The Bitcoin mining industry is attracting the attention of traditional and venture investors. With the adventsynthetic assets and financial instruments based on the hashrate, there are more options for investing in mining.

This testifies to the maturity of the sector, but investors still lack the knowledge and experience to build the right investment strategy.

Researchers from Anicca Research talked about what options those wishing to invest in mining have besides purchasing and connecting equipment to the network.

They classified all hashrate-related assets and financial instruments and considered their advantages and disadvantages.

Key:

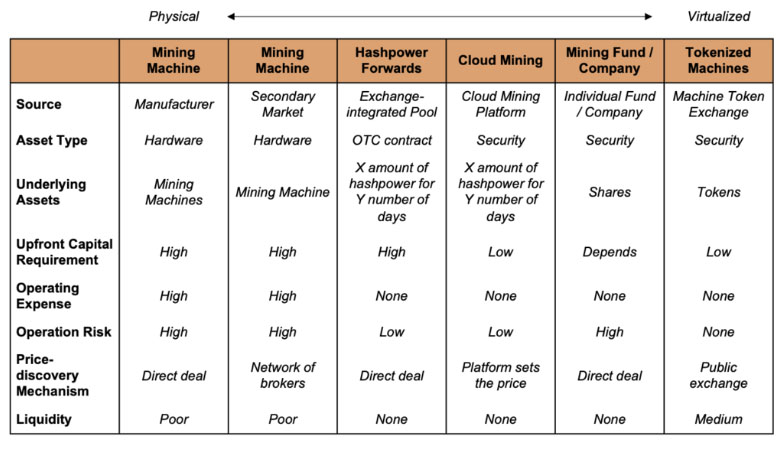

- Investments in mining are possible not only through the purchase and operation of equipment, but also through financial instruments (contracts for cloud mining, machine tokens, hash forwards, and others).

- Markets for such synthetic instrumentsare that most projects are small and immature, there is a risk of fraud, so you should use only reliable, time-tested services (the rating of cloud mining services can be found here).

- Another way to invest in mining is to work with specialized companies (SPVs).

Equipment Markets

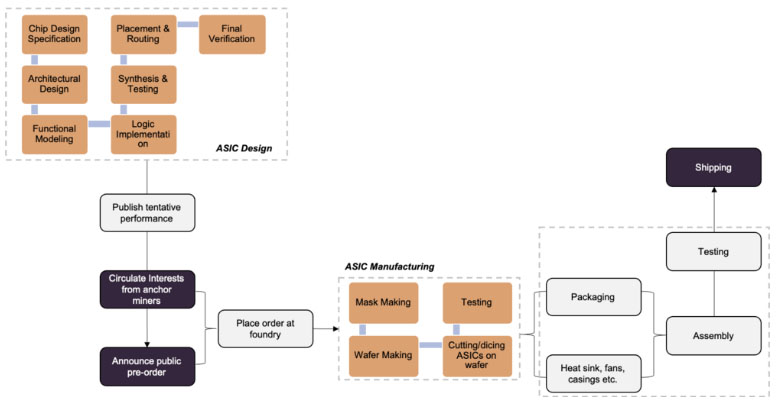

Mining is significantly influenced by factors such asquality characteristics of equipment, farm location and power supply conditions. The production of ASIC miners includes many stages, including the development of microcircuits (chips), production itself, supply chain and maintenance.

Manufacturers usually release new equipmentare scheduled for the monsoon season in China's Sichuan province in May to maximize the demand from miners. Most often, new items are sold out instantly. A small percentage goes to retail. Most of the devices are shipped to large miners and distributors on pre-orders. The new generation of ASIC miners is usually available about six months after the announcement.

Purchasing new devices from manufacturersis like buying contracts for the supply of oil before the 1980s. The seller under the contract agreed to deliver the agreed amount of oil on schedule, but the price was unilaterally determined by the oil company.

After 2018, miner manufacturers have becomemore careful in inventory management. They only collect devices after orders are confirmed and aggregated. Buyers usually expect 2-3 months of delivery.

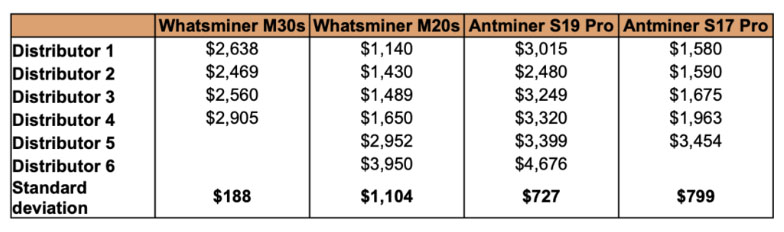

Many are forced to purchase new equipment at a premium from distributors. The price for it can vary significantly depending on the location of the distributor and the availability of the product.

