Agree that 12 years ago none of us could have imagined that one day we would buy and sellinvisible assets on an online exchange.Of course, the creator of Bitcoin probably already then assumed a similar scenario, but most of those people who use cryptocurrency today in 2008 did not even suspect that an alternative financial instrument would soon appear.

Be that as it may, rapid developmentcrypto industries and the dizzying price hikes for digital coins have attracted a lot of attention. Everyone, from financial consultants to ordinary users, wants to participate in the exchange game. The world of cryptocurrencies burst into everyday life, forever changing the usual way.

Like stock market players, crypto tradersbuy virtual assets in order to sell them at a better price. This is often done at random and most aspiring crypto traders rely on their intuition and articles in popular web publications. In this review, we will try to outline the basics of trading on the cryptocurrency exchange in a simple and understandable language.

Types of platforms for crypto trading

First you need to choose a site.Like any other financial instrument, cryptocurrency is listed on exchanges. There are over 400 sites in the Global Network. Unlike traditional Wall Street exchanges, crypto exchanges are divided into two types:

- Centralized.

- Decentralized.

Both those and others work on blockchain technology.To work on a centralized platform, you need to create an account and replenish the deposit. Decentralized exchanges do not store any user information on their servers.

Most decentralized exchanges are less convenientand when it comes to speed, centralized platforms outperform their decentralized counterparts. Despite the emerging trends towards reversing this issue, the situation still remains in favorcentralized exchanges.

Centralized exchanges also outperformdecentralized in another important factor vital to trading is liquidity. Decentralized exchanges cannot compete with centralized ones in terms of trading volume. However, decentralized exchanges benefit from an almost complete lack of fees and higher security.

Traders also need to know how they workcrypto trading bots, they are allowed on crypto exchanges and make trading much easier. When contacting bots, it is important to first analyze the available exchanges and understand which ones offer the best tools for convenient trading.

Which exchange is better to trade cryptocurrency?

When choosing a cryptocurrency exchange for tradingusers must first analyze all the features of the exchanges. Experienced traders prefer more complex platforms that offer more functionality, while novice traders want to hone their skills on less complex services.

Binance Exchange is the largest cryptocurrency exchange in the world in terms of trading volume and number of users, the site has a wide range of functionality and a number of important advantages.

- Firstly, binance has a very user-friendly interface that allows you to see all the important information on one screen.

- Secondly, Binance Exchange has low fees and wideselection of orders. The variety makes it a convenient platform for a wide range of strategies, and the high level of protection allows traders to not worry about their assets. Although, of course, no one has canceled the rules of safe storage.

- ThirdlyBinance supports transfers in rubles from Visa / MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Do not delay the start, register on the exchangeright now by going to the official website of the platform https://www.binance.com/. In the meantime, we will tell you about the main tools that a crypto trader should be able to use.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on the Binance crypto exchange for rubles?

Types of charts and orders

The scary part of trading is charts and lines,which you will see on the exchanges. More often than not, people don't even bother reading charts, but immediately buy or sell crypto, following the advice of their colleagues. Let's take a look at some of the popular charts.

Japanese candlestick charts

If you've even visited the exchange's website, chances are you've seen Japanese candlesticks before. Let's try to explain the meaning of these models.

