the banking system will no longer be able to provide more credit to mitigate the economic shock. Of course, credit expansion can also be implemented outside the banking system, but this will require individuals to withdraw their money from the banking system. Withdrawals will have to wait until their term deposit becomes available for withdrawal, plus this will lead to a reduction in reserves in the banking system. However, if credit expands outside the banking system, then there is no amount of reserves, which means that the rules of the banking system with full reserve do not restrict the issuance of loans outside it. Thus, a full reserve system is much less efficient at lending in excess of the reserves of the banking system.

Banking system with fiduciary paymentfunds is less limited and responds to the demand for credit by issuing credit money, and, as a result, is more pliable. Any bank can issue more fiduciary tenders, although doing so risks being insolvent in the future. Thus, full-reserve systems can still distribute loans during times of economic turmoil, but free banking is much more efficient because credit terms are standardized and liquid. This is analogous to the liquidity of the secondary market for trading public shares compared to conducting an IPO or private placement. Although the elasticity of a given money supply has both desirable properties and undesirable consequences, it is not a necessity.

In conclusion, it should be noted that fiatcentral banks take credit expansion beyond the natural market level and continually exacerbate its negative effects until it is no longer sustainable. Free banking is associated with market incentives and imposes natural restrictions on credit expansion. Free banking is also imperfect, leading to fluctuating credit and encouraging inefficient investment. However, the effects of free fractional-reserve banking are fundamentally different from those of constant credit expansion in fiat fractional-reserve central banking systems.

Theoretical Implications of Full-Reserve vs. Fractional Banking Systems

The cost of issuing money

One of the main criticismsEconomists' argument about a gold standard with full reserve banking is the opportunity cost of the economic resources needed to produce and store gold. According to a popular estimate by Milton Friedman in the 1960s, the cost of a gold standard with 100 percent reserves would be approximately 2.5 percent of net national product. This is a significant amount of resources and I expect history to repeat itself. We are already seeing this criticism regarding «environmental costs» Bitcoin.

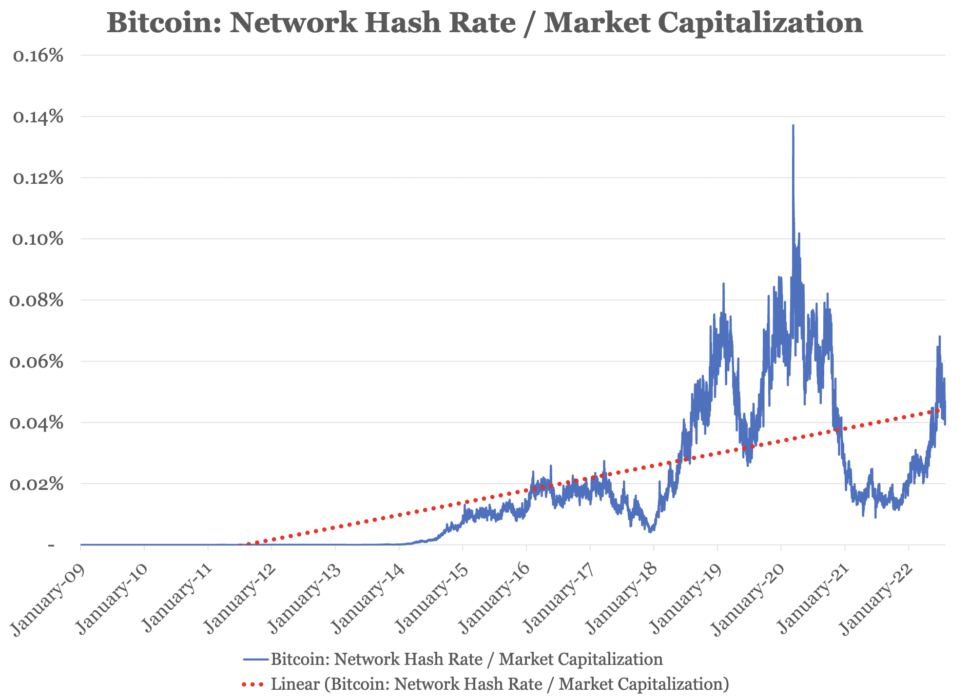

Mining costs - capital, labor andenergy supply - at maturity is likely to be several times higher than today. We want bitcoin mining to be expensive, because the security of the decentralized monetary basis of the global financial economy, on which the distribution of all other resources depends, is worth it. But how high will these costs be? If Bitcoin remains the only form of money in the world, then the level of security will potentially be proportional to the demand for it. Currently, this proportion appears to be increasing:

Bitcoin: Ratio of Network Hashrate to Market Cap

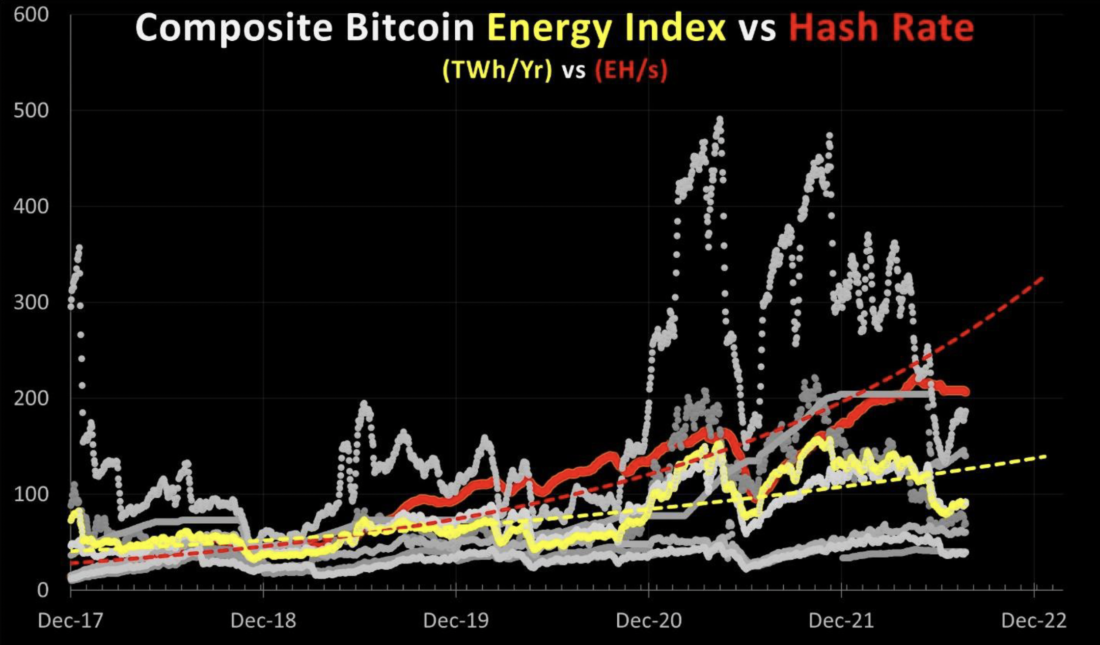

What matters, however, is the actual cost of producing that hashrate, which decreases over time in proportion to the hashrate as the mining infrastructure becomes more efficient.

Bitcoin Composite Energy Index (TWh/year, yellow) and network hashrate (Ehash/sec, red). :Tyler Bain

This trend can be expected to continuehowever, it does not take into account the labor and capital associated with infrastructure, which constitute a significant portion of total costs. One estimate puts the cost of a 51% attack on Bitcoin at ~$48 billion in hardware alone (at minimum market price) and ~$33 million per day in energy. You would have to mine ~1400 days to spend the same amount of money on electricity as you initially spent on hardware. This is a simplified and approximate calculation, and more research is needed to estimate the overall economic costs associated with mining. If the price of Bitcoin increases 100 times, how much will the hashrate increase and what will be the total economic cost of its production? Whether this issue bothers the reader or not, this will be a key area of criticism from the economics community, and this must be understood.

The main thing is that the network is secure.In an ideal world, we would like to spend resources on providing a 100% security guarantee and nothing more. The practical difficulty of actually carrying out a 51% attack on the network makes it very unlikely to succeed with Bitcoin's current level of security. If the price of bitcoin increases only 10 times in the next 10 years, how much will the cost of mining increase? If only 5 times, will this protect the network beyond what is needed to protect against a 51% attack?

I do not know the answer to these questions and do not think thatit is in principle possible to know. There is potential for a commons resource tragedy in the future, as individual market incentives are not directly linked to the social impacts of mining. Individuals are betting on block space over security, and the two may or may not overlap. It is entirely possible that market incentives will push mining hashrate to rise beyond what is necessary for the network to be completely secure, and thus inefficiently use economic resources that could be used for alternative production purposes. In a hyperbitcoinized world, there will be some optimal level of security budget, and it is likely that today we are not so far from it.

Fiduciary treatment will reduce the demand for Bitcoin,which means that less economic resources will be allocated to its mining. In this case, the price of Bitcoin will be lower, mining will be less attractive, and fewer resources will be spent on it. Bitcoin differs from gold in that spending more resources to mine it does not lead to faster production. I think this will be the main argument for introducing alternative forms of money into the system, such as the Central Bank. The existence of fiduciary means of payment in a free banking system could be an argument against the political purveyors of the CBCB narrative. Since the politically charged media is screaming "Bitcoin is too expensive, we need CBCBs," it would be better to have a free market alternative that exists with the same economic benefits that CBCBs are supposed to have.

Thus, the theoretical advantage of the systemfree banking is that it can free up the resources used to increase Bitcoin's security beyond its optimal level for alternative economic purposes. This will also be a strong argument against the inevitable narratives about CVCB. Selgin in «Theory of Free Banking» argues that «potential investment in commodity money… are transformed into an increase in borrowed funds. This is the main economic advantage of the fractional reserve banking system.

business cycles

For the reasons discussed earlier in relation tobenefits of an elastic money supply, a banking system that issues fiduciary tender can respond more effectively to economic shocks than a full-reserve credit system. A fully provisioned credit system is still capable of responding to economic shocks, but its capacity to do so is more limited. While relatively lesser constraints on monetary elasticity are an advantage of free banking, the important question is, will this not end up creating credit volatility, which itself will produce business cycles?

In theory, free banking should supportgreater short-term price stability than a fully redundant system. Market incentives for free banking limit the creation of credit money, but historically fractional reserve systems have mostly been associated with constant credit expansions and subsequent contractions. The large fluctuations that we are familiar with were mainly caused by centralized intervention in the market system (public insurance, regulatory restrictions, central banks, etc.). The theory of free banking is fundamentally different from this, since it is based solely on market relations and does not imply centralized control. However, there are two main problems with free banking, which, according to Selgin, are formulated as follows:

- violation of the monetary balance under the influence of shocks in the supply of commodity-money resources; and

- disturbances caused by periodic «raids» on banks and panic reactions.

Fluctuations in the supply of commodity-money resources do notwill be a problem for Bitcoin, since its supply is known and algorithmized in advance. In addition, it is a purely monetary commodity that is not subject to changes in demand for any market purposes, unlike gold, for example (the demand for gold in electronics or jewelry is rapidly declining). This is the key innovation of Bitcoin as money.

Disturbances caused by «raids» onbanks and panics are the main problem of free banking and the main rationale for the full reserve standard. Depositor flight and panic arise due to a lack of trust in the banks themselves. Historically, war, recession, or the collapse of big business have been harbingers of a loss of public confidence. However, as in any market, if banks are allowed to fail, solvent banks will acquire them or their shareholders will ultimately pay the losses, and deposits must be well insured.

