In the middle of the second quarter, the DeFi market sank due to the fall of Bitcoin, however, according to Messari analysts,The decentralized finance (DeFi) market will be on the rise in the coming months.

According to Chen Limin, CFO andhead of the department of trade operations of ICB Fund, the aggregators of profitable farming also felt the decline. For example, after a maximum of $ 9.5 billion by the end of the first half of the year, the indicator stabilized near $ 6 billion.

"At the same time, one of the projects, the most famous in this sector yEarn.Finance, felt the deterioration of the market situation to a lesser extent - having accumulated $ 4.1 billion of this $ 6 billion with a share of 69%", - said Limin.

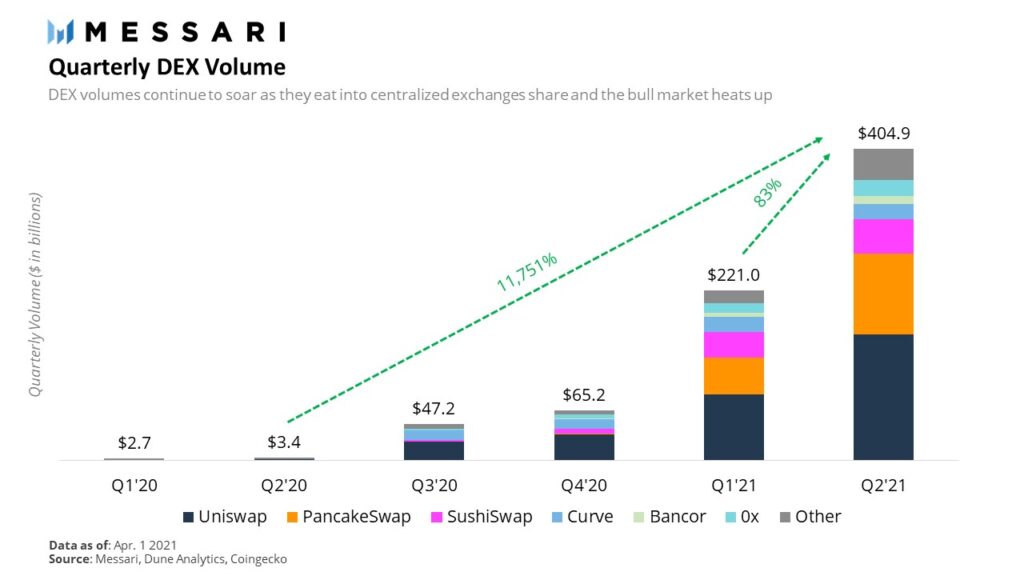

However, despite the drawdown, the indicators of the second quarter were still higher than at the beginning of the year. For example, the volume of decentralized exchanges has reached a new high of nearly $ 405 billion.

Thus, the market for decentralized exchangesgrew by 83% compared to the first quarter of this year. Moreover, analysts point out that May alone accounted for more than half of the quarter's sales.

For further development of projects onThe DeFi ecosystem of Ethereum needs scaling solutions, analysts say. Among the upcoming innovations are solutions that allow you to combine thousands of transactions into one block. These are already Arbitrum and Optimism, the launch of which is planned for the third quarter.

At the same time, most of all from scalingDecentralized exchanges will benefit. As Messari analysts say, trading platforms will no longer have to operate in a tightly constrained computing environment. This way, they can focus on capital efficiency. This quarter, Polygon clearly showed what can be achieved through scaling: activity in this lending protocol saw explosive growth.

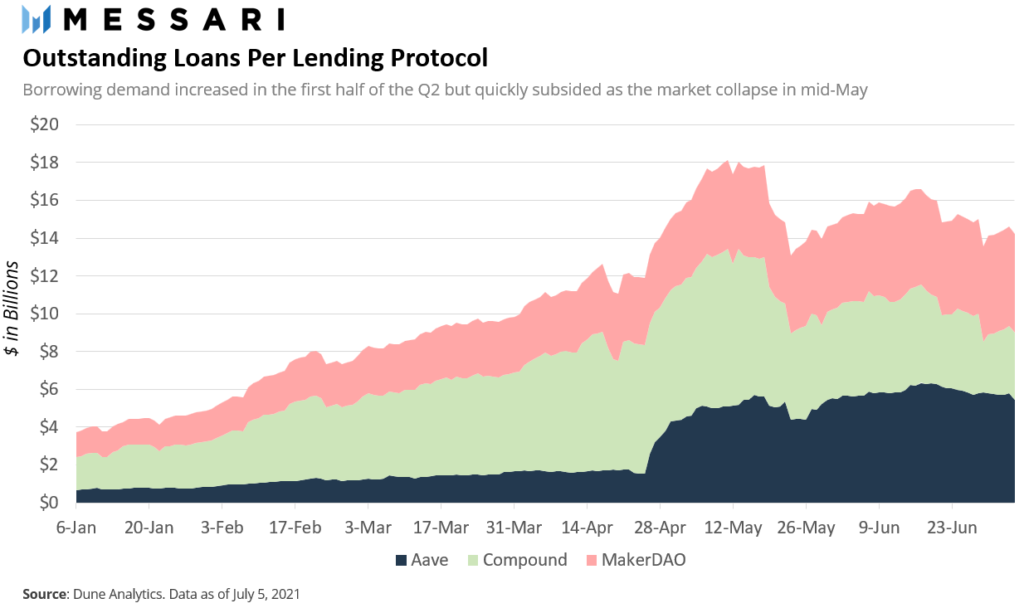

Experts admit that the fall of the crypto market inMay-June also affected the DeFi lending market. In the first six weeks of the second quarter, total outstanding loans rose 62%. However, experts admit that the decline in the DeFi lending market was not sharp. In total, the collapse amounted to only $4 billion, which is 21% of the maximum.

Messari believes that in the coming quartersThe DeFi market will become more “safe” for users thanks to scaling solutions. However, when exactly the mood of the crypto community will change to start the rally remains unclear.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication