Rosen Law Firm has filed a class action lawsuit against Canaan Creative on behalf of buyers of its valuablepapers. The manufacturer of bitcoin miners was accused of manipulating information during an IPO.

According to a press release, investors intend to recover from Canaan Creative losses incurred after the purchase of shares in the company during the IPO.

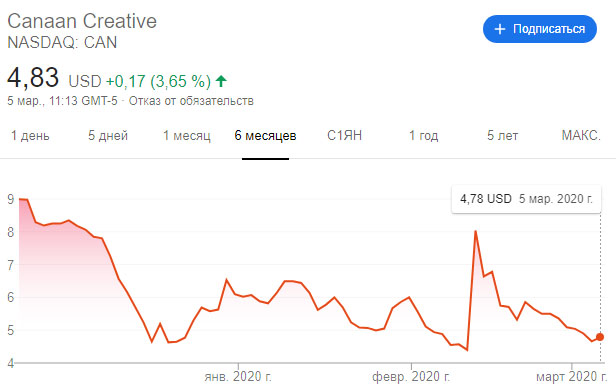

The company held an initial public offeringat the NASDAQ in October. Investors bought 10 million American Depositary Receipts (ADS) for $ 9. The attracted $ 90 million met minimum expectations, although Canaan had previously planned to receive $ 400 million during the IPO.

Already in December, stock prices fell off the levelIPO by 40%, in mid-February, the decline reached 50%. Following Canaan securities unexpectedly rose to $ 8, but again collapsed. Now they are trading at $ 4.8 per ADS.

The Chinese company was accused of submitting false information during an IPO and violation of securities laws.

The lawsuit states:

- announced «strategic partnership» Canaan turned out to be fictitious;

- the company overestimated the real financial indicators;

- Numerous distributors, mostly small and suspicious companies, were removed from the Canaan website before the IPO;

- Some of the claimed large regular customers had nothing to do with the blockchain industry and could hardly be such.

Rosen called on investors to join the class action lawsuit. The law firm also clarified that the lead plaintiff (who will represent everyone in court) has not yet been selected.

Recall that over the past year, Canaan has increased the market share of ASIC miners to 22%. The company announced plans to equip its devices with 5 nm chips in the first quarter.