At the end of July 2020, the President of Russia, VladimirPutin signed the law “On Digital Financial Assets” (DFA), according to which, from January 1, 2021, cryptocurrencies in the country will become a legalized financial instrument. At the same time, settlements in digital assets, according to the document, will be prohibited. This and other contradictions have become a reason for criticism of the law from members of the crypto community.

To understand the current situation of cryptocurrencies in Russia and the changes that will take effect from the new year, the editors of Mining-Cryptocurrency.ru decided to find out the opinions of experts.

One of the first to share his vision of the situation with us was the co-founder and CEO of the Raison investment management application, Alexander Zaitsev.

- How has the position of bitcoin and other cryptocurrencies changed after Vladimir Putin signed the law on the regulation of cryptocurrencies?

«So far, the adoption of the law is nothing specialchanged. Yes, now all crypto-exchange operations of Russian clients in Russia will be regulated and Bitcoin will “come out of the shadows.” For legitimate investors who use cryptocurrency to preserve or increase capital, this will make life easier. They will no longer be afraid of their accounts being blocked by banks and other financial institutions. Those who are accustomed to using Bitcoin in gray schemes will take on additional risks.

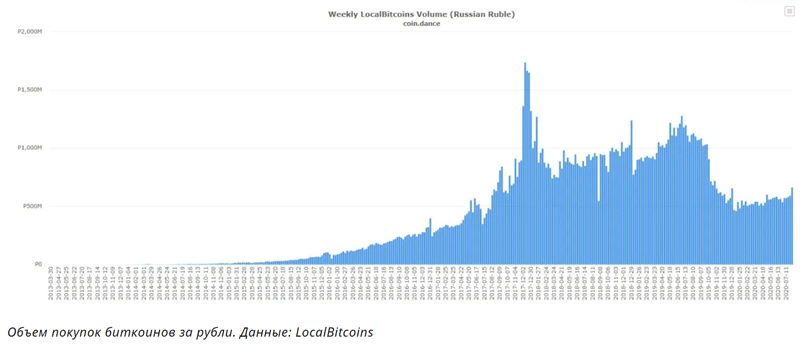

Most Russians conduct transactions with Bitcoineither through crypto exchangers (peer-to-peer transactions) and systems like LocalBitcoins (also peer-to-peer transactions in which LocalBitcoins acts as an intermediary, like in an auction), or through foreign providers.

«I don’t know any domestic providers yet,that would work within the Russian legal framework and new legislation. Perhaps these will appear, but it is not a fact that Russians will use their services.

– Do you think regulators will try to monitor crypto transactions in the Russian Federation? Do exchanges like, say, Binance, hand over information about their users to the authorities?

«From the point of view of the new legislationIt will not be difficult to track crypto transactions on the territory of the Russian Federation. Most likely, responsibility for this will be assigned to platforms operating within the Russian legal framework. This is how the system works in the European jurisdiction where our Raison platform operates. European legislation obliges us to score all blockchain transactions and take action in suspicious cases - for example, if bitcoins come from mixers (services in which transactions can be confused, increasing their anonymity). We are obliged to block such transactions and find out the circumstances of the transaction.

If the system is the same in Russia, it will be responsible fortracking crypto transactions will also be operators. As far as Binance is concerned, as far as I know, the exchange is still not legally regulated, although they recently applied for registration in Singapore. In the future, in the event of criminal and administrative proceedings, Binance will be required to transfer data where it is domiciled - if required by local authorities. However, I doubt that today the exchange shares information on all clients, although only representatives of the company itself can accurately answer this question.

For some Binance clients there is noregulation is a plus, for others it is an additional risk. If a gray Bitcoin transaction occurs between users and Binance does not slow it down, a bona fide buyer may face additional problems.

- How to conduct operations with cryptocurrencies from 2021 in Russia?

«For now we can only guess.Will Russian businesses have the opportunity to nominate accounts in rubles, but accept payments in bitcoins? Most likely not, but it is not excluded. If merchant providers act as a crypto-acquirer (change cryptocurrency into rubles and transfer them to the recipient’s bank accounts), legally this will not be considered a settlement in bitcoins, but de facto it will be. For businesses, this additional opportunity to receive payment from the buyer is undoubtedly a plus.

