Due to its high correlation with Bitcoin, BTC mining stocks can serve asinvestment bitcoin tools forrisk-tolerant investors. In this review, an Arcane research analyst details how mining stocks performed in 2021 versus Bitcoin and explains how investors can use them to increase their Bitcoin exposure.

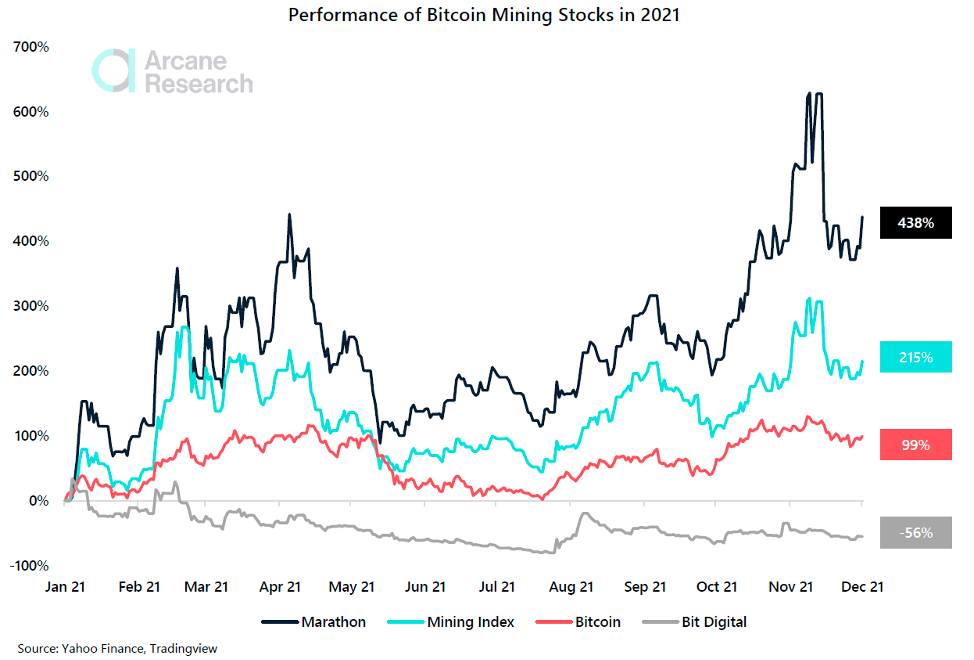

The graph below shows the indicatorsbitcoin mining index relative to its price in 2021. The Bitcoin Mining Index includes the 15 largest mining stocks, weighted by market cap. From the graph, I determine five characteristics of bitcoin miner stocks, which I will explain below. First, take a look at the graph and see for yourself:

Bitcoin Miner Shares in 2021

1) Bitcoin Miner Shares Surpassed Bitcoin in 2021

The mining index in 2021 grew by 215%, whichmore than double the 99% growth of bitcoin. If we go back even further, we see that from January 2020 to the present, the Bitcoin mining index has grown by about 1500%, while Bitcoin itself has grown by 670% over the same period. Based on this historical data, it can be argued that if Bitcoin rises 1%, mining stocks can be expected to rise 2%.

Why is this happening?Like all companies, Bitcoin miners are priced based on the present value of their future earnings. Since mining companies are risky investments and are often 100% equity funded, their Weighted Average Cost of Capital (WACC) is relatively high. Due to the high WACC, the immediate impact of the rising bitcoin price on the bottom line of the BTC mining company is causing the stock price to jump. Simply put, since investing in a bitcoin miner's stock is more risky than just owning bitcoin, a mining company's stock should theoretically outperform bitcoin, albeit with higher volatility.

Another reason why companiesbitcoin miners can outperform bitcoin, as Nelson Hsieh of Volt Equities eloquently explains in this article, that a bitcoin miner's profit margins increase by several times compared to the rise in the price of bitcoin.

Inference:As with all investments, the higherthe risk, the higher the expected profit. Bitcoin mining stocks are a riskier investment than Bitcoin itself and should therefore be expected to have a higher return than Bitcoin. Also, as you can see in the chart, when the price of bitcoin falls, the shares of the mining companies tend to be inferior to bitcoin.

2) The characteristics of the shares of various mining companies are very different

Although the mining index has shown excellent resultsin 2021, the companies included in the index differ significantly in terms of performance. Of the 15 largest publicly traded mining companies, Marathon Digital Holdings performed best in 2021 with revenue growth of 438%. Marathon invested heavily in new mining hardware in early 2021: a bet that paid off as the price of bitcoin rose throughout the year.

Also, while some are in publictraded mining companies are vertically integrated and own the data centers in which they operate, Marathon rents space to host their machines. The lack of their own data centers allows them to invest all their capital in mining equipment. Since the cost of mining equipment correlates much more with the price of bitcoin than the cost of data centers, Marathon shares are more tied to the price of bitcoin than the shares of vertically integrated mining companies. This strategy is a winning strategy when the price of bitcoin rises, but can be a double-edged sword in a bear market.

On the opposite side is BitDigital, whose share price is down 56% YTD after the company moved from China to North America in 2021. Moving equipment across the globe is costly, especially given the current supply chain challenges. But while the cost of transit is undoubtedly high, it is still not the highest cost component. Downtime is the worst enemy of a Bitcoin miner as the hardware is expensive and has a limited lifespan. In 2021, most of Bit Digital's mining equipment was in transit or in storage, which gave them a significant opportunity cost of not producing Bitcoin. At the beginning of 2021, Bit Digital investors did not consider the possibility of reducing Bitcoin production due to the move process. As usual, when a company falls short of expectations, its share price plummets.

Output:Like any other mining companythe company has business risk and a lot can go wrong, as Bit Digital's terrible year has proven. Business risk makes investing in mining stocks riskier than investing directly in Bitcoin. An investor in the mining industry should build a diversified portfolio by investing in multiple mining stocks rather than just one to reduce this risk.

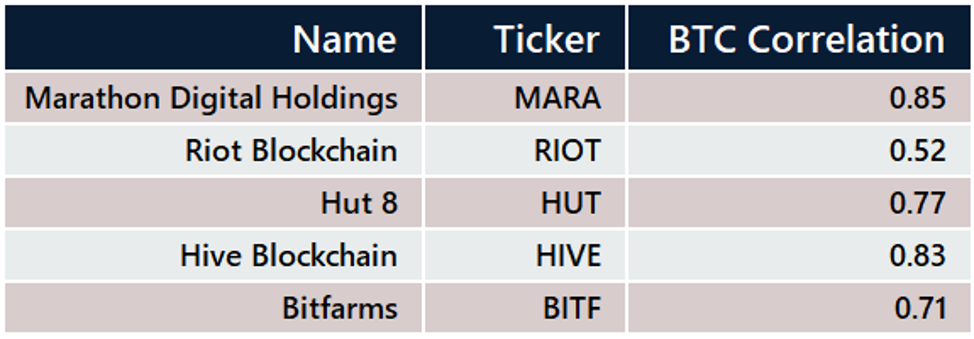

3) Bitcoin mining stocks are highly correlated with Bitcoin price

Mining stocks are highly correlated withthe price of bitcoin. In 2021, the mining index has a 0.84 correlation with bitcoin. As you can see in the chart, the mining index tends to follow the bitcoin price both up and down. Fortunately for investors in Bitcoin mining, Bitcoin price has performed well in 2021, making this a great year for Bitcoin miner stocks.