For example, in the Scottish free systembanking system, which existed from 1716 to 1845, only 19 banks failed, and the final cost to depositors during this period was only £32,000 («The Theory of Free Banking», George A. Selgin, Rowman & Littlefield, 1988, p. 135). However, there was a 20-year period (starting in 1797) during which withdrawals were suspended, which was caused by the Napoleonic Wars when countries actually began to abandon the gold standard. As mentioned above, during this period the level of reserves of Scottish banks fell significantly and they were not protected from geopolitical shocks. This system was not perfect and could not respond to all challenges - like all market systems. If the world relied on a neutral monetary standard like Bitcoin, the number of wars would likely be significantly reduced. In addition, private insurance markets may emerge to protect depositors.

There is also a risk not only«raid» on banks, but widespread panic caused by contagion. Theoretically, panic occurs primarily because liability holders lack information about a particular bank's bank reserves in proportion to its bank liabilities. In the Scottish banking system or in Canada during the period of free banking, the failure of individual banks never led to panic («The Theory of Free Banking», George A. Selgin, Rowman & Littlefield, 1988, p. 138). In a Bitcoin standard, trust in the free banking system is likely to be greater due to information transparency and innovations such as proof-of-reserves (more on this below). This innovation will also provide private insurance companies with the opportunity to conduct proper risk assessments and provide deposit insurance without government involvement.

In a free banking system, there isthe risk of business cycles due to monetary events. The question is, are the business cycle risks of free banking worth the benefits of greater money supply elasticity?

Price stability and signals

Bitcoin has an asymptotic supply curve,and therefore the supply of Bitcoin itself will be disinflationary. However, bitcoin's purchasing power at maturity is likely to be deflationary if economic performance outpaces the rate of change in its supply. As technology continues to improve productivity, the prices of the most innovative goods and services will naturally decline. But will prices be stable in the short term? Not really.

Bitcoin is a perfectly inelastic money, andunder a 100 percent redundancy system, we assume that there is no other physical form of money other than bitcoin. Any shocks to supply and demand will always be reflected in prices, which can cause short-term economic fluctuations that are resolved by price adjustments in the long term.

However, the general price level under the fullbank reserve needs to be stable and/or deflationary in the long run. Credit markets will still respond to short-term economic shocks, but will be more constrained by an inelastic money supply. Unlike an elastic money system, where supply and demand shocks are not always reflected in prices as the money supply (via fiduciary tender) adjusts in response. Elastic money can make prices more stable in the short term (for example, fiduciary issuance smooths out imbalances resulting from price fluctuations), but historically they have led to an overall rise in the price level. It is noteworthy that elastic credit money throughout history has led to economic shocks as a result of persistently high inflation caused by the risk of abuse that is inherent in the central control of these credit systems.

The free banking system could potentiallyprovide greater short-term price stability than a full reserve system. Remember that a free banking system will cause overall prices to rise as a result of credit expansion in its infancy, but will eventually establish a stable price level due to free market incentives. And historical examples of free banking systems (in Scotland, Canada, etc.) confirm this idea. When this price level is found, the overall result is price stability.

On the other hand, such price stabilitydistorts their (price) reality. And this is the main argument of the Austrian school against an unsecured loan. If prices do not reflect economic reality, it is more difficult for entrepreneurs to respond effectively to market behavior, leading to inefficient investments. The other side of this argument is that there are short-term market shocks that, in the absence of credit systems, would be reflected in prices and encourage entrepreneurs to make long-term decisions based on short-term changes, which otherwise, with an elastic money supply, would resolve themselves. Thus, believing that market prices always give entrepreneurs the right price signals is not such a flawless argument. These arguments are theoretical in nature, and both of them are valid.

Investments

The main risk of elastic credit money will betheir influence on the distribution of capital through the impact on price signals. A negative result is an inefficient investment. A full reserve banking system will significantly reduce the risk of inefficient investments compared to free banking. Since credit will be limited to the full amount of bitcoins held in savings, capital allocators will be forced to invest only in those projects that they believe will generate the highest expected return on capital.

Free banking is less restricted inissuance of credit through fiduciary means of payment and increases the available supply of credit compared to a full reserve system. While this increase in investment contributes to overall economic growth, it also increases the risk of underperforming investments, making tougher business cycles more likely.

Take a Look at Today's Central Bank Fiatsystems. Such systems provide structural incentives for over-lending, which over time leads to inefficient investment. Eventually the music stops, and economies caught in the thrall of inefficient investment must restructure their capital allocation in favor of relatively more efficient enterprises in order for economic growth to resume. It is clear that the fractional reserve system of central banks creates the risk of abuse, which directly encourages the issuance of substandard loans.

Inefficient investing is bad because itamplifies the amplitude of business cycles. The question is, is there such a thing as underinvestment, and if so, what is it? This theoretical concept is difficult to qualify, but we can recognize its probable existence. Will a full reserve system ultimately ignore investment in projects that would benefit the world if credit in the system were more expansive?

If the free banking system can expandvolume of credit through fiduciary issuance, then more investment projects with a relatively greater risk of inefficient investment will be financed. However, the potential for boosting economic growth through greater credit expansion has its benefits, which should not be thrown out the window because of the risk of abuse inherent in fractional-reserve central banking systems.

The question for free banking is, will the increase in inefficient investments from free banking eventually pay off with additional profits in a valuable enterprise?

And in essence it is a question of what is the optimalthe level of time preference for society. None of the extremes is the optimal choice. One leads only to consumption, the other only to saving. The best option is somewhere in the middle, and rather than imposing your time preference on the market, I think it's better to let the market determine it for itself. If market participants voluntarily agree to accept fiduciary means of payment, then so be it. If capital allocators decide to invest in more projects due to easier credit expansion, then so be it.

Deposit rates and risks for depositors

In fractional-reserve systems, banksearn money by creating it - so-called seigniorage - which allows them to generate profits that go beyond simply capturing the spread between the interest on loans and the amount paid to savers.

