The collapse of the market on March 12-13 was a surprise and a severe ordeal even for those who had seen the scenescryptocurrency investors. And many are wondering what caused the sudden collapse of the price of bitcoin.

From the point of view of economic theory, pricerapidly declining due to the clear prevalence of the supply of coins over demand. Also, obviously, massive sales were due to a cardinal change in mood, because on the eve of the World Health Organization announced the coronavirus pandemic, provoking a real panic in traditional markets.

However, all these thought experiments suggestonly a very superficial explanation of what happened. They do not give an idea of who was selling more actively than the rest - large or small investors, newcomers to the market or seasoned scammers.

ForkLog magazine has adopted CoinMetrics, Chainalysis, and Glassnode’s on-chain analysis tools to understand what’s happening.

Short-term investors are at the head of the collapse

Using the tools of online analytics,CoinMetrics researchers have concluded that short-term investors played a key role in the recent collapse. Presumably, many of them have only recently discovered the digital asset market.

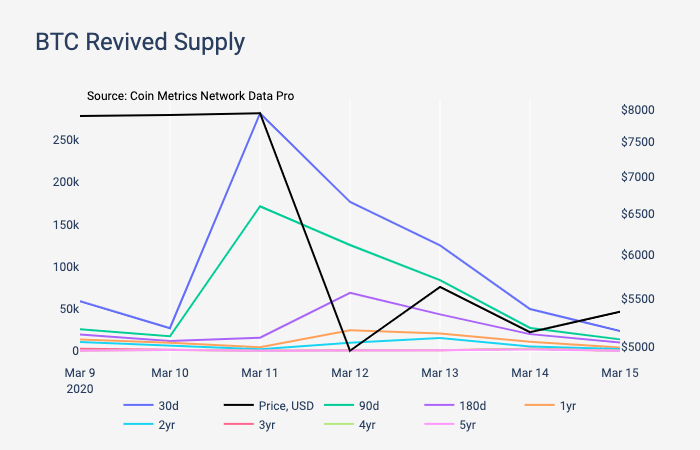

So, on March 11, approximately 281,000BTC, which before that "dozed" for at least 30 days. Of these, only 4,131 BTC did not move for more than a year. The violent activity of May 11-12 occurred mainly due to coins that held less than a year.

The movement of coins of various "age categories" against the backdrop of a rapid drop in the price of bitcoin on March 11-12.

On March 11, there was the fourth largest increase in BTC activity over the past 8 years, previously stored for more than 30 days.

However, among the coins of long-term investors in those days, such high activity was not observed.

