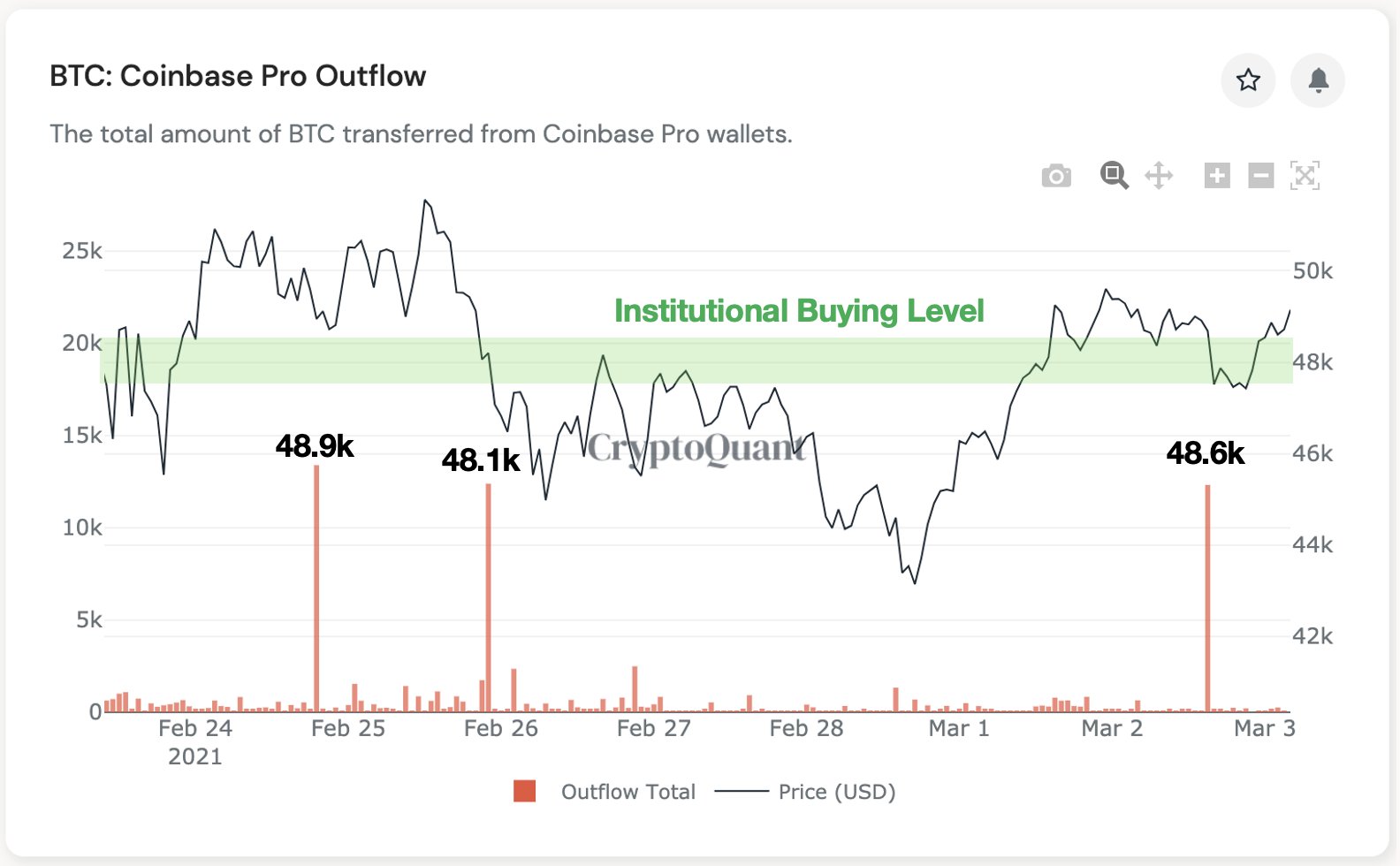

Large waves of outflows from Coinbase show that some major players continue to buy Bitcoin onfalls below $50 thousand.

According to the latest data from CryptoQuant, whales continue to accumulate BTC, despite the fact that its price has already more than doubled since the beginning of the year.

This trend signals increased confidence in Bitcoin as its price tries to stabilize above $50K.

Why whale confidence matters

During bullish cycles, whales can take profits on their positions, especially if the futures market is overheated.

Whales selling off their savings to balance their portfolio can cause significant price fluctuations, especially if their sales are accompanied by cascading liquidations of short positions.

In the current bull cycle, according to on-chain data, whales continue to buy up bitcoins instead of selling them, probably in anticipation of further gains.

Ki Young Joo, head of CryptoQuant, tweeted:

“Whales are accumulating $BTC.They've been setting up a lot of bear traps lately, but the price seems to be recovering from $48k, the institutional buying level. Based on the latest waves of outflows from Coinbase, the majority of Bitcoins withdrawn to external wallets were purchased at the $48K level.”

Outflow of funds from Coinbase Pro. The gray graph is the BTC price, the green bar is the purchase level with large capital, the red columns are the total volume of BTC withdrawn with the average purchase price. : CryptoQuant

The fact that whales or wealthy investors are accumulating BTC, instead of fixing profits on positions, probably indicates that they are expecting the formation of a super cycle.

Prior to the current bull cycle, Bitcoin did not attract such a high level of institutional interest, especially from public companies and financial institutions.

Now, when the constant increase in monetaryWith the mass central banks of many countries prompting some companies to seek alternatives to cash, Bitcoin is becoming an extremely attractive asset.

Macro factors favor a new rally

Fundstrat's Leeor Shimron explains that Bitcoin still has plenty of room to grow when you compare its capitalization to M1 money supply.

According to Shimron, Bitcoin's current bull cycle could exceed any expectations about the likely rate of growth and is still very far from a potential top.

“If we compare Bitcoin with the money supply M1,it is still very far from the completion of the bullish cycle and the formation of the final top. In the face of unprecedented central bank money printing, the Bitcoin bull market may be just beginning. This cycle could still get much wilder. ”

Several other on-chain metrics also confirm that Bitcoin is probably still far from the top of a bull market.

For example, the value of the SOPR indicator, which is useful for understanding the real sentiment of investors on average in the market, suggests that many investors have already taken profits on their positions.

In the near future, this could reduce selling pressure on the price of BTC, while the whales continue to accumulate it.

Raoul Pal, head of the Real Vision Group, also shares this view. Over time, he said, Bitcoin will absorb most of the world's capital. He tweeted:

“But what this does say is that investment in technology and primarily in Bitcoin (and also, I believe, ineverythingdigital assets) will continue to graduallyabsorb all the capital in the world because people understand that this is the most efficient way of generating wealth available to them, not just a store of value.”

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>