Long-term holders continue to increase their share of total Bitcoin supply amid a renewedmarket volatility, Glassnode points out in its latest report.

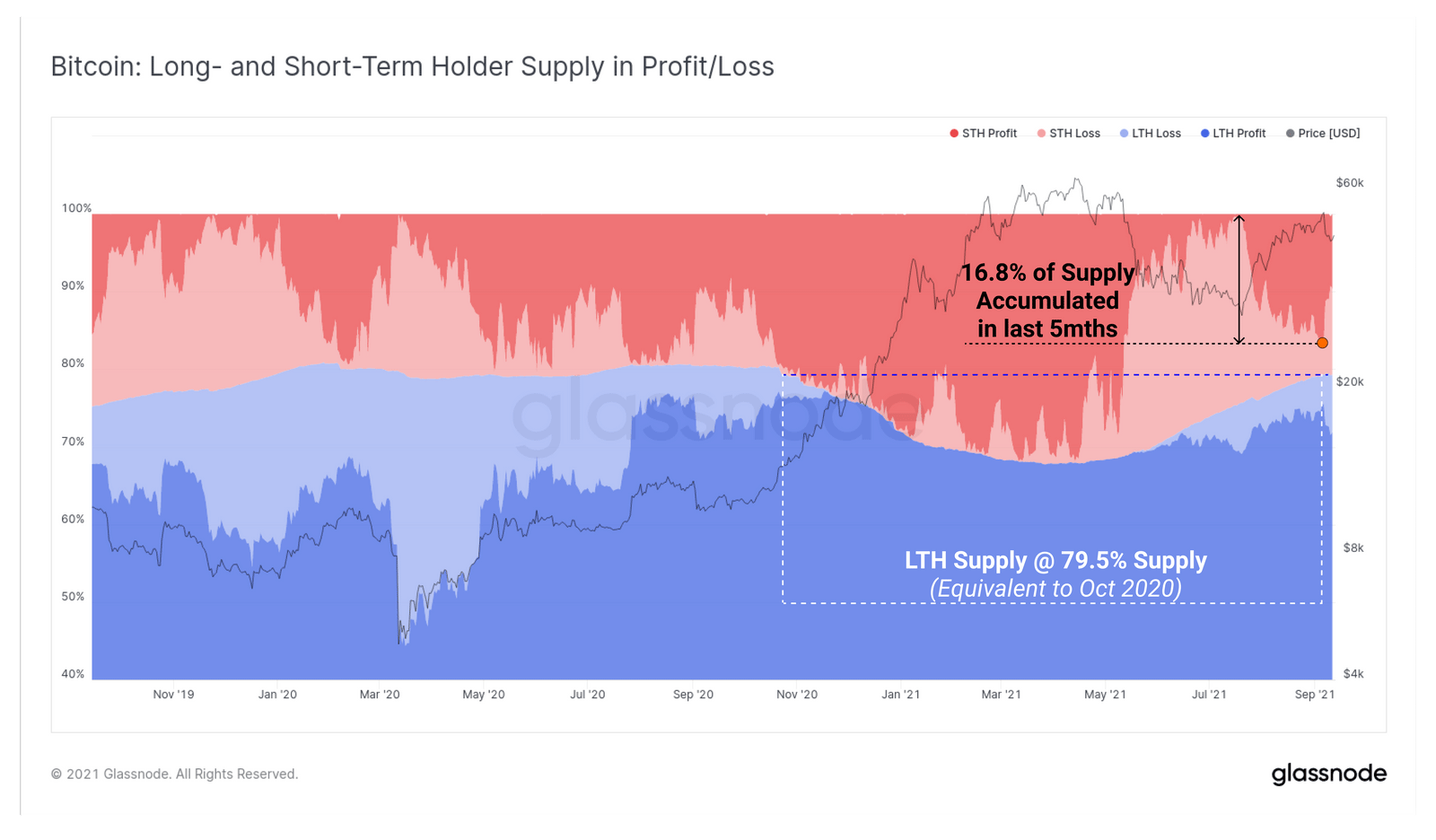

To separate short-term and long-termholders analysts were guided by the 155-day mark - in mid-April, bitcoin was trading at about $ 60,000 and was still heading for a new high. In other words, coins purchased after the highs are considered short-term investors, and before long-term ones.

As shown in the chart below, at the highslast week, about $ 52,800, over 16.8% of the coins were in the wallets of short-term holders and at the same time were profitable. This means that there has been a large accumulation of cryptocurrency in the range from the lows of around $ 29,000 in recent months.