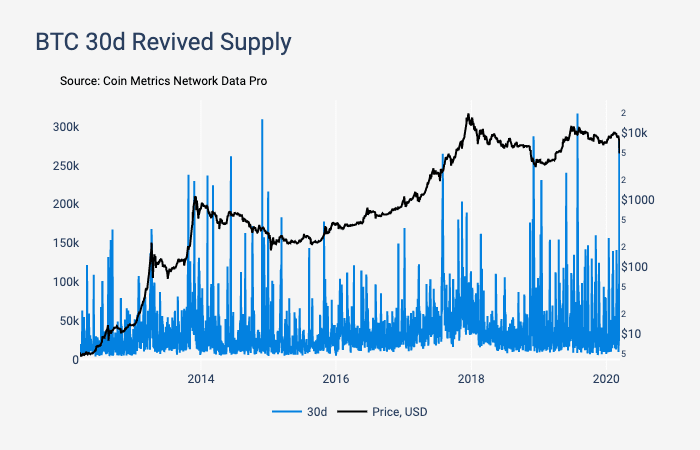

The dynamics of the movement of bitcoins stored for more than a year

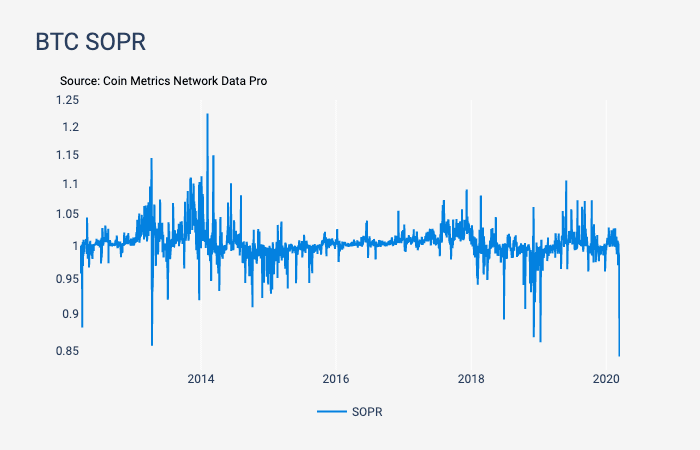

March 12 is the first time since February 2020 to the level of 0.843 the indicator of the BTC SOPR onchain indicator fell. This tool shows the ratio of selling and buying prices at the time of creating new exits and transaction inputs, respectively. BTC SOPR values below 1 indicate massive loss sales.

In addition, only for the fourth time in the history of bitcoin, the MVRV indicator (the ratio of market capitalization to realized) fell below the 1 mark:

Values of MVRV greater than one indicate thatspeculators value coins higher than long-term investors. Marks below one indicate the opposite, as well as the fact that scammers are unlikely to sell "digital belongings" at the current price. Thus, periods of low indicator values are the most successful for the accumulation of coins.

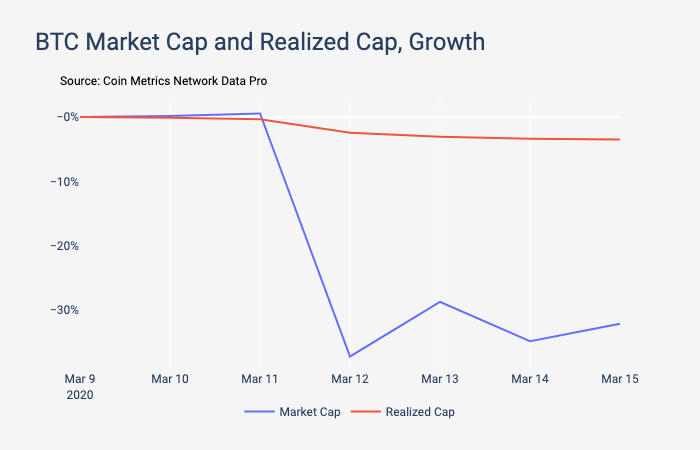

March 12 MVRV fell for the first time since December 2013immediately half a point. According to CoinMetrics, such a sharp decline in the indicator values is caused by the collapse of BTC market capitalization immediately by 30% compared to March 9 marks. At the same time, the realized capitalization indicator decreased only by about 3%, indicating that the "old" coins were almost not sold.

The dynamics of the market and realized capitalization of bitcoin at the beginning of the second decade of March.

