Bitcoin is now trading around $12,000, a level it has broken through twice in the past two weeks.and did not gain a foothold above. What is the impact on the price of the USDT issue and the influx of new investors?

After surpassing $12,000 on August 2, the first time since June 2019, it found itself in a bull trap.Such traps occur when multiple sell orders are placed at or close to a specific price, and the trading price reachesAt this point, a large number of sell orders are triggered (usually at lower prices to ensure quick trades), which sendsthe price is down.

Each of Bitcoin's previous failed attemptsconquering $12k, fortunately for the hodlers, ended with a recovery. The reason for this is the nature of supply and demand in the Bitcoin ecosystem with rising prices, as detailed in a recent market report from Chainalysis.

Despite the rise in prices, currentlythere is a high demand for bitcoins, which has happened only three times in the entire history of cryptocurrency, including during the bull market of 2017-18 and in June 2019.

The first indication of the source of this demand is crypto-to-crypto exchanges, where the Tether stablecoin "provides liquidity."

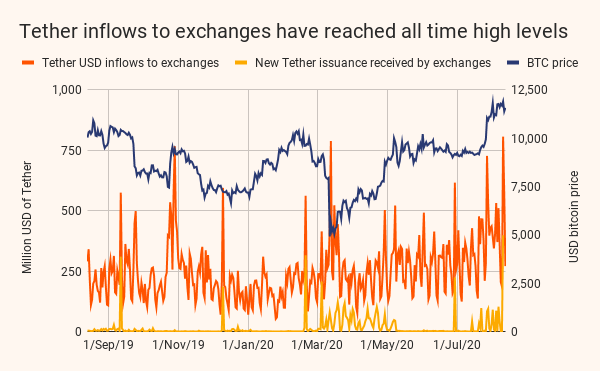

August 10 USDT wave of 806 milliondollars poured into several exchanges, accounting for 9% of the total supply. The report notes that these one-day pumps "are based on an upward trend in inflows [to exchanges] since April." One USDT dollar has a 19x liquidity return on the exchange, and so it's no surprise that more USDT in the markets means more cryptocurrency trading.

The Chainalysis report states:

"Given that, on average over the past seven days, Tether received by the average major exchange has traded 19 times, Tether maintains tens of billions of dollars of liquidity per day."

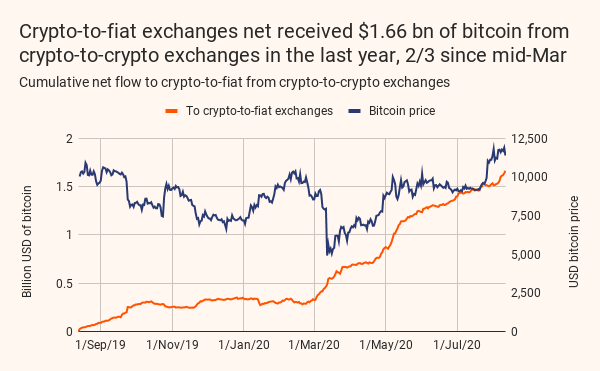

Despite this wave of new stablecoins, the exchangeFiat for cryptocurrency is the mainstay of the "new demand for bitcoin", not the exchange of cryptocurrency for cryptocurrency. Author Philip Gradwell, chief economist at Chainalysis, said this because bitcoin is "leaving the crypto-to-crypto exchange and heading to the crypto-to-fiat exchange." That churn in 2019 totaled a whopping $ 1.66 billion.

Gradwell identified two key reasons for this churn (or positive net flow for converting crypto to fiat).

- First, given the rising price, traders intend to cash out fiat currencies, which indicates the supply of bitcoins.

- Second, buyers looking at this rising price want to enter cryptocurrency through fiat, which underscores the demand for bitcoins from new buyers.

Another important point to notepay attention, — it is that of the above $1.66 billion, $1.12 billion has been a net flow since mid-March, when the price dropped to below $4,217,000 and began to rise. The Chainalysis report says this:

«As the price exceeded $10,217,000, the net flow of crypto-to-fiat exchanges accelerated, with 154,000 bitcoins purchased for fiat since July 27.».

If this demand was absent from the market,the accumulated pressure from sellers would "lower the price." In the future, the equation of supply and demand for bitcoin will be crucial in the formation of a long-term price trend.

Rate this publication