We are all familiar with the internal understanding of the value of something that gradually arose in us in the processcognition of the surrounding reality. A gold bar has value, a glass of mineral water also has it, though not so much. When we are faced with something new, the assessment of intrinsic value usually does not cause us problems, but with Bitcoin everything is different. Bitcoin is not easy to understand, and for many beginner bitcoiners, the question of assessing its true value is very acute. So why is Bitcoin so valuable?

First we need to figure out why at alldoes anything have value? Fans of post-apocalyptic fiction often point out that, after all, the only things of value are those that support and protect life. Perhaps they are right in some ways, but with the growth of civilized societies, things have become somewhat more complicated, because the things that support and protect these societies are also of great importance. In this context, all money, including Bitcoin, is gaining value. Since our societies are heavily dependent on trade and commerce, everything that promotes the exchange of goods and services has some degree of value.

From barter to money

Imagine, for example, a trading platform beforesince the advent of money, where the barter exchange system prevailed. Perhaps you are a fisherman who came to the market with his catch, and you want to return home with some chicken eggs. Unfortunately for you, the chicken farmer currently does not need fish, and therefore you will have to make a series of exchanges to get what the egg seller needs. You may even lose a certain percentage of the value of your fish during these exchanges, in addition, you should clearly know the exchange rates for each of them. The confusion and only.

That's what money is for.By agreeing to use, say, silver coins as an intermediate good, we reduce the number of necessary exchanges to a maximum of two. In addition, there is now only one exchange rate for each product — this is its value in silver coins.

Of course, in reality, everything is somewhat more complicated: not every product is convenient to use as money. For example, take your fish: it will deteriorate quite quickly, it is difficult to divide it into equivalent parts, in addition, depending on the exchange rate, you may have to carry an absurd amount of fish with you to make all the necessary purchases.

Silver coins, on the other hand, also havetheir internal problems if you trade them in very large or very small quantities. In this, Bitcoin undoubtedly surpasses them, and therefore it is much more valuable. It’s just the best money.

Evolution to Bitcoin

It's been quite a while sincethe first «hard» cash, and today most transactions are carried out primarily in the digital form of money pegged to fiat currency. We imagine a bank with vaults full of heaps of banknotes, but in reality, in our time, most money exists only in digital form as numbers in databases. There is nothing wrong with this type of system. It works great in an era where there is no need to be physically present while making a deal. The problem is that the system is becoming outdated, and it is widely susceptible to human abuse, incompetence and greed.

Every IT professional knows that from time to timeyou need to take a decisive step by throwing the old system in the trash and building a new one from scratch. The old systems, of which the current monetary system is, have been revised many times, but they no longer function as efficiently as they should.

Previously, we were finalizing monetary systems,based on gold and silver, through the introduction of paper banknotes. We have been fixing more and more issues by removing precious metals from the collateral of these banknotes. Then additional steps were taken to improve, such as the introduction of wire transfers, credit and debit cards, direct bank lending and online bill payments. But all these are just minor tweaks to the old monetary system that has already become obsolete. Patching holes — That's what we've been doing all this time.

But what would you do if you had a chancebuild everything from scratch? What if you could make a system based on a purely digital form of money and based on modern technology to meet modern needs? What if we simply do not need all these old dusty systems and the people who support them, who make absurd profits on this? And here Bitcoin appears.

No repairs. Only a complete replacement!

Bitcoin is not just another patchwork patchholes of the old monetary system. This is not some new bank or payment system offering new ways to transfer old dollars. Bitcoin — it is a simple, elegant and modern replacement for the whole concept of money. And it has value for the same reason that paper money in your wallet has value: it simplifies the exchange of goods and services, and this is no longer relative to what we had in the ancient setting of the barter market, but in the modern situation where networked Internet interactions play a vital role.

«And that’s all it’s useful for? What is its true value?» — I hear questions from perplexed people. The answer to them consists of two words:network effect. Network effect is a term thatexplains that networking products and services tend to be increasingly valuable if more people are using them. A good example is the telephone: in the early days of his invention, only a small handful of people had access to it, and therefore its value was meager. Today, almost everyone has it, and its value and usefulness is undoubtedly very high. Thus, the value of Bitcoin directly depends on the number of users and the frequency with which they use it.

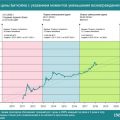

Confirmed: in the long run, Bitcoin's capitalization follows Metcalf's law (http://t.co/B0PkWZSNt4) pic.twitter.com/dpq3RvAUpT

— BitNovosti.com⚡️ (@bit_novosti) August 2, 2014

Of course, the value resulting from the network effectBitcoin has its own unique features and challenges. While the network is relatively small, the entry and exit of each new group of participants can cause serious price fluctuations, resulting in huge profits for earlier participants. Unfortunately, looking at Bitcoin superficially, all this is very suspicious: it looks too good to be true. Hence the widespread emergence of opinions that Bitcoin is a pyramid or Ponzi scheme.

Ponzi scheme and pyramids are different typesfraud, but they have one thing in common: those who entered the scheme first — make profits, and those who are last — lose their money. In all pyramids «firstborn» They make money thanks to all the new participants. Earnings are always amazingly large and grow exponentially.

For the reason that Bitcoin's value is so dramaticsoared upwards since its debut in 2011, it seems that it falls under the definition of a pyramid. But if this is so, then in this case, and in general, all new technologies fall under it. In fact, in the case of Bitcoin, the situation is quite unique: we have the opportunity to invest in this technology and make a profit along with the growth of its adoption by the masses. Imagine that you would have the opportunity to invest in the concept of email in 1965, when some smart hacker from the Massachusetts University of Technology found a way to send messages in primitive multi-user computer systems. Then it seemed almost useless, but today, the owner of a tiny percentage of the rights to the concept of email would be fabulously rich.

Technology is always well known.their adoption curve, which includes a period of exponential growth. And Bitcoin is no exception. The fundamental difference is that Ponzi schemes and pyramids create value only for the oldest investors by simply redistributing money from new participants. No economic component. Just an ordinary theft.

Bitcoin creates value as for earlierinvestors, as well as for new ones, providing more and more opportunities for using currency, the quantity of which, moreover, is limited. This is not cheating or theft, but simply the good old law of supply and demand at work, or in other words, an ancient economic principle, in the service of a modern monetary system.

: ybitcoin