To whom the collapse, and to whom the growth of capitalization

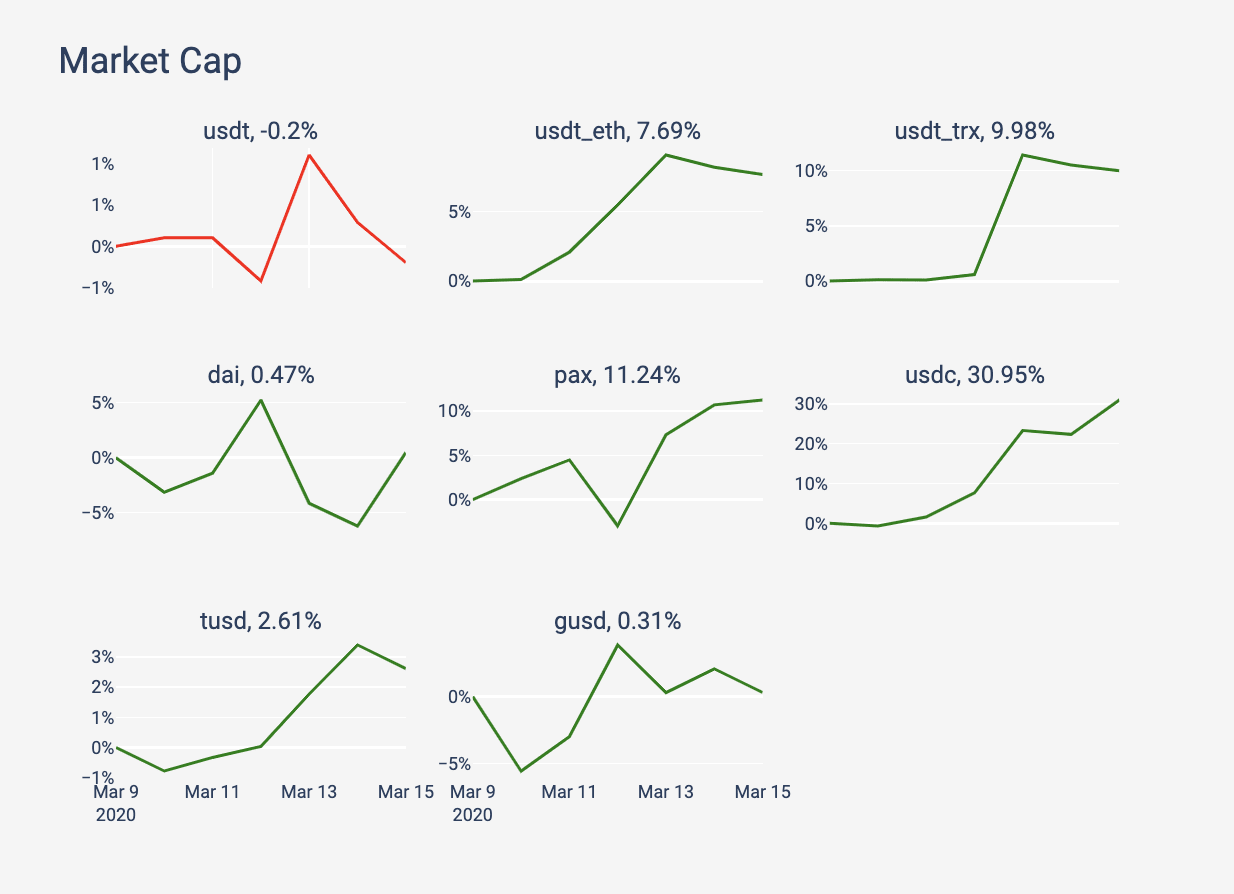

CoinMetrics also found a significant increase in the capitalization of most stablecoins amid a sharp collapse of the wider market.

“This may indicate that investors preferred to go cache or its equivalent.”- emphasize the researchers.

According to their observations, capitalization issued onEthereum’s stablecoin base Tether grew by about $ 300 million from March 10 to 15. Used by Coinbase and many other platforms, USD Coin (USDC) for the same period increased in capitalization by $ 150 million.

The dynamics of changes in the market capitalization of popular stablecoins for the period from March 10 to 15