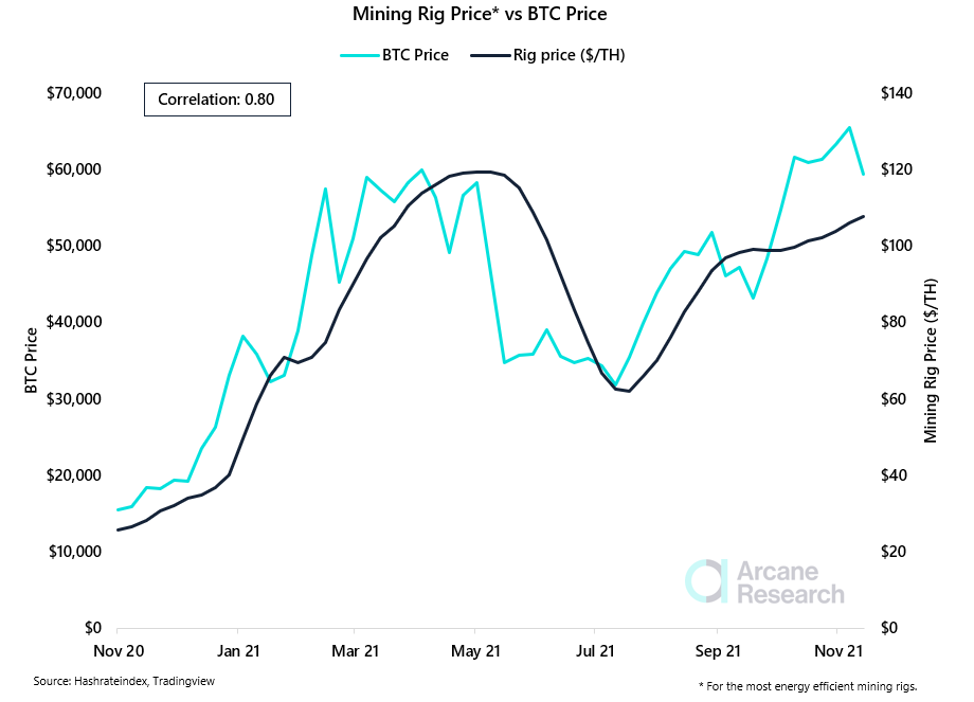

Mining hardware price vs BTC price

Mining companies are naturally connectedwith Bitcoin, since their income depends on the price of the cryptocurrency. In addition, several of the largest publicly traded mining companies hold huge amounts of BTC on their balance sheets. As Peter Brown of Compass Mining explained in this article, public mining companies hold a total of 23k BTC. This part of their balance sheet should theoretically be completely correlated with the price of Bitcoin. Mining companies are incentivized to keep as much of the Bitcoin they mine as possible and issue debt or equity to pay their expenses instead of selling BTC. They know that investors are willing to pay a premium for Bitcoin owned by a publicly traded company. Marathon Digital Holdings even states on its website that“Marathon helps you gain exposure to Bitcoin in your portfolio without having to deal with the complexities of owning the asset directly.”It is in the interest of investors to make the stockcorrelated with bitcoin, as many investors who do not want to directly own bitcoin use shares of mining companies to increase exposure on the crypto market.

Some stocks are more correlated withthe price of bitcoin than others. Of the five largest publicly traded mining companies in North America, Marathon Digital Holdings is most closely associated with Bitcoin, with a correlation coefficient of 0.85. As mentioned, Marathon does not own data centers and invests all of its capital in Bitcoin mining hardware. With a correlation of 0.80, the cost of hardware correlates much more with the price of bitcoin than the cost of data centers.

Output:Since shares of mining companies are stronglycorrelate with Bitcoin, they can be used to gain exposure to Bitcoin, but keep in mind that some companies correlate with BTC more than others.

4) Bitcoin miner stocks are more volatile than Bitcoin price

As seen in the chart, the Bitcoin mining indexwas much more volatile than the price of the cryptocurrency. Higher volatility is the reason the index outperforms Bitcoin. Since they are correlated, the mining index increases severalfold as the price of bitcoin rises due to its higher volatility. If you look at the individual stocks of mining companies such as Marathon Digital Holdings and Bit Digital on the chart, you can see that they are very volatile. Marathon Digital Holdings has dropped nearly 30% over the past two weeks as the bitcoin price has declined, suggesting that higher volatility is also a disadvantage.

Output:Be prepared for high volatility ifinvest in shares of Bitcoin mining companies. But know that volatility and high risk are why these stocks are outperforming.

5) Bitcoin miners' shares make almost all the profits in short periods

Bitcoin miners' shares are not only incrediblevolatile, but also receive most of the profit in a short period of time. Anyone who has invested in Bitcoin for over a year knows that this cryptocurrency has the same characteristic. The price can sit idle for several months before moving higher when it is least expected. An example of a short period of extreme rallies in the price of Bitcoin miners' shares was the first eight days of January 2021. The mining index is up 74% in those eight days, and Marathon Digital Holdings shares are up 140%. Even the most volatile altcoins struggle to make the same profit in just eight days.

Inference:When investing in bitcoin, it is difficult to determineoptimal duration. Since mining companies make so much profit in shorter periods, it is important to think long term rather than jumping into and out of these stocks. If you skip these short periods of reaching extreme levels, you might miss out on any profit at all.

Conclusion

Mining stocks are highly correlated withbitcoin, and therefore investors can use them to increase their exposure on the crypto market without buying cryptocurrency directly. These stocks are also more volatile than Bitcoin, which means that Bitcoin bulls who want to make the most of their assets can purchase shares of mining companies to complement their portfolio.

Although the mining index in 2021 doubledBitcoin's rise, it is important to understand that investing in mining companies carries a much higher risk than investing in Bitcoin itself. Bitcoin miners' shares have business risks that cryptocurrencies do not have. These characteristics make it extremely important to diversify rather than just invest in one mining company.

The recent focus on Bitcoin ETFs has shown ushow much the market craves for investment bitcoin instruments. Institutions are increasingly investing in bitcoin, and investing in bitcoin miners' shares remains a popular way for them to gain access to bitcoin without directly purchasing the asset. Will we see institutional-fueled growth in Bitcoin miners in 2022?

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>