There is a fairly large secondary marketmining equipment. Shopping on it requires significant experience. Most of the deals are done without a middleman, and sellers understand the quality of devices better than buyers. As a rule, used ASIC miners are not guaranteed and often do not provide claimed performance characteristics.

In the secondary market, it is even more important to select reliable distributors and sign contracts that provide compensation in the event of delayed delivery or poor quality equipment.

It is common knowledge that the mining equipment market is illiquid. Some of the devices are easier to buy from the secondary market because they have been in production for longer and in larger quantities.

Mining devices are a commodity. Equally efficient machines can have the same price from different manufacturers. But once they enter the secondary market, it all depends on supply and demand. This is why, even though Bitmain has been ousted by MicroBT and Canaan over the past two years, Bitmain's devices still dominate the secondary market.

ASIC miner cost estimation

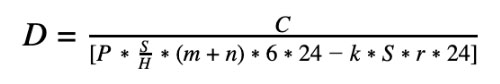

The price of mining devices is influenced by manyfactors, but most of all it depends on the profitability of mining. The most commonly used estimate of the cost of machines today, especially in China, is the number of work days to break even. This indicator is easy to calculate and intuitive.

Where:

- D - static days to break even.

- C - upfront capital costs.

- P is the current bitcoin price.

- S is the hash rate produced by the purchased hardware.

- H is the network hashrate.

- m is the block reward (currently 6.25 BTC).

- n is the current average transaction fee per block.

- k - efficiency (J / TH) of equipment.

- r is the total cost of electricity ($ / kWh).

However, this is a static metric that cannot capture all the components of the device's cost. Its two main components are income and price.

Before investing in mining, you need tounderstand your cost structure and record your unit costs for the life of your machines. Income is determined by the price of bitcoin, the network hash rate and the size of the block reward.

Synthetic hashrate

In addition to the complexity of the financial assessment,buying and operating mining devices comes with many operational risks. For retail buyers, the process can be challenging. An easier way to invest in cryptocurrency mining is with hashrate-based synthetic assets.

One of them -cloud mining contracts... It is a primitive form of a financial derivative that separates the hash rate from the physical location of the equipment.

Over the years, appeared and disappeared imperceptiblycountless cloud mining projects. The dilemma of such proposals is that they are clearly aimed at retail investors, as large players prefer to work with equipment. But evaluating such contracts requires knowledge of the mining industry and experience with financial derivatives. This is the main reason why, despite the fact that in theory, the concept of cloud mining is the next natural step in the development of capital markets in the industry.

Immature and still relatively smallsphere, cloud mining suffers from a complete lack of market standards. You can see that there are completely different contract terms and prices on different platforms:

Due to additional cost markupgenerating a hash rate requires specific market conditions for cloud mining to be profitable. As a rule, after a long period of decline, the price trend turns into a rally (for example, April-May 2019). Then the demand for the hash rate increases. Buying and installing ASIC miners takes time, and buying cloud mining contracts is a faster way to invest in mining.

Another synthetic asset based on hashrateare “machine tokens”. These are liquid tokens that virtually represent part of a mining device. Traders speculate on the volatility of the secondary market for the machines, not the coins that the equipment produces. The concept has been around for some time, but the size of this market has not shown significant growth. The main reason is that the multidimensional nature of mining revenues makes it difficult for speculators to form a consensus on the pricing of these assets.

Experienced traders can structure portfoliossynthetic assets based on hash rates. For example, buy a long contract for cloud mining at the same time as a long position in futures on a hash rate and add a short on BTC futures. There are many creative ways to structure portfolios using financial instruments. For foundations and trading firms that do not want to operate equipment, this is another opportunity to invest in mining.

In practice, drawing up a balancedportfolio is a task with many nuances. The hedge ratios for each instrument must be constantly updated. Management requires careful monitoring and frequent adjustments. There are many constraints, such as low liquidity and non-transparent pricing. Traders need to understand exactly what risks they need to take into account.

For miners, a new way to hedge steelforward contractson hashrate.Similar to leasing computing power on cloud mining platforms, forward contracts allow a miner to sell a fixed amount of hashrate over a specified period of time at an initial price. Unlike cloud mining, they usually offer more flexible terms. But without an accepted benchmark, the forward market has no established pricing system. Every transaction turns into a negotiation, and the agent who conducts it inevitably takes on certain risks.

The number of such transactions will grow as more and more exchanges and financial services integrate with mining pools.

Many are interested in the flow of BTC from miners, but the large pool of liquidity at cryptocurrency exchanges allows offering creative and potentially risky types of transactions to win this race.

Miners can set parameters toalways sell a percentage of your hashrate to pay operating costs. The counterparty receives a flow of coins produced by this hashrate from the pool. For example, a miner can pre-sell 100 TH/s for 30 days at the beginning of the month. Based on the expected increase in mining difficulty and fees, the pool offers to pay 0.02 BTC upfront. The miner blocks 100 TH/s in production for the entire month, transferring production risks to the pool.