Inflow of funds to exchanges

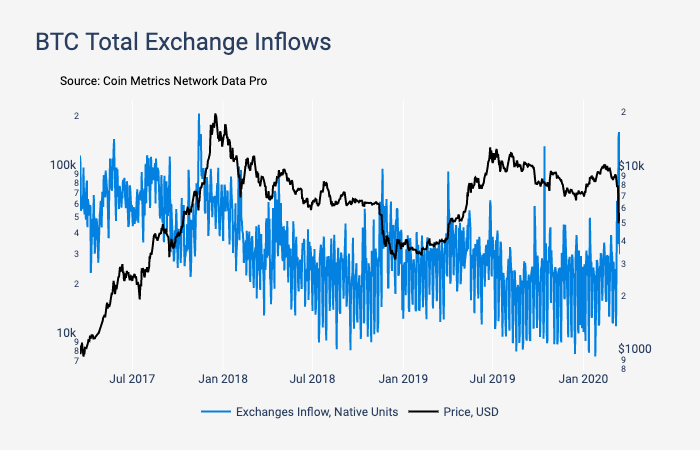

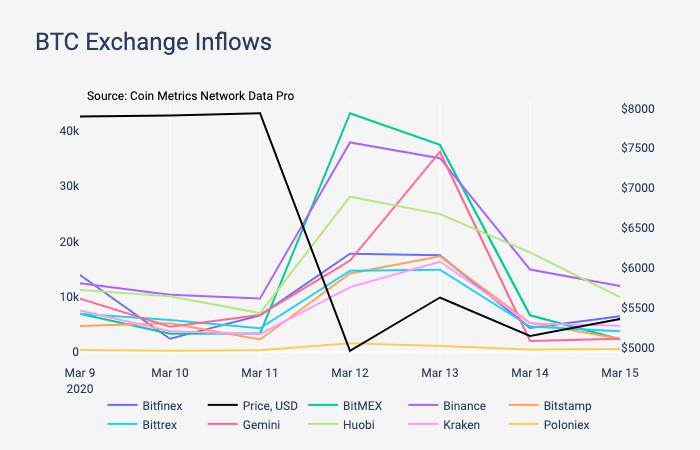

According to CoinMetrics, on March 13, more than 160Thousands of BTCs have gone to a number of popular centralized exchanges, including Binance, Bitfinex, BitMEX, Bitstamp, Bittrex, Gemini, Huobi, Kraken and Poloniex. This was the largest inflow of funds in one day since November 2017.

The dynamics of the inflow of funds to exchanges against the backdrop of changes in the price of BTC since July 2017.

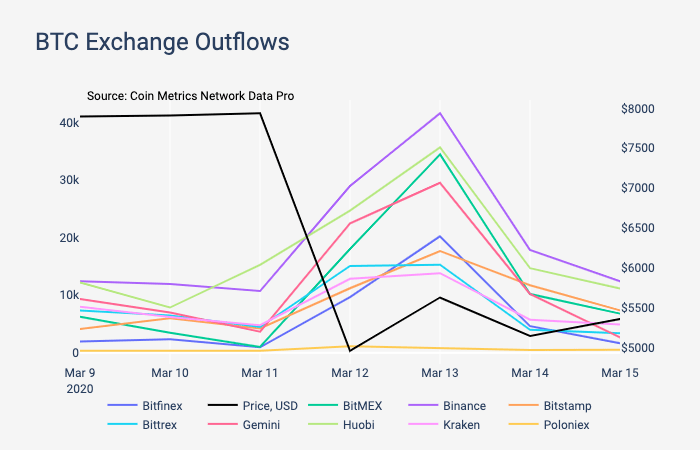

Over 171,000 BTCs were listed on March 13th.

The inflow to the BitMEX exchange was the largest of all trading platforms - 42,200 BTC and 37,500 BTC on March 12 and 13, respectively.

Dynamics of BTC inflow to various exchanges from March 9 to March 15.

The outflow of funds from the Binance and Huobi platforms then exceeded the performance of BitMEX:

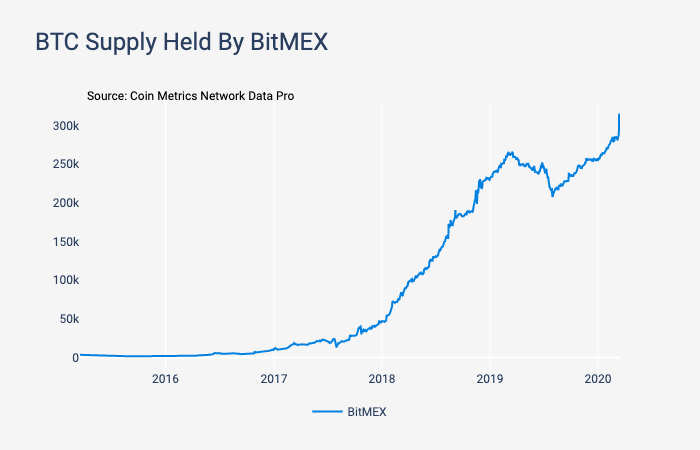

As a result, the volume of BitMEX-controlled offerings soared to a new all-time high - on March 13, this figure reached 315,700 BTC.

