We explain the phenomenon of Bitcoin halving in an amateurish way.Halving or halving of the mining rewardBitcoin is a programmed reduction in the number of new BTCs that miners receive for adding new blocks to the blockchain of the largest cryptocurrency.

</p>Imagine a bowl and tap. The bowl represents the number of bitcoins that have already been mined and are in circulation. As of February 29, 2020, Bitcoin’s total offer is 18,244,039 BTC coins. The faucet represents the new bitcoins that are mined right now and merge into a bowl.

Over time, the pressure of the crane decreases. Something like this can be described halving rewards for mining Bitcoin. Pressure decreases every 4 years, until eventually over the course of the next century it completely runs out. That is, new bitcoins will cease to be mined and put into circulation. What at that moment is typed inside a bowl will represent 21 million bitcoins - such a number was programmed by the mysterious Satoshi Nakamoto in the bitcoin whitepaper.

The technical component of bitcoin halving

: Unsplash

When Nakamoto launched Bitcoin in 2009, hethought out a decentralized model in which bitcoins can be distributed without the participation of any person or a centralized group of people. The innovative idea of Bitcoin mining was that miners would receive BTC as a reward for successfully creating new blocks by checking transactions and finding mathematical solutions.

To determine how these new BTCs will bedistributed among miners, Satoshi Nakamoto made certain rules in the Bitcoin protocol. The first rule was that Bitcoin would have a limited supply of 21 million coins in history. The second rule was that every time the next 210,000 blocks are mined in the Bitcoin blockchain, the mining reward is halved. This procedure will be repeated until all 21 million coins are in circulation.

It is this procedure that is called "halving".

When the whole system was just starting to work, andonly the most savvy geeks began to learn about Bitcoin, miners received 50 BTC for each block mined. The first reduction in remuneration occurred in 2012 - then the amount decreased from 50 to 25 BTC. The second halving took place in mid-2016, on block number 420 001. Since then, miners receive 12.5 bitcoins every 10 minutes. When the next queue of 210,000 blocks is completed, another reduction will occur. Then another one. And completely the emission of new bitcoins will stop supposedly in 2140.

Why is Bitcoin's offer limited?

The key question here is whyThe total number of BTC was limited from the start, and why was this reduction in reward invented? If it is simple, then it is all about the law of supply and demand. If Bitcoin's offer were unlimited, and would be generated in large volumes every 10 minutes without any reduction, then too many Bitcoins would be in circulation too soon. This, of course, would have an extremely negative impact on its market value.

This can be seen in fiat currencies,which have unlimited supply, as central banks can print them as much as they want. This is the main mistake and the problem of traditional fiat currencies. The Central Bank prints currencies more than necessary, and in accordance with the law of supply and demand, its value is reduced. Its purchasing power is also declining. That is, over time, for the same amount of money, you can buy much less goods. In economic theory, this phenomenon is called inflation.

The line for bread at sunset of the USSR. Images: Livejournal

Satoshi Nakamoto created Bitcoin just in light ofinflation ailment of fiat currencies. In essence, Bitcoin’s mechanism of operation is somewhat reminiscent of gold. Gold reserves on Earth are limited, it was easy to mine only at the beginning of history. But over time, it became more and more difficult to mine it, since it was necessary to drill deeper and deeper into the ground. Since gold reserves on earth are limited, it has managed to maintain its value over the past 6,000 years. That is why Nakamoto made Bitcoin look like gold, limiting its offer, giving it a margin of value and complicating mining as more and more coins appear in the world. The goal was for Bitcoin to maintain its value in the same way for many years.

What will be the impact of Bitcoin's next halving in 2020?

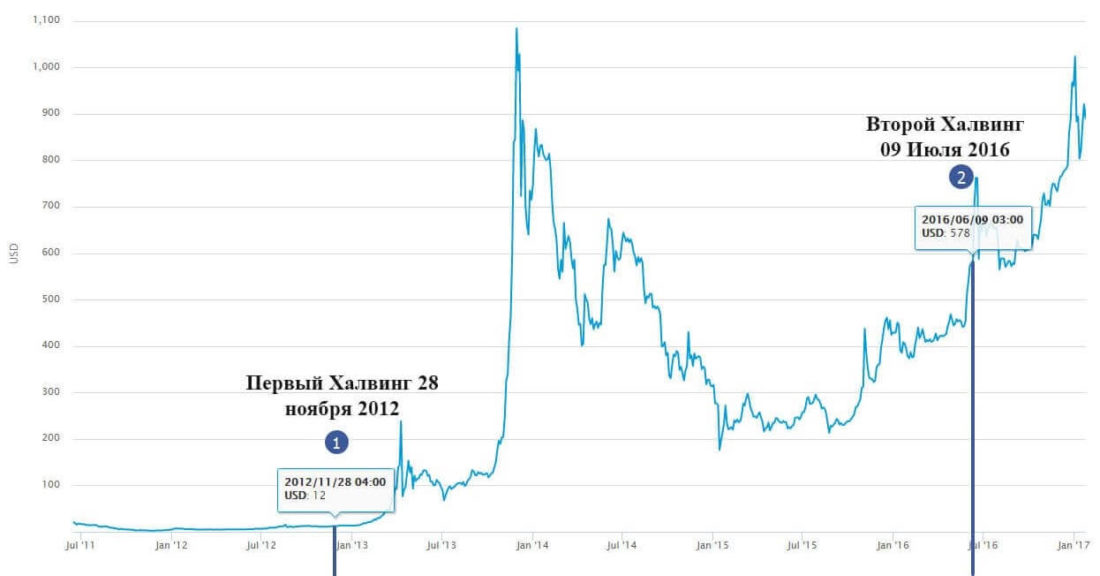

If you study the history of the BTC price chart, you can see that the price of the largest cryptocurrency has been constantly growing over the years.And one of the interesting observations is that the growth of thePrices accelerated before or after each previous halving (reduction in mining rewards).There were already 2 of them, and after each of themBitcoin price broke through another historic high.

Previous bitcoin halvings in 2012 and 2016. : Bytwork

Third Mining Remuneration Reductionexpected in May 2020. If this time Bitcoin repeats the price pattern of the previous two halving, then in theory its price can rise to $ 11-16 thousand. Moreover, by December 2020 or at the beginning of 2021 the price of the largest cryptocurrency can reach $ 19 thousand or even exceed the next historical maximum.

However, keep in mind that this is only an assumption.or even the wishes of some analysts. This is not financial advice, you can invest in cryptocurrency solely at your own peril and risk. And always remember that you can invest as much as you can afford to lose. The crypto market is a very unpredictable and high-risk industry.

</p>