Imagine if banks didn't lend at allloans. In this case, they would earn on commissions that cover their expenses for holding depositors' funds. Banks figured that lending was another way to make a profit, and by paying their depositors a portion of that profit in the form of interest, they could attract more depositors. Even so, the interest rates paid to savers may be too low or potentially below their operating costs.

If banks issue their own money, keepingfractional reserve, which they in turn lend out to earn interest (seigniorage), they can make even more profit, allowing them to pay depositors higher interest. Put aside your opinions about fractional reserves for a moment and consider this fact in isolation. The ability of banks to lend, or more specifically, to lend in excess of their reserves, increases the ability of savers to benefit from capital formation. This is one of the reasons why fractional reserve banking systems have arisen throughout history, while full reserve banking systems have not been widely adopted or survived for long. Of course, profit-making through seigniorage by fractional-reserve institutions carries an increased risk of «run» to banks of escapes and panic. In addition, it is important that banks not only allocate capital, but allocate it correctly. Relatively low restrictions on credit expansion through fiduciary issuance increase the risk of inefficient capital allocation.

Ideally, depositors want a higherinterest rate, and the demand for that opportunity depends on whether savers think it's worth the risk. If the banks keep their reserves at 99%, you can be sure that everything will be in order. What if it's 90 percent? And 80%? The market will eventually determine that amount.

On the other hand, digital banks thatemerging in the future will have alternative ways to generate interest for savers without taking on counterparty risk when lending, particularly through the Lightning Network. This makes the full reserve system more viable, and fractional reserve banks will have to compete with it. I will return to this issue later, but for now it is important to understand that a full redundancy system is more «expensive» for savers compared to fractional reserves, and this is one reason, among others, why fractional reserve systems arose privately.

I think the ideal result isthe ability for private markets to choose what type of system they want to participate in, with full information transparency. Adam Smith would agree with this («The Wealth of Nations», Adam Smith, Oxford, 1979, p. 252, book 2):

“It can be said that to prohibit private individualsto receive in payment banker's bills of any amount, great or small, when they themselves wish to receive them, as to forbid a banker to issue such bills when all his neighbors are ready to accept them, is a clear violation of that natural freedom that the law should support, and do not violate."

Fully redundant systems have always beenlegal, but free banking was chosen by depositors in private markets. Adam Smith also recognizes this idea («The Wealth of Nations», Adam Smith, Oxford, 1979, p. 256, book 2):

“Thanks to the division of the entire turnover into morethe number of parts, the collapse of one company - a nuisance that should naturally happen from time to time - becomes less significant for society. Free competition also obliges all bankers to be more liberal in dealing with clients so that they do not go to competitors. In general, if any industry or division of labor is beneficial to society, then the freer and wider the competition, the greater will be the benefit to society.

In «An Inquiry into Nature and Causeswealth of nations» Adam Smith recognizes that it was the freest banking systems that promoted industrialization by stimulating the use of greater economic resources.

Inequality in the distribution of wealth

Toward a full bank reserve systemthe Cantillon effect is inapplicable. Since credit does not exceed the existing amount of money, prices will not rise as a result of monetary expansion in the long run, and therefore there will be no classes of people who benefit from or suffer from the expansion of the supply of credit money.

The criticism of free banking is thatcredit extensions will benefit most from those closest to credit creation, while those farthest from it will suffer from price increases. This is true only during the period of free banking, when the price level rises, but is not true when prices reach a new equilibrium level. Of course, rising prices in the early days of the system is not desirable, but a similar argument can be made for Bitcoin in its early days. The earliest investors will benefit the most from its absorption of the cash market. Over time and as the system matures, this disparity will even out. In fact, it is a property of any emerging system as a whole: new fast-growing economies are subject to high wealth inequality in their infancy, but it tends to decline as they reach maturity.

Thus, since in the conditions of freebanking, the price level reaches market equilibrium, there is no permanent inequality in the distribution of wealth due to the constant creation of credit, exacerbating the Cantillon effect. The reverse is true only when a new system emerges, and this is true for all emerging economies.

Summary

In general, when comparing a full redundancy system with a partial one:

- Money production costs:a fully redundant system canstimulate the growth of hashrate beyond the level necessary for complete network security and, thus, contribute to the excessive use of economic resources that could be used for other productive purposes. The introduction of fiduciary means of payment through a free banking system may allow the mining market to find equilibrium, reducing the security provided to the network to a more optimal level. This is a very theoretical area that deserves more in-depth research.

- Business cycles:a fully redundant system facilitatesthe formation of pronounced business cycles only due to supply and demand shocks, without the participation of monetary factors. The flip side is that such an inelastic money supply may allow economic shocks to cause short-term economic fluctuations that could potentially be mitigated by a more elastic money supply. However, credit creation in a full reserve system will still respond to economic shocks. Free banking, as past experience shows, can provide stability in the face of economic shocks without constant monetary inflation. The resulting natural price equilibrium will be more elastic and reduce short-term economic volatility.

- Price stability and signals:a fully redundant system will provideentrepreneurs receive almost ideal price signals, which also implies short-term fluctuations in market behavior. Free banking makes it possible to ensure price stability in market equilibrium at the cost of distorting price signals for entrepreneurs. None of the systems is ideal in this regard, having its own advantages and disadvantages.

- Investments:fully redundant system allows up toreduce ineffective investments as much as possible, and only the most viable enterprises will be able to afford to attract additional financing. A free banking system could potentially finance more business investment, but at the cost of higher risk of ineffective investment.

- Deposit rates and risk:a fully redundant system canneglect the riskier lending opportunities in the economy and will not be able to pass on that portion of the economic gains. However, the likelihood of their solvency is much higher. A free banking system provides higher deposit rates through seigniorage, but implies a higher risk of insolvency due to increased risks of lending practices, capital flight and panic. However, historical examples of free banking systems have demonstrated high stability due to the lack of government intervention. However, they are not immune to such risks.