Binance, OKex and Huobi are actively expanding their pools. Other exchanges are expected to follow suit or partner with existing pool operators. Some financial and trading companies are also moving in this direction: Babel Finance intends to launch a mining pool Ethereum (ETH), Three Arrows Capital - to offer structured products through Poolin.

Specialized companies for hashrate investing

Since most traditional investors andventure capitalists do not have the skills and experience to manage equipment or structure complex portfolios of assets based on hash rates, they often invest in mining through specialized companies (SPVs). SPV managers buy and operate machines for the capital of investors, and in exchange take a share of the proceeds.

How SPV managersmanage cash flow. Developing a smart sales strategy to cope with changes in the market environment is critical to financial success.

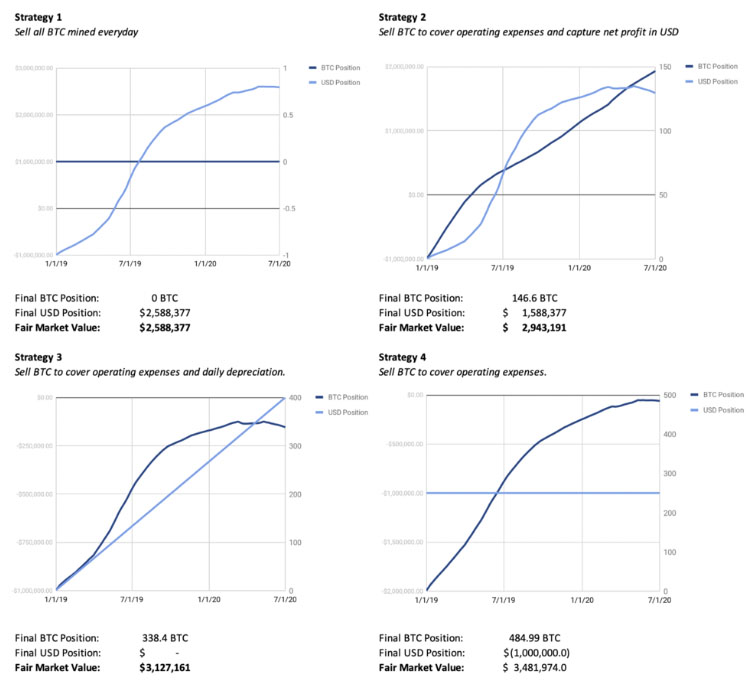

There are four typical strategies to consider under the assumed conditions:

- Start date: 01.07.2009.

- Evaluation date: 07/01/2020.

- Initial Investment: $ 1 million

- Number of devices: 4,840 S9 units, purchased at $ 206.6 per unit. Depreciation is charged on a straight-line basis over 18 months.

- Total hash rate: 67,761 TH / s.

- Total power consumption: 6 389 kW.

- Total electricity price: $ 0.04 per kWh.

Options:

- Sell all mined BTC daily.

- Sell BTC to cover operating expenses and lock in net profit in USD.

- Sell BTC to cover operating costs and equipment depreciation.

- Sell BTC to cover all operating costs.

The strategies indicated represent differentrisk preferences for positions in BTC and USD. The most profitable ones may not provide maximum returns in a different market environment. Depending on the manager's goal (accumulation of BTC or return on investment in USD), the strategy can be adjusted in the right direction.

Mining enterprises with experiencedtraders can also sell rewards and redeem coins when the price falls below the production cost, use financial instruments (secured lending, BTC futures, etc.) to protect against price risks.

There were many well-capitalizedmining projects that have failed due to mismanagement of trading positions. A notorious example is Gigawatt in 2018. According to court documents, the company's assets were valued at less than $ 50,000 with liabilities of $ 10- $ 50 million at the time of the bankruptcy declaration.

Cloud mining — the best Bitcoin mining option for 2020

For the vast majority of investorsThe best option for mining bitcoin in 2020 remains cloud mining, due to the flexibility of contracts and more favorable working conditions than mining on your own equipment.

Cloud mining is a model of earningcryptocurrency, which creates groups (mining pools), with one goal: to generate more income, in comparison with conventional distributed mining, due to the management of equipment by a contractor who solves all issues related to technical and software components.

TOP-3 reliable cloud mining services according to Mining-Cryptocurrency.ru:

| Service | Rating | Detailed overview |

| IQ Mining (Editor's Choice!) | 9.8 | Read the review |

| HashFlare | 7.1 | Read the review |

| Genesis mining | 6.8 | Read the review |

The criteria by which the score is given in our rating:

- Profitability and profitability– we calculate the payback period, clarify the reality of mining.

- Prices and commissions– we take into account the validity of tariff plans and compare them with competitors.

- Deposit / withdrawal, discounts, reliability– we analyze reviews, test the correctness of accruals and withdrawals.

- Convenience of the platform and site– we evaluate the functionality, errors and failures when working with the service.

- Features of the company– unique services and useful services, period of work on the market.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)