Dynamics of the Bitcoin supply volume controlled by BitMEX

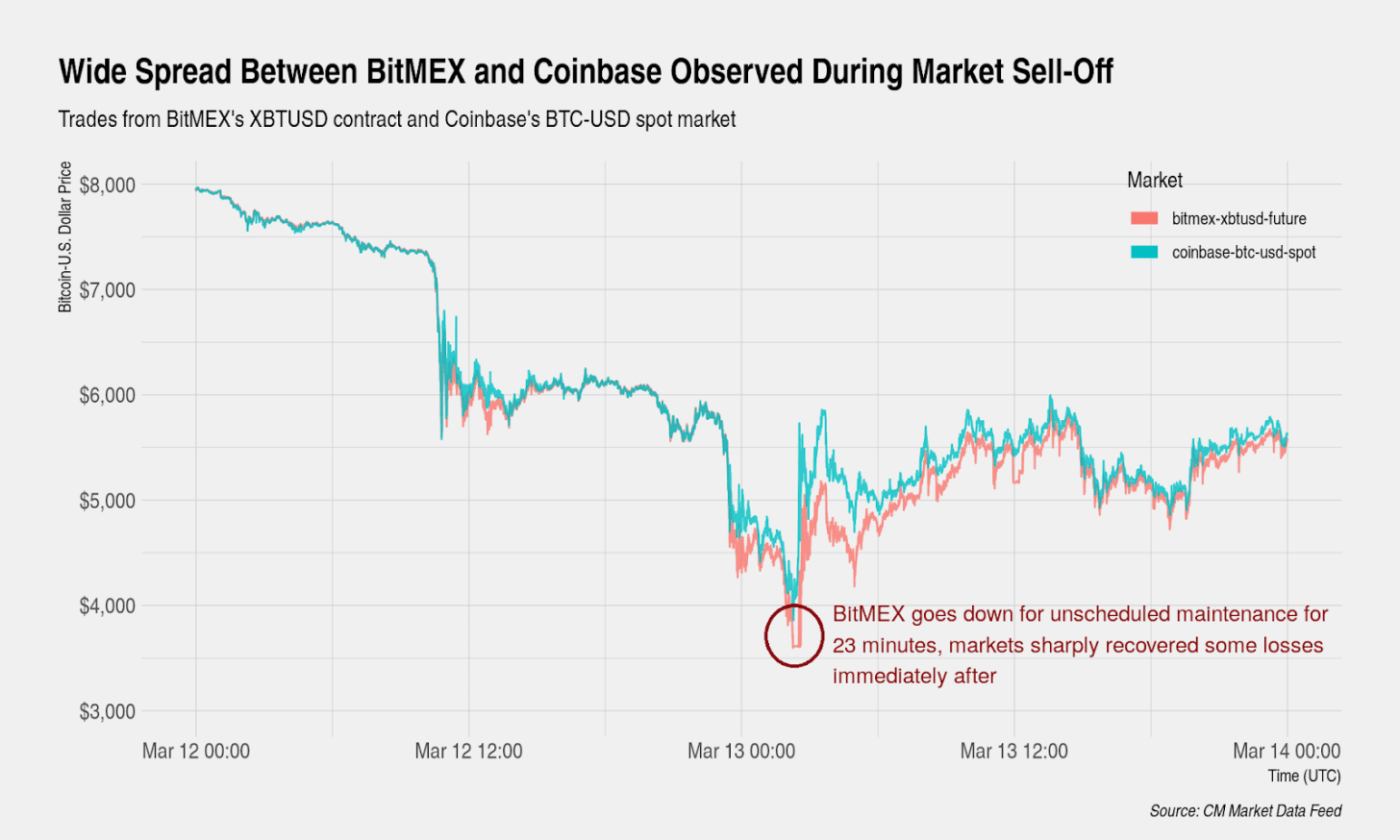

Among other things, during mass sales between BitMEX and Coinbase, spreads of up to 16% were observed.

Spreads in BTC / USD and XBT / USD pairs between the Coinbase spot platform and the derivative BitMEX

“This was probably due to forcedthe liquidation of leveraged futures that leverage price movement. The market recovered after BitMEX left for 23 minutes for unplanned maintenance. ”, - experts explained.