- Inequality distribution of wealth:a fully redundant system does not lead toinequality of wealth distribution, the Cantillon effect does not apply to it. A free banking system is likely to lead to an unequal distribution of wealth during the system's infancy and rising prices, but once equilibrium levels are reached, this effect is likely to be insignificant.

Bitcoin banking systems in practice

So far we have seen that the dispute between the completereserve banking and free fractional reserve banking are theoretical in nature. Free banking has a limited number of historical examples, some of which are more illustrative of the theory than others. The Scottish and Canadian systems, according to Selgin, are the best examples of free banking. Many systems were characterized as "free banking" but were largely constrained by regulators, which distorted market incentives and ultimately led to their collapse. The system that existed in the USA in 1837-1863. often cited as an example of a free banking system, but was far from this due to strict regulation (bond laws) and geographical restrictions on branches. However, none of the historical examples of free banking fully corresponded to the theory.

Moreover, never in the history of a system of completebanking reservations did not exist for a long time and on a large scale. Banks emerged as pure depository institutions, but no widespread full-reserve system was ever chosen by the private markets. Even Ludwig von Mises seems to have recognized that the implementation of such a system would require a government ban on fractional reserve banking.

The fact is that no matter disagreeWhether you are with the idea of free banking based on its properties or for some ethical reason, the emergence of any large-scale system based on Bitcoin with full redundancy would be the first such case in history. Since free banking systems have been rare, and since full reserve banking has not yet existed at all, consideration of any of them implies an exception to historical patterns. On the other hand, Bitcoin itself is such an exception.

Bitcoin and the innovations that come with itemergence, make the choice by markets in favor of full reserve banking or free banking more likely than in analogies from the past with physical assets. I believe that both systems are likely to exist, but the digital system has significant limitations that may prevent the emergence of fiduciary means of payment. If the industry can create a sufficiently decentralized infrastructure, I think it could significantly reduce the amount of government overreach that has characterized the history of finance. Bitcoin eliminates the risk of abuse inherent in base money and makes it possible to abandon any financial system in favor of exclusivelypeer-to-peereconomy, creating the conditions for private markets to determine what the future of the global financial system will look like.

Lightning Network and Time Value

Hal Finney, as already quoted above, believed thatbitcoin banks will be needed as a scaling mechanism. While this is entirely possible in the short term, in the long term the Lightning Network has already proposed a plausible method for scaling Bitcoin. This does not mean that banks will not be needed in the long run. This means that the nature of banks is likely to be quite different.

Lightning Network (LN) is a secondary paymenta level that optimizes the efficiency of transactions for payments. Bitcoin holders can lock their BTC in a special contract with some channel partner and transact both ways through that channel in a much more scalable way, without exceeding the amounts you both invested in the channel. In addition, links between channels can be used to transfer payments between parties that do not have an active direct channel for a fee. These forwarding payments are routed between different LN nodes until the payment reaches the destination. Each node that forwards (i.e., routes) the payment receives a small fee for doing so.

You can deposit your bitcoins in the payment channel anduse it not only for mutual settlements with a channel partner, but also for routing payments of other users, receiving a commission for this. The more bitcoins you deposit into the channel, the more payments you can send. The more channel partners you have, the more likely it is that payments will reach the recipient and you will receive your reward. Thus, individuals are compensated for integrating with LN and providing it with liquidity.

By providing liquidity to LN, you are effectivelyyou lock your bitcoins for a certain period of time and receive interest on them as compensation for the time they were locked. This is essentially a form of fully collateralized LN lending with no counterparty risk, and can be thought of as Bitcoin's native interest rate reference. Nick Bhatia, a professor at the University of Southern California and author of Layered Money, was the first to theorize that holding bitcoin in cold storage is fundamentally risk-free. rate (although the risk of loss due to poor security practices still exists, as with any other asset), and the routing fees are the Lightning Network reference rate.

Nik Bhatia

In traditional markets, reference rates such aslike the Fed rate, LIBOR, etc., are used as benchmarks for setting other interest rates. For example, you take out a business loan at LIBOR + credit spread, and the final interest rate you pay depends on the LIBOR rate and is therefore variable. This allows banks to offset not only the credit risk (credit spread) they take on by lending to you, but also fluctuations in the credit market (reference rates).

The LN reference rate actually compensatesto people the opportunity cost of their capital, or time value, as the capital is locked up for a selected period (e.g. a week) and could otherwise be spent or invested in other assets. This also compensates for the security risk (for example, when you lock your bitcoins in the Lightning Network, you must move them from a cold wallet to a hot one, which implies a security risk). Thus, the LN reference rate pays users the following compensation:

