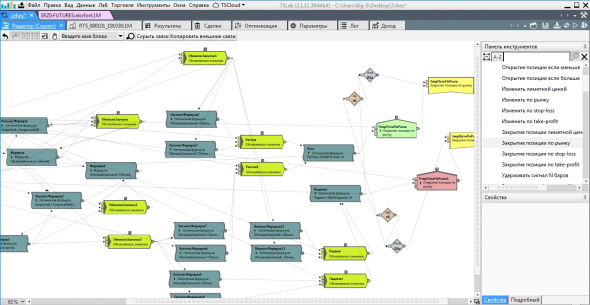

I would like to immediately clarify that the system itself essentially does not have indicators inside, but any of our logic is soor otherwise created an indicator.

The idea is really simple, we sum up the volume on rising candles, separately from falling ones, up to a certain “cutoff”. In our case, the cutoff is the indicator (the very parameter that can be changed).

We check the logic, if the volume on both falling and rising candles has reached the desired value, and the market has grown, then we buy, if it falls, we sell.

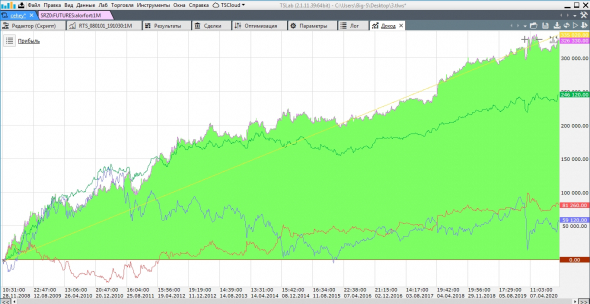

The equity looks pretty good, although if you look at the transactions, it clearly begs to be attached to the stop position.

For those who want to understand the use of blocks of updated values, the very thing is to open this script, since it basically consists of these blocks!)

There are only two parameters in the robot, Constant andConstant1, the first is the required volume for rising bars, and the second is for falling bars. Naturally, it depends on the paper what value to indicate, and whether you intend long transactions or quick ones. In the example indicated for RTS, the average speed of transactions.

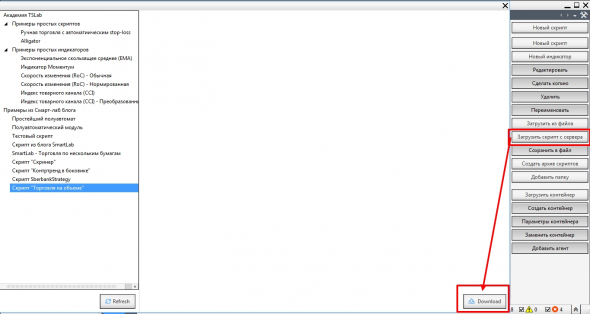

The script is available for download to everyone. You can also now request such scripts from the program.

We also remind you that TSLab can be used absolutely free on binance, okex, lmax - www.tslab.pro/ru-RU/home