Similar results to CoinMetrics were obtained andResearchers at analytic startup Chainalysis. According to them, since March 9, 1.1 million BTC have been received on cryptoexchanges over eight days. The largest daily inflow occurred on March 13 - 319,000 BTC. For comparison, from the beginning of the year until March 9, this figure averaged 52,000 BTC.

“On March 12-13, the volume of bitcoins sent to exchanges exceeded the average by 9 times. Pressure from sellers drove prices down about 37%. ”Says the Chainalysis blog.

Experts came to the conclusion that the massive sales were mainly by retail players, since the volume of receipts in the range from 0.1 to 10 BTC doubled over the period from March 9 to 17.

However, according to Chainalysis, significantlarge coin holders were also active - 70% of transfers to exchanges and from trading platforms were carried out in amounts from 10 to 1000 bitcoins. More than 10% of transfers were made in amounts over 1000 BTC.

However, in those days only 5% of all available bitcoins were sold.

“Despite the sale of 712 thousand bitcoins, most of the hodlers in this difficult period did not go to the cache”, The researchers of Chainalysis reassure.

Buy when blood is pouring in the streets

According to Simplex payment processing, retail investors not only sold - during the collapse of the market, purchases increased by 50%.

Bitcoin was the most popular asset inbuyers - it accounted for 59.6% of the total volume for the period from March 12 to 14. Digital Gold was followed by the stablecoin Tether (USDT) and Ethereum (ETH) with 12.6% and 9.78% respectively.

“The market downturn has not weakened enthusiasm forcryptocurrency purchases. In fact, it is obvious that many saw in the recent fall the opportunity to buy, and not a sign that the thesis about investments in cryptocurrencies is refuted ”“Said Simplex CEO Nimrod Lehavi.

According to Simplex, processing partners, including bitcoin exchanges, have recorded a fourfold increase in cryptocurrency purchases these days.

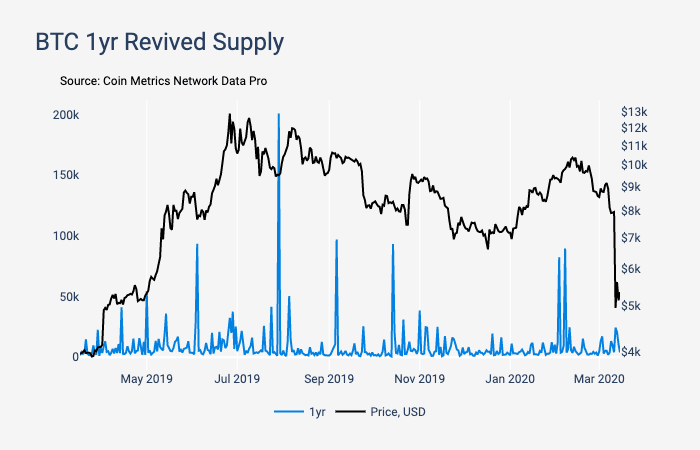

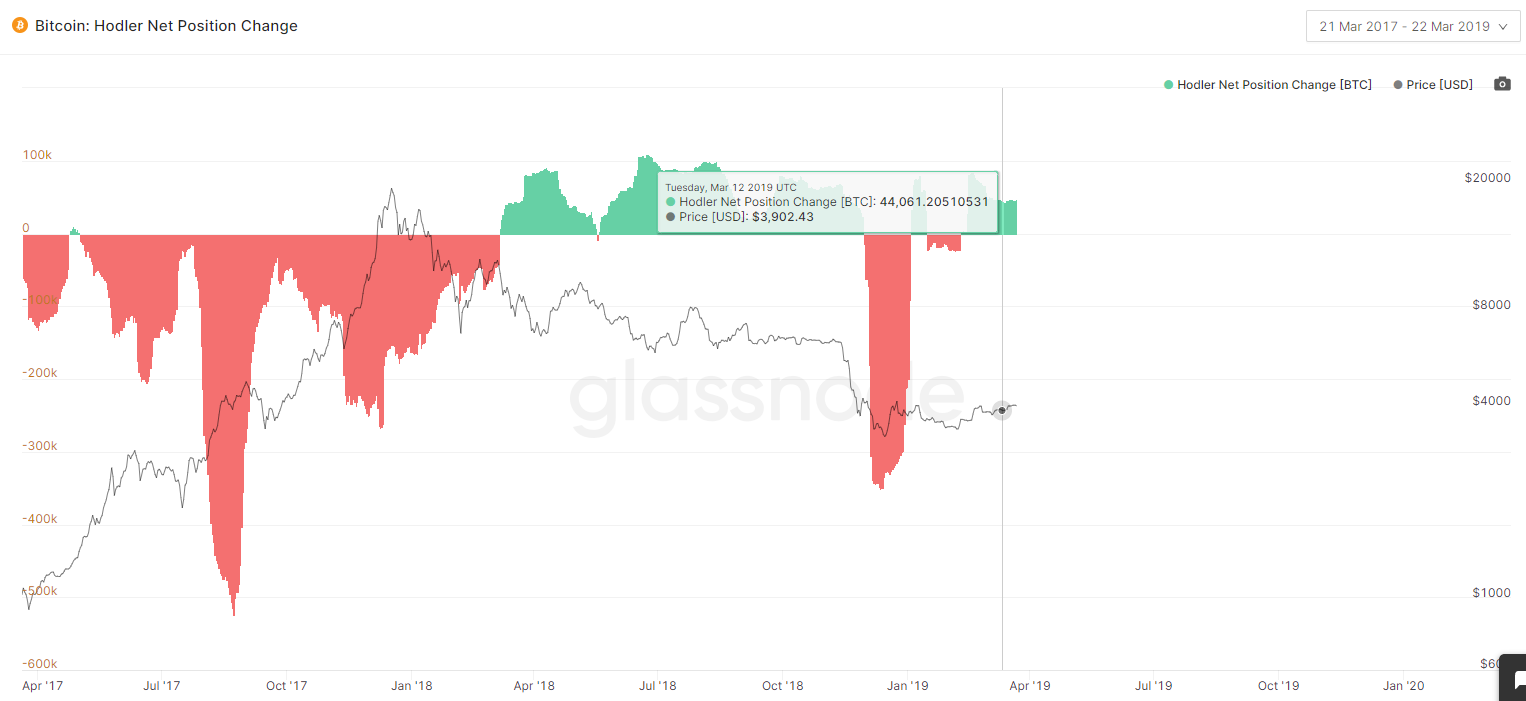

Glassnode service data confirms the above theses about the equanimity of most long-term investors, even in the most stressful periods.

Hodler Net Position Green Bar Graph MetricChange indicates that long-term BTC holders are accumulating positions. The red color indicates sales in the “Hodler” camp in order to take profits.

On March 12-13, the histogram shone with green light - this means that during the collapse, the whales accumulated positions.

“We can see that this February amidAs the price approached $ 10,000, the scammers stopped accumulating BTC because they probably identified this period as the top of the market. However, during the recent collapse of the market, scammers began to accumulate positions, being confident that Bitcoin would reach the bottom ”, Glassnode analysts explained in a blog post.

Experts added that the marks reached at that time would serve as support for long-term investors.

findings

On-chain tools provide wideopportunities for fundamental analysis of crypto assets. With their help, it is possible, for example, to predict an oversupply of offers on exchanges and subsequent sales, to identify periods of accumulation of coins by whales, moments of discrepancy between market and realized capitalization, moments of revaluation / undervaluation of assets, etc. There are no such opportunities in the world of traditional finance, which speaks in favor of a new class of assets.

Given the high activity of "young" addresses withsmall balances and extremely low values of the BTC SOPR indicator, it can be assumed that short-term investors who are new to the market are more prone to panic sales than long-term hodlers.

Major holders during a recent collapseBitcoin behaved much more restrained by retail investors. Moreover, the whales more actively than others accumulated positions and bought coins on the bottoms. This once again confirms the adherence of the hodlers to the long-term investment horizons and indicates their confidence in the future prospects of the first cryptocurrency.

Alexander Kondratyuk