Often, advanced trading data on cryptocurrency exchanges can only be obtained through third partiesservices like Coinmarketcap, Coingecko, Messarior Skew. These services allow you to study trading volumes and price movements of cryptocurrency instruments on exchanges. However, some exchanges independently provide access to tools for analyzing trading data. Listing.Help analysts conducted a market analysis and compiled a list of the main opportunities to get acquainted with the trading data of bridges.

Own terminals

Since January 2020, OKEx has been offering itsusers with additional “Trading Data” functionality for working with trading data of both the spot market and the futures market. Traders can use these indicators to predict further market movements and develop trading strategies.

On the OKEx exchange in the Trading Data section there are threeindicator for spot trading: this is the Margin Lending Ratio, the Taker Buy and Sell ratio indicator, and the USDT C2C interest rate.

There are also seven indicators for trading.Futures: the ratio of long and short positions (Long / Short Ratio), an indicator of the difference in the price of futures and spot positions for cryptocurrency (Basis), the funding rate for perpetual swaps (Perpetual Swap Funding Rate), the ratio of the amount of open positions for futures and trading volume (Future Open Interest and Trading volume), a Taker Buy and Sell ratio indicator for futures, the Top Trader Sentiment Index and the average amount of margin funds used by the best traders.

As a representative of the OKEx exchange explained:

It is very important for the team to providehigh-quality and professional service for users. Therefore, we always try to take into account the needs of the markets and quickly integrate all the new products that are available on the market. We support spot and margin trading, derivatives, futures and swaps. We also have a decentralized exchange, a mining pool and our own blockchain. Therefore, we are pleased to provide all the opportunities for highly profitable trading.

All indicators are available for a range ofcryptocurrencies: BTC, LTC, ETH, ETC, BCH, EOS, XRP, TRX, BSV and are updated online. In addition, they have recently become available on the personalized OKEx dashboard on the skew service. To understand the ways of working with them, we will analyze a couple of indicators on bitcoin futures.