ref. LN rate = time value + security risk premium

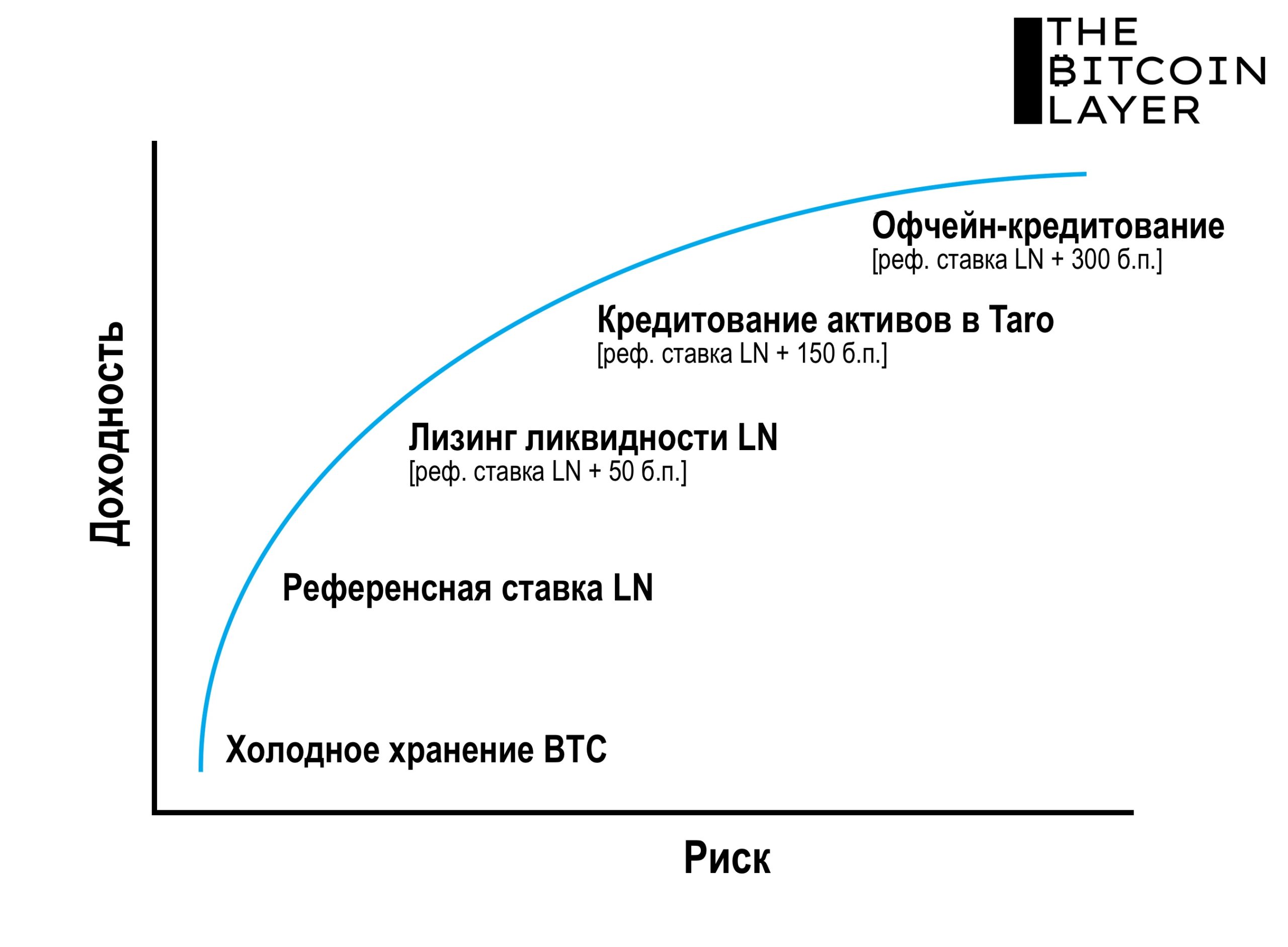

In addition to the LN reference rate, a larger percentagecan be obtained through liquidity leasing. I won't go into all the details, but I recommend checking out the article from which I borrowed the chart below, where Nika Bhatia and Joe Consorti detail how the capital markets on LN will develop.

At the very bottom we have cold storage, withwhere users can store their own bitcoins. Users may not have the knowledge to secure a significant portion of their bitcoin capital on their own and may wish to use an LN bank with the expertise to hold BTC. In addition, they may be interested in obtaining the least risky rate of return on capital and ask the LN bank to move their bitcoins from cold storage to a hot wallet earning the LN reference rate. In addition, banks could take their deposits and lease liquidity to the channels to earn a return on top of routing fees, taking on more risk through liquidity leasing to LN.

Liquidity Leasing for Lightning Network:To understand this, I will briefly explain one of theaspects of LN. When you open an LN channel, you have a capacity constraint: you and your channel partner agree on how much capital you will lock into it. Limiting your link capacity is a key issue in LN and impacts how you optimize your node. Let’s say you and your partner open a channel with a capacity of 1 million satoshi. You lock 1 million satoshi into the contract and now you have 1 million satoshi to SPEND. Your channel partner can only ACCEPT 1 million satoshi since the balance on their side of the channel is zero. If you send him 300k Satoshi, you will have 700k left that you can still spend, and you can also receive 300k Satoshi - the difference between 1 million of your channel capacity and 700k Satoshi you still have didn't spend it. Since you can't exceed the capacity limit, you may want to optimize your node for a specific purpose. The amount you can spend is called outgoing capacity, and the amount you can receive is called incoming capacity. If you are only going to use a lightning node for payment, then you are simply funding your node with the amount of Satoshi you expect to spend over a certain period. If your goal is to receive payments, this is more difficult because now you need to find someone to allocate a certain amount of capacity to the channel that will allow you to receive payments. A good example is an online store: since it will mainly accept satoshis on its LN node, it will need a capacity sufficient for the amounts it expects to receive. This means that this seller needs to find incoming liquidity, and they can turn to Lightning Pool or Magma to lease a channel with the required capacity. Thus, owners of LN channels can lease them to other users (for example, online stores) who want to use the capacity of such a channel to receive more payments than what they send themselves.

LN banks would be an ideal counterparty forsellers on LN, as banks can lease their liquidity for a fee higher than what they would receive for routing payments. Liquidity leasing is further down the risk spectrum as it involves taking on additional risks: reputational fines, early or unplanned channel closures, and marketplace disruptions. Since the LN bank ultimately sells all of its liquidity, there is a risk that the channel with the seller will close prematurely. In this way, LN banks will compete, based on their reputation, to be reliable providers of incoming liquidity for those who seek it, and receive a return in return that exceeds routing fees.