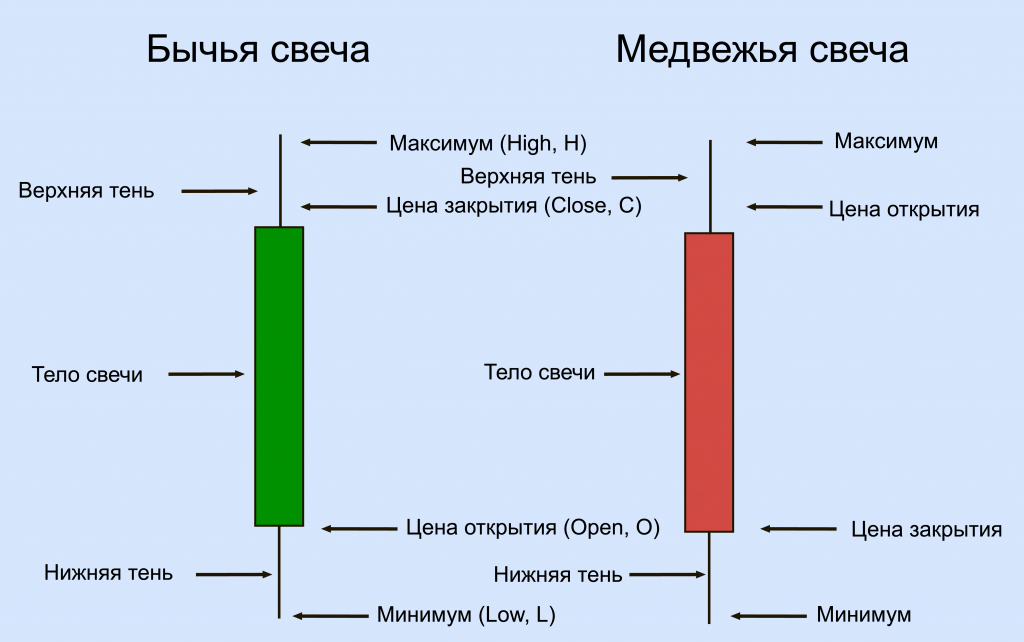

The first thing you'll notice is the reds and greenscandlesticks lying one after another. Each candle shows the price movement of an asset over a specific time interval. Each candle has a body and a pair of shadows that stick out from it.

- Bodyshows the difference between opening and closing prices.

- Shadowsshow you how high or how low those prices have gone.

In a green candle, the upper shadow is the priceclosing, and the lower opening of trading, and vice versa for red candles. If the value of an asset remains unchanged for some time, there is virtually no body. This candle is calleddodge, and short candles are calledspinning tops... The beauty of this graph is that itclearly shows exactly where the market has turned and helps to identify various patterns that help predict further market movements.

Besides Japanese candlesticks, traders use the following types of charts:

- Linear- a simple type of chart that displays only the value of assets on the stock exchange. Allows you to track the balance of supply and demand and the direction of the trend.

- Bars— visually this chart is similar to Japanese candlesticks,but here the vertical lines are connected by horizontal ones, which indicate the opening (left) and closing prices (right). Such a graph is easy to read if the left line below the right line increases the rate of the coin, and if, on the contrary, it decreases.

- Tic-tac-toeis an even simpler graph that displays only the general dynamics of the exchange rate. A cross indicates an increase, and a zero indicates a decrease in value.

Knowing how to read charts is very important, otherwise you will most likely go broke on the first day. But it is equally important to know how the different types of orders differ and to place them correctly.

Types of trade orders on the cryptocurrency exchange

To carry out a particular operation on the exchangeyou need to make an application. For this, there is a special form that the trader fills out before each deal. The process of registration is simple, and in order for the trader not to sit at the computer waiting for a favorable moment, the service supports several types of orders, the execution of which can be postponed indefinitely.

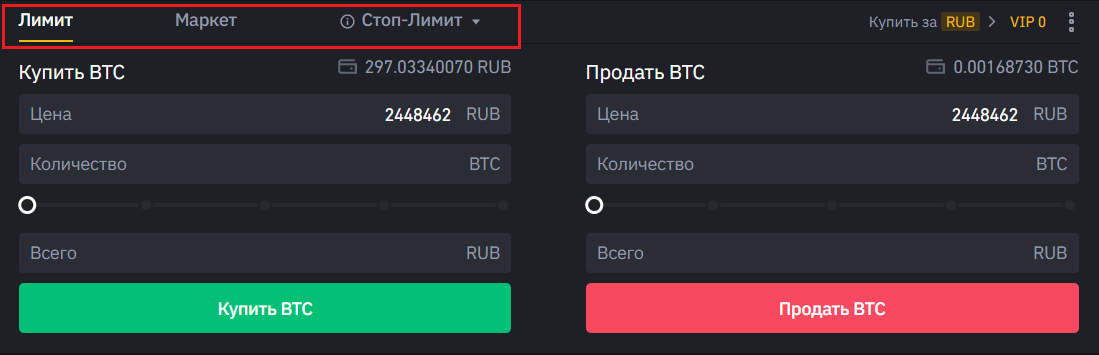

Orders can be divided into 3 types:

- Limit order- one of the basic categories.The trader sets the volume and price of coins purchased (or sold) and can safely leave the site. The order will be executed when a suitable counter offer appears. It is recommended to use a limit order if you are waiting for a sharp rise or decline in the rate of the cryptocurrency you are interested in.

- Market orderused if you need to purchase or sell an asset right now. You indicate only the transaction amount, the exchange will do the rest.

- Stop Limit Order- provides an opportunity to earn moneyintra-exchange manipulations. If the rate of a coin is artificially raised or lowered, it goes in a given direction not like a gentle ladder, but very sharply. A stop limit allows you to buy before the price reaches the top point and have time to sell profitably.

In addition to basic types, exchanges can work with special orders designed for professionals.

- Fill or Kill- the order is either executed at the price specified by the trader, or is closed.

- One Cancels Other(one cancels the other) - allows you to place two counter orders (buy if the rate is down, sell if it’s up).

- The hidden order is not added to the general register, which allows you to conduct a large transaction without causing panic on the exchange.

If you are trading limit, it is important to calculate the swing depth correctly. Otherwise, the order will not be executed and you will not earn anything.

Market analysis by order book

The order book displays the current sentimenttraders, which allows you to simulate the direction of the market in the short term. You can see limit orders, the execution price of which is close to the market price and can affect the rate of a particular coin.

Based on the current state of affairs, you cancorrectly determine the entry and exit points, thus, the order book is traded. The cryptocurrency must have a fairly high liquidity, that is, the glass must be constantly filled. And keep in mind that it does not always accurately reflect the situation; large traders can use hidden orders and OTC transactions. A comprehensive market analysis is required.

Support and resistance levels

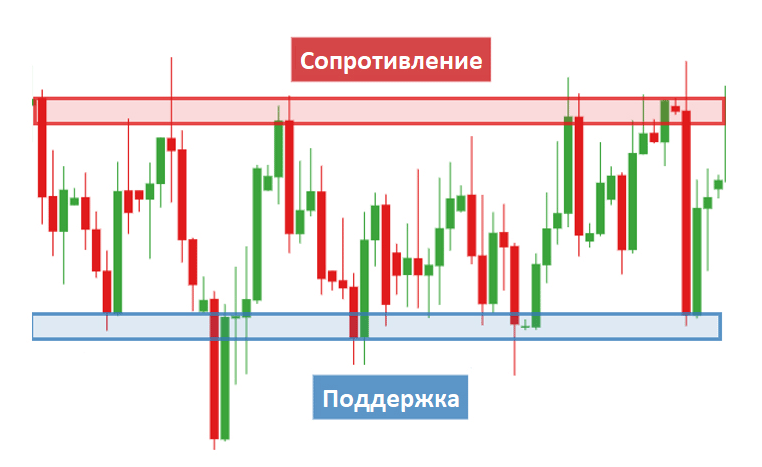

Sellers want to sell their coins as much as possiblemore profitable, but if there are too many of them, the price will inevitably fall and the bearish trend will dominate the market. An excess of buyers will lead to a bullish trend, that is, an increase in prices. Support and resistance lines clearly represent the confrontation between bulls and bears.

Supportis the lower level of value in the current period, andresistance- this is the top point that the bears hold.As long as the coin rate fluctuates between these levels, it can be considered relatively stable. A breakdown of one of the levels indicates a radical change in the balance of supply and demand. The coin needs to be bought or sold urgently, depending on which direction the wind is blowing. But if the majority of interested players consider the changes to be unfounded, “traders’ remorse” will occur. They will buy or sell an asset in order to return the price to the desired level, and the imaginary winners of the battle will fall into a trap.

Trading volume

As the famous saying in the world of traders says:"Volume precedes price." The more cryptocurrency trading revives, the higher the chances that the price will skyrocket. A coin with high liquidity shows the strength of the underlying trend. Such an asset is worthy of attention and promises profit.

Trader's deal history

The register of executed orders, like the order book, is an important tool for analyzing the situation. By the history of transactions, one can judge the demand for the cryptocurrency and the liquidity of the exchange pair.

Technical analysis when trading cryptocurrency

Technical analysis focuses on forecastingfuture market behavior based on previous price action and trading volume data. This approach applies to stocks and other assets on traditional financial platforms and is an integral component of digital currency trading.

Unlike fundamental analysis, whichconsiders many factors around the price of an asset, TA focuses on previous data. Therefore, it is used as a tool for studying price fluctuations. With its help, traders try to identify favorable trading opportunities.

Modern technical analysis begins with the work of the founder of The Wall Street JournalCharles Doe... He noticed that individual assets and markets oftenmove according to trends that can be segmented and studied. His work later spawned the Dow Theory, which further developed technical analysis.

Strategies in technical analysis

The technical analysis strategy is developed onthe basis of tools and indicators that form signals of rate changes. At the same time, you need to take into account historical data and correctly form hour intervals (timeframe). Find the pattern of course changes and form a strategy using the entire set of analytical tools.

Elements and shapes in technical analysis

Technical analysis patterns representa kind of graphical tool for modeling the market situation. Pattern elements are candlesticks and resistance and support lines. Traders associate their repetitive combinations with certain symbols warning of changes. Basic patterns:

- Head and shoulders;

- Double top;

- Pennant;

- Triangle;

- Flag;

- Wedge.

The rest of the figures are derivatives of the five basic ones. The appearance on the chart serves as a signal for action, or at least a reason for serious thought.

Reversal and trend continuation patterns

There are two types of patterns:

- Patterns indicating trend continuation;

- Patterns indicating an imminent reversal.

The pattern cannot be considered complete until it breaks one of the technical lines. Pivot patterns include:

- Bowl with a handle;

- Double top;

- Pennant;

- Triangle.

Continuation shapes include a rectangle and a flag.

Five Rules and Tips for Safe Trading on a Crypto Exchange

The cryptocurrency market is controlled by whales.They place thousands of bitcoins on order books and are adept at manipulating the market. The whales are patiently waiting for common traders to make a single mistake to get their hands on their assets.

This may seem obvious to some, but inthe first step is to determine the entry and exit points. Regardless of the strategy, clear guidelines are needed, as digital currency trading is a zero-sum game. You must understand that for every win, there is a corresponding loss. If someone makes a profit, then there is someone who has suffered a loss today.

Do not invest the entire amount of funds in one deal

Divide the capital into two or three parts. If the initial trading strategy on the cryptocurrency exchange turns out to be unprofitable, then by analyzing the errors, you can get your money back.

You can play on the stock exchange only with the money that you do not mind losing

Don't waste your last money, and don't usemargin account. Cryptocurrency trading is like playing backgammon, it is excitement and accurate calculation in one bottle. Beginners are sometimes lucky, but luck is changeable, and it is not easy to calculate all the nuances.

Record of deals and strategies, diary of deals

If you are not inclined to capture events, thenyou will have to get used to, otherwise you will not be able to learn even from your own mistakes. The only difference between a blogger and a trader is that the former talks about his experiences with the Internet audience and makes money from advertising, while the latter is unlikely to show his diary.

You should not try to catch only the minimum and maximum quotes.

Whatever strategy, sometimes you're better offto get less profit on the deal than to get into a negative. Based on years of market analysis, it is safe to say that on certain days or periods, you can save capital only by freezing some transactions.

Don't mess with little-known cryptocurrencies

Beware of dying coins and scam projects.Only an experienced trader who is fluent in fundamental analysis techniques and is an expert in blockchain technologies can afford to bet on a young altcoin. Well, if you are still learning the basics of cryptocurrency trading, work with a BTC-ETH pair or other top coins.

Arbitration on crypto-exchanges, how to make money on the difference in rates?

Earning on the difference in exchange rates is profitable, butrisky venture. In the crypto industry, speculation on the difference in exchange rates is called arbitrage. If you work on the same site and with the same pair, the profit will not always be stable. Not everyone knows how to diversify risks competently, and if the rate reverses, even relatively successful traders can fall into the red. Cross-exchange arbitrage allows you to play on the current exchange rate differences between platforms.

Example of an arbitration exchange:

Open the website https: // coinmarketcap.com and select a cryptocurrency for arbitrage. The coin must have good liquidity. Use not only data from quotes, but also operational information from the order book in order to understand how much volume can be realized without delay, otherwise rate fluctuations can bring a loss.

How much can you earn from arbitration?

Let's try to make calculations.At the time of this review, on the Binance Polkadot exchange, it is paired with USDT $ 18.06, and on the Bithumb Global exchange $ 17.96. By purchasing 1500 DOT on binas, you can resell them for $ 150 more, minus the trading commission and withdrawal fee. It is not worth entering arbitrage with scanty amounts, but with serious volumes, 1-2% of the transaction will bring tangible profit.

For convenience, you can use an arbitration bot -This is a special program for automated crypto trading that has access to the API of several exchanges at once and instantly responds to rate fluctuations.

Important!Often popular exchanges have a special department (arbitrageurs) that controls that traders do not engage in this type of trading. Be careful if you want to make money by not reselling coins.

Commissions on exchanges

Trading platforms charge a commission for each transaction made and for withdrawing funds to third-party wallets. This must be taken into account, since with small trading volumes, paying fees will hit your pocket.

For 2021, Binance offers the lowest fees.Also, the percentage of sales tax can be reducedby 50%, paying commissions with internal tokens of the Binance Coin (BNB) exchange. A similar practice is used on other platforms that issue their own tokens, for example, OKEx or Huobi.

Advantages and Disadvantages of Cryptocurrency Trading

| Pros of crypto trading | Cons of crypto trading |

|---|---|

| Extensive opportunities to earn money in a short time | High risk |

| High level of profitability | Lack of legislative regulation |

| Variety of trading platforms | It is necessary to have special skills, knowledge and experience |

| Large selection of financial instruments | The trader must constantly monitor the market, which takes a long time |

| Remote work | |

| The presence of bots to automate the trading process | |

| Relatively low entry threshold |

Safety and precautions

Not all internet users are law-abiding. To prevent hackers from stealing assets, you need to know and strictly follow the security rules.

- Make sure the reliability of the exchange you plan to operate on.

- Every time you enter the exchange, check the validity of the link so as not to end up on a phishing site.

- Update the antivirus software on your computer regularly.

- Create a strong password and keep it on paper.

- Connect 2FA and create a white list of addresses for withdrawal of funds.

- Do not use a cryptocurrency exchange deposit for permanent storage of funds.

A skeptic may say that these actions do not guarantee 100% security, but if you do not take any protective measures, the risks will increase many times over.

Conclusion

From the above, we can conclude thatcrypto trading is not the highest mathematics and it is quite possible to make money. Especially if you master the tools of fundamental and technical analysis, and will carefully weigh each step. The main rules of a novice trader: do not neglect training and do not compare visiting the exchange with going to a bitcoin casino.

If this material seemed too complicated for you, we have prepared a separate guide especially for beginners: How to buy bitcoin on the Binance crypto exchange for rubles?

5

/

5

(

1

voice

)