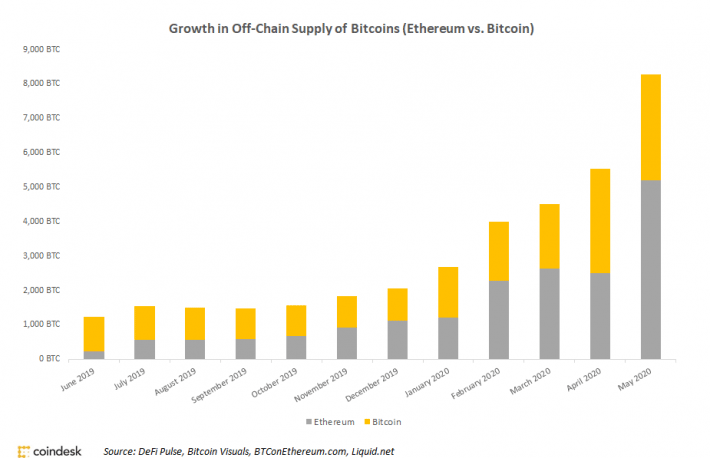

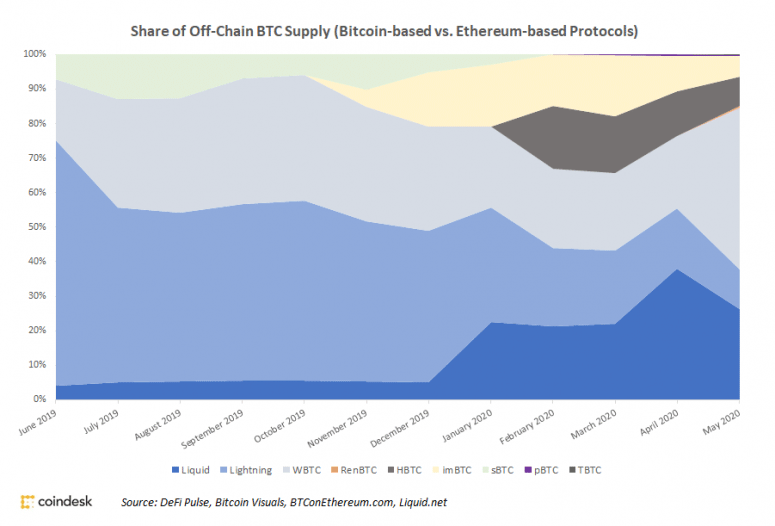

Years of development in the cryptocurrency space have led to the emergence of a number of alternatives for useBitcoin outside the main blockchain, for exampleLightning Network and Liquid Network. However, the undisputed leader in this direction is the network of the second largest cryptocurrency, Ethereum, notes CoinDesk. According to him, Ethereum projects such as WBTC and imBTC hold 70% more bitcoins than Lightning or Liquid.

As Camilla Russo, Defiant blog author, explainsEthereum is a “more flexible” platform allowing the development of tokenized protocols, while Bitcoin is designed to “transfer assets without trust and with protection from censorship.”

Tokenized Bitcoins Allowusers to make settlements in the first cryptocurrency when interacting with decentralized finance services (DeFi), which have developed in the Ethereum ecosystem. Since the beginning of the year, the supply of such bitcoins has grown by 330%.

The total amount of bitcoins on the Ethereum blockchain and sidechains is small - 8,285 BTC. However, Messari analyst Jack Burdi claims that "this is only the beginning."

“Ethereum has an incredibly diverse set of financial applications. We will see many new application scenarios as the bitcoin market on Ethereum grows ”- said Jack Burdy.

Developers of Bitcoin tokenization projects believe that they complement the functionality of Lightning and Liquid, and do not compete with them.

“Wrapped Bitcoin is a digital asset - bitcoin - in the Ethereum chain and actually complements Lightning,- said Kiarash Mosaieri, product manager at the custodial firm BitGo, which helped distribute WBTC during its launch in January 2019.

The development of such protocols will contribute to the spread and increase of the network effect of bitcoin, attracting more applications and developers to this space. ”

Unlike tokenized bitcoins,Lightning and Liquid have a narrower range of applications associated with increased privacy and speed of small and large transfers outside the main blockchain, respectively.

“Both approaches present different opportunities and trade-offs from a security perspective,– said Matt Luongo, CEO of Thesis startup developing tokenized Bitcoin tBTC.

I'm a big fan of the Lightning Network and think it will become increasingly important in commerce and new applications such as gaming."

The growing demand for bitcoin on othersblockchains speaks of “increasing interest in creating more advanced functions that may not be available directly in the bitcoin blockchain itself,” said Christian Decker, developer of Blockstream, the company behind Liquid Network and the c-lightning implementation for the Lightning Network.

Both types of off-chain protocols are important, says Olivia Lowenmark, who previously worked at BitGo and Thesis.

“Tokenized protocols such as tBTC and“WBTCs can be of great interest because they expand the financial capabilities of bitcoin holders, while protocols without the use of tokens, such as Lightning, improve the network infrastructure, which benefits the community as a whole.”

In any case, whether users commitBitcoin transactions in his own blockchain or Ethereum is chosen for this, the current dynamics testifies to the demand for operations with the first cryptocurrency.

According to Decker, interest in using Bitcoin in other blockchains “is a strong indicator of growing interest in Bitcoin itself, while other tokens lose to it.”

“I'm not surprised that Ethereum network usersseek to have access to bitcoin, but do not want to go to the bitcoin network. This also explains why tokenized bitcoins exist on the Ethereum network, and not vice versa, since the basic functionality of bitcoin already covers the needs of its users ”- he declared.

5

/

5

(

1

voice

)