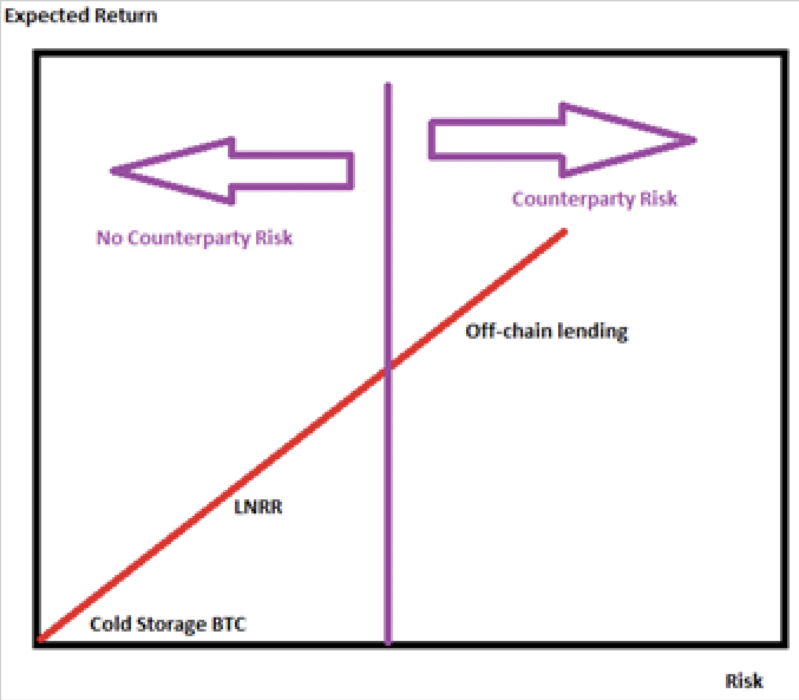

New Model for Full Banking Reservation

Note that in traditional markets, referencerates are created from short-term lending rates between banks. While they have a low risk presumption, they still retain counterparty risk. Nick Bhatia has suggested that the Lightning Network has created a new reference rate that removes counterparty risk (see chart above). In addition, banks of this kind will also be spared the risk of maturity mismatches described at the beginning of this article.

This is an important innovation because, in my opinion,it will fundamentally change the incentives for digital banks to use fractional reserve systems to the same extent that banks have used them historically. In the absence of counterparty risk or maturity mismatches, the opportunity cost of taking on these risks increases and therefore the lending market that takes on these risks will be less attractive. Individuals now have an opportunity that was not available in traditional finance - to benefit from the support of the payment network. Such an opportunity would shift the public's risk preference towards accepting counterparty risk and maturity mismatches.

LN is essentially a payment system,that allows you to scale the base level money (Bitcoin) for making payments. Parties participating in this payment network are compensated for this. Enabling users to capture economic benefits from payment layer support allows LN banks to pass on those economic benefits to depositors. This feature is not present in the traditional financial system, and therefore a new model is being formed in which it is possible to earn interest by supporting the payment network. Traditional banks or financial institutions charge interest for mismatched maturities and taking on counterparty risk. LN banks will most likely not have to take on these risks and will be able to provide interest on deposits simply by supporting the payment network. It is the fundamentally open nature of LN that allows participants to derive economic benefits from the payment infrastructure, which until then was the privilege of financial institutions. This is similar to a bank deposit, which entitles Visa to receive dividends, but is independent of its share price.

The first function of digital LN-banks will beproviding liquidity to LN. This will require specialized banks as they will try to get the highest amount of fees (interest) by optimizing their channel partnerships using the infrastructure of the LN node. Depending on where the market interest rate from fees ultimately ends up, there may simply be full-reserve banks earning the LN+ reference rate on liquidity leasing and accruing a portion of that amount to depositors after covering their costs and deriving a rate of return. In this way, a new full-reserve banking model could emerge, with no counterparty risk or maturity mismatch.

Let me remind you that paper banknotes originated inbanking as a scaling mechanism for payments. Banks issued notes because they were more portable than the physical transfer of gold. When these banknotes were accepted as money, banks were able to issue fiduciary tender (notes not backed by anything) because people used these banknotes as money. Banks were rewarded for providing this scaling mechanism through seigniorage. With LN, private users can earn these rewards directly by maintaining a payment scaling network.

Moreover, it was the appearance of banknotes in the firstturn made possible the existence of fiduciary means of payment. If banknotes were never issued, banks would not be able to issue fiduciary tender at all. LN's innovation eliminates the need for banks to issue banknotes, and this may prevent the emergence of a fiduciary tender system in LN. However, in my opinion, there are other reasons why the emergence of fiduciary means of payment within LN is still possible.

A new model of free banking

Banks and financial institutions usingmaturity mismatches or counterparty risk takers will be forced to compete with a lower risk model. While this is likely to reduce the number of fractional reserve banks, it is unlikely that all banks will avoid these risks. Let's take another look at this chart:

Further down the risk spectrum for LN banks isasset lending in Taro. Taro is a new protocol being developed by Lightning Labs that will allow LN-based assets to be issued, and not just Bitcoin transactions. While there are many use cases for this protocol, I will focus here on the ability for LN banks to create bitcoin-backed assets. Nodes can issue on-chain assets, which can then be traded through LN. A serious problem in this case will be the availability of sufficient liquidity for these assets, since some kind of on-chain mechanism for distributing them among exchanges will be required. If these restrictions are eventually overcome, then banks will be able to issue their own digital banknotes.

Banknotes can be fully backedbitcoins issued in off-chain lending to generate more profit for depositors. However, as LN banks gain the trust and reputation of users, they will be able to issue their own banknotes partially backed by bitcoin. The additional interest earned by LN banks from lending their banknotes to the market will encourage bitcoin holders to take on more risk when placing deposits with these banks in order to increase the rate of return on their bitcoins. If the history of the cryptocurrency industry is indicative of consumer preferences, then such a system is likely to emerge.

Although the issuance of banknotes is not necessary,since the actual bitcoin can be used for payments on a large scale, the economic benefits of fiduciary means of payment will still exist. Banks can pay a portion of the seigniorage benefit to their depositors, and this is likely to create demand for fractional reserve banks that provide higher deposit rates. The question is how fractional-reserve LN banks will force borrowers to accept fiduciary means of payment instead of directly bitcoin. I think there are two main reasons for this: economic benefit and privacy.