You can determine the purpose of the transfer in the blockchain,only when the wallet is serviced by a regulated operator. If in the future all crypto transactions in Russia are facilitated by regulated exchange operators, they will be required to monitor the purpose of the transactions and report suspicious cases. This is required by the anti-money laundering law.

Official representative of the cryptocurrency exchangeGarantex, Tatiana Maksimenko, in turn, believes that the process of buying and selling cryptocurrencies, against the background of the entry into force of the law on digital financial assets and digital currencies, is unlikely to change significantly in 2021.

“As before, no one bothers to exchange bitcoins forone of the foreign trading platforms. Most of the operations for the purchase and sale of cryptocurrencies were not carried out on sites registered in Russia anyway ", - said the expert.

The law, according to Tatiana Maksimenko, prohibits making payments for goods and services using cryptocurrencies, but no one did it openly.

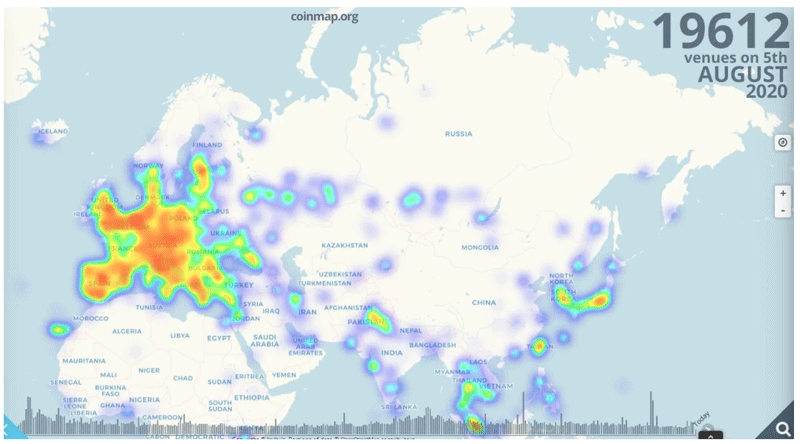

Map of crypto ATMs and places where you can legally pay in bitcoins, which demonstrates the level of distribution of cryptocurrencies in the Russian Federation, in comparison with Europe:

"If such operations were performed, they were done through a series of exchange operations with fiat, and in the financial statements they were displayed as ordinary operations with the Russian ruble.", - the representative of Garantex explained her point of view.

Large operations for the purchase and sale of cryptocurrency,in her opinion, they will continue to carry out in a semi-legal mode - when the seller and the buyer meet face to face, exchange money and a conditional flash drive.

“If anything changes, it will be a tougher attitude of banks towards incomprehensible transfers between individuals. But this is not so much connected with the law on DFA,how many with other initiatives and laws, includingincluding a ban on replenishing anonymous electronic wallets or the latest proposal of the Ministry of Finance to confiscate funds of Russians if the source of their origin is not confirmed", - said Tatiana Maksimenko.

By tracking transactions, as the expert noted,Rosfinmonitoring and the banks themselves should be involved in order not to fall under Central Bank sanctions. But determining the purpose of each transfer, if we are not talking about millions of rubles at a time, according to her, will be quite difficult.

“In any case, the era of universal use of Sberbank. Online is coming to an end. The state will take control over this huge flow of money that circulates between individuals ", - summed up the representative of Garantex.

To summarize

Despite the readiness of the legislative framework, howit is its application that will change the position of the digital asset market in the Russian Federation, it is not fully known. Experts draw attention to the fact that the government does not have the resources for total control of all operations with cryptocurrencies. Against this background, it can be assumed that market participants, despite the adoption of the law, will be able to use coins for illegal transactions.

To other conclusions:

- It is beneficial for the government to control the digital asset market. In the future, in order to improve the conditions for monitoring transactions with cryptocurrencies, regulators may take additional actions.

- The adopted law on CFA is not detailed enoughdescribes the principles of interaction between participants in the digital asset market. Representatives of the cryptocurrency-related business also do not fully understand how innovations will affect the position of cryptocurrencies in the country.

- The ban on settlements in cryptocurrency is not an obstacle to conducting semi-legal transactions. For example, using mixers to increase the anonymity of operations.

At the time of this writing, there is nocurrent regulatory framework for cryptocurrencies. In other words, as of August 10, 2020, Russian laws do not recognize the existence of bitcoin - they do not mention digital assets. Accordingly, operations with cryptocurrencies in Russia today are not prohibited.

</p> 5

/

5

(

1

voice

)