At the same time, the share of bitcoins in the wallets of long-term investors reached 79.5%. The indicator was at similar levels in October before the start of the bullish stage.

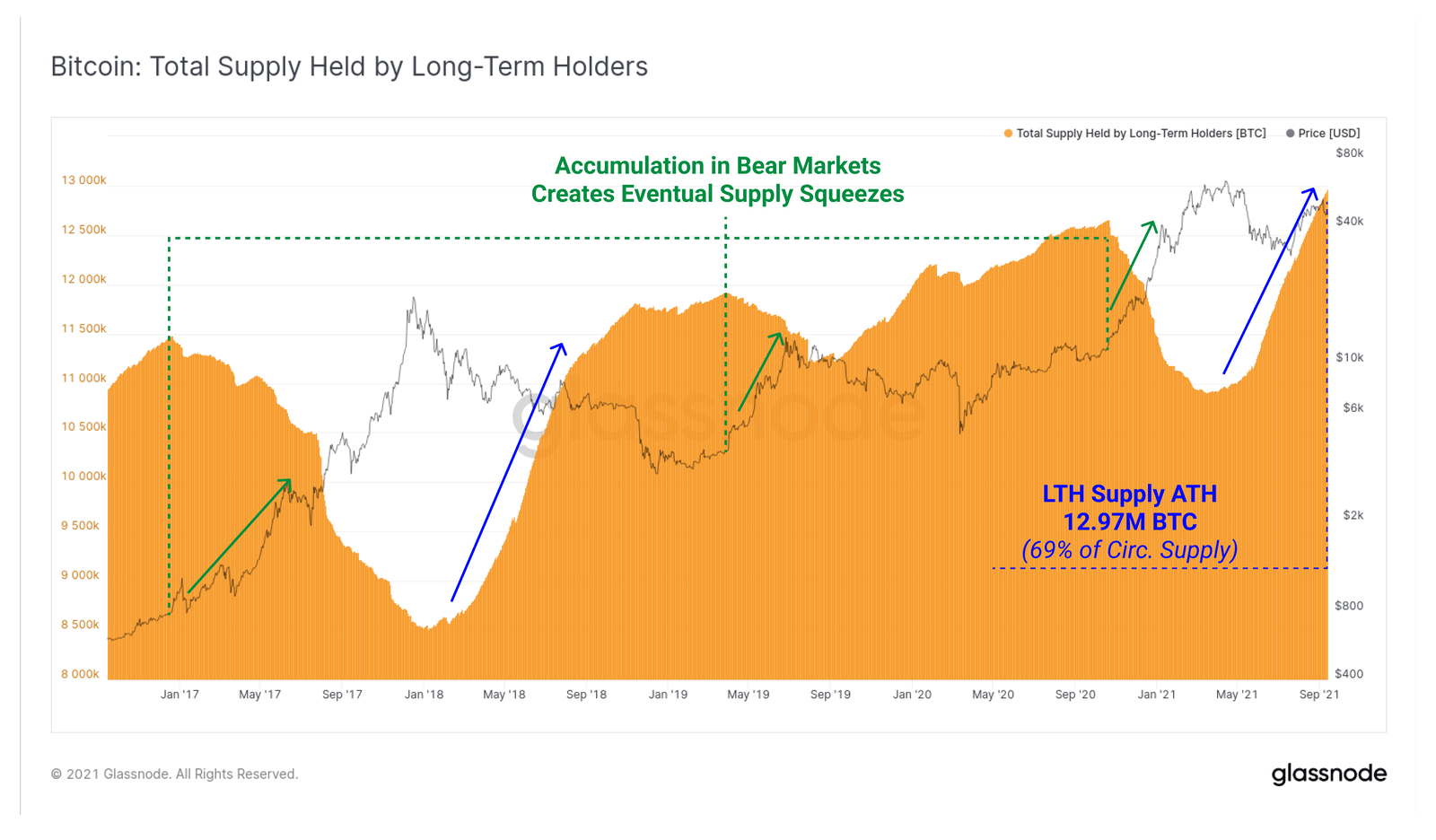

In absolute terms, the number of coins in the Bitcoin wallets of long-term holders is nowthe maximum for the entire existence of bitcoin and is 12.97 million... Peaks in this indicator usually correspond to the late stages of a bear market and herald the beginning of a bullish cycle, the authors note.