Economic benefit:just as benefits from fiduciarymeans of payment can be paid to depositors, it can also be transferred to borrowers. Imagine borrowers applying for loans and credit from various banks. Some banks offer Bitcoin directly, others offer their own banknotes at some discount. Many potential borrowers would consider better terms on such bank notes if they knew that others would accept them for payment. While it may not be easy, it is possible that banking networks can accelerate the adoption of their digital banknotes through targeted incentive programs. Banks will likely not make money from seigniorage, instead incentivizing acceptance of their notes, but once widespread acceptance is achieved, the potential profits will be significant. If the system allows for more economic wealth to be generated, then it is likely to appear somehow. This will be a key test of whether free and fractional reserve banking systems are worth using.

Privacy:another factor that will determinethe issuance of banknotes, and therefore the possibility of subsequent issuance of fiduciary means of payment, is a need for privacy. Payments on LN provide privacy, but it is not perfect. Another privacy option already in development is Federated Chaumian Mints. These are bank-like federations that allow users to deposit bitcoins and receive tokens (essentially bank receipts). These tokens use a cryptographic signature scheme called blind signing, which allows users to anonymously transfer their tokens. Thanks to the privacy of payments and the integration of these mints with LN, the technology can gain widespread adoption and will encourage the adoption of such digital banknotes. Essentially, this system converts Bitcoins into anonymous bearer assets, creating a strong incentive for users to trade these tokens and trust their value. While these Chaumian mints may operate with full reserves, it is possible that they will become the starting point for the subsequent issuance of fiduciary means of payment.

Limitations of Digital Free Banking

While I believe the emergence of fractional reserve banking systems is possible, their spread and the extent of credit expansion will likely be constrained by competition frompeer-to-peersystems and full redundancy systems.Depositors will decide whether fractional reserve banks are worth the extra risk or not and will have strong alternatives if they decide they are not. As a result, fractional reserve banks may find themselves in the minority or maintain significantly higher reserve ratios than have historically been common in free banking systems. The implementation of a full redundancy system will hinder the expansion of partial redundancy systems.

Another obstacle to broadthe spread of fractional reservation will be the digital nature of fiduciary means of payment. Consider historical examples of brokerage arbitrage and the competitive duel of banknotes in free banking systems. These practices were operationally intense and challenging due to the limitations of the physical world. With the existence of banknotes and their corresponding bank reserves in purely digital form, the operational complexities of banknote arbitrage and dueling are substantially reduced. These operational complexities will be mitigated by greater information transparency, the relative ease of digital transactions, and the potential for greater scale of speculative attacks.

Attacks on fiduciary means of payment can be carried out in a similar way to dueling banknotes, but much more effectively and on a larger scale. It can be calledredemption attacks: when speculators accumulate a significant part ofdigital receipts of the institution and present them for redemption at once in order to provoke the insolvency of the institution. Such attackers can speculate on the liabilities of fractional reserve institutions in proportion to the reserves of bitcoins. Such institutions are likely to use a proof-of-reserves system in which the bank's assets (bitcoins) are digitally verifiable. Verifying the amount of commitments will be more difficult, as it requires assurance that the institution has not issued more commitments than it claims. Commitments will require trust, and economic agents will speculate on the fidelity of this trust.

The digital nature of banking institutions will make themsusceptible to efficient and scalable redemption attacks. Flash loans are a method of unsecured borrowing on a large scale, and this technology would allow speculators to attack fractional reserve institutions on a large scale. For example, in a redemption attack, an attacker could determine the amount of bitcoins held by a fractional reserve bank, obtain a flash loan for that amount, buy fiduciary receipts from the bank for the same amount, and claim them from the bank in bitcoins to repay the flash loan. This will quickly deplete the bank's reserves, and then the speculator can use his own capital to further redeem the bank's receipts until it becomes insolvent.

If a fractional redundant system at allable to survive the attack on redemption, it is likely to continue to exist on a smaller scale and with significantly larger reserves. Just as banks maintained substantially larger reserves during the note duel era in the Scottish free banking system, the ease of attacking redemptions in fractional reserve digital banks will encourage high levels of reserves. Thus, if this constraint is not fatal to fractional reserve banks, it will stimulate the emergence of relatively more competitive and reliable institutions.

Despite potential limitations, a system withFractional reserve LN banks competing with each other to attract Bitcoin savers could be exactly the kind of technological innovation needed to enable free banking to scale and last. Let me remind you that a well-functioning free banking system primarily requires (1) high competition, (2) minimal regulation, and (3) information transparency. Such a system would be able to produce these attributes in a way and to a degree never seen before in the history of banking:

- High competition and minimal regulation will be stimulated by lowering barriers to withdrawal of digital money. Don't like your LN bank? Go topeer-to-peer. Is regulation becoming too burdensome? Go topeer-to-peer. The ease with which people can abandon this system will ensure high competition. In addition, information transparency will also promote competition and facilitate regulation.

- Information transparency will be ensuredproof-of-reserves, a method by which banks will be able to transparently report their outstanding obligations and the amount of reserves that back them. Nick Carter wrote that implementing such a reserve verification system is the single most important practice that will benefit the custody industry. Proof-of-reserves is not an exhaustive, full-spectrum system. Assets can be easily verified using services such ashoseki, but auditors will be required to verify liabilities.Fractional reserve institutions will transparently adhere to the standards as speculators may try to prove that their reserve level claims are unfounded. Speculators will play a valuable role in ensuring the accuracy of information about reserves, but it is important that a regulatory framework emerge that reduces these risks and promotes greater transparency. Hopefully it will come from the bottom up, through setting industry standards, which I think is very likely. The industry will have an incentive to self-regulate or risk draconian top-down regulation. In addition, increased transparency will allow private deposit insurance providers to assess risks much more carefully, which will ultimately protect depositors from the insolvency of fractional reserve institutions.