Several notable on-chain analysts and traders have changed their short-term forecasts for Bitcointo neutral or bearish, while the price of BTC is having difficulties with the return of the upward momentum.

Ki Young Ju, Head of CryptoQuant anda well-known on-chain analyst believes that Bitcoin's short-term outlook is likely to range from neutral to bearish.

There are two main indicators that have been shown to be useful for identifying temporary trend reversals within the current bull cycle.

The first one is whenever there was a coursethe premium on Coinbase - that is, when BTC started trading at a higher rate on Coinbase than, for example, on Binance - this preceded a pronounced bullish momentum in the Bitcoin market. Second, bitcoin's price momentum intensified whenever there was a massive outflow of funds from addresses associated with Coinbase.

However, in the past few days, none of these indicators have shown stability, and on January 24, the value of the metric went into the negative zone.

BTC price chart (top) and Coinbase premium index (bottom). :CryptoQuant

When will sentiment in the bitcoin market recover?

Bitcoin's bullish rally is likely to continue when Coinbase's exchange rate premium recovers and is confirmed by a significant wave of outflows from the exchange.

A logical combination of these two factors would indicate that wealthy people are accumulating bitcoins again. Ki Yong Joo says:

“My bearish sentiment will continue untilAgain, there will not be a significant exchange rate premium on Coinbase and it will not be confirmed by the outflow of funds from the exchange addresses. To start the next phase of the bullish rally, bitcoin needs spot inflows of dollars from institutional investors. "

A popular narrative explaining bitcoin's recent rally is that high net worth individuals and institutional investors aggressively buy up bitcoin whenever its price drops.

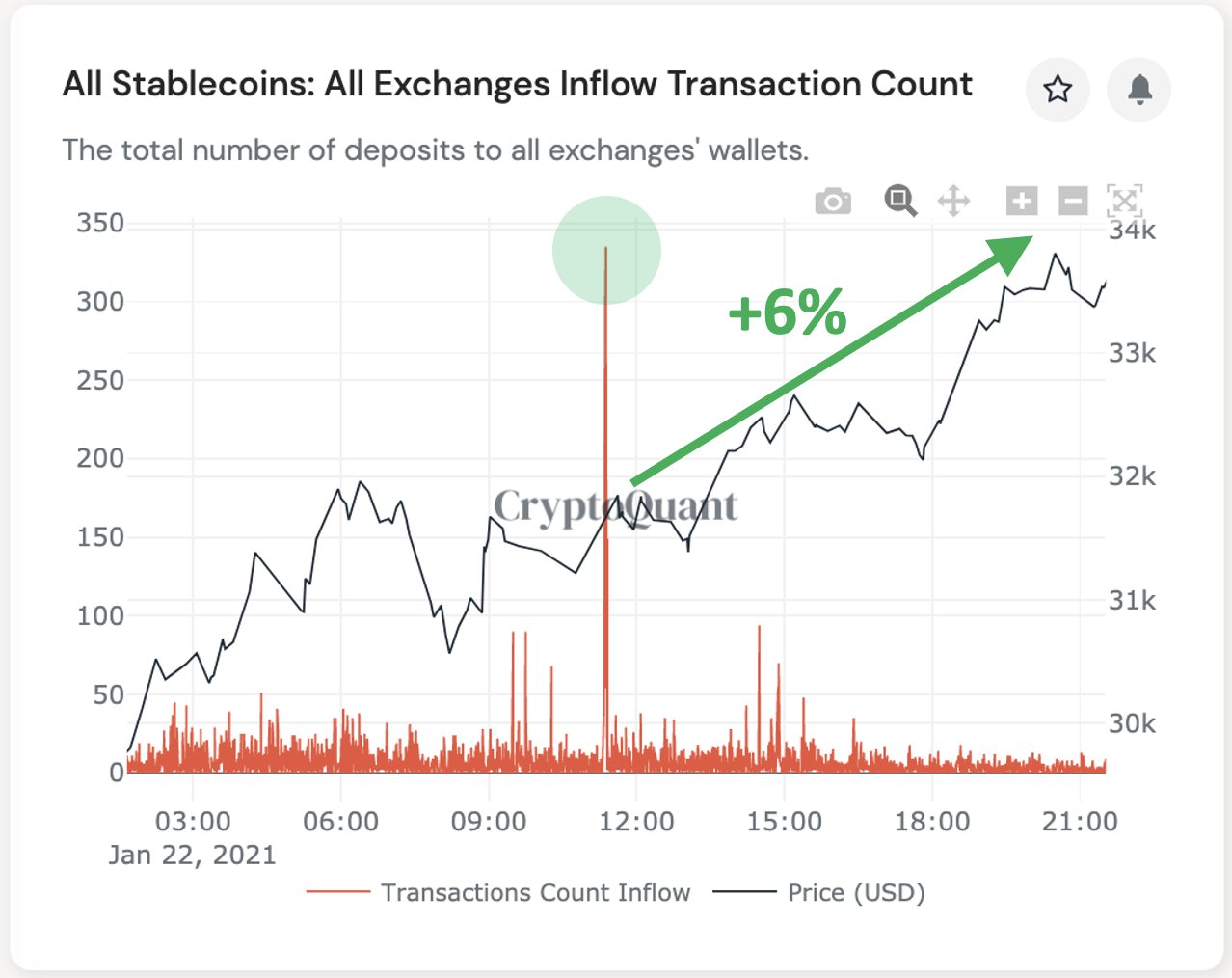

In addition to the two metrics related to Coinbase, an important factor that can indicate the formation of the foundation for a new wave of aggressive growth is the influx of stablecoins.

Ki Yong Joo notes that the influx of stablecoins to exchanges is often a powerful signal of an imminent price rally, as it indicates the entry of capital that has not yet been invested into the markets.

Influx of stablecoins. :CryptoQuant

For example, when stablecoin inflows surged on January 22, BTC recovered 6% over the next 24 hours. Ki Young Joo said:

“This indicator is one of the most powerfulon-chain signals. It allows you to predict short-term growth waves with a fairly high accuracy, regardless of the general market trend. We are talking about the number of new deposits in stablecoins on all exchanges. This shows how many investors are channeling stablecoins to exchanges to buy cryptoassets. For example, if this value reaches 80, then we can assume that in one block, in 15 seconds, 80 people transfer funds to the exchange wallet. "

To what levels can the price of BTC drop?

For the foreseeable future, if Bitcoin continues to trade sideways, some traders believe that the BTC price could drop to $27,000.

A pseudonymous trader known as CJ shared a potential scenario where the price of BTC could drop to around $26,000 - $27,000.

Bitcoin price chart with key levels. : TradingView.com

But even in the most pessimistic forecasts, analysts generally do not see the price of Bitcoin falling to levels around $20,000. CJ wrote:

“The channel indicated on the chart can servethus the technical factor preventing a retest of the $20,000 level. Based on this chart, the best level to potentially buy is somewhere between $23K and $27K.”

Although in the short term, on-chain indicators signal a somewhat bearish outlook, they do not show signs of a deep correction approaching.

Bitcoin declines to around $20,000, tothe high of the previous bull market would mean a fall of 40% from current levels. This seems extremely unlikely, but we should not forget about the possibility of another “black swan” in the form of a regulatory crackdown or a high-profile lawsuit against a major industry player.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>