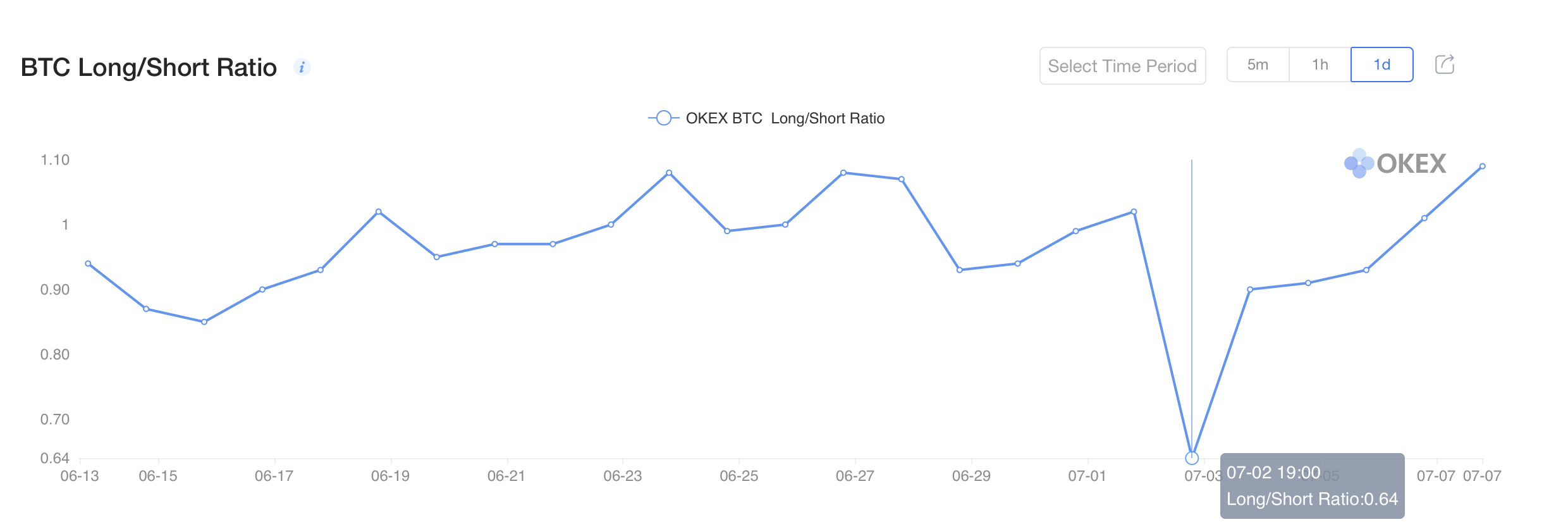

The ratio of long and short positions

This indicator shows the ratiousers with open long and short positions for a certain period of time. The indicator includes user data on weekly, two-weekly and quarterly futures, as well as on perpetual swaps. The position ratio is calculated based on the totality of the user's open positions. For example, when a user has long and short positions in BTC at the same time, but he has more long positions than short ones, he will be classified as a holder of a long position.

Leading Traders Sentiment Index

This indicator reflects the percentage of long andshort positions held by traders on the top 100 list. One active account is entitled to one vote, regardless of the size of its position. Only accounts that have opened a position are considered active and are included in the indicator.

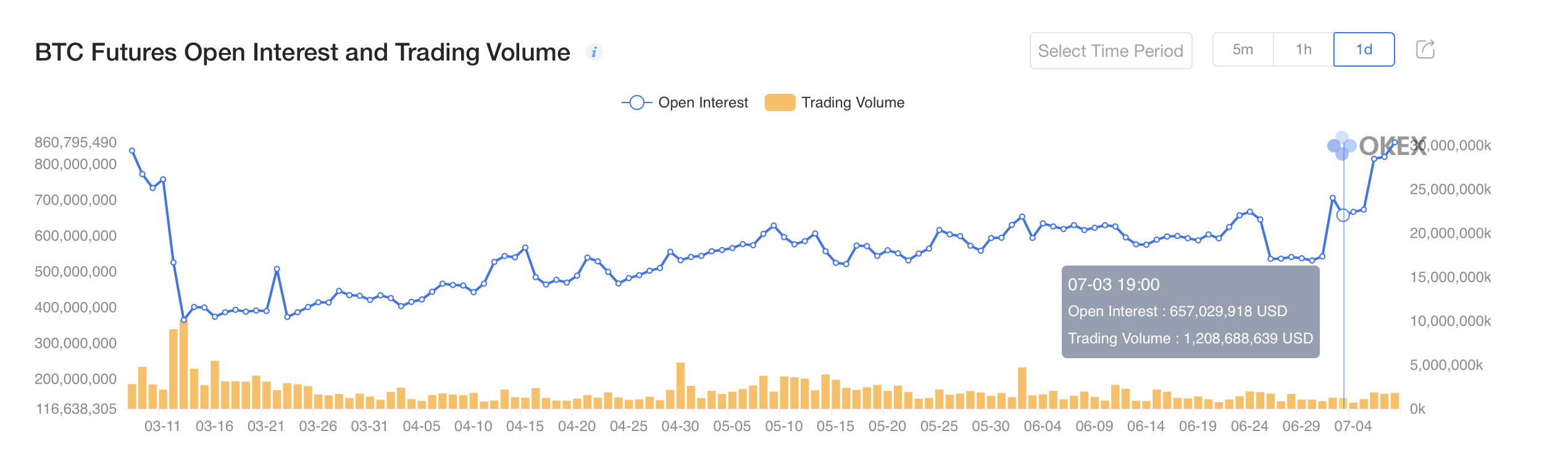

The amount of open positions on futures and trading volumes

Total funds held: the total amount of long and short positions of held futures and perpetual swaps of a particular asset over a period of time. Trading Volume: The total trading volume of futures and perpetual swaps of a particular asset over a period of time.

OKEx Exchange combined both indicators tousers could find out the volume of liquidation and the volume of executed orders in the market. When the volume of trade increases, but the amount of funds held at the same time decreases, this means that many orders have been executed or liquidated. But when the volume of trade and held funds increases simultaneously, this means that traders open many orders.

The Bybit exchange has a similar terminal with indicators. According to Ekaterina Panchenko, head of strategic partnerships at Bybit, “For the analysis of the market, we use the expertise of our partners TradingView, TigerTrade, Bookmap and many many others. Partnerships with experts in analytics help us to be experts in providing in trading operations ”

Such partnerships are complemented by Bybit Historical Data. In it, the exchange allows you to collect information about price movements and volumes of futures trading on BTC, ETH, EOS and XRP.

Subscribe to ForkNews on Telegram