Optimization of Mechanical Trading Systems.

What the note cycle is about

We begin a series of short notes abouttrading algorithms.

Our experience and quotations from worthy books are based on our work.

The purpose of the notes is to structure knowledge about building trending strategies and optimizing them.

We hope that our notes will be interesting for traders with different levels of knowledge.

In a series of these notes will be:

- What strategies are needed for.

- How trading strategies are developed.

- Revenue and drawdown.

- Optimize trading strategies. Re-optimization, instructions on how to avoid it.

- Let's show optimization problems that lead to unreliable results and losses in trading.

- Algorithm operation in the real market. Expectation and reality.

- Evaluation of the results of the work.

What strategies are needed for.

Let's look at two simple strategies.

Investing strategy in Sberbank at the end of 2007

In this strategy, we bought shares of Sberbank for 100,000 rubles.

Without taking into account dividends, we received an income of 83,000 rubles over these 12 years.

With an income of 83%, we immediately lost 85% of the initial deposit in value.

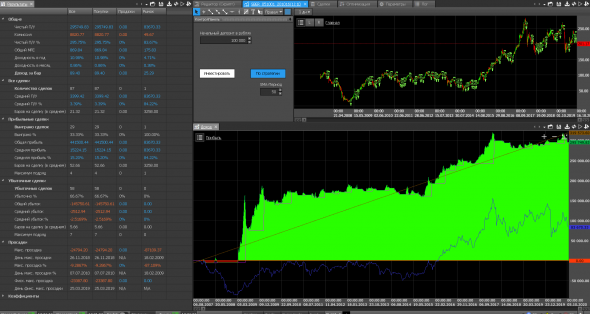

The second trading strategy under consideration is the intersection of price with the arithmetic average.

Work only from purchase

In this strategy we used the same deposit of 100,000 rubles.

Without taking into account dividends, we received an income of 295,000 rubles over these 12 years.

With an income of 295%, at the moment we suffered a drawdown of 25% of the initial deposit.

No optimization has been carried out, this is left to you. Commissions are taken into account.

Do not call to trade the first or second strategy.

We are only talking about the need to compare performance indicators.

While both strategies are right to life, if you are satisfieddrawdown and that's what possible income is.

Before you start trading, the main thing is that the strategy is clearly defined.

Trading without any strategy always leads to losses.

If the risks are not determined in advance, this gives a person the right to make rash actions in the market.

Therefore, if your strategy is Buy and Hold for 10 years, then you need to buy and hold for 10 years.

No 85% losses should worry you, even though the whole world will collapse, the strategy is clear and understandable.

It is not necessary to trade on a strategy without knowing the probability of success and the magnitude of risk, and therefore the size of the initial deposit strategy necessary to achieve the desired results.Such trading is also the most common result of losses.

Those. Before you start, you need to choose a goal. To choose a goal, you need to understand what you can get from the market. What tools can you use to achieve your goals?

The main purpose of the strategy testing is to understand what results can beto be obtained from the application of a set of rules, indicators and formulas.

Testing allows you to find out whether an idea has always worked and whether it is likely to work in the future.

Testing a strategy allows you to find out which formulas have errors and which formulas are absolutely correct.

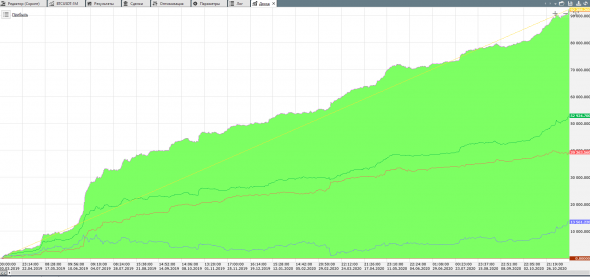

Different traders have different volumestrading capital, time, profit requirements and risk appetite. Optimization allows you to tailor your trading strategy to the preferences of each trader.

But optimization has its own pitfalls on which in future notes we will dwell in detail.

The fact is that any testing causes a constant desire to improve the system into something more. This leads to the appearance of many parameters in the system.

The current development of computers allowstesting so many combinations of patterns, rules and formulas that it leaves no doubt in front of the trader that a successful strategy will certainly be found or confirmed.

Our experience shows that increasing the number of parameters in the system does not always lead to profit in real trading.

There is a huge difference between optimization (correct testing) and adjustment (wrong testing).In our notes we will try to give practical information on this topic, in order to correctly solve the problem of adjustment (re-optimization).

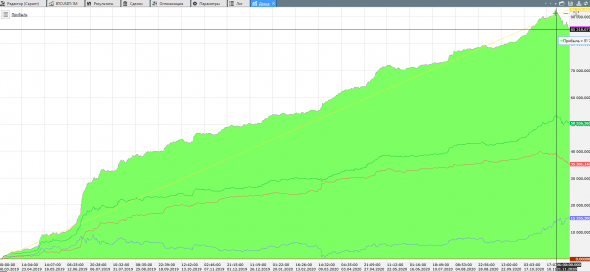

An example illustrating the problem if the strategy picture above was launched into trading immediately after optimization:

Conclusion of the note “What are strategies for”

Trading without strategies leads to losses.

The strategy must be clearly defined.

The value of any trading strategy is expressed in two interconnected parameters: income and drawdown.

These two indicators of trading performance cannot be considered separately;

they can only be considered in relation to each other.

These two performance indicators are fundamental, so they must be measured very accurately.

Measurements are needed so that a person can determine for himself his pain threshold when achieving a goal.

When there is no long-term trade experience, accurate measurements can only be obtained by testing historical data.

The development of a strategy is associated with optimization, which encourages a person to do too complex things from simple things, which ultimately leads to problems in trading.

In our short notes, I would like to show the way of unconfidence, haphazardness, shattered nerves, exhausting stresses, to meaningful trading.

If you are interested in this topic, put the article "Good" and subscribe to our blog.

You can discuss it in our Telegram chat; users often raise interesting topics.

The strategy created using the TSLab visual editor for this article can be downloaded here.