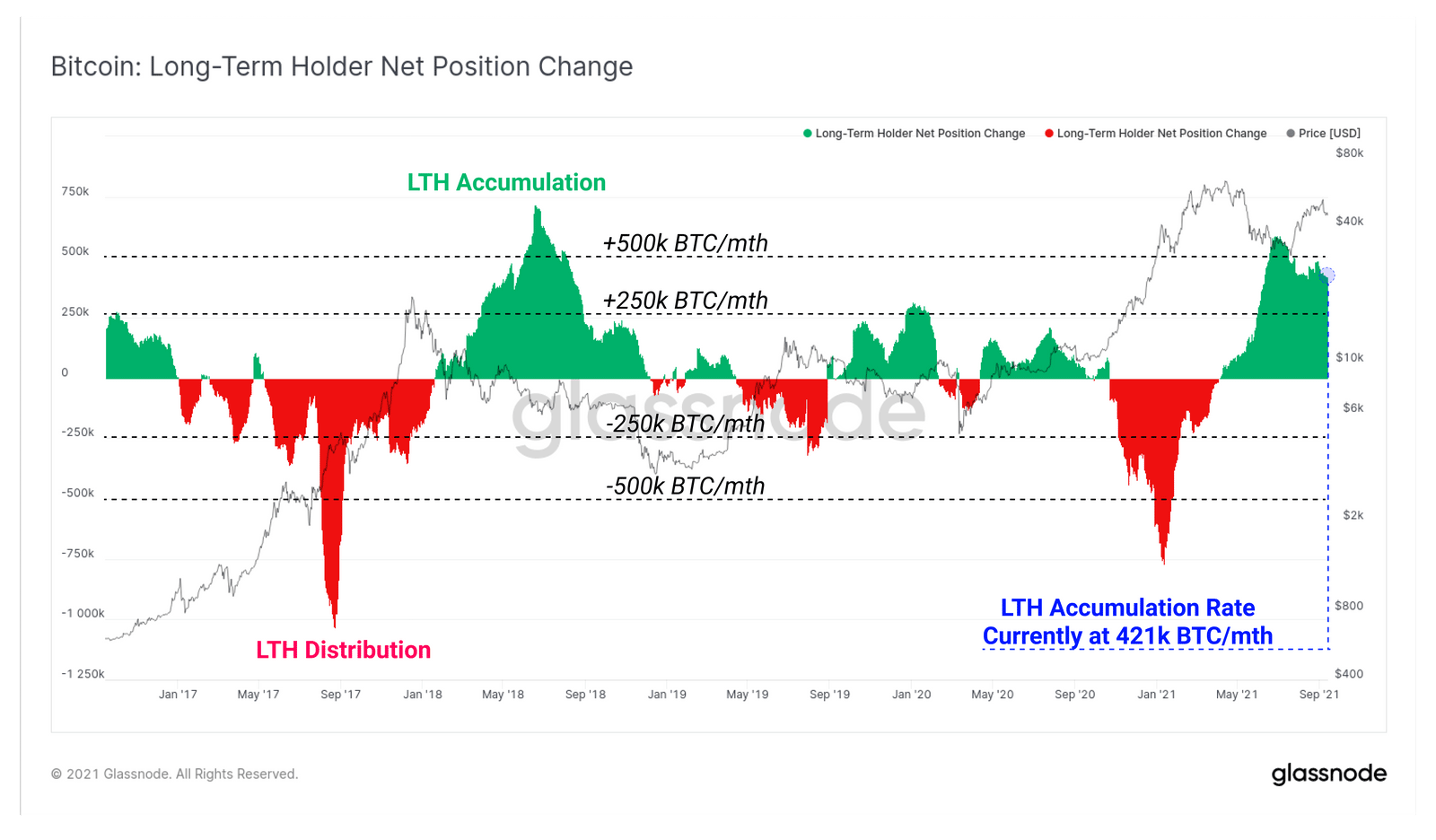

At the same time, long-term holders also boughtbitcoins are close to the highs and are in no hurry to spend them. Currently, about 421 thousand bitcoins per month are being classified as long-term holders in wallets according to the established classification.

“Since we have already established that over 16.8%of the issue was purchased in the recent range between $ 29,000 and 40,000, one can reasonably expect that this trend will continue from October to December (155 days from the consolidation of May-July) ", - write Glassnode.

