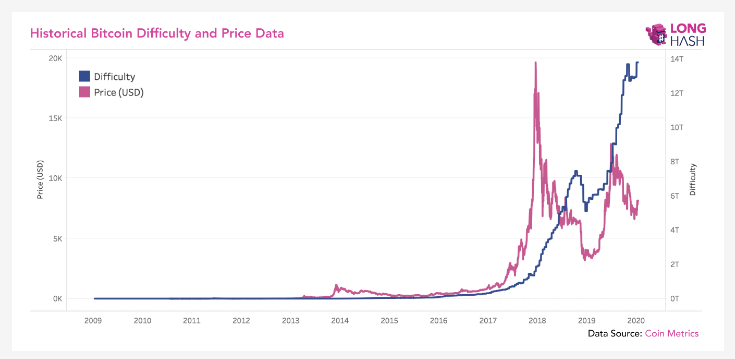

It can be useful to go back to the basics, refresh your memory and see how the price, like a carrot on a stick, dictatesnetwork hashrate. Our friend Dan McArdle kindly provided us with a very concise explanation of why the hash rate increases with a marked delay relative to the price increase, while the hash rate decreases almost simultaneously with the price drop.

In case it's unclear… Price vs Hashrate charts look like this because:

— Adding hashrate in response to bull markets takes a long time cuz you have to physically deploy new hardware.

— But responding to sudden bear moves can be immediate; just hit the off switch. https://t.co/kKYeA9K2Zm pic.twitter.com/nxieFbED70

— Dan McArdle (@robustus) January 14, 2020

In case it's not already clear… The graph of hashrate versus price looks like this because:

- — Increasing the hash rate in response to a bull market takes so long because the equipment still needs to be physically deployed somewhere.

- — At the same time, the reaction to an unexpected price drop can be immediate - just turn off the power.

- Dan McArdle (@robustus) January 14, 2020

Why do people decide to invest in an acquisitionBitcoin mining equipment? Someone wants to earn bitcoins without interacting with third parties, others want to contribute to the decentralization of the network, but I think that most of them somehow want to make a profit. And what is the driver for this pursuit of profit? The way others boast about how much they have earned on rising Bitcoin prices. Especially during a bull rally.

Those who were thinking of becoming minerssee the price increase, decide that they also want to make money on it, and begin their brave journey with organizing and buying equipment and energy. This is a very important variable that should not be forgotten: the amount of time that elapses between the decision to mine and connect the equipment. As we all know, the price of bitcoin is historically extremely volatile. Bitcoin is famous for rising to completely obscene values and falling back to earth in a very short time in comparison with other markets, more familiar to many. This paves the way for the formation of such a lagging growth indicator.

As you can see on the chart, the difficulty is higher (blueline), the hash rate continues to grow after a quick price drop, signaling that miners continue to connect new machines. These cars, apparently, were purchased after their owners decided to mine Bitcoin, which probably happened at a lower cost, on the other hand, the price peak.

When the price falls below a certain level, itinstantly affects the level of complexity, as miners begin to turn off the equipment so as not to work at a loss. Mining profitability levels are determined by the total costs of acquiring equipment and energy necessary for its operation. Electricity costs vary greatly.

A break between the decision to start mining andconnecting equipment, especially for the first time, can be lengthy. After all the efforts necessary to purchase equipment and its connection, you can be sure that those who have walked this path will support the work of these machines until they are profitable. Even if the price has just dropped by 50%. In the end, sanity, by all indications, takes over, and we see how they turn off the equipment as soon as we decide that continuing to work could jeopardize their future activities. As Dan notes, the shutdown happens almost instantly.

That's why the feverish cries about«mining death spiral» always appear in the middle of a bear market, after a significant drop in difficulty. The speed of this decline frightens people and makes them unable to think critically. As a result, they make the common mistake of discounting other miners who are still in the process of purchasing and connecting equipment.

Developing this idea, it’s not easy to come up with a compelling one.the reason for opening a short position in complexity, except perhaps by hedging the risks of significant investments in a particular batch of mining equipment. You never know at what stage of your path this or that mining enterprise is located.

</p>