Chinese bans led to a sell-off in cryptocurrencies, and the heads of JPMorgan and Goldman Sachs again declared Bitcoin junkinvestment (which does not prevent them from promoting their own crypto trading platforms). However, there is a positive backlog in the Chinese bans that will strengthen the position of digital currencies in the future.

Decentralization

The Leading Advantage of Bitcoin vs Fiatmoney is decentralization and independence from financial institutions: they can no longer be printed to fill holes in the budget or be prohibited from being used by other states.

Image source: bitinfocharts.com

According to various estimates, China has 50-65% hashrateBitcoin. This worried US National Intelligence Director John Lee Ratcliffe, who last year recommended SEC Chairman Jay Clayton to let US companies compete with China on digital currencies. However, the Celestial Empire itself withdrew from the game and, after successfully testing the digital yuan, banned mining. Now miners from China are scattering around the world in search of the most profitable option.

The erosion of China's share in the global hashrate makesBitcoin is more resilient in the future. The next largest country, the United States, has only 7-10%. Therefore, possible bans on mining in other countries will have less impact on the stability of the network and the cost of the cryptocurrency..

Environmental friendliness

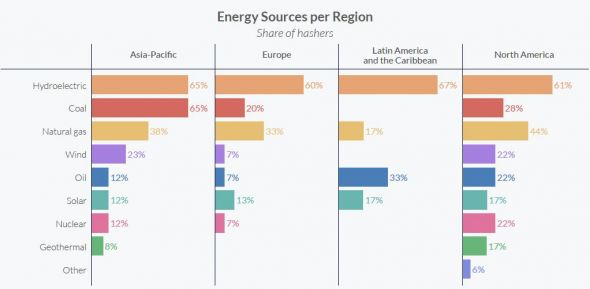

The abandonment of Chinese capacities has a positive effecton the environmental friendliness of mining, which has become fashionable to talk about after Elon Musk's pirouette. In China, as in the entire Asia-Pacific region, coal is actively used to generate electricity, which causes the greatest harm to the environment.

Image source: coindesk.com

Now Chinese miners are offered favorable conditions by countries rich in nuclear and hydropower, and a number of pools are going to use exclusively green energy.

Driver for the economy

Miners will attract investments in certainregions. For example, Chainbytes plans to open a crypto ATM manufacturing center for the Americas in El Salvador. This will lead to both the opening of new vacancies and the improvement of the skills of local specialists. And Kazakhstan, where the mining pool included in the TOP-5 is migrating, is considering the introduction of an additional tax on crypto mining of 1 tenge per kWh, which will increase the annual budget by about 3.6 billion tenge ($ 8.4 million).

Correction

A market decline opens up opportunities for those whohoped to drop in at better prices. Funding rates for perpetual futures contracts have also bounced back, making it easier to hold leveraged positions.

Image Source: StormGain Cryptocurrency Exchange

In addition, in the domestic market of China, the costsecond-hand GPUs, heavily used in Ethereum mining, are down 30% from May highs. And the leading ASIC manufacturer Bitmain announced on June 24 it will stop selling to help miners sell used devices.

Analytical group StormGain