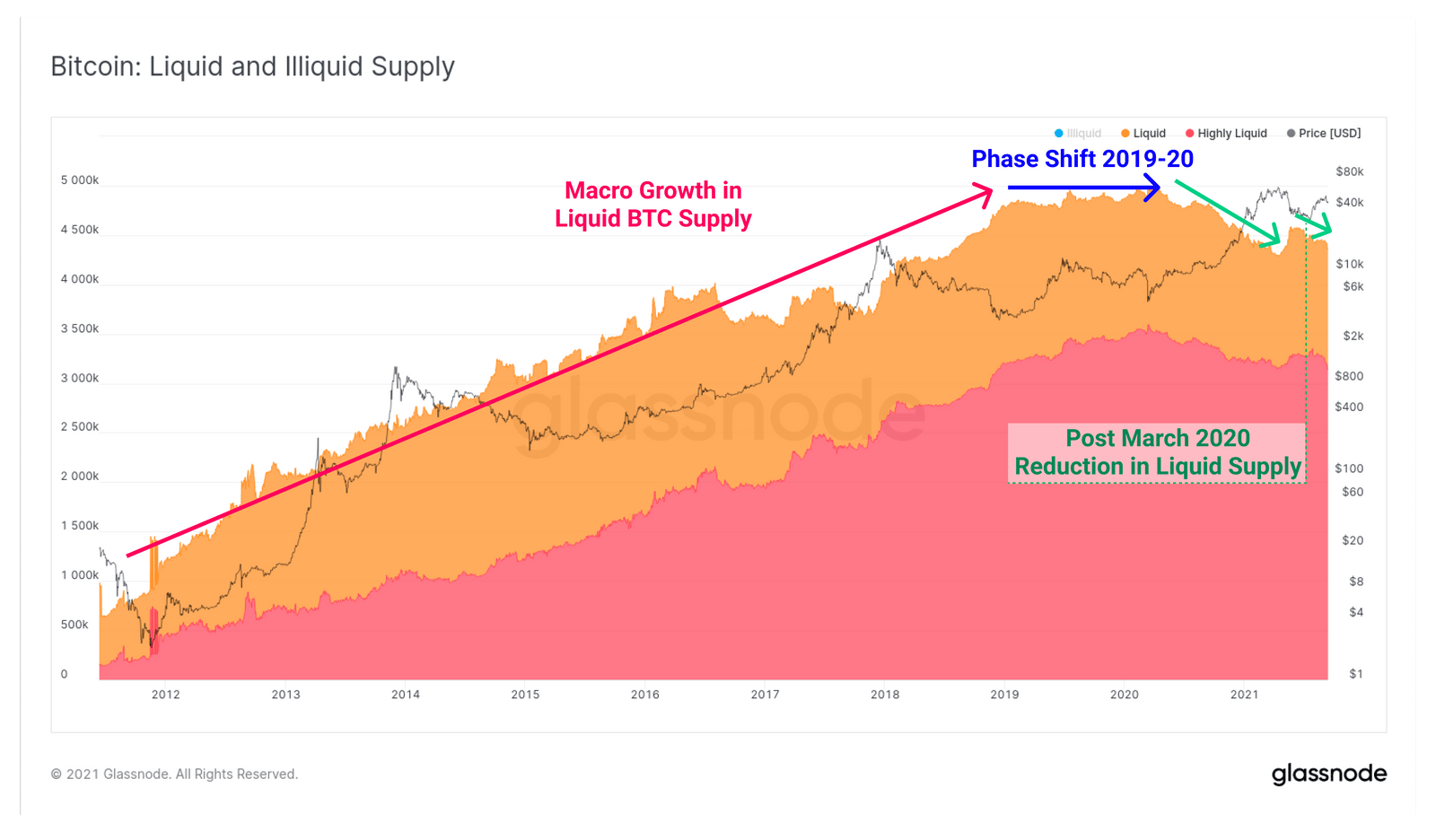

In general, the authors consider the current stage in the development of the Bitcoin market"Unique"... Most of the history of cryptocurrency has happenedan increase in the volume of coins in free circulation. After the final surrender of the bear market in 2018, the changes became neutral, and since the collapse in March 2020, there has been a trend towards an increase in the number of illiquid coins moving from exchange wallets to the wallets of long-term holders.

After a moderate inflow of bitcoins to the wallets of cryptocurrency exchanges in May 2021, the growth in the number of illiquid coins resumed:

"It looks like despite significant volatility throughout 2021, long-term investors continue to hoard bitcoins and keep their coins in cold storage.", - conclude Glassnode.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication