Why does Bitcoin continue to rise? So is he affected by the flow of good news or are there others?indicators that can suggest an answer?

After Bitcoin broke through $50,000 again in March, the price settled quite confidently above this level. This week BTC set a record near $65,000.

What is driving the price of bitcoin up?

1. FOMO effect

The statement that news moves the market can betake for an axiom. Over the past few months, we have seen large corporations, as if under the influence of a snowball effect, invest in cryptocurrency one after another.

The last one can be considered the start of the bull run.quarter of 2020. In October, the price of BTC skyrocketed at the same time as news of PayPal's entry into the crypto market emerged. The next price spike came when JPMorgan announced the launch of JPM Coin.

MicroStrategy invests in BTCalmost all the free money, and Tesla acquired BTC for $ 1.5 billion. Some experts believe SpaceX and Boring Company have also invested in bitcoin. Since these Musk companies are not public, they are not required to report investments.

Large banks – Goldman Sachs and Citigroup have begun offering various crypto services.

Coinbase, America's largest crypto exchange, has listed its shares on the Nasdaq.

All these factors have given investors more confidence in cryptocurrencies as a reliable asset class.

Growth on good news isn't always good

The problem with our new axiom – if the pricedriven only by good news and market sentiment, it ceases to be sustainable in the long term. Simply put, if the good news runs out – growth will end. And a deep rollback will follow, which will create the same snowball effect, only in the opposite direction.

Therefore, we should consider other on-chain and off-chain indicators that can serve as a price driver.

2. Buy and hold and hold and hold

If sellers are active, this is an indicator –then the peak of sales is still far away. According to a recent report, long-term hodlers are reluctant to give up their investments. They have a firm grip on their bitcoins and have no plans to sell them yet.

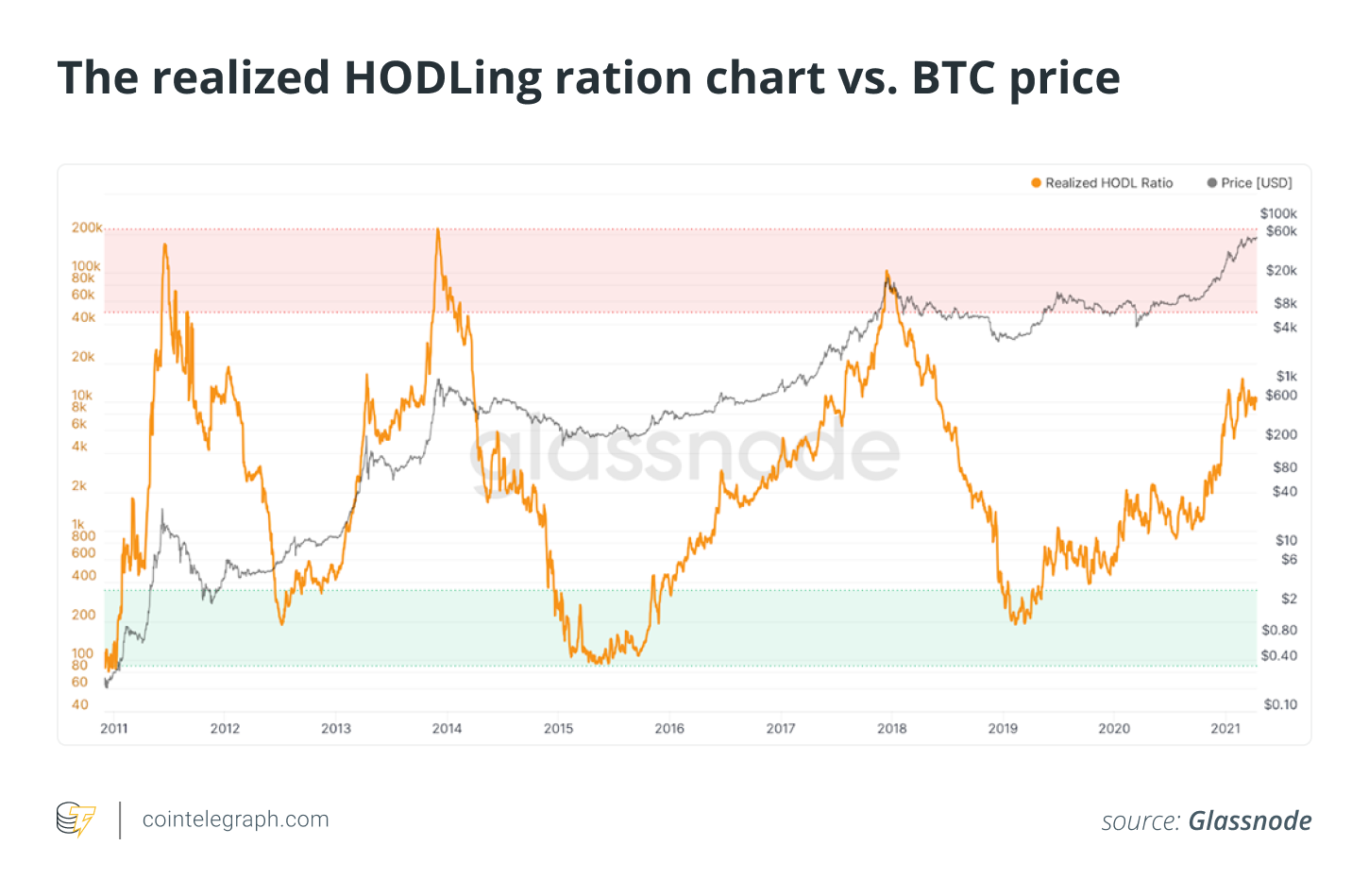

As we can see in the chart below, all previous price pullbacks occurred after the holder sales ratio reached above 50,000. At the moment it is at around 1,000.

According to historical data, a bull runis halfway to the peak. That is, the price of BTC could reach $ 100,000 by the end of this year. And given the predictions of many investors, this is still a fairly conservative outlook.

3. $ 200,000 or more?

According to the stock-to-flow analyst PlanB,the bull run is at an even earlier stage. His model predicted previous runs with amazing accuracy. Many holders hope that this particular forecast will turn out to be reality.

PlanB projects BTC to peak at $288,000 in 2021.

If this seems overwhelming, keep in mind that inIn the history of bitcoin, there has never been such interest from corporations in it. Plus, there has never been a shortage of cryptocurrencies on exchanges to meet demand. Even previous race patterns may be too conservative for this cycle.

In general, given these indicators and the ongoing FOMO, there is every reason to believe that the race will not end soon.

Subscribe to ForkNews on Telegram to keep abreast of news from the world of cryptocurrencies

Based on materialscointelegraph.com