Sysco Corporation

Form10-Q

https://www.sec.gov/ix?doc=/Archives/edgar/data/96021/000009602120000044/syy-20200328.htm

A similar situation (in particular,last quarter) can be very dangerous and applies to enterprises of different industries.

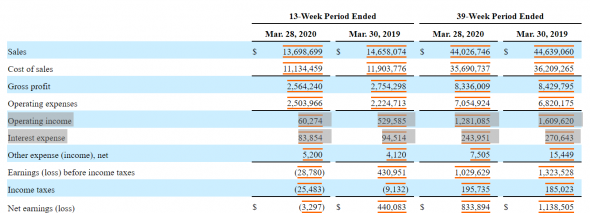

CONSOLIDATED RESULTS OF OPERATIONS

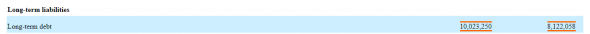

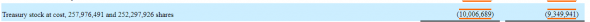

CONSOLIDATED BALANCE SHEETS

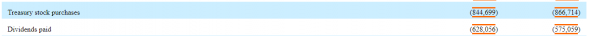

CONSOLIDATED CASH FLOWS

By the end of March 2020, Sysco's business had significantlyhas declined since federal, state, local and local governments issued shelter-in-place orders related to the COVID-19 pandemic. Many Sysco customers, including those in the restaurant, hospitality and education segments, have ceased operations due to government mandated closures to help limit the spread of COVID-19, and there are no guarantees as to how long these closures may remain in effect . In addition, even after reopening, there can be no assurance as to the time required to restore operations and sales to previous levels. Given the dynamic nature of this situation, the Company cannot reasonably estimate the impact of COVID-19 on its financial condition, results of operations or cash flows in the foreseeable future.

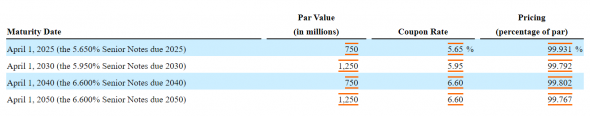

April 2, 2020, i.e. in the fourth quarterSysco in FY2020, Sysco issued Senior Notes for a total of $ 4 billion in aggregate principal, in an effort to improve the company's liquidity in response to the COVID-19 pandemic.

Sysco expects to use the net proceeds fromplacements to repay their commercial paper loans and redeem the aggregate principal of US $ 750 million senior notes due in October 2020 ...

Sysco serves a wide range of businessesCatering. Before the COVID-19 pandemic, approximately 50% of food consumption in the United States occurred outside the home, with the remainder occurring inside the home. The COVID-19 pandemic has shifted the balance and shifted more shopping to the retail grocery channel. As a result, we have changed our distribution model to include retail, food distribution and new supply chain partnerships, sectors we largely did not serve before the COVID-19 crisis.

We expect continued decline in sales growth inthe remainder of fiscal 2020 as a result of the fallout from the COVID-19 pandemic. However, we are actively seeking new revenue streams by leveraging our supply chain expertise to provide services to the retail food sector.

We expect an increase in customer bankruptcies, which could contribute to a significant increase in bad debt expense to be recorded in the fiscal fourth quarter.

We regularly participate in share repurchase programs,to ensure that Sysco continues to offset dilution associated with shares issued under the company's compensation plans and make opportunistic repurchases. In November 2017, our Board of Directors approved a repurchase program to authorize the repurchase of shares of the Company's common stock not to exceed $1.5 billion. USA until the end of fiscal year 2020. In August 2019, our Board of Directors approved a separate repurchase program to authorize the repurchase. the company's common shares will not exceed $2.5 billion by the end of fiscal year 2021. We repurchased 11.1 million shares for $844.7 million during the first 39 weeks of fiscal 2020, compared to 12.8 million shares repurchased in the first 39 weeks of fiscal 2019 for $866.7. million in March 2020.

The carrying value of total debt was $10.9 billion and $8.2 billion as of March 28, 2020 and June 29, 2019, respectively.

Some actions of management are very difficult to explain.

Now many companies will try to veil their problems...

The truth is that shareholders will ultimately pay for the stupidity of the company's management.

Management, standing up to its neck in unjustifiably erroneous actions, will announce restructuring.

Most likely, this will not affect their salaries, bonuses and cozy places in any way...

</strong>Denial of responsibility

This material is provided exclusively forinformational purposes and is not an offer or request to buy or sell securities of any company. Any investment decision made by you should not be made solely on the basis of the information described in this article. The author is not responsible for losses or profits you have